ID: PMRREP32259| 198 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

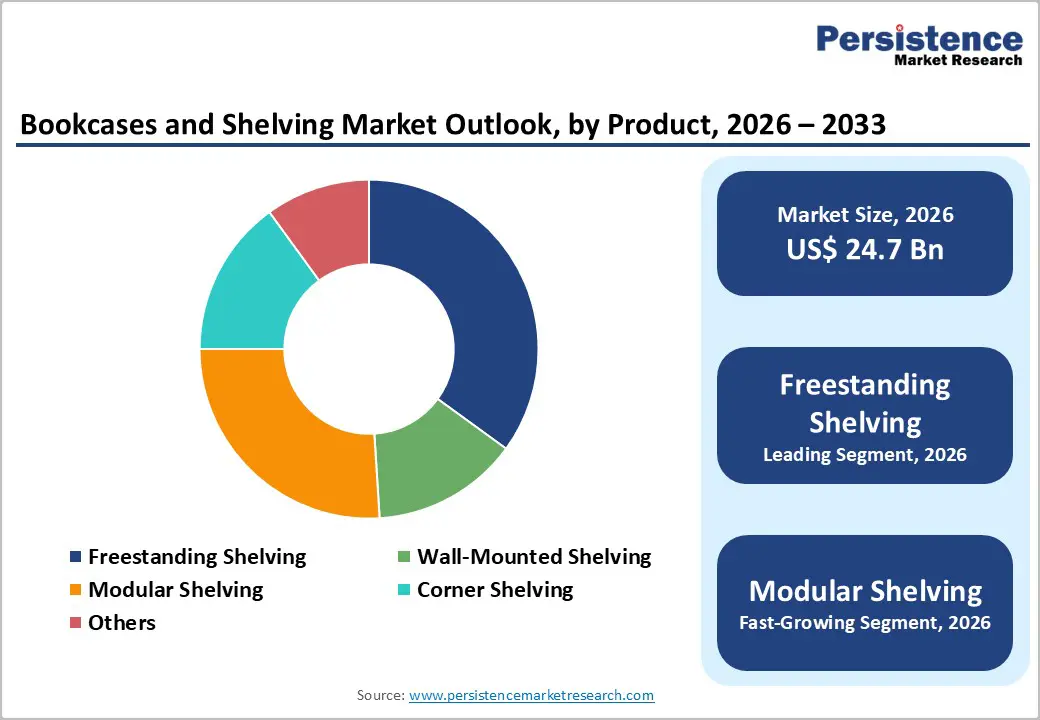

The global bookcases and shelving market size is likely to be valued at US$24.7 billion in 2026 and is expected to reach US$34.3 billion by 2033, growing at a CAGR of 4.8% during the forecast period from 2026 to 2033, driven by rapid urbanization and shrinking residential spaces, which are increasing demand for space-efficient, multifunctional, and modular storage solutions across residential and commercial settings.

Increasing disposable incomes and changing lifestyle preferences are driving greater spending on home furnishings, especially through e-commerce and omnichannel retail, which offer enhanced accessibility and customization options. The widespread adoption of remote and hybrid work arrangements has boosted demand for home office furniture, including bookcases and shelving that combine organization with style. Current interior design trends, which emphasize minimalism and well-structured living spaces, are positioning shelving as both a practical and decorative feature.

| Key Insights | Details |

|---|---|

|

Bookcases and Shelving Market Size (2026E) |

US$24.7 Bn |

|

Market Value Forecast (2033F) |

US$34.3 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.8% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.6% |

Increasing migration toward urban centers has led to a rise in high-density housing, including apartments, condominiums, and mixed-use developments, where floor space is limited and efficient storage becomes essential. Average home sizes shrink in major metropolitan areas, and consumers are prioritizing furniture that maximizes vertical space and enhances organization without occupying large footprints. Wall-mounted shelving, corner units, and compact freestanding bookcases are increasingly favored for their ability to provide storage while preserving usable living areas. Urban households also tend to adopt minimalist and clutter-free interior styles, encouraging the use of shelving solutions that combine functionality with clean design.

Space optimization trends are accelerating demand for modular and multifunctional shelving solutions across urban markets. Modern consumers increasingly seek furniture that can adapt to changing needs, layouts, and lifestyles, especially in cities, where residents relocate more frequently or repurpose rooms for multiple functions. Modular shelving systems allow users to reconfigure units, expand storage vertically, or integrate shelving with desks, cabinets, and entertainment units, making them particularly suitable for urban homes and home offices. The growth of remote and hybrid work in urban environments has strengthened this trend, as professionals require organized storage for documents, books, and equipment within constrained living spaces.

Regulations related to deforestation control, responsible forestry management, and chemical usage in finishes and adhesives are increasing compliance requirements for manufacturers. For wood-based bookcases and shelving, adherence to certifications such as FSC and PEFC has become essential, raising procurement and production costs. Restrictions on volatile organic compounds (VOCs) used in paints, coatings, and laminates are compelling manufacturers to invest in cleaner technologies and alternative materials. While these measures support long-term sustainability goals, they can reduce short-term profitability, especially for small and mid-sized manufacturers with limited financial flexibility. Compliance costs also translate into higher product prices, potentially limiting affordability in price-sensitive markets.

Competitive pressures constrain market growth, as the bookcases and shelving industry is highly fragmented and characterized by intense price competition. The presence of numerous unorganized and regional manufacturers offering low-cost alternatives puts pressure on established brands to maintain competitive pricing while investing in design innovation and sustainability. E-commerce platforms have increased price transparency, enabling consumers to easily compare products and favor lower-priced options, often reducing brand loyalty. Private-label furniture brands and mass retailers compete aggressively by leveraging scale advantages and efficient supply chains. Continuous product differentiation through design, modularity, and customization requires sustained investments, straining margins.

Rising housing costs and high population density in major urban centers are encouraging the development of smaller apartments and studio homes, where efficient storage becomes a priority. In such environments, bookcases and shelving systems are no longer viewed solely as storage units but as integral design elements that help organize living spaces without adding clutter. Wall-mounted shelves, vertical bookcases, and corner shelving are gaining popularity for their ability to utilize unused wall areas while maintaining an open layout. Consumers in urban areas also value versatility, driving demand for modular shelving systems that can be easily reconfigured or expanded as needs change. Compact living is encouraging manufacturers to innovate with slim profiles, lightweight materials, and aesthetically appealing designs tailored specifically for space-constrained urban households.

The continued rise of home offices further strengthens growth opportunities within the bookcases and shelving market. Remote and hybrid work arrangements have become a long-term feature of modern employment, increasing the need for organized and productive work-from-home environments. Bookcases and shelving play a critical role in home offices by providing storage for documents, books, equipment, and decorative elements that enhance workspace functionality and comfort. Compact desks with integrated shelving, adjustable modular systems, and multifunctional storage solutions are particularly attractive to professionals working from smaller homes or apartments. The emphasis on ergonomic and visually appealing home office setups is encouraging investment in premium shelving designs that balance practicality with style.

Freestanding shelving is expected to lead the bookcases and shelving market, accounting for approximately 40% of revenue in 2026, due to its versatility, ease of installation, and wide applicability across residential and commercial environments. Unlike fixed storage systems, freestanding units do not require wall drilling or permanent structural changes, making them highly attractive to renters, urban households, and businesses seeking flexible layouts. These shelving systems are widely used in living rooms, bedrooms, home offices, libraries, and retail environments, where flexibility and mobility are key considerations for buyers. Freestanding shelving fits seamlessly with modern interior design trends that emphasize open layouts and versatile furniture. Companies such as IKEA have effectively tapped into this demand by offering freestanding bookcases that blend modular design with easy assembly, appealing to both budget-conscious and style-savvy consumers.

Modular shelving is likely to represent the fastest-growing segment in 2026, driven by increasing consumer demand for customizable, space-efficient, and multifunctional furniture solutions. Urbanization and compact living environments are encouraging buyers to choose shelving systems that can be easily reconfigured, expanded, or adapted to changing needs. Modular shelving allows users to adjust shelf heights, add or remove units, and integrate storage with workstations or entertainment areas, making it especially suitable for modern apartments and home offices. This adaptability resonates particularly with younger urban consumers and professionals who prioritize both functionality and modern design. For example, companies such as Herman Miller have launched modular storage solutions that combine ergonomic design with scalability, catering to the needs of dynamic work-from-home and hybrid office environments.

Wood is expected to dominate the market, accounting for approximately 40% of total revenue in 2026, driven by its enduring aesthetic appeal, durability, and strong consumer preference for natural materials. Wooden shelving is commonly used in homes, offices, libraries, and premium interiors, where visual warmth and long-term reliability are highly valued. Consumers often associate wood with quality, craftsmanship, and elegance, making it a favored choice for bookcases that complement both traditional and contemporary décor. Growing awareness of sustainability has further boosted demand for responsibly sourced wood, particularly products certified by recognized forestry standards. For example, Ashley Furniture Industries offers a wide range of wooden bookcases across various styles and price points, reinforcing wood’s leading position in the market.

Metal is expected to be the fastest-growing shelving material in 2026, driven by increasing demand for modern, durable, and heavy-duty storage solutions across both residential and commercial settings. Metal bookcases and shelving systems are gaining popularity in offices, retail spaces, warehouses, and contemporary homes due to their strength, sleek design, and long-lasting performance. This material complements industrial and modern interior design trends, which emphasize clean lines and functional aesthetics. Metal shelving is valued for its capacity to support heavier loads, making it ideal for professional and high-usage environments. For example, Steelcase has expanded its metal shelving portfolio to meet the needs of corporate offices and co-working spaces seeking robust and adaptable storage solutions.

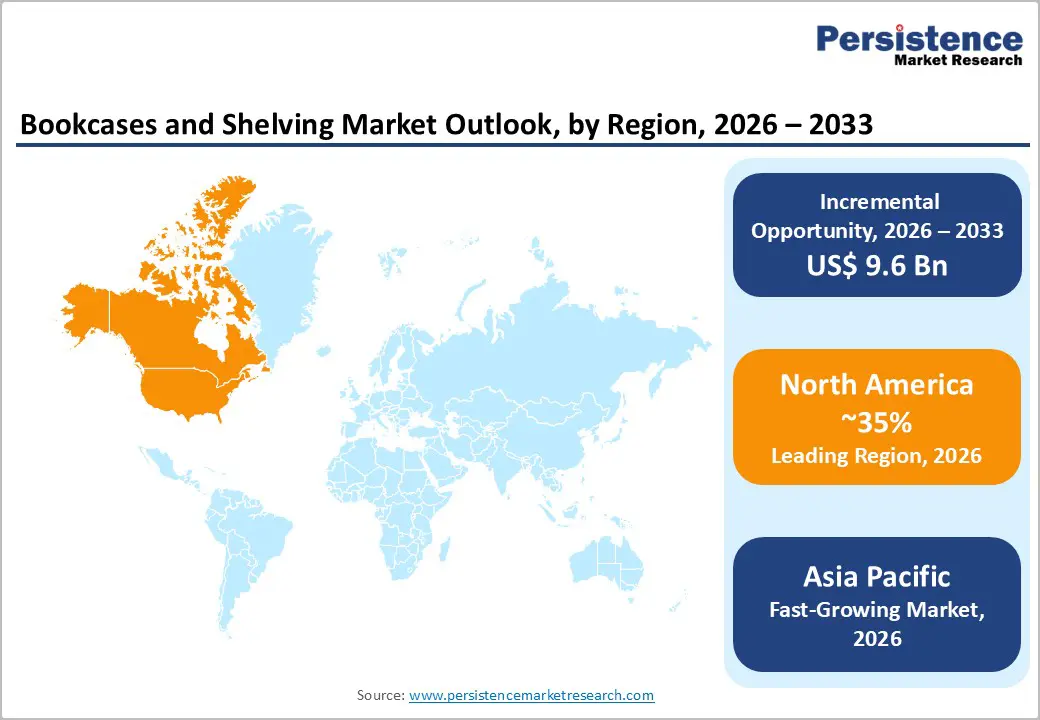

North America is expected to lead the market, accounting for approximately 35% of the share in 2026, driven by changing consumer lifestyles and functional needs. A prominent trend is the growing demand for multifunctional, space-saving shelving solutions, particularly in urban homes and apartments with limited floor space. As remote and hybrid work arrangements become more permanent, homeowners are investing in storage options that integrate seamlessly with home office furniture, such as shelving combined with desks or media units. Sustainability continues to be a key consideration, with buyers increasingly seeking products made from responsibly sourced wood and low-emission materials. Retailers and manufacturers are responding with eco-certified products and greater transparency regarding material sourcing.

Commercial demand is also shaping the North American market, as businesses, educational institutions, and co-working spaces seek durable and adaptable storage systems. Organizations are prioritizing shelving that supports organized workflows, efficient document management, and flexible space layouts. For example, Haworth, Inc. has introduced versatile shelving and storage solutions tailored for dynamic office environments, addressing the evolving needs of collaborative workplaces. At the same time, aesthetic preferences are shifting toward contemporary and minimalist designs, prompting manufacturers to expand their range of styles and finishes.

Europe is expected to be a significant market for bookcases and shelving in 2026, driven by strong demand for sustainable, eco-friendly furniture, a preference for modern and modular designs, strict environmental regulations, and the growing adoption of space-efficient storage in urban homes and commercial spaces. European rules on deforestation, chemical use, and recyclability are encouraging manufacturers to implement greener supply chains and eco-conscious production practices. This is reflected in the rising popularity of FSC-certified wood shelving and low-VOC finishes, which appeal to environmentally aware consumers. Contemporary European interior design continues to favor minimalist, modular storage solutions that integrate seamlessly with modern décor.

Commercial demand is also shaping the market, as businesses and institutions increasingly seek flexible, durable shelving that supports collaborative and adaptable workspaces. For instance, Knoll, Inc. leverages its design expertise to offer shelving systems that blend aesthetics with practical storage, catering to evolving workplace dynamics where modularity and adaptability are essential. The retail and hospitality sectors in Europe are embracing customized shelving solutions for merchandising and displays, further diversifying market demand.

The Asia Pacific region is expected to be the fastest-growing market for bookcases and shelving in 2026, driven by rapid urbanization, rising disposable incomes, and changing consumer lifestyles in key economies such as China, India, Japan, and Southeast Asian countries. Increasingly limited living spaces in urban areas are boosting demand for space-efficient, versatile shelving and storage solutions suited to modern homes and apartments, where vertical storage and multifunctional furniture are highly valued. The growing middle class and rising focus on home renovation and interior décor are further fueling interest in stylish and aesthetically appealing bookcases and shelving units. E-commerce growth is accelerating this trend, with consumers increasingly purchasing furniture online, supported by digital tools such as AR visualization for in-home previews.

Commercial and institutional demand is also shaping market trends, as businesses, educational institutions, and retail sectors seek durable and flexible shelving solutions to support organized operations and modern layouts. For example, Hatil, a leading furniture manufacturer based in Bangladesh with a growing presence in India and Southeast Asia, has expanded its portfolio of modular and stylish storage furniture to meet diverse residential and commercial needs. Hatil’s regional expansion, investments in showrooms, and enhanced online platforms reflect the broader trend of companies strengthening their market presence amid rising consumer expectations for quality, design, and sustainability.

The global bookcases and shelving market is moderately fragmented, shaped by a mix of established multinational furniture manufacturers and regional players offering varied product portfolios and value propositions. Major brands leverage extensive distribution networks, strong retail presence, and continuous product innovation to secure significant market share, while smaller niche companies differentiate themselves through specialized designs, customization, and local expertise. Rising consumer demand for space-saving storage, multifunctional furniture, and sustainable materials is driving investments in eco-friendly products and digital sales channels to enhance differentiation and customer engagement.

Key industry leaders include IKEA, Sauder Woodworking Co., Ashley Furniture Industries, Herman Miller, and Wayfair. Competition is centered on design, sustainability, pricing, and distribution reach, with companies pursuing product enhancements, global and online expansion, strategic partnerships, and sustainability initiatives to attract environmentally conscious consumers and grow across both residential and commercial segments. Overall, the market’s dynamic landscape is defined by innovation, supply chain optimization, and strategic marketing efforts.

The global bookcases and shelving market is projected to reach US$24.7 billion in 2026.

The bookcases and shelving market is driven by increasing urbanization, the growing need for space-saving and versatile furniture, and the expansion of home office environments.

The bookcases and shelving market is expected to grow at a CAGR of 4.8% from 2026 to 2033.

Key market opportunities include the growing need for compact, modular, and customizable storage in urban homes, the expansion of home office setups, and the rising preference for sustainable, eco-friendly materials.

IKEA, Sauder Woodworking Co., Bush Furniture, Herman Miller, Inc., Steelcase Inc., and HNI Corporation are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Material

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author