ID: PMRREP12181| 192 Pages | 23 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

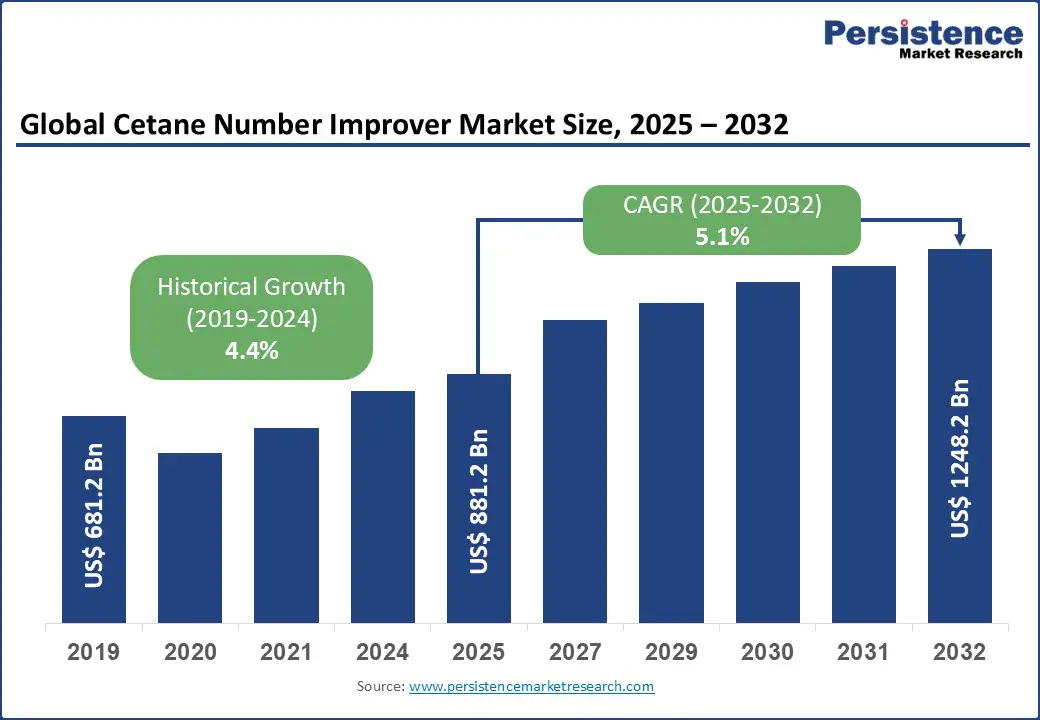

The global cetane number improver market size is likely to be valued at US$881.2 Bn in 2025 and is expected to reach US$1,248.2 Bn by 2032, registering a CAGR of 5.1% during the forecast period from 2025 to 2032. The cetane number improver market has experienced robust growth, driven by the rising demand for high-efficiency diesel fuels, advancements in fuel additive technologies, and the increasing need for emission-compliant engines.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

|

Cetane Number Improver Market Size (2025E) |

US$881.2 Bn |

|

Market Value Forecast (2032F) |

US$1248.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.4% |

The global surge in diesel engine demand is a primary driver of the cetane number improver market. According to the International Energy Agency (IEA), global oil demand is projected to rise by 2.5 million barrels per day (mb/d) from 2024 to 2030, reaching a plateau around 105.5 mb/d, with diesel accounting for a significant portion due to its dominance in transportation and industrial sectors. This rising demand, particularly in regions with high freight volumes and strong economic growth, underscores the need for cetane number improvers, which enhance ignition quality, improve combustion efficiency, and reduce emissions in diesel fuels.

In developing economies such as India and China, government programs such as India’s BS-VI emission standards and China’s Blue Sky initiative are accelerating the adoption of high-cetane fuels to meet air quality standards, boosting the use of additives such as 2-EHN. Moreover, the proliferation of heavy-duty vehicles further amplifies the need for cetane enhancers to handle escalating fuel quality requirements. Environmental considerations are also critical, as regulators such as the U.S. Environmental Protection Agency (EPA) mandate lower NOx emissions; studies show that increasing cetane levels can significantly reduce particulate matter.

The COVID-19 recovery phase emphasized resilient supply chains, with diesel’s role in logistics prompting investments in fuel optimization. In North America, shale oil production and export demands are driving diesel consumption growth, while in Europe, initiatives to cut transport emissions are boosting additive use in low-sulfur diesels. These factors collectively propel the industry’s growth, with projections indicating sustained demand as biofuels and hybrid engines increasingly integrate cetane improvers for performance stability.

The industry faces significant restraints due to high production and application costs, coupled with the need for skilled personnel. Manufacturing cetane improvers such as 2-EHN or DTBP involves complex chemical processes, with raw material costs such as alkyl nitrates fluctuating in line with volatile crude oil prices. The application of these additives requires precise blending to avoid engine inefficiencies, demanding specialized equipment and trained technicians, which adds to operational costs. In developing regions, the lack of skilled labor and advanced refining infrastructure limits adoption, particularly for small-scale refineries. Regulatory compliance, including adherence to international diesel fuel quality standards, further raises costs through rigorous testing and certification procedures.

Environmental concerns about additive byproducts, such as nitrogen oxides from 2-EHN, have also led to stringent regulations in regions such as Europe, adding to compliance expenses. Additionally, retrofitting refineries to accommodate bio-diesel-compatible improvers can be prohibitively expensive, discouraging smaller players. Economic uncertainties and ongoing supply chain disruptions have further strained raw material availability and pricing. These restraints disproportionately impact new entrants and smaller firms, slowing overall market expansion despite robust demand.

The sector offers significant opportunities through innovations in sustainable and versatile additive solutions. The global push for cleaner fuels, supported by international climate initiatives, encourages the development of eco-friendly improvers such as bio-based additives, which can significantly reduce carbon emissions compared to traditional compounds. Advancements in DTBP and other novel compounds have enabled greater compatibility with bio-diesel, aligning with renewable fuel mandates in regions such as the EU, where blending targets continue to expand. Multi-application additives that not only enhance cetane levels but also improve lubricity and stability are gaining strong traction, allowing refiners to lower blending costs and optimize fuel performance.

The rise of hybrid diesel-electric engines across transportation and industrial sectors is creating fresh demand for tailored improvers capable of enhancing performance across diverse fuel types. In emerging markets, government incentives promoting bio-diesel adoption are further boosting demand for compatible cetane improvers. Additionally, the integration of digital technologies, including AI-driven fuel optimization systems, offers refiners opportunities for more precise additive dosing, improving efficiency and reducing waste. Strategic partnerships between additive manufacturers and refineries are strengthening market reach, driving growth by addressing environmental priorities and cost challenges while fostering long-term expansion.

The global cetane number improver market is segmented into 2-Ethylhexyl nitrate (EHN), di-tertiary butyl peroxide (DTBP), and others. 2-EHN dominates, holding approximately 48% of market share in 2025, due to its cost-effective production and scalability for industrial and transportation applications.

Di-tertiary butyl peroxide (DTBP) emerged as the fastest-growing segment, fueled by rising demand for advanced and eco-friendly alternatives in biodiesel applications. Its ability to enhance combustion efficiency, reduce emissions, and ensure compatibility with renewable fuels positions DTBP as a critical additive in sustainable fuel strategies.

The cetane number improver market is segmented into petroleum diesel and bio-diesel. Petroleum diesel leads with a 48% share in 2025, supported by its dominant role in powering conventional engines, commercial fleets, and heavy machinery, where consistent performance and reliability remain critical for large-scale operations.

Bio-diesel is the fastest-growing segment, propelled by stringent regulatory mandates for renewable fuel adoption and global sustainability targets. Its eco-friendly profile, compatibility with advanced additives, and role in reducing carbon emissions drive rapid uptake across transportation and industrial sectors, strengthening its market momentum.

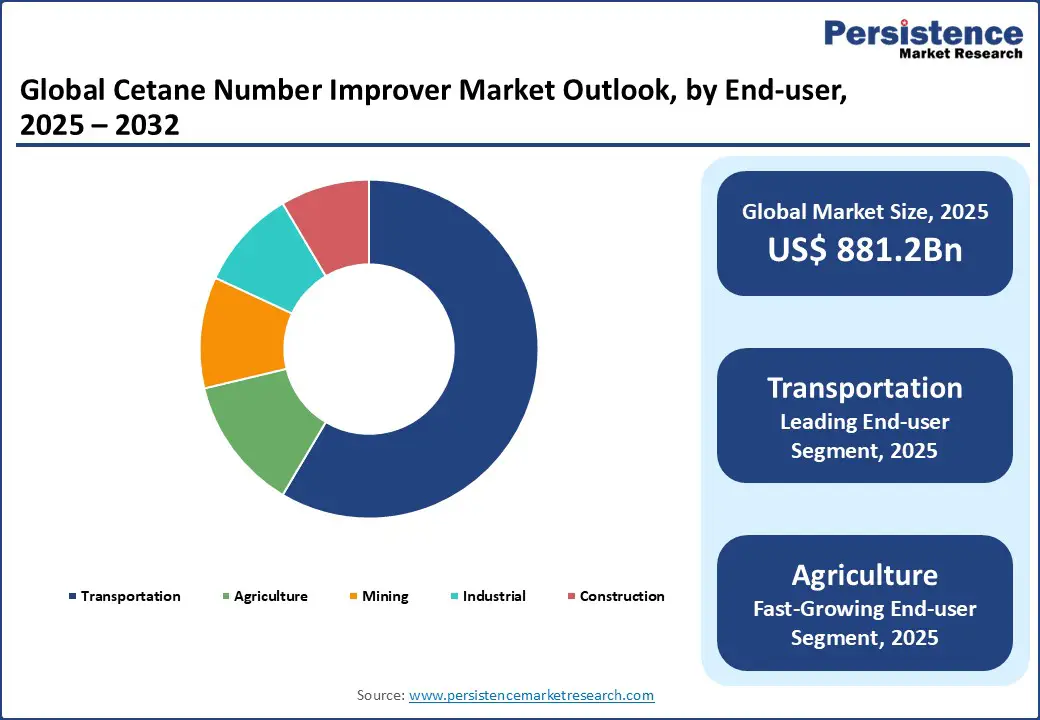

The cetane number improver market is segmented into transportation, agriculture, power generation, mining, construction, industrial, and others. Transportation dominates with a 55% share in 2025, driven by its critical role in supporting fleet operations, logistics networks, and long-haul mobility across global supply chains.

Agriculture is the fastest-growing segment, fueled by the rising adoption of mechanized farming practices and the extensive use of diesel-powered equipment. Growing demand for higher efficiency, improved fuel quality, and reduced emissions in agricultural machinery continues to accelerate the uptake of cetane number improvers.

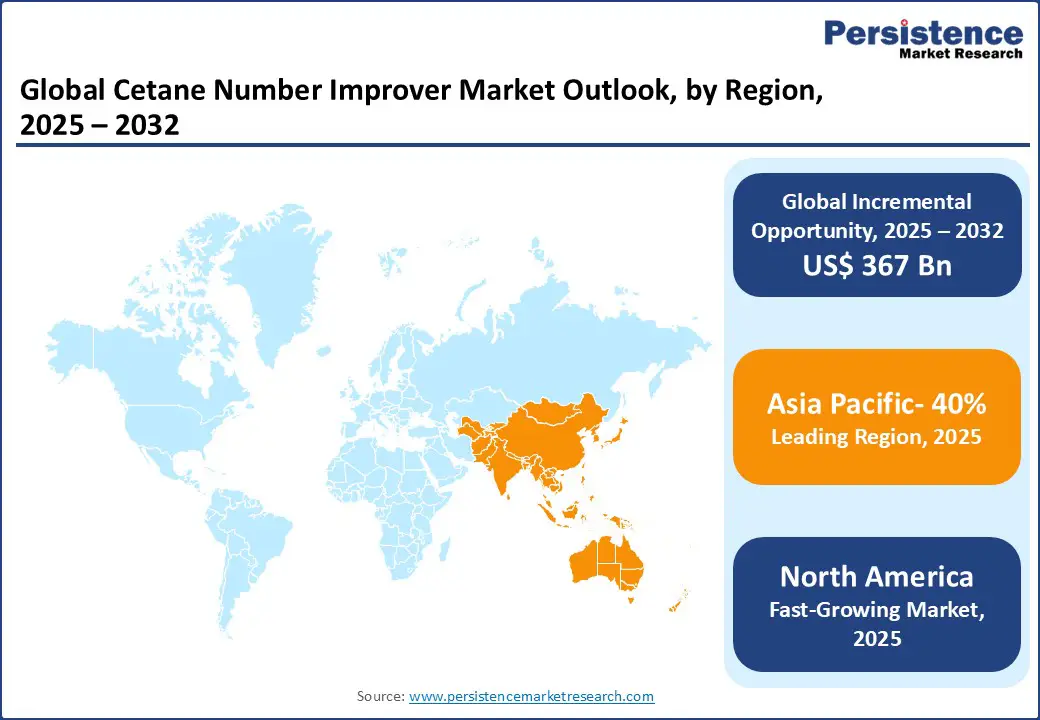

Asia Pacific dominates the global cetane number improver market, expected to account for a 40% share in 2025, supported by rising diesel consumption, rapid industrial growth, and increasingly stringent emission regulations in major economies such as China and India. In China, the government’s Blue Sky initiative is focused on reducing air pollution, with diesel fuel quality upgrades creating strong demand for cetane improvers. The country also represents a substantial portion of Asia’s diesel consumption, reinforcing its role as a key driver of market expansion.

In India, the nationwide adoption of BS-VI standards mandates the use of higher-cetane fuels, boosting the penetration of fuel additives across its massive vehicle base. Meanwhile, Japan and South Korea are advancing with cutting-edge refining technologies and green fuel programs, driven by the integration of hybrid engines and sustainability goals. Together, these factors position Asia Pacific as the central hub for growth, combining regulatory pressures, technological advancement, and high fuel demand.

North America is the fastest-growing region in the cetane number improver market, driven by stringent U.S. Environmental Protection Agency (EPA) regulations and expanding refining capacities. In the U.S., strong investments are directed toward meeting rising diesel demand, supported by shale oil exports and growing logistics needs. A notable trend is the increased blending of bio-diesel in states such as California, supported by clean fuel mandates and tax incentives that encourage refiners and distributors to adopt eco-friendly solutions. This shift is creating higher demand for cetane improvers compatible with renewable and blended fuels.

Canada follows similar growth patterns, with a focus on renewable diesel adoption, particularly in remote industrial and resource-driven regions where sustainable fuel solutions are critical. Collectively, supportive policies, technological upgrades in refining, and the growing emphasis on reducing emissions position North America as a dynamic market for cetane number improvers, with strong potential for continued expansion over the coming years.

Europe maintains a steady share in the cetane number improver market, supported by strong regulatory frameworks and sustainability targets. Leading countries such as Germany, the UK, and France are at the forefront of growth. In Germany, the diesel-reliant logistics and industrial sectors are key drivers, with rising adoption of low-emission fuels boosting the need for cetane enhancers. The UK’s Net Zero by 2050 goal is accelerating bio-diesel usage, creating consistent demand for improvers that enhance performance and emission compliance.

France, on the other hand, is strengthening its focus on renewable energy, particularly hybrid diesel systems, where regulatory incentives and clean energy policies encourage the integration of additives to optimize efficiency. Together, these markets showcase a balanced approach that combines environmental mandates with industrial demand, ensuring steady growth in cetane improver consumption. Europe’s alignment with EU-wide emission targets continues to play a pivotal role in shaping market expansion while supporting the transition toward cleaner and more sustainable fuels.

The global cetane number improver market is highly competitive, with global and regional players vying for share through innovation, competitive pricing, and reliability. The rise of sustainable and multi-application products intensifies competition, as companies meet stringent regulatory and industrial demands. Strategic partnerships, mergers, and regulatory approvals are key differentiators.

The cetane number improver market is projected to reach US$881.2 Bn in 2025.

Rising diesel demands, technological advancements in fuel additives, and government initiatives for emission control are key drivers.

The cetane number improver market is poised to witness a CAGR of 5.1% from 2025 to 2032.

Innovations in sustainable systems and multi-application solutions present significant growth opportunities.

BASF SE, The Lubrizol Corporation, and Innospec are among the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Chemical Compound Type

By Diesel Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author