ID: PMRREP18625| 199 Pages | 20 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

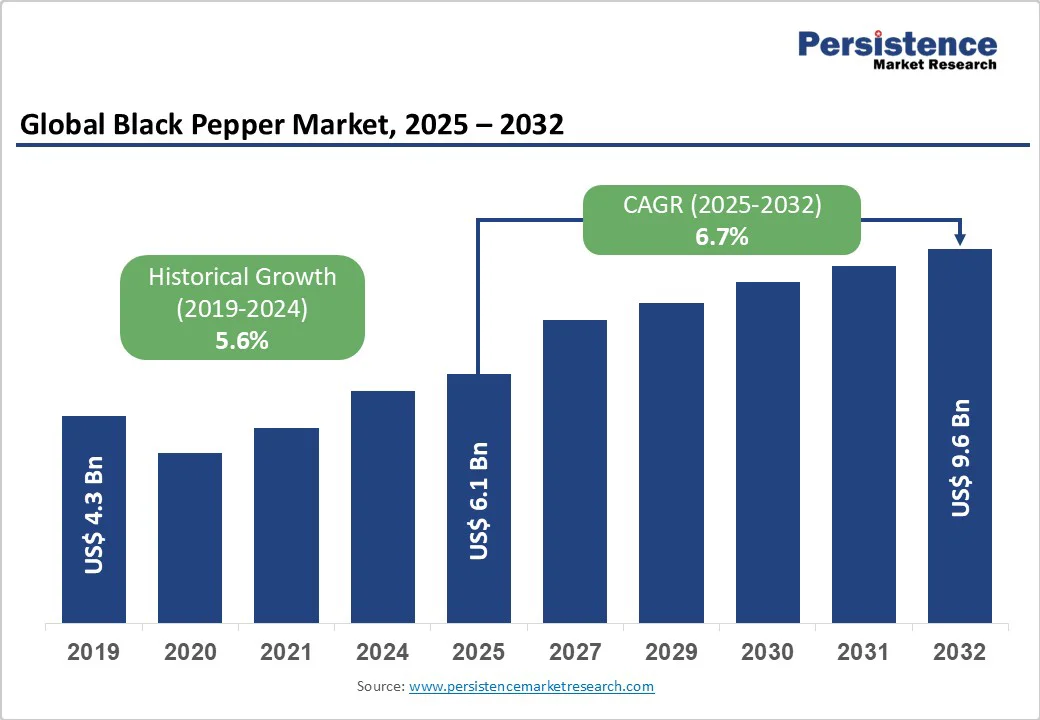

The global black pepper market size is likely to be valued at US$ 6.1 billion in 2025, and is projected to reach US$ 9.6 billion by 2032, growing at a CAGR of 6.7% during the forecast period 2025-2032, driven by widening utilization of the ingredient in the food and beverage sector, increasing demand for natural flavoring agents, and growing awareness of its health benefits.

| Key Insights | Details |

|---|---|

|

Black Pepper Market Size (2025E) |

US$ 6.1 Bn |

|

Market Value Forecast (2032F) |

US$ 9.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.6% |

Growing awareness of the health benefits of black pepper is increasingly driving its market demand globally. Per the National Nutrient Database of the U.S. Department of Agriculture (DOA), 100 g of black pepper contains about 25.3 g of dietary fiber, 10.39 g protein, and high levels of essential minerals such as 443 mg calcium and 171 mg magnesium. These nutrients contribute to improved digestion, gut health, and metabolic functions. Moreover, clinical reviews show that piperine, the major bioactive compound in black pepper, has measurable effects in reducing total cholesterol, LDL (“bad”) cholesterol, and triglycerides in overweight or obese subjects, while also boosting antioxidant enzymes such as superoxide dismutase and lowering markers of inflammation including C-reactive protein.

Adulteration and quality issues represent a significant restraint on black pepper market growth. In India, for example, tests by the Food Safety and Standards Authority of India (FSSAI) found that 60-65% of 68 lots of black pepper seized from NCDEX warehouses in Kochi contained traces of mineral oil, which is not fit for human consumption. Furthermore, a recent seizure in Gujarat revealed 2,600 kg of black pepper adulterated with starch powder, oil, and powdered gum.

On a broader international level, a European Commission survey during 2019-2021 tested nearly 1,885 spice and herb samples (including black pepper) and found 17% of pepper samples were at risk of adulteration. Furthermore, in the EU Rapid Alert System for Food and Feed (RASFF), almost 96.3% of serious notifications related to black pepper were due to Salmonella, aflatoxins, and mycotoxins, indicating contamination and safety hazards. These issues have eroded consumer confidence, raised regulatory risks, increased costs for producers through testing, recalls, or reformulation, and constrained growth, especially in high-standard export markets.

The rising demand for organic and fair-trade spices presents a significant opportunity for black pepper market players. India, as the world's largest producer of certified organic farmers, has seen substantial growth in organic agriculture. In the 2020/2021 marketing year, India's organic crop production reached 3.2 million metric tons, marking a 36% increase from the previous year. Spices and condiments accounted for 4% of this production, totaling approximately 104,821 metric tons. This market growth is driven by increasing consumer preference for chemical-free, sustainably produced foods, supported by government initiatives promoting organic farming. The expansion of organic certification areas, particularly in states like Madhya Pradesh, Maharashtra, and Rajasthan, further bolsters the sector's development.

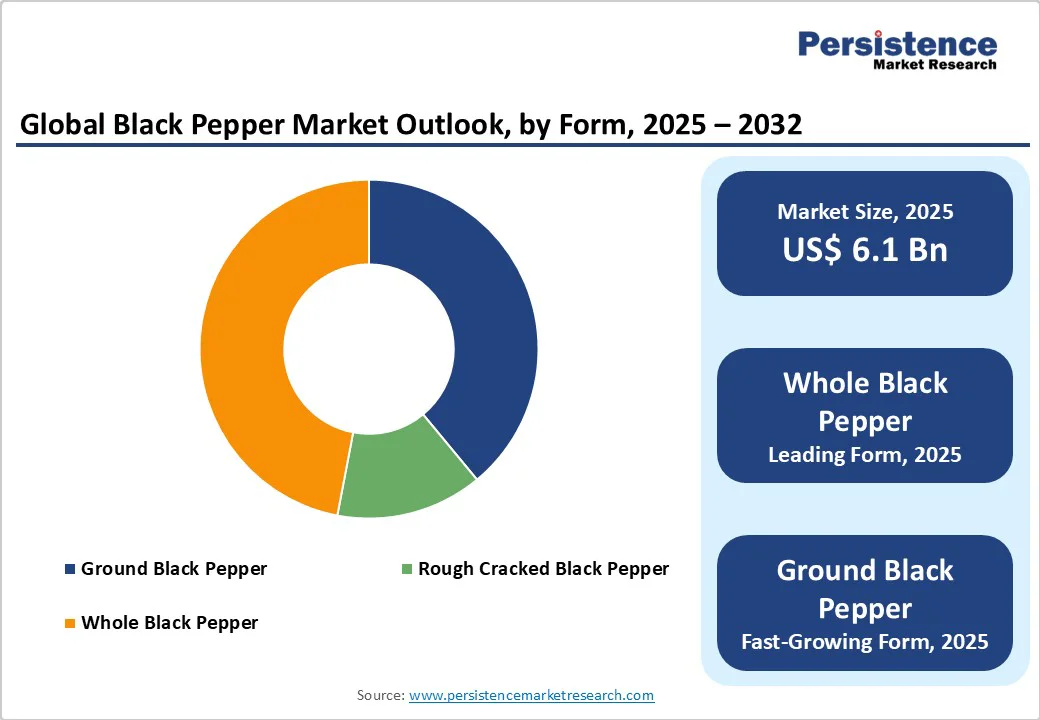

Whole black pepper is poised to dominate the market with approximately 48.2% share in 2025 due to its superior shelf life, flavor retention, and versatility. Whole peppercorns maintain their essential oils and pungency for up to four years, whereas ground pepper loses potency within months. This extended freshness makes whole peppercorns more desirable for both domestic and export markets. India, a leading producer, exports significant quantities of whole black pepper, with destinations including the U.S., the United Arab Emirates (UAE), and China. The preference for whole peppercorns is also evident in the domestic market, where they are commonly used in traditional cooking methods.

Conventional black pepper is set to lead the market revenue share in 2025, primarily because of its established cultivation practices, higher yields, and cost-effectiveness. In India, the largest producer globally, the area under black pepper cultivation is approximately 183,000 hectares, with a production of around 64,000 metric tons. This extensive area is predominantly under conventional farming methods, which are well-suited to the country’s agro-climatic conditions and have been optimized over decades.

In contrast, organic black pepper cultivation remains limited, with adoption rates growing gradually. For instance, the Indian Organic Sector Vision 2025 report indicates that while the organic sector is expanding, it still represents a small fraction of the total agricultural area. The limited scale of organic farming is attributed to factors such as lower yields, higher certification costs, and the time required for soil conversion, making conventional farming the dominant practice in black pepper production.

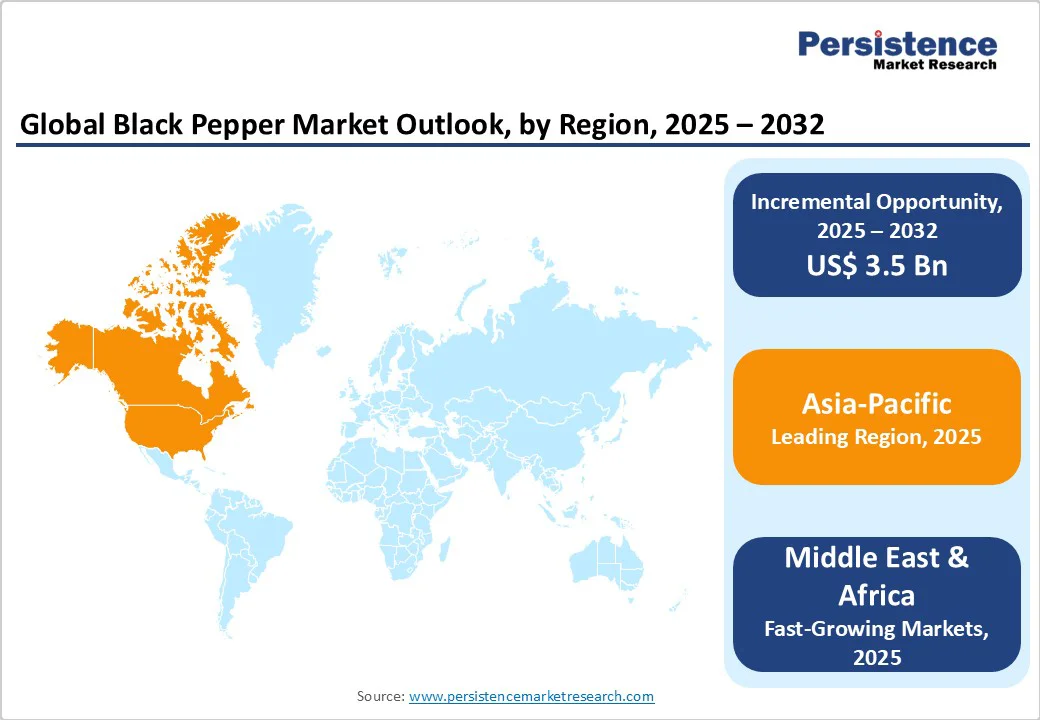

Asia Pacific is likely to dominate accounting for 53.4% share in 2025, on account of its extensive cultivation, favorable climatic conditions, and significant export contributions. India leads with approximately 183,000 hectares dedicated to black pepper cultivation, accounting for about 80% of global production and 90% of exports. Other major producers include Indonesia and Vietnam, with Vietnam's productivity reaching 1,760 kg per hectare.

The region's dominance is further supported by established trade routes and a deep-rooted culinary tradition that integrates black pepper into various cuisines. According to the Food and Agriculture Organization (FAO), Asia Pacific countries have significantly increased their agricultural production over the past generation, contributing to the region's leadership in spice markets.

Europe is anticipated to hold about 15.6% share in 2025, due to its substantial import volumes and role as a key re-exporter. The EU imports a considerable amount of black pepper, primarily from major producing countries such as India, Vietnam, and Indonesia. For instance, Germany and the Netherlands are among the largest importers within the EU, serving as distribution hubs for the spice across Europe. This trade is facilitated by the EU's well-established infrastructure and trade agreements with producing countries.

Additionally, Europe is a major consumer of black pepper, with demand driven by its culinary traditions and the food processing industry. The EU's stringent quality standards and certification systems also ensure that imported black pepper meets high safety and quality benchmarks, further integrating it into the global supply chain.

North America is slated to emerge as the fastest-growing regional market for black pepper due to increasing consumer demand, especially in the United States. The U.S. is the world's largest spice importer and consumer, with imports and consumption on an uptrend for the past 10 years. The U.S. imports more than 40 separate spices, with black and white pepper accounting for a significant portion of the total annual value of spice imports. The growing domestic use of spices reflects rising consumer interest in ethnic cuisines and health-conscious eating habits, leading to increased demand for black pepper in various food products. Moreover, the U.S. produces nearly 40% of its annual spice needs, with imports supplying the remainder. This robust import activity underscores the region's expanding role in the black pepper market.

The global black pepper market landscape is becoming increasingly competitive as producers adopt advanced cultivation, processing, and value-addition techniques. Leading exporters are focusing on quality, flavor retention, and shelf life, while emerging players are targeting organic and specialty segments. Strategic partnerships, sustainable farming, and traceability systems boost competitiveness, exports, and consumption, making black pepper increasingly preferred across food, beverage, pharmaceutical, and personal care industries.

The global black pepper market is projected to reach US$ 6.1 billion in 2025.

Rising culinary demand, health awareness, organic adoption, exports growth, and applications in food and pharmaceuticals drive the market.

The market is poised to witness a CAGR of 6.7% between 2025 and 2032.

Organic and fair-trade products, value-added innovations, nutraceutical applications, e-commerce expansion, and traceability technology are key market opportunities.

Some of the major market players are McCormick & Company, Inc., Olam International Limited, Everest Spices Pvt. Ltd., Mahashian Di Hatti (MDH) Pvt. Ltd., and Synthite Industries Ltd.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Form

By Source

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author