ID: PMRREP32243| 199 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

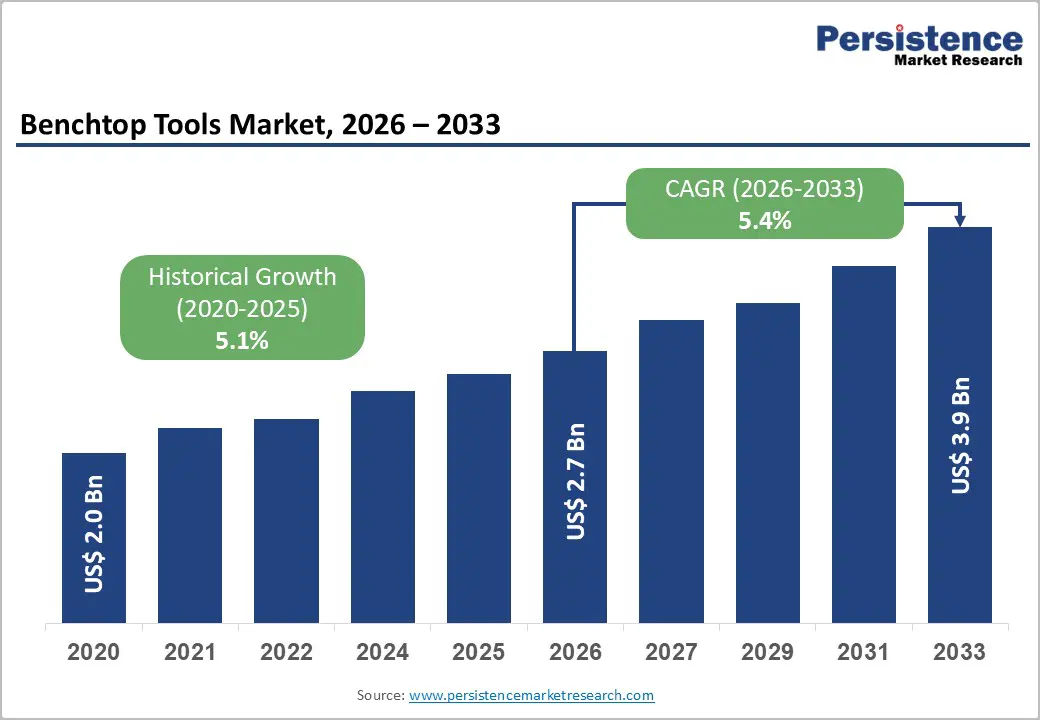

The global benchtop tools market size is likely to be valued at US$2.7 billion in 2026 and is expected to reach US$3.9 billion by 2033, growing at a CAGR of 5.4% during the forecast period from 2026 to 2033, driven by increasing demand from the industrial, construction, woodworking, and residential DIY sectors, where compact and precise tools are preferred for small-scale production, home improvement, and hobbyist projects.

Technological advancements, including improved precision, safety features, ergonomic designs, and energy-efficient motors, have enhanced the appeal of benchtop tools for both professional and casual users. The growth is also supported by expanding e-commerce channels, which provide easier access to a wide range of tools across markets. Rising infrastructure investments in emerging economies and the trend toward miniaturized, multifunctional tools are creating new opportunities for manufacturers and suppliers.

| Key Insights | Details |

|---|---|

|

Benchtop Tools Market Size (2026E) |

US$2.7 Bn |

|

Market Value Forecast (2033F) |

US$3.9 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

5.1% |

Construction projects require a broad spectrum of benchtop tools for tasks ranging from cutting and shaping materials to surface finishing and precision drilling, enabling faster project execution and enhanced quality control. This trend is especially pronounced in emerging economies where infrastructure development is aligned with urbanization and industrialization strategies, driving strong uptake of benchtop tools in construction workshops and on-site fabrication units. Power tools improve productivity by reducing manual labor, increasing accuracy, and accelerating completion times, which is critical in meeting tight construction schedules and cost objectives. Durable, high-performance stationary tools are increasingly preferred by contractors and fabrication professionals because they can withstand demanding job-site conditions and repetitive use.

Infrastructure acceleration stimulates broader industrial activity, benefiting the market, particularly in sectors such as woodworking, metal fabrication, and manufacturing support services. Construction projects proliferate, and adjacent industries such as furniture, fixture production, and interior finishing work also expand, further increasing the need for precise saws, sanders, routers, and drill presses on the shop floor and on-site. These downstream effects amplify the overall tool consumption as infrastructure builds often catalyze related production cycles. Technological advancements in benchtop tools, such as improved ergonomic design, enhanced safety mechanisms, and energy-efficient motors, have made them more attractive for diverse applications across construction and allied sectors.

Advancements in lithium-ion batteries, brushless motor technology, and compact engineering have significantly improved the performance of cordless and handheld power tools, enabling them to increasingly compete with traditional benchtop equipment, particularly for on-site applications where power outlets are limited. As battery-powered tools gain wider adoption across construction, woodworking, and maintenance activities, users benefit from faster setup, greater mobility, and fewer workflow disruptions caused by cords, especially on large or mobile job sites. The growing availability of cordless saws, drills, grinders, and multifunction tools has led many users to favor versatile portable platforms over investing in multiple fixed benchtop machines, thereby weakening demand for stationary equipment.

This shift is further reinforced by the rapid expansion of portable tool ecosystems supported by major manufacturers with strong brand recognition and substantial investment in cordless innovation. Shared battery platforms allow users to build integrated tool fleets within a single system, improving convenience and lowering long-term ownership costs. As a result, benchtop tool manufacturers face the challenge of differentiating their stationary offerings amid increasingly capable cordless alternatives. Across both developed and emerging markets, preferences for mobility, ease of transport, and multifunctionality continue to drive demand toward portable tools, limiting growth prospects for traditional benchtop units.

The growing adoption of benchtop CNC machines, compact and more affordable alternatives to industrial CNC systems, has increased demand for compatible tooling such as end mills, drill bits, and router accessories, creating new revenue opportunities for manufacturers and suppliers. These CNC-enabled benchtop tools offer greater precision, repeatability, and automation, allowing both professionals and hobbyists to produce complex cuts and designs with minimal manual effort. This capability is particularly valuable in woodworking, prototyping, and small-batch manufacturing, where accuracy and consistency are critical. The integration of CNC technology also aligns with broader trends toward automation and digital fabrication, as users increasingly seek tools that integrate seamlessly with CAD and CAM workflows to improve efficiency and reduce material waste.

For manufacturers, incorporating CNC technology into benchtop tools offers multiple strategic growth opportunities, including the development of value-added products tailored to both industrial users and DIY enthusiasts. Unlike conventional stationary benchtop equipment, CNC-enabled machines allow users to program intricate tool paths, automate repetitive processes, and achieve consistent, high-quality outputs. This enhances productivity and raises quality standards in precision-focused applications, such as custom furniture-making, detailed woodworking, and prototype development. The shift toward digitally controlled tooling promotes wider adoption of software-driven workflows, enabling users to design and execute complex patterns that would be difficult or impractical to achieve through manual operations.

Sawing tools are expected to lead the benchtop tools market, accounting for approximately 40% of revenue in 2026, due to their foundational role in cutting and sizing materials across woodworking, construction, and fabrication applications. These tools, including bench saws, table saws, and band saws, are integral to both professional and residential workshops, providing fast, accurate cutting of wood, plastics, and non-ferrous metals and enabling consistent outcomes across diverse projects. For example, a small woodworking shop may rely on a benchtop table saw as its primary tool for breaking down lumber, trimming panels, and creating repeatable components for cabinetry, underscoring the essential role of sawing tools in everyday operations.

Grinders & Sanders are likely to represent the fastest-growing segment in 2026, driven by increasing demand for efficient surface preparation, material finishing, and buffing applications in both industrial and residential projects. These tools are essential for refining workpiece surfaces after cutting or machining, ensuring smooth, uniform finishes that meet quality standards in furniture making, metal fabrication, and DIY crafts. For example, a metalworker using a benchtop grinder to remove burrs and polish edges before assembly highlights how improved abrasive technologies and enhanced safety features, such as better dust collection and ergonomic grips, are contributing to the rising adoption of grinders and sanders. The growth of this segment is also driven by rising interest in precision surface treatments across industries, where finishing quality directly affects product aesthetics and performance.

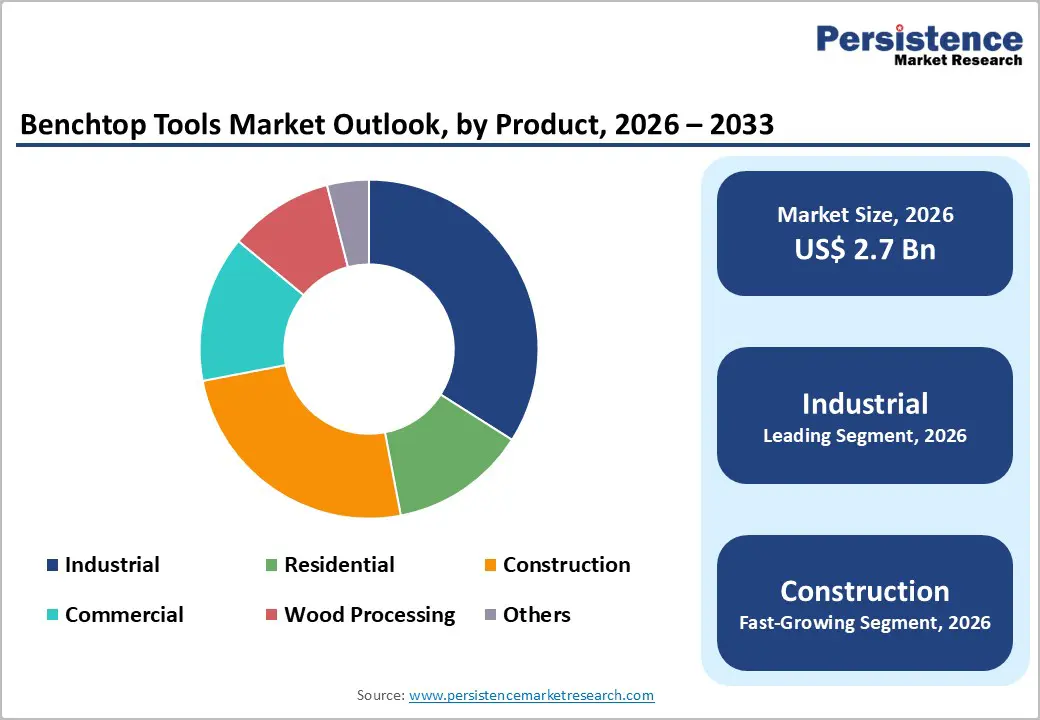

The industrial segment is projected to lead the market, capturing around 45% of the revenue share in 2026, supported by strong demand for precision, efficiency, and durability in manufacturing and fabrication environments. Industrial workshops require stationary power tools capable of handling high-volume, repetitive tasks with consistent accuracy, such as cutting metal components, drilling precise holes, or shaping parts for machinery and equipment. For example, an automotive component manufacturer using benchtop drill presses and grinders to produce high-precision engine or chassis parts demonstrates how these tools support operational efficiency, quality control, and standardized production processes. The significant share of the industrial segment is driven by ongoing investments in manufacturing facilities across sectors such as automotive, aerospace, electronics, and heavy machinery, where benchtop tools form essential parts of production lines, secondary operations, and prototyping tasks.

The construction segment is likely to be the fastest-growing end-user, driven by expanding infrastructure development, rising renovation activities, and increased adoption of stationary tools for on-site fabrication and workshop tasks. Construction professionals increasingly integrate benchtop saws, drill presses, and finishing tools into their workflow to support precision cutting, assembly preparation, and surface finishing for materials such as wood, plastics, and light metals. For example, a construction contractor setting up a temporary job-site workshop to prepare customized wood components for interior installations highlights how benchtop tools enhance productivity and quality control in construction projects. This growth is propelled by global investments in residential and commercial infrastructure, where reliable benchtop equipment can accelerate workflow and ensure consistent results under demanding timelines.

North America is expected to remain a key market in 2026, supported by strong construction and industrial activity, widespread adoption of DIY projects, ongoing technological advancements in precision and safety, and sustained demand from professional workshops and manufacturing facilities. As manufacturers and workshops aim to improve productivity and maintain strict tolerances, benchtop tools with integrated digital controls, improved ergonomics, and advanced dust management systems are gaining popularity. At the same time, the expanding DIY and hobbyist segment, particularly in the U.S. and Canada, is driving demand for compact, intuitive, and user-friendly stationary tools for home improvement and woodworking applications. Sustainability and energy efficiency are also shaping purchasing behavior, with customers increasingly preferring models that offer reduced power consumption and extended service life.

At the company level, the North American benchtop tools market is characterized by a strong focus on product innovation led by established power tool brands and supported by strategic partnerships. For instance, Stanley Black & Decker has reinforced its regional footprint by launching benchtop solutions that feature enhanced safety mechanisms, high-precision cutting performance, and seamless compatibility with its broader professional tool ecosystem. This trend highlights a broader industry shift toward comprehensive solutions that address demanding workshop requirements while appealing to professional contractors and dedicated hobbyists. In addition, manufacturers are expanding their service and support offerings, such as extended warranties, training programs, and responsive after-sales service, to strengthen brand loyalty and stand out in an increasingly competitive market.

Europe is expected to emerge as a key market in 2026, supported by diverse end-user requirements, rapid technological advancement, and evolving consumer preferences. The growing adoption of cordless and energy-efficient tools reflects broader European priorities around portability, sustainability, and lower operating costs. This shift is also evident within the benchtop segment, where cordless versions of compact stationary tools are gaining popularity among both professionals and DIY users, particularly in environments where limited workshop space and mobility are important considerations. Additionally, Europe’s strong DIY and home-improvement culture has expanded demand for benchtop tools beyond traditional industrial customers.

Strict environmental and energy-efficiency regulations across the region are further encouraging manufacturers to innovate through the use of eco-friendly materials, brushless motor technologies, and intelligent power-management systems, ensuring product offerings align with sustainability objectives. The European benchtop tools market is increasingly shaped by a strong emphasis on precision, automation, and high-performance capabilities driven by advanced manufacturing processes and specialized end-user needs. Industrial workshops, woodworking operations, and professional craftspeople are seeking tools with enhanced features such as integrated safety mechanisms, digital interfaces, and ergonomic designs that enable prolonged use and consistent output quality.

For instance, Festool GmbH, a leading European power-tool manufacturer, has launched advanced benchtop sanders and routers equipped with integrated dust extraction systems and precision control features. These innovations are highly valued in woodworking and professional renovation applications, demonstrating how tool-level advancements support specialized, high-value use cases across the European market.

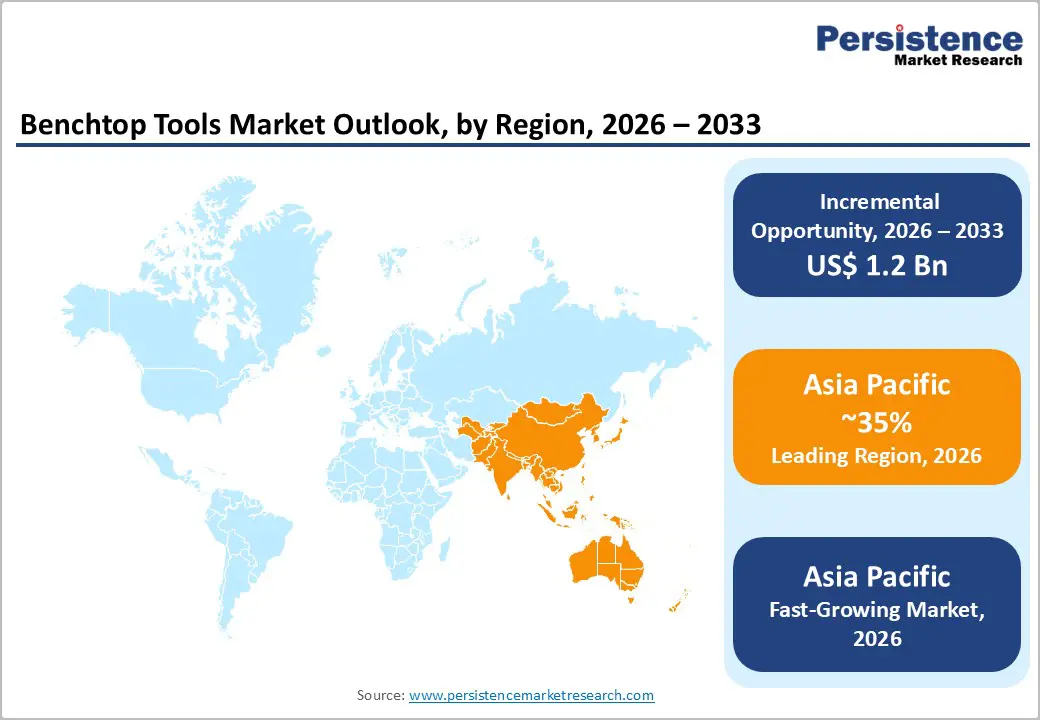

The Asia Pacific region is expected to lead the global market in 2026, accounting for approximately 35% of the total market share. This dominance is driven by rapid industrialization, expanding manufacturing capacity, and sustained construction activity, all of which generate strong demand for accurate and durable stationary tools across sectors such as woodworking, metal fabrication, automotive components, and general manufacturing. Key countries, including China, India, Japan, and South Korea, play a central role in this trend, as government-backed infrastructure programs and accelerating urbanization stimulate investments in workshops and on-site fabrication, increasing demand for benchtop sawing tools, drill presses, grinders, and sanders. For instance, Stanley Black & Decker has expanded its presence in the Asia Pacific market by offering a wide range of benchtop saws and grinders designed for both professional and DIY users, supported by robust regional distribution networks and localized technical support that improve product accessibility and after-sales service.

Asia Pacific is also projected to be the fastest-growing region for benchtop tools in 2026. This growth is fueled by rising infrastructure spending, increasing adoption of DIY practices, and the expansion of small and medium-sized manufacturing enterprises. The DIY segment is gaining momentum as higher disposable incomes, growing interest in home renovation, and widespread access to online tutorials and community platforms encourage consumers to take on more advanced projects using stationary tools. Urban millennials and hobbyists, particularly in countries such as India and China, are key contributors to this growth, favoring mid-range benchtop saws, sanders, and drill presses that offer a balance between performance, affordability, and ease of use.

The global benchtop tools market exhibits a moderately fragmented structure, driven by the presence of both established multinational brands and numerous regional and niche players competing for market share in woodworking, construction, industrial fabrication, and residential segments. Unlike highly consolidated markets dominated by only a few giants, the benchtop tools space features a mix of legacy power tool makers and specialized stationary tool manufacturers, all striving to differentiate through product performance, durability, and targeted applications. The competitive intensity is heightened by rapid technological advancements, the rising demand for precision tools, and broad adoption across DIY and professional user segments, which together create multiple entry points for innovation and specialization.

With key leaders including Robert Bosch, Stanley Black & Decker, Makita Corporation, Techtronic Industries, Koki Holdings, and Hilti, the market’s competitive hierarchy reflects a blend of power tool expertise and focused stationary tool innovation. These players compete through continuous product innovation, expansive global distribution networks, strong brand equity, and customer support services that reinforce long-term loyalty. Competition also extends to pricing strategies, localized manufacturing, and tailored solutions for specific end users such as industrial workshops.

The global benchtop tools market is projected to reach US$2.7 billion in 2026.

The benchtop tools market is driven by increasing construction and manufacturing activity, the growing popularity of DIY and woodworking projects, and rising demand for compact, precise, and cost-efficient stationary tools across both professional and residential workshops.

The benchtop tools market is expected to grow at a CAGR of 5.4% from 2026 to 2033.

Key market opportunities include the integration of advanced technologies such as CNC capabilities and smart features, rising demand from emerging economies, and increasing adoption among small workshops, educational institutions, and DIY users who are seeking compact, high-precision, and easy-to-use tools.

Robert Bosch, Stanley Black & Decker, Makita Corporation, and Techtronic Industries are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author