ID: PMRREP33154| 200 Pages | 16 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

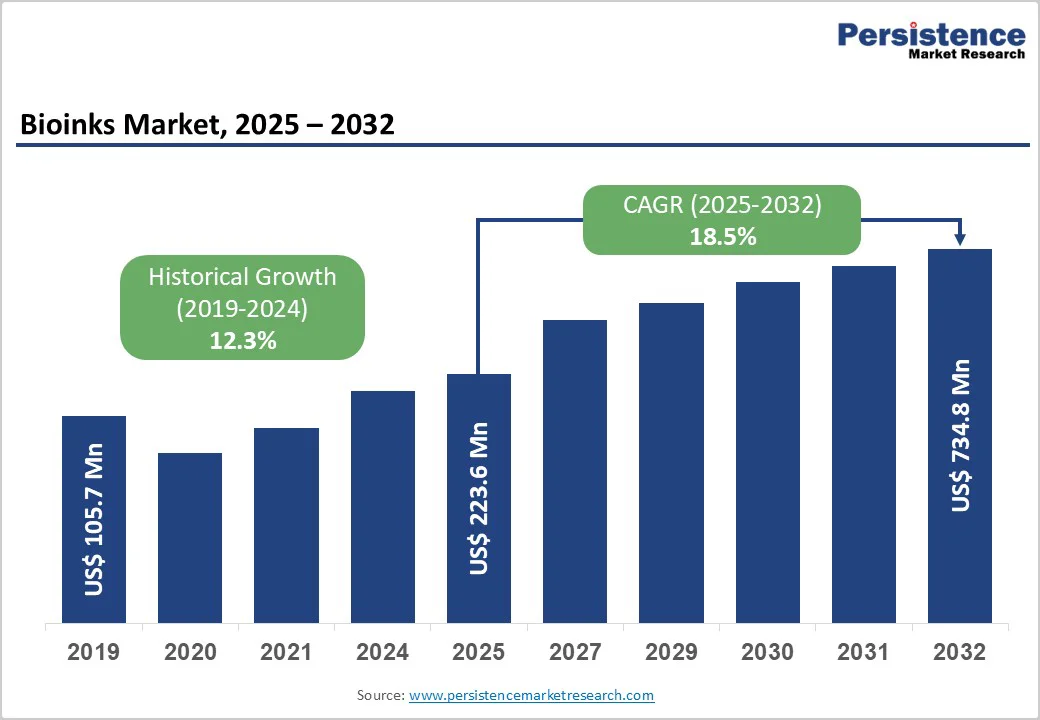

The global bioinks market size is valued at US$223.6 million in 2025 and is projected to reach US$734.8 million, growing at a CAGR of 18.5% from 2025 to 2032. Bioinks are biomaterials used to produce engineered living tissues via 3D printing.

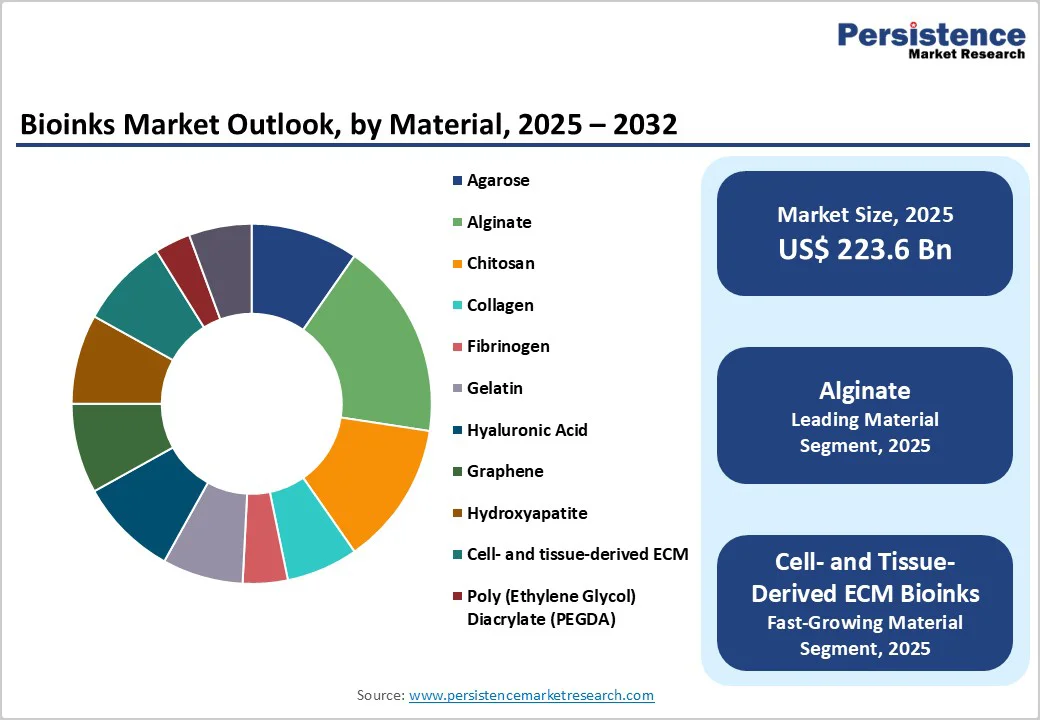

Various bioinks derived from natural or synthetic sources, such as hyaluronic acid, gelatin, alginate, collagen, agarose, poly(ethylene glycol) diacrylate (PEGDA), and graphene, play important roles in organ development and skin regeneration.

Growing use of bioinks in tissue engineering, tissue transplantation, and pharmaceutical drug development is expected to favor market expansion. Moreover, Companies are investing heavily in R&D to expand their product portfolios and market presence globally, especially to meet the evolving needs of researchers.

| Key Insights | Details |

|---|---|

| Bioinks Market Size (2025E) | US$223.6 Mn |

| Market Value Forecast (2032F) | US$734.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 18.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 12.3% |

Increasing cases of organ failure due to several reasons, such as unhealthy lifestyles, accidents, aging, and burns, are leading to a rise in the sales of bioinks as a result of the tremendous need for 3D printed organs. 3D bioprinting is a potential way to address the global organ shortage. Currently, no drug therapy is available to reverse organ failure.

As per reported data from the Organ Procurement and Transplantation Network in 2021, around 180,000 patients suffer from renal failure every year, and only 6,000 renal transplants are carried out.

The bones are a crucial component in orthopedic treatment and surgeries. Organ transplants is in demand due to the rise in accidents and prevalence of osteoporosis globally. A major clinical challenge in craniomaxillofacial (CMF) and orthopedic surgery is the development of correctly sized bones.

In such cases, 3D bioprinted bones and cartilages are helpful. The need for biocompatible and durable organs is expected to shift conventional procedures toward tissue engineering with 3D bioprinting techniques, thereby boosting the bioinks industry's revenue.

Intellectual property rights and strict guidelines for patent filing are major restraining factors for the market. Ethical, religious, and moral concerns are expected to be heightened by the development of synthetic human body organs using 3D printing and intellectual property clearance. Advancements in 3D printing have been associated with intellectual property theft and are expected to create major challenges in the future.

Furthermore, to receive FDA approval, implanted devices must undergo the approval filing process in specific countries. The rising failure rate of FDA filings for such devices presents a negative outlook for market growth. Moreover, the biocompatibility of materials used in 3D bioprinting is a major concern in tissue engineering and organ transplantation, where allergic reactions and life-threatening complications must be avoided.

Bioinks for neural and brain tissue regeneration represent one of the most groundbreaking frontiers in bioprinting, enabling the repair of highly complex nervous system structures. These formulations combine electrically conductive materials with neuro-supportive biopolymers to guide axonal growth, synapse formation, and neural signal transmission.

By encapsulating neural stem cells or dopaminergic cells, they support regeneration after spinal cord injuries, stroke, and neurodegenerative diseases such as Parkinson’s and Alzheimer’s. Their viscoelastic behavior mimics soft brain tissue, while biochemical cues promote revascularization and neuroplasticity.

As next-generation neuro-bioinks advance, they hold potential for printing implantable neural patches, disease-model brains, and personalized platforms for neuro-drug evaluation.

Alginate accounts for the highest share in the bioinks market because it uniquely balances biological compatibility, mechanical stability, and processing convenience. Its gentle ion-induced crosslinking preserves cell viability during printing, enabling robust encapsulation of stem cells and primary cells without structural collapse.

Alginate hydrogels closely mimic extracellular matrix hydration, supporting nutrient diffusion and tissue maturation, which makes them suitable for diverse applications such as cartilage, bone, vascular, and soft-tissue constructs. It is also cost-efficient, sourced abundantly from brown algae, and easily modified with peptides or blended with gelatin and collagen to enhance biofunctionality.

This versatility, combined with broad commercial availability and strong adoption in academic and pharmaceutical bioprinting workflows, establishes alginate as the market’s dominant bioink material.

Extrusion-based bioprinting holds the highest market share because it offers unmatched flexibility in printing a wide range of bioinks, including highly viscous, cell-dense, and multi-material formulations. Its continuous filament deposition enables reliable construction of large, clinically relevant tissue volumes with strong structural fidelity.

The technique supports precise spatial patterning of cells and biomaterials, making it suitable for bone, cartilage, skin, vascular, and organ constructs.

Compared with inkjet and laser systems, extrusion bioprinters are cost-efficient, easier to operate, and compatible with custom bioink development, driving widespread adoption across research labs, pharmaceutical drug-screening units, and regenerative medicine programs. Consequently, it remains the most preferred printing modality in the global bioinks market.

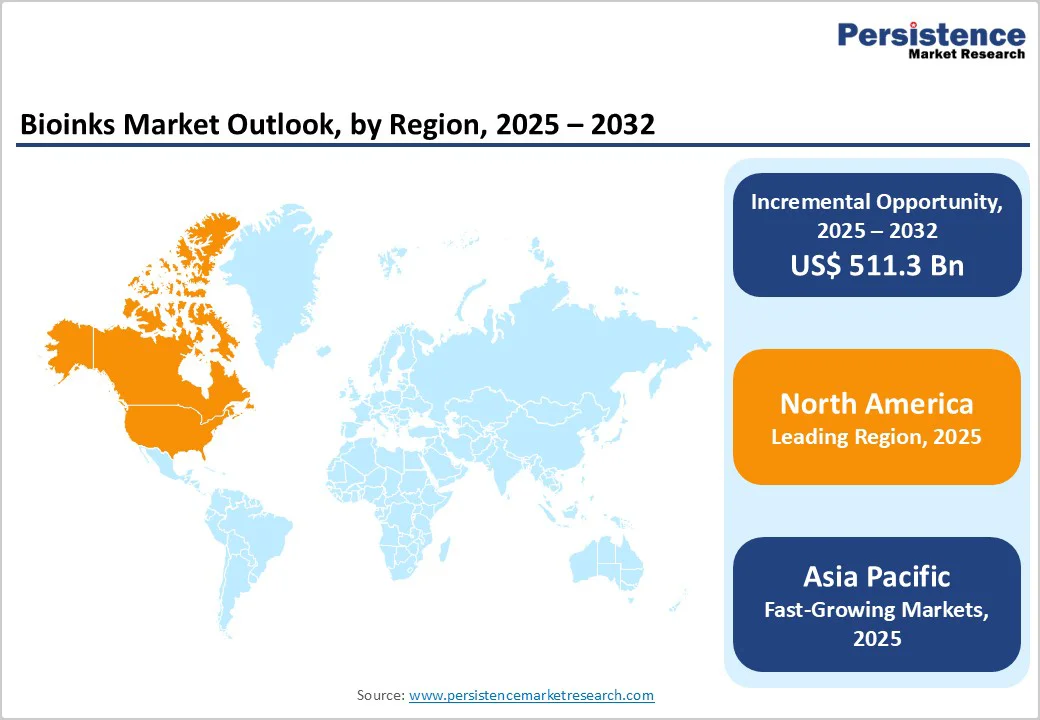

North America continues to lead the bioinks market, supported by robust investments in regenerative medicine, organ fabrication research, and bioprinting infrastructure. The region benefits from strong academic-industry collaboration, government-backed funding, and early adoption of advanced tissue engineering solutions.

In the U.S., rising awareness of personal care and aesthetics has increased demand for dermal reconstruction and skin transplantation, particularly among the 16-33 age group that actively seeks advanced dermatology solutions. Higher disposable income and growing self-care trends further support adoption.

Additionally, expanding research and development efforts in organ development and disease modeling continue to accelerate bioink consumption, reinforcing North America’s dominant market position.

The Asia Pacific bioinks market is rapidly emerging, driven by expanding biomedical research infrastructure, growing government support for regenerative medicine, and increasing academic investment in 3D bioprinting. Countries such as China, Japan, South Korea, and India are accelerating commercialization through funding programs, university partnerships, and biotechnology incubators.

Rising prevalence of chronic diseases and organ shortages is stimulating interest in tissue-engineered skin, cartilage, and bone constructs. Local bioink manufacturing capabilities are also strengthening, reducing dependency on imported materials and lowering development costs. With rising pharmaceutical R&D activities and growing adoption of personalized medicine, the Asia Pacific is expected to be the fastest?growing region in the global bioinks industry.

Leading bioink manufacturers are developing technologically advanced products. Correspondingly, major competitors in the industry are engaged in merger and acquisition strategies to enhance their product offerings. Moreover, companies are also focusing on the expansion of corporate collaborations to boost their overall revenue.

The global bioinks market is projected to be valued at US$223.6 Bn in 2025.

The Global Bioinks Market is driven by rapid advancements in 3D bioprinting for regenerative medicine, organ fabrication, and tissue engineering. Growing demand for personalized and precision medicine encourages the development of patient-specific tissue constructs.

The global market is poised to witness a CAGR of 18.5% between 2025 and 2032.

Custom formulations using a patient’s cells or ECM signatures to minimize immune rejection and enhance implant success.

Merck KGaA, Allevi, Inc., TheWell Bioscience Inc., CollPlant Biotechnologies Ltd., and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Source

By Printing Modality

By Application

By Organ

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author