ID: PMRREP36065| 210 Pages | 2 Feb 2026 | Format: PDF, Excel, PPT* | Packaging

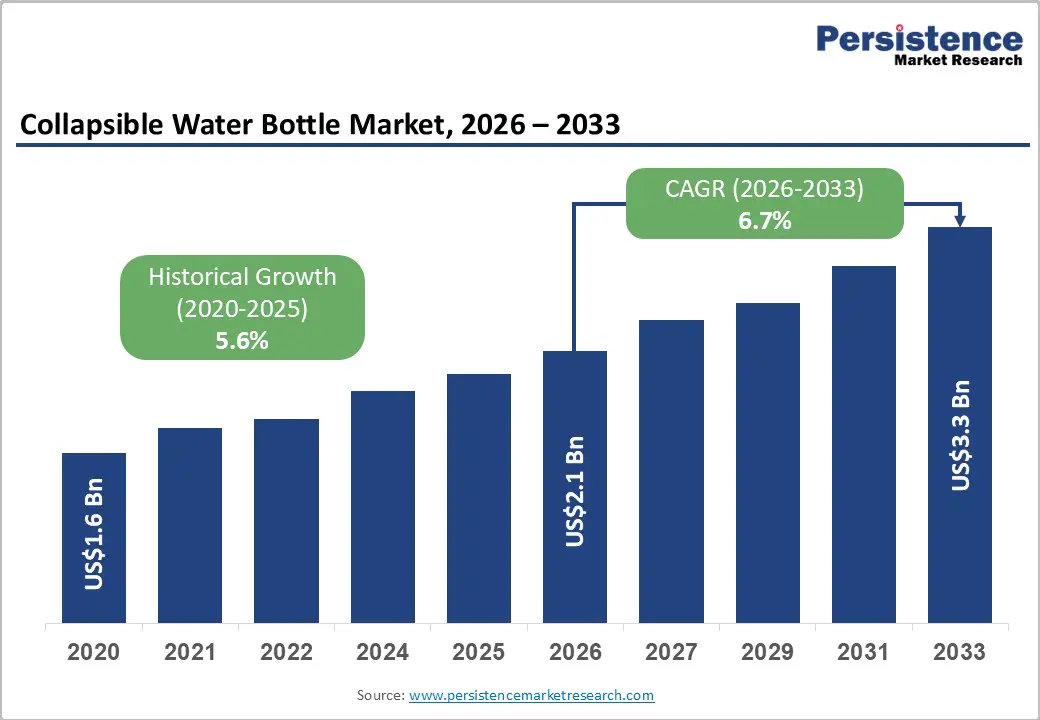

The global collapsible water bottle market size is likely to be valued at US$2.1 billion in 2026 and is expected to reach US$3.3 billion by 2033, growing at a CAGR of 6.7% between 2026 and 2033, driven by sustainability-led consumer behavior, recovery in travel and outdoor activities, and ongoing material innovation that improves durability and hygiene.

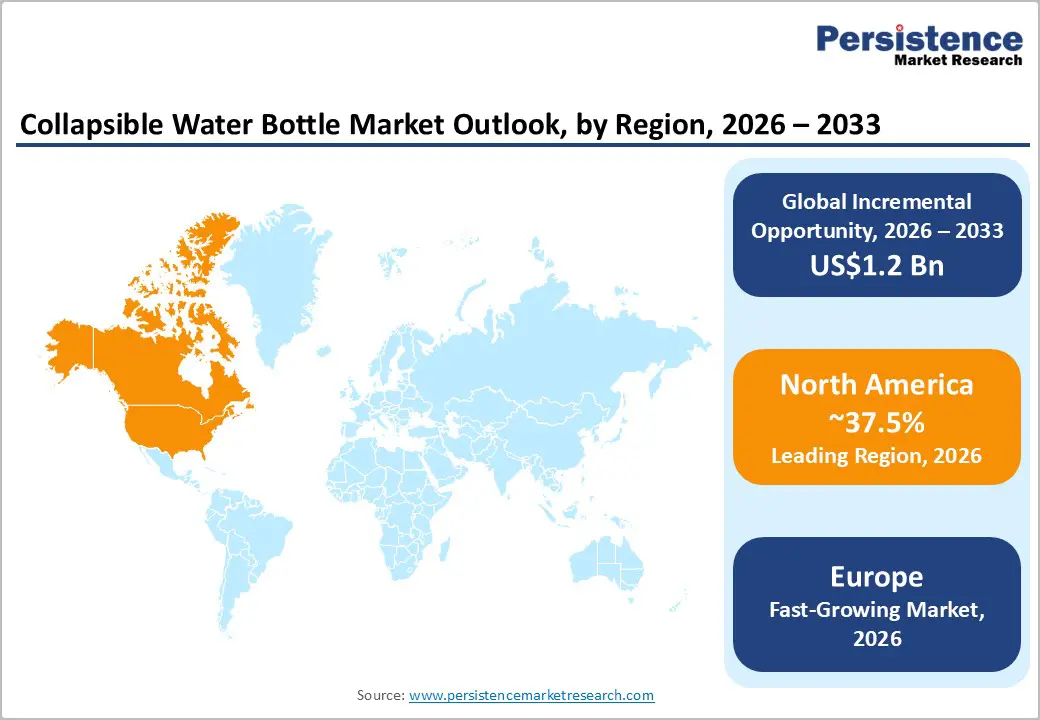

North America and Europe anchor near-term revenue, while Asia-Pacific offers scale advantages through manufacturing and urban consumption growth. Product premiumization and channel diversification remain central to competitive differentiation.

| Key Insights | Details |

|---|---|

| Collapsible Water Bottle Market Size (2026E) | US$2.1 Bn |

| Market Value Forecast (2033F) | US$3.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.6% |

Global efforts to reduce single-use plastic waste have structurally increased demand for reusable hydration products. Government-led bans, extended producer responsibility frameworks, and corporate sustainability commitments are accelerating adoption across consumer and institutional channels. Collapsible water bottles convert environmental intent into functional behavior by reducing storage space and transportation burden when empty. Their lightweight form factor lowers carried weight and packaging footprint, reinforcing sustainability narratives. For brands, this trend supports premium pricing for food-grade, BPA-free materials and encourages repeat purchasing through accessory ecosystems. Sustainability-driven procurement programs, especially in corporate gifting and event merchandise, further reinforce long-term demand stability.

The rebound in domestic and international travel, combined with rising participation in outdoor recreation, is a major driver of demand. Collapsible water bottles appeal to travelers, hikers, cyclists, and commuters because they minimize bulk while meeting hydration needs. Airline carry-on restrictions and minimalist travel trends favor compact, foldable products. Outdoor and lifestyle brands increasingly bundle collapsible bottles with backpacks, apparel, and activity kits, broadening exposure across specialty retail and online marketplaces. Institutional demand from events, festivals, and sports venues has also risen as organizers adopt refill-friendly hydration strategies.

Advances in silicone formulation, multilayer polymer films, and valve engineering have improved leak resistance, odor control, and product lifespan. Innovations such as integrated filtration, insulated, collapsible shells, and dishwasher-safe designs address historical user concerns regarding hygiene and durability. These improvements reduce return rates and support higher average selling prices. As innovation cycles shorten, manufacturers with in-house design capabilities and tooling control gain pricing power and shelf-space priority. Product differentiation has become a decisive competitive factor rather than a secondary feature.

Premium collapsible bottles made from food-grade silicone or equipped with filters and insulation carry higher manufacturing costs than rigid plastic alternatives. Price sensitivity remains evident in mass retail, particularly below the mid-price range, where consumers favor simpler rigid bottles. Input cost volatility for polymers, additives, and logistics places pressure on gross margins. Premium collapsible bottles often command 20-60% higher average selling prices, but price thresholds above approximately US$30 reduce conversion rates in mainstream channels, limiting penetration.

Collapsible designs can retain moisture if not engineered for full drying, leading to odor and hygiene concerns. Institutional buyers such as schools and healthcare facilities often favor rigid stainless steel or hard plastics due to sanitization requirements. Durability risks, punctures, seam fatigue, and valve leakage remain deterrents to heavy-duty use. Negative consumer reviews linked to cleaning difficulty directly affect conversion and repeat purchases, making design quality and testing critical to brand credibility.

There is strong revenue upside from integrating filtration, insulation, and modular components. Premium collapsible bottles with replaceable filters or insulated sleeves enable repeat purchases and higher customer lifetime value. If adoption mirrors trends in adjacent travel-gear categories, integrated-function products could account for approximately 5-8% of market value by 2030. Bundled offerings and accessory ecosystems present a clear path to margin expansion.

Rapid urbanization, expanding middle-class populations, and improving retail infrastructure across the Asia Pacific and parts of Latin America are creating meaningful long-term growth avenues for the collapsible water bottle market. As daily commuting, domestic travel, and outdoor leisure activities increase, consumers are increasingly willing to adopt reusable hydration products that align with space-efficiency and sustainability preferences. Growth in these regions is being accelerated by the expansion of e-commerce platforms, mobile-first shopping behavior, and cross-border online retail, which lower barriers to market entry for both global and regional brands. To successfully scale in emerging markets, manufacturers are prioritizing localized product designs, simplified feature sets, and tiered pricing strategies that balance affordability with acceptable standards of durability and safety.

B2B and institutional channels are emerging as a structurally important growth driver as organizations seek practical tools to meet sustainability and waste-reduction objectives. Corporations, municipalities, educational institutions, and sports venues are increasingly adopting branded collapsible water bottles for employee programs, public events, and large gatherings where portability and reusability offer clear operational advantages. These initiatives not only provide high-volume, upfront orders but also generate recurring demand through replacement cycles, accessory sales, and program renewals. For suppliers, institutional contracts help smooth seasonal fluctuations typical of consumer retail and offer greater revenue predictability. The visibility of collapsible bottles in high-traffic environments such as stadiums, conferences, and public events reinforces behavioral change among end users, strengthening long-term adoption and supporting broader rollout of refill infrastructure.

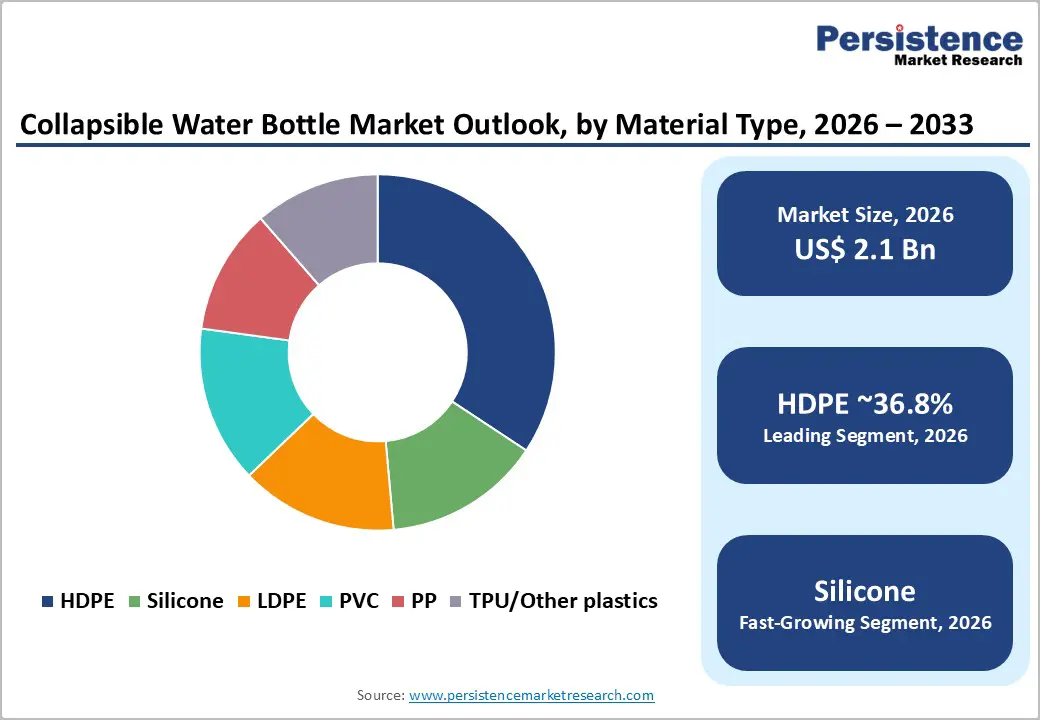

HDPE is expected to account for approximately 36.8% of the market in 2026, maintaining its position as the dominant material due to its low production cost, mature global supply chains, and compatibility with high-volume manufacturing. It is widely used in promotional giveaways, private-label offerings, and entry-level collapsible bottles sold through mass retail and e-commerce platforms. HDPE’s lightweight, recyclability, and well-established regulatory acceptance for food contact support adoption in price-sensitive consumer segments. Large OEMs in China and Southeast Asia commonly rely on HDPE for foldable pouches and basic collapsible bottle designs, reinforcing its leadership in volume-driven channels.

Silicone is expected to be the fastest-growing material segment over the forecast period, driven by rising demand for premium, long-lasting, and hygienic reusable drinkware. Consumers increasingly value odor resistance, thermal stability, soft-touch flexibility, and stain resistance, all of which favor food-grade silicone. Adoption is strongest in North America and Europe, where consumers are more willing to pay for durability and safety, while uptake in the Asia-Pacific region is accelerating as local silicone compounding and molding capabilities expand. Examples include premium collapsible bottles with reinforced silicone walls, insulated sleeves, and integrated filter lids, designed for travel and outdoor use.

Daily use applications are anticipated to represent approximately 34.2% of market share in 2026, supported by frequent replacement cycles and broad availability across retail formats. Urban commuters, office workers, and households favor collapsible bottles for space efficiency when empty, particularly in bags, desks, and lunch kits. Purchase decisions in this segment prioritize leak-proof performance, modern aesthetics, dishwasher safety, and ease of cleaning. Common examples include collapsible bottles sold through supermarkets, pharmacies, and online marketplaces, as well as corporate gifting programs where compact reusable drinkware aligns with sustainability messaging.

The sports & outdoor segment is projected to grow the fastest, driven by rising participation in hiking, cycling, trail running, and adventure travel. Collapsible bottles appeal to this audience for their lightweight construction, compatibility with packs, and ability to collapse after use, freeing up space during activities. Innovations such as quick-flow valves, carabiner attachment points, freeze-safe materials, and abrasion-resistant designs are accelerating adoption. Event merchandising at marathons, outdoor festivals, and co-branding with performance apparel and gear brands further amplifies visibility and supports higher margins in this segment.

North America is projected to account for an estimated 37.5% of market share in 2026, supported by high disposable incomes, a deeply entrenched outdoor recreation culture, and early adoption of sustainability-driven consumer products. The U.S. dominates regional revenue, benefiting from strong e-commerce penetration, a dense network of specialty outdoor retailers, and large-scale institutional procurement programs. Brands such as Vapur, HydraPak, HYDAWAY, and Stojo have built significant traction through direct-to-consumer channels and partnerships with outdoor and lifestyle retailers, reinforcing North America’s leadership in premium and branded segments.

Regulatory clarity around food-contact materials and consumer product safety lowers entry risk for manufacturers, particularly for food-grade silicone and BPA-free plastics. At the municipal and institutional level, waste-reduction initiatives and refill-station deployments continue to influence procurement behavior. For example, stadium and venue refill programs in the U.S. have increased demand for branded collapsible bottles as part of zero-waste event strategies, creating recurring B2B opportunities tied to sports teams, festivals, and corporate sustainability commitments. Investment activity in the region favors DTC-first brands, patented lid or valve systems, and premium silicone designs that support higher margins.

Product innovation has centered on insulated collapsible formats and integrated filtration, expanding use cases beyond short trips to everyday commuting and outdoor sports. Companies such as HydraPak have leveraged their soft-bottle heritage in endurance sports to expand collapsible hydration systems into the trail-running and cycling markets, while lifestyle brands such as Stojo have normalized collapsible drinkware for daily urban use. North America remains the testing ground for premiumization, bundled accessories, and institutional sales models that later scale globally.

Europe is likely to be the fastest-growing regional market, driven by stringent single-use plastic regulations, high urban density, and strong consumer alignment with sustainability goals. Countries such as Germany and the U.K. lead adoption, followed closely by France and Spain, where urban commuting and tourism reinforce demand for compact reusable hydration solutions. The EU-wide policy alignment around waste reduction and packaging has accelerated the shift toward reusable drinkware, benefiting collapsible formats that combine portability with sustainability credentials.

European consumers place strong emphasis on product safety, recyclability, and provenance, favoring brands that can demonstrate compliance with food-contact standards and transparent supply chains. This has encouraged both international and regional brands to introduce premium silicone collapsible bottles tailored to European preferences, often emphasizing dishwasher safety, durability, and minimalist design.

Outdoor and lifestyle retailers across Germany and Scandinavia have expanded shelf space for collapsible hydration products, particularly those positioned for hiking, cycling, and commuter use. Growth opportunities are strongest in travel retail and event merchandising, especially at airports, rail hubs, marathons, and cycling events, where reusable bottles align with sustainability messaging.

Private-label partnerships with large European retailers have also expanded, allowing collapsible bottles to reach mainstream consumers at accessible price points. While regulatory compliance raises upfront entry costs for manufacturers, it also raises barriers to entry, favoring established suppliers and contributing to long-term market stability. Europe is emerging as a structurally resilient growth market rather than a purely cyclical one.

Asia Pacific combines manufacturing scale with rapidly expanding consumer demand, making it strategically critical to the global collapsible water bottle market. China remains the primary production hub, supplying HDPE and collapsible plastic bottles for engineered plastic for global private-label and branded programs. Domestic consumption in China’s tier-one and tier-two cities has increased as urban consumers adopt reusable drinkware for commuting and travel.

Japan leads the region in premium design and quality standards, with collapsible bottles positioned around compact living, precision engineering, and long product life. India and ASEAN markets offer the fastest unit growth, driven by urbanization, rising middle-class incomes, and a recovery in domestic and regional travel. E-commerce platforms play a central role in accelerating market penetration, particularly in Southeast Asia, where online marketplaces enable rapid distribution of value-priced collapsible bottles. In India, adoption is strongest in travel and daily-use segments, though localized pricing and simplified designs remain essential to scale beyond early adopters.

Asia-Pacific also serves as the backbone of export-oriented manufacturing, with suppliers in China and Vietnam expanding silicone molding capabilities to serve premium global brands. Regulatory diversity across the region increases complexity, especially for exporters supplying North America and Europe, favoring audited, certified manufacturers with established compliance processes. Overall, the region’s combination of cost-efficient production, growing domestic demand, and travel-driven consumption positions Asia Pacific as both a volume engine and a long-term growth market.

The global collapsible water bottle market is moderately fragmented, with numerous private-label OEMs and a smaller group of branded players capturing premium value. HDPE products dominate volume, while silicone specialists lead margin generation. Competitive advantage is shaped by design innovation, certification credibility, and channel access.

Key strategies include product innovation, omnichannel expansion, sustainability partnerships, and modular ecosystems that drive repeat purchases and retention.

The global collapsible water bottle market size is valued at US$2.1 billion in 2026.

By 2033, the collapsible water bottle market is expected to reach US$3.3 billion.

Key trends include rising substitution of single-use plastics, premiumization through silicone materials, integration of insulation and filtration features, and expansion of B2B and institutional sustainability programs such as stadium refill initiatives. Growth in travel and outdoor recreation also continues to drive demand for compact, lightweight designs.

By material type, HDPE is the leading segment with approximately 36.8% market share, driven by its cost efficiency and wide use in mass-market and private-label collapsible bottles.

The collapsible water bottle market is projected to grow at a CAGR of 6.7% between 2026 and 2033.

Major players with strong product portfolios include Vapur, HydraPak, HYDAWAY, Stojo, and Platypus.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Capacity

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author