ID: PMRREP18085| 247 Pages | 26 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

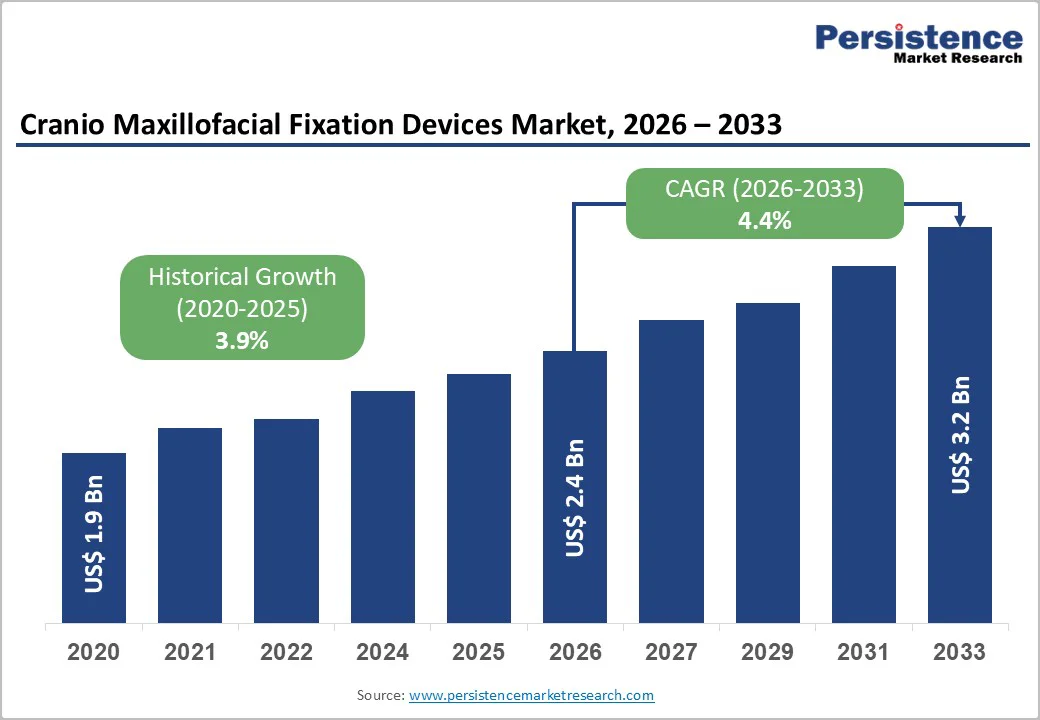

The global cranio maxillofacial fixation devices market size is estimated to grow from US$ 2.4 billion in 2026 to US$ 3.2 billion by 2033 growing at a CAGR of 4.4% during the forecast period from 2026 to 2033.

The global market is expanding steadily as trauma cases and reconstructive needs rise worldwide. Increasing incidence of facial injuries from road accidents, sports activities, and violence continues to drive demand for advanced fixation systems. Hospitals and trauma centres are adopting titanium plates, screws, and resorbable implants that offer strong stability and faster healing. Innovations in 3D printing and patient-specific implants are transforming surgical precision, improving outcomes in both trauma and corrective procedures. Growing preference for minimally invasive techniques and improved regulatory approvals further strengthen market growth across developing and developed regions.

| Key Insights | Details |

|---|---|

| Cranio Maxillofacial Fixation Devices Market Size (2026E) | US$ 2.4 Bn |

| Market Value Forecast (2033F) | US$ 3.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.9% |

The rising global burden of craniofacial trauma remains the strongest force propelling the cranio-maxillofacial fixation devices market. Road traffic accidents, interpersonal violence, industrial injuries, and high-impact sports continue to elevate fracture rates, especially in regions with limited road safety enforcement. Data from global trauma registries confirm that mandible, zygomatic, and midface fractures make up a substantial proportion of acute facial injuries, often requiring surgical intervention for functional and cosmetic restoration. Rigid fixation using plates and screws is now the standard of care, helping surgeons achieve precise anatomical alignment, reduce healing complications, and enable quicker return to normal activities. As urbanization increases and motorcycle usage rises in lower-income economies, hospitals are reporting higher volumes of facial trauma cases requiring operative management. Growth in specialized trauma centers, wider availability of CT-based diagnosis, and improved training in maxillofacial surgery further contribute to the expanding use of fixation devices. Together, these trends reinforce sustained demand for reliable, biocompatible implants across both developed and emerging markets.

Despite strong clinical need, the high cost of advanced cranio-maxillofacial implants limits broader adoption, particularly in resource-challenged health systems. Titanium plates, resorbable polymers, and patient-specific 3D-printed components often carry significant price tags, making them difficult for many hospitals to procure in adequate quantities. Public and rural facilities where most trauma cases are treated frequently operate under constrained budgets, forcing clinicians to rely on basic stainless-steel hardware with increased risk of long-term complications. Reimbursement frameworks in many developing regions do not adequately cover high-value implants, leaving patients to shoulder substantial out-of-pocket expenses. Complex implants also require specialized surgical tools and trained personnel, adding to operational costs. These financial hurdles slow the transition toward next-generation devices, particularly in high-volume trauma centers where affordability is a critical determinant of care. As a result, uneven access persists, delaying widespread integration of the most advanced fixation technologies.

Emerging technologies such as resorbable fixation systems and custom-designed 3D-printed implants offer significant growth potential in the global market. Resorbable plates made from biodegradable polymers are increasingly preferred in pediatric trauma and corrective procedures because they eliminate the need for hardware removal, reducing surgical burden for both patients and hospitals. Newer formulations feature strength and degradation rates that align closely with natural bone healing, enhancing clinical outcomes and lowering long-term complication risks. Parallel to this, the adoption of patient-specific 3D-printed implants is accelerating. These customized components designed using high-resolution imaging and computer-aided modeling support precise reconstruction in cases involving congenital deformities, tumor resections, and complex fractures. Their ability to match anatomical contours improves functional restoration and reduces operative time. Hospital systems and manufacturers are forming partnerships to scale production and broaden access to personalized implants. As digital surgical planning, intraoperative navigation, and biocompatible printing materials advance, both resorbable and customized solutions are positioned to capture premium, fast-growing segments within the market.

Plate and screw fixation systems dominate the cranio-maxillofacial fixation devices market, accounting for approximately 57% of the global share in 2025. These devices are considered the gold standard for achieving rigid stabilization in trauma and orthognathic surgeries. They allow precise anatomical reduction and contouring, particularly for mandibular and midface fractures, which together constitute around 50% of facial trauma procedures. Clinical studies demonstrate that plate and screw systems achieve union rates of up to 90%, compared to 70% for alternative fixation methods, while low-profile designs reduce hardware palpability and patient discomfort. Adoption is reinforced by clinical guidelines from professional bodies such as the American Association of Oral and Maxillofacial Surgeons (AAOMS), which recommend these systems for both trauma and corrective procedures. The combination of predictable outcomes, ease of use in complex fractures, and compatibility with advanced imaging and surgical navigation has solidified their dominance in hospitals and trauma centers worldwide.

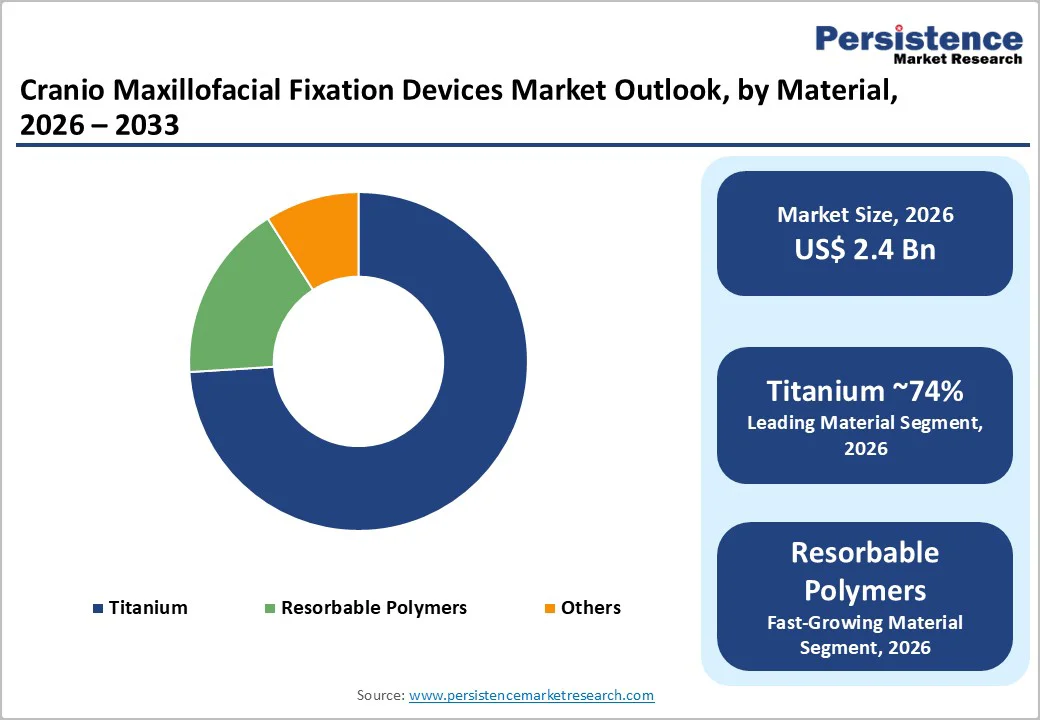

Titanium remains the leading material for cranio-maxillofacial fixation devices, capturing around 74% market share in 2025 due to its superior mechanical properties and biocompatibility. Titanium alloys provide exceptional strength, corrosion resistance, and compatibility with MRI imaging, making them suitable for nearly 80% of load-bearing facial fractures. These alloys withstand masticatory forces up to 500 N, outperforming polymer alternatives by approximately 40% in durability, which ensures long-term stability and reduces the risk of implant failure. FDA-cleared pure titanium screws are widely used in emergency settings, offering versatility across various fracture types, including mandibular, zygomatic, and orbital repairs. The material’s favorable biological profile also minimizes inflammatory responses and promotes faster osseointegration. Surgeons favor titanium implants for both trauma and elective orthognathic procedures due to predictable outcomes, long-term reliability, and ease of intraoperative contouring, driving continued dominance in both developed and emerging markets.

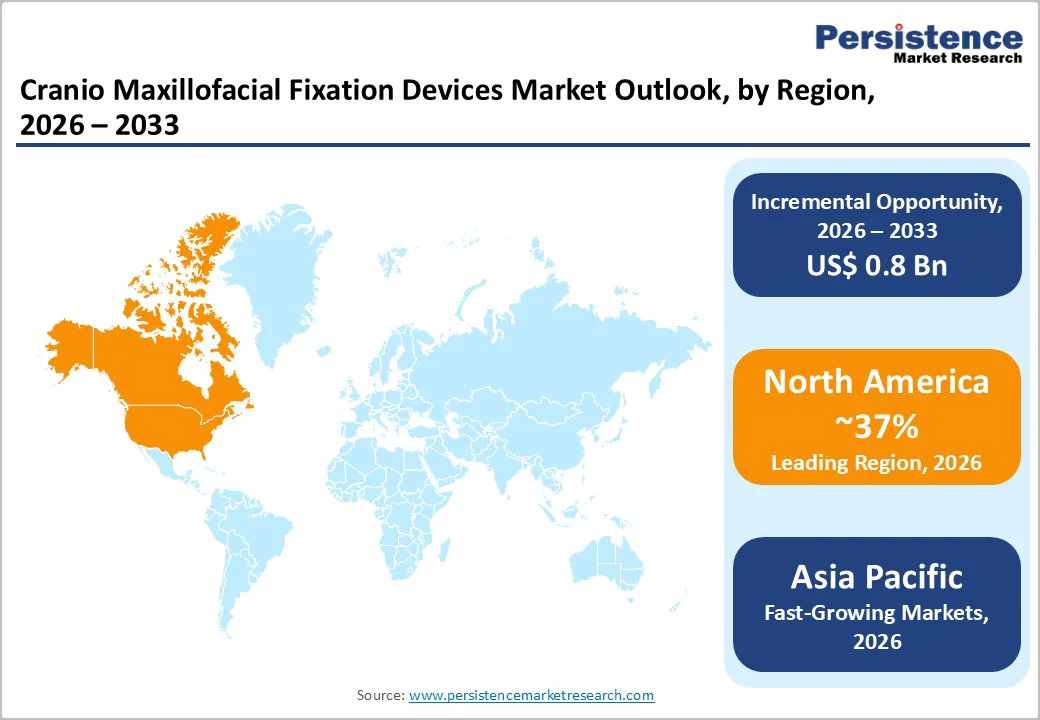

North America dominates the cranio-maxillofacial fixation devices market, driven by advanced healthcare infrastructure, high trauma incidence reporting, and widespread adoption of innovative surgical technologies. The U.S. records significant numbers of facial fractures annually, particularly from road accidents and sports injuries, creating sustained demand for rigid fixation systems. Hospitals increasingly adopt titanium plate and screw systems, FDA-cleared resorbable implants, and patient-specific 3D-printed devices for both trauma and reconstructive procedures. Regulatory approvals and clinical guidelines from bodies such as the American Association of Oral and Maxillofacial Surgeons (AAOMS) support device standardization, ensuring predictable outcomes and safety. Investment in trauma centers, surgical training programs, and hospital automation further boosts adoption. North American surgeons also leverage advanced imaging and intraoperative navigation tools for precise placement of implants, while reimbursement frameworks in the U.S. and Canada facilitate access to high-value devices. Together, these factors position North America as a mature, innovation-driven market with steady growth potential in cranio-maxillofacial fixation.

The Asia Pacific cranio-maxillofacial fixation devices market is experiencing rapid growth, supported by rising trauma cases, expanding healthcare infrastructure, and increased surgical awareness. Countries such as India, China, Japan, and Southeast Asian nations report growing facial fracture incidence due to road traffic accidents, industrial injuries, and sports-related trauma. Hospitals and specialty clinics are increasingly adopting titanium plates, screws, and emerging resorbable and 3D-printed systems to improve surgical outcomes. Government initiatives promoting trauma care, investment in digital surgical planning, and expansion of private healthcare facilities are further fueling demand. Japan and South Korea are integrating advanced imaging, AI-guided planning, and minimally invasive techniques for elderly and pediatric patients, while China leverages domestic manufacturing to provide cost-effective implants for hospitals and trauma centers. India’s rising hospital networks and growing surgical volumes in urban centers also support market expansion. Collectively, the combination of increasing patient awareness, modernization of surgical care, and accessibility to advanced fixation devices positions Asia Pacific as a high-growth region in the global market.

The global cranio-maxillofacial fixation devices market is moderately consolidated, with leading players such as Stryker, Zimmer Biomet, and DePuy Synthes collectively holding approximately 50% of market share. These companies drive growth through continuous investment in research and development, focusing on 3D-printed, patient-specific implants and resorbable fixation systems. Strategic initiatives include acquisitions, partnerships, and surgeon training programs to enhance adoption of advanced technologies. Differentiation is achieved through software solutions that enable precise patient-matched implant planning and customization. Subscription-based models for pre-configured surgical kits are emerging, allowing hospitals to access tailored solutions efficiently, reinforcing the dominance of established players while encouraging innovation in personalized craniofacial care.

The global cranio maxillofacial fixation devices market is projected to be valued at US$ 2.4 Bn in 2026.

Rising craniofacial trauma, road accidents, sports injuries, and adoption of advanced implants drive global market growth.

The global cranio maxillofacial fixation devices market is poised to witness a CAGR of 4.4% between 2026 and 2033.

Custom 3D-printed implants, resorbable systems, and pediatric applications offer significant growth opportunities in emerging and developed markets.

Key companies include Zimmer Biomet Holdings, Inc., Stryker Corp., Johnson and Johnson (DePuy Synthes), and Medtronic.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author