ID: PMRREP26713| 287 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

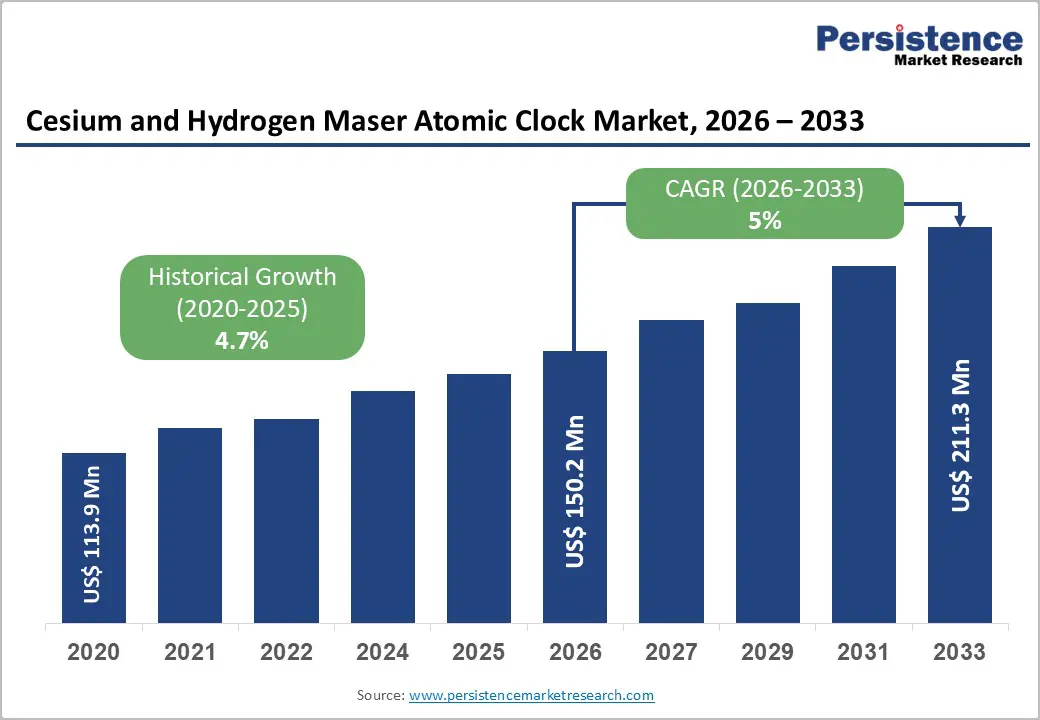

The global cesium and hydrogen maser atomic clock market size is likely to be valued at US$ 150.2 million in 2026, and is projected to reach US$ 211.3 million by 2033, growing at a CAGR of 5% during the forecast period of 2026–2033. The expansion of this market is driven by the rising dependence on ultra-precise time synchronization across space navigation, military communications, and telecom infrastructure, alongside government-funded investments in satellite constellations and national metrology systems. The increased deployment of Global Navigation Satellite System (GNSS) modernization programs, coupled with the growing requirement for long-term frequency stability in deep-space missions, continues to reinforce sustained demand. Regulatory mandates on timing accuracy in telecom and broadcasting further strengthen adoption.

| Key Insights | Details |

|---|---|

|

Cesium and Hydrogen Maser Atomic Clock Market Size (2026E) |

US$ 150.2 Mn |

|

Market Value Forecast (2033F) |

US$ 211.3 Mn |

|

Projected Growth (CAGR 2026 to 2033) |

5.0% |

Government-led expansion of space navigation, defense communication, and critical network infrastructure is the primary driver of the cesium and hydrogen maser atomic clock market growth. Between 2025 and 2030, more than 120 navigation and scientific satellites are scheduled for deployment by agencies such as NASA, European Space Agency (ESA), Indian Space Research Organization (ISRO), and the U.S. Department of Defense (DOD), each requiring highly reliable onboard atomic timekeeping. Hydrogen maser clocks are increasingly specified for space and deep-space missions due to their superior short-term frequency stability, while cesium beam clocks remain essential for ground-based synchronization. Procurement is typically executed through long-term, lifecycle-based government contracts, creating predictable demand and structurally high entry barriers.

Telecom network synchronization and national time standardization programs are reinforcing sustained adoption. For example, in June 2025, the Indian government announced that Indian Standard Time (IST) will become mandatory for all legal, commercial, digital, and administrative purposes, marking the first time IST serves as India's official legal time. The transition to 5G standalone architectures and early 6G research has elevated timing accuracy requirements to sub-microsecond levels, accelerating deployment of cesium-based primary reference clocks across terrestrial networks. A majority of Tier-1 operators had upgraded timing infrastructure to meet regulatory synchronization mandates. At the institutional level, national laboratories such as the U.S. National Institute of Standards and Technology (NIST) and the National Metrology Institute of Japan (NMIJ) have continued clock modernization programs to maintain traceability to the Coordinated Universal Time (UTC). Notably, in 2025, multiple space and defense agencies reaffirmed investments in secure, GNSS-resilient timing systems, underscoring long-term commitment to precision timing infrastructure.

The market for cesium and hydrogen maser atomic clock faces structural constraints due to high capital intensity and limited commercial scalability. These systems require complex vacuum assemblies, magnetic shielding, and ultra-stable oscillators, resulting in unit prices ranging from US$ 120,000 to over US$ 500,000, depending on configuration. In 2025, several government agencies reported procurement delays as funding was reallocated toward satellite manufacturing and launch programs, temporarily deferring timing system upgrades. Such cost sensitivity confines adoption largely to government, defense, and Tier-1 telecom operators, limiting penetration into broader commercial segments.

The market is also constrained by supply chain concentration and skilled labor dependency. Critical components, including microwave cavities, hydrogen storage units, and low-noise quartz oscillators, are sourced from a narrow supplier base in North America and Europe, resulting in extended lead times of 6–9 months. Clock integration, calibration, and lifecycle maintenance require highly specialized physicists and engineers, creating workforce bottlenecks. In response, leading manufacturers and regional governments-initiated capacity expansion and workforce development programs, aimed at improving component availability and strengthening long-term production resilience, though near-term constraints persist.

A growing global focus on GNSS independence and resilient timing infrastructure is creating sustained opportunities in the cesium and hydrogen maser atomic clock market. Major spacefaring economies, including China, Japan, Europe, and the United States, continued incremental upgrades to their navigation and satellite systems, with atomic clocks remaining a core and indispensable payload component. Publicly disclosed satellite modernization programs under BeiDou, QZSS, Galileo, and GPS emphasized improved timing accuracy, signal reliability, and longer in-orbit operational life, reinforcing steady demand for space-qualified cesium and hydrogen maser clocks without relying on speculative investment figures.

The regulators and infrastructure authorities in North America and Europe advanced frameworks to strengthen terrestrial timing resilience in response to GNSS disruption risks. The policy initiatives promoted the deployment of non-GNSS timing sources across telecom networks, financial systems, data centers, and power grids, directly supporting wider adoption of cesium-based holdover clocks. At the technology level, space agencies in Europe and Japan continued validated demonstration programs evaluating hybrid architectures combining masers with optical references, signaling future procurement preference for modular and upgrade-ready timing systems. Leading manufacturers aligned product development and capacity planning to support these globally converging requirements.

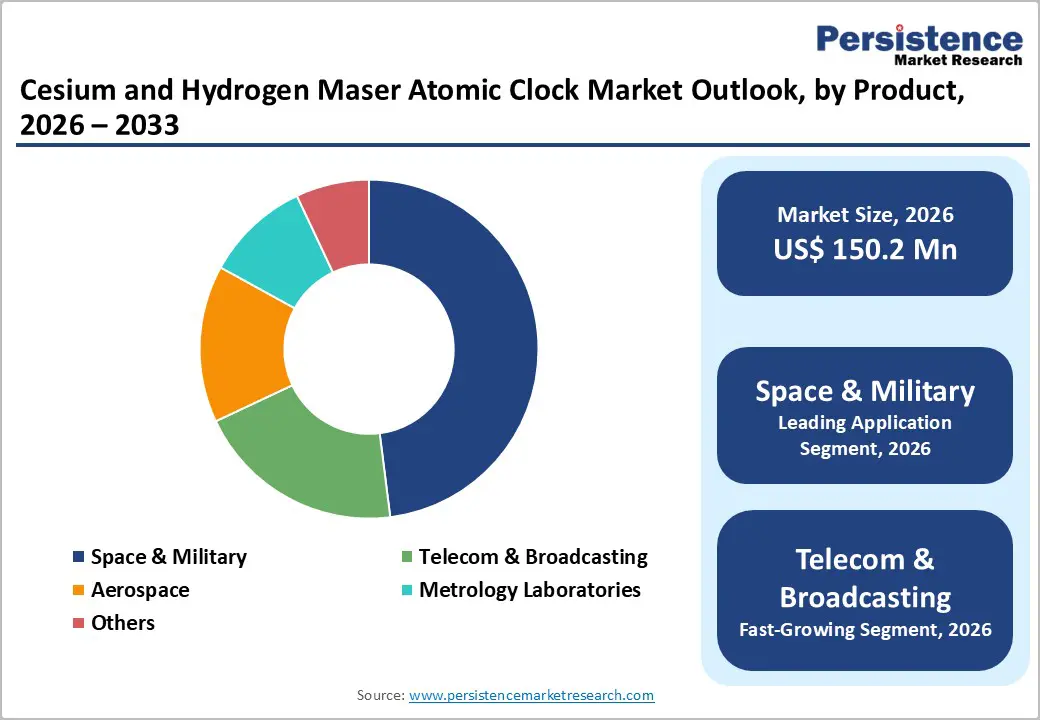

Cesium beam atomic clocks are expected to remain the dominant product type, accounting for approximately 60% of the market revenue share in 2026. Their leadership is driven by their role as primary frequency standards, offering long-term stability and direct traceability to UTC. These attributes make them indispensable across telecom networks, national metrology laboratories, and ground-based timing infrastructure. Regulatory acceptance and comparatively lower lifecycle complexity further reinforce adoption. Moreover, in North America and Europe, cutting-edge research & development (R&D) activities have further bolstered the importance of cesium atomic clocks. For example, in April 2025, NIST certified the NIST-F4, a new cesium fountain atomic clock in Boulder, Colorado, as one of the world's most accurate timekeepers with precision stable enough to lose less than one second over 100 million years. It measures cesium atom oscillations via laser-cooled atomic fountains, supporting UTC calibration and U.S. time scale for telecom, finance, and transport.

Hydrogen maser atomic clocks are projected to be the fastest-growing product type, expanding at a CAGR of approximately 5.6% during 2026–2033. Growth is supported by rising deployment in space missions, deep-space tracking, and scientific applications requiring exceptional short-term frequency stability. Unlike cesium clocks, masers are optimized for high-precision satellite payloads and deep-space ground stations. The upgrades to deep-space communication facilities supporting interplanetary missions reinforced demand for advanced hydrogen maser systems. Leading suppliers are investing in radiation-hardened designs and extended operational lifetimes, aligning product development with long-duration space mission requirements. In April 2025, for instance, the Space Hydrogen Maser (SHM), an ultra-precise atomic clock developed by Safran Electronics & Defense, became a part of the ESA's Atomic Clock Ensemble in Space (ACES) mission aboard the International Space Station (ISS), achieving unprecedented timekeeping accuracy (one second error over 300 million years).

Space and military applications are projected to represent the largest application segment, accounting for approximately 48% of total market revenue in 2026. Defense and space agencies prioritize secure, redundant, and tamper-resistant timing systems for navigation, missile guidance, and encrypted communications. Hydrogen masers are commonly deployed in satellite payloads, while cesium clocks dominate ground control, tracking stations, and reference timing systems. Procurement is typically structured around long-term contracts and rigorous qualification standards, ensuring high revenue visibility. The continued satellite constellation upgrades and defense communication modernization programs sustained strong demand. High reliability requirements and mission-critical use cases reinforce this segment’s dominance.

Telecom and broadcasting are expected to be the fastest-growing application segment, registering a CAGR of approximately 5.4% from 2026 to 2033. Growth is driven by 5G standalone deployment, early 6G development, and stricter synchronization requirements across advanced networks. Regulators increasingly mandate atomic-grade timing sources to ensure service continuity during GNSS outages. Cesium beam clocks are widely adopted due to their long-term stability and regulatory compliance. The telecom operators across North America and Europe accelerated investments in GNSS-resilient timing and holdover infrastructure. These initiatives are expanding atomic clock adoption beyond traditional core network deployments.

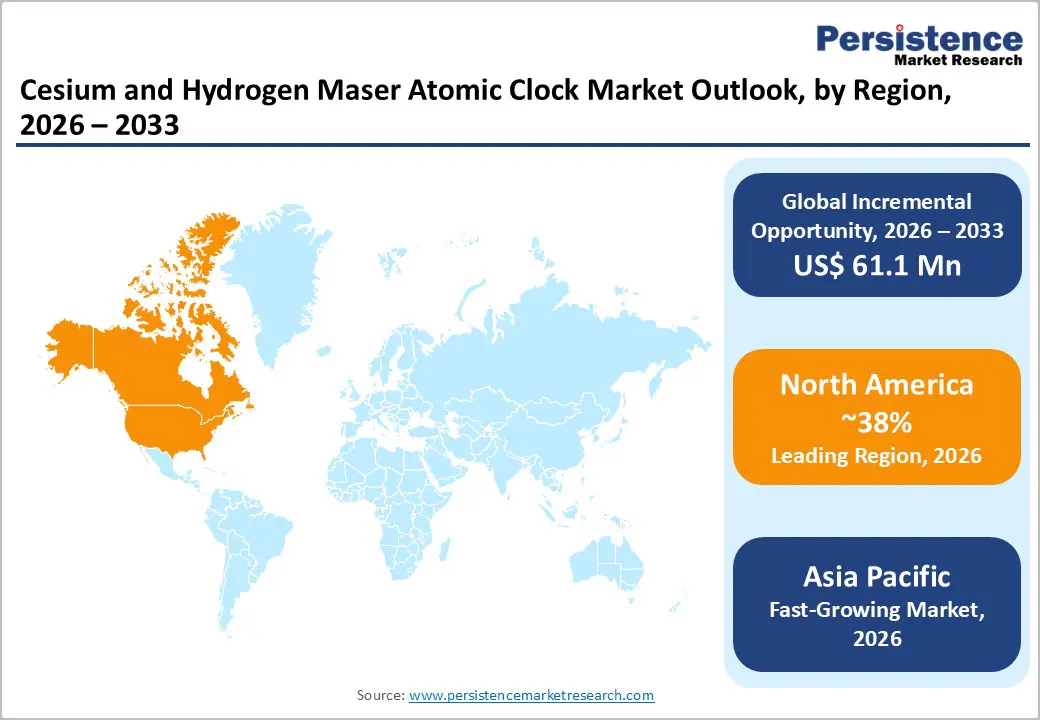

North America is expected to command approximately 38% of the cesium and hydrogen maser atomic clock market share in 2026, with the United States driving most of the demand. Its dominance is underpinned by substantial federal funding for space navigation, defense communications, and national metrology programs, coordinated by NASA, DOD, and NIST. The region’s advanced telecom ecosystem, including early 5G deployments and experimental 6G research, relies heavily on atomic clock-based primary reference systems, reinforcing stable market demand. Regulatory clarity from the FCC ensures consistent deployment and operational compliance, while public-private R&D partnerships promote innovation in timing solutions.

A variety of federal initiatives have increasingly included upgrades to ground-based satellite tracking stations and GNSS-independent timing infrastructure, strengthening demand for both cesium and hydrogen maser clocks. Long-term procurement contracts with lifecycle support provide predictable revenue streams, while collaborative R&D programs continue to advance space-qualified clock designs. Future investments focus on resilient, GNSS-independent timing networks to support defense modernization, next-generation telecom, and metrology applications. The presence of well-established suppliers, coupled with high entry barriers, ensures North America remains a stable and technologically advanced market leader, attracting both domestic and international investment.

Europe remains a key regional market for atomic clocks, with Germany, France, and the U.K. serving as primary contributors. The growth is supported by ESA satellite programs, EU-wide regulatory harmonization on telecom timing, and public funding initiatives such as Horizon Europe, fostering innovation in high-precision timekeeping. National metrology institutes are continuing to upgrade primary frequency standards and deploy modern cesium and hydrogen maser clocks to maintain UTC traceability, supporting both scientific and defense missions.

Several satellite constellation upgrades and terrestrial timing projects were implemented, improving reliability and redundancy of navigation and communication systems. For instance, in December?2025, two new Galileo navigation satellites (SAT?33 and SAT?34) were successfully launched aboard an Ariane?6 rocket from Europe’s Spaceport in French Guiana, reinforcing the Galileo constellation and enhancing the precision, availability, and robustness of Europe’s navigation and timing services. National agencies continued procurement of cesium and hydrogen maser clocks for research, defense, and telecom applications, favoring established suppliers with proven technology. Coordinated regulatory frameworks and cross-border collaborations support market stability, while private sector adoption for timing resilience in telecom and energy networks is gradually increasing. Europe’s investment in next-generation clock technologies and hybrid systems ensures the region remains competitive and strategically significant for atomic timekeeping infrastructure expansion.

Asia Pacific is projected to be the fastest-growing regional market for cesium and hydrogen maser atomic clocks, expanding at a CAGR of over 5.8% between 2026 and 2033, with China, India, and Japan as leading contributors. Growth is primarily driven by GNSS sovereignty programs, defense modernization, and national navigation constellation expansion, including BeiDou, NavIC, and QZSS. The region benefits from manufacturing cost advantages, domestic capability development, and government support for indigenous atomic clock production, reshaping the supplier landscape and enabling long-term self-reliance.

Key developments included the advancement of ground-based atomic clock networks and regional timing centers, such as Japan’s NICT Otemachi Project, which distributes Japan Standard Time with nanosecond-level precision over optical fiber to critical urban infrastructure. These efforts support advanced research, defense coordination, and synchronization of telecom, data center, and power networks, complementing satellite programs while enhancing domestic timing capabilities and operational redundancy. Regional initiatives also focused on skill development and local component manufacturing to reduce reliance on imported high-precision sub-assemblies. With increasing public and private sector investment, Asia Pacific is emerging as a strategic hub for high-precision timing technologies, attracting global suppliers and reinforcing long-term adoption, innovation, and market influence.

The global cesium and hydrogen maser atomic clock market has a moderately consolidated structure, with key companies such as Microsemi (Microchip), SpectraTime, Oscilloquartz, and T4Science controlling a substantial portion of the revenue. These organizations benefit from established partnerships with government, defense, space, and telecommunications sectors, enabling them to drive innovation and maintain market leadership. Their focus remains on research and development for space-qualified masers, radiation-hardened cesium clocks, and enhancements in long-term frequency stability, ensuring they remain at the forefront of precision timekeeping technology.

Regional and specialized competitors cater to niche applications, including metrology laboratories, Very Long Baseline Interferometry (VLBI) radio astronomy, and telecom holdover solutions. Regulatory compliance, complex calibration requirements, and extended qualification cycles present significant barriers to new entrants. However, advancements such as software-enabled monitoring systems and hybrid architectures are creating new growth opportunities. The market is likely to experience further consolidation as leading firms expand their global footprint, acquire smaller niche suppliers, and establish strategic alliances to strengthen their positions and meet evolving industry demands.

The global cesium and hydrogen maser atomic clock market is projected to reach US$ 150.2 million in 2026.

Key drivers include the expansion of GNSS and defense navigation infrastructure, telecom network synchronization for 5G/6G, and national metrology programs requiring high-precision, reliable timekeeping systems.

The market is poised to witness a CAGR of 5% from 2026 to 2033.

Prominent opportunities are coming up in the form of indigenous GNSS and defense modernization initiatives in Asia Pacific, timing resilience for critical infrastructure, and technological convergence with hybrid optical-maser systems.

Microsemi (Microchip), SpectraTime, Oscilloquartz, T4Science, and Vremya-CH, among others, are few of the key players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author