ID: PMRREP35895| 198 Pages | 25 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

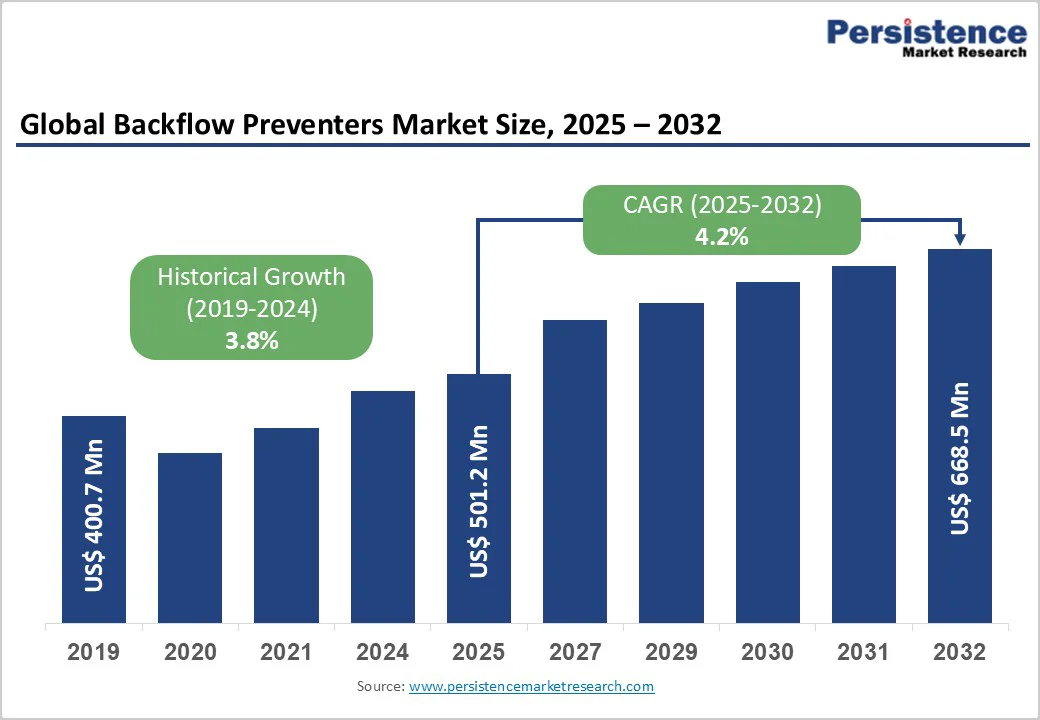

The global backflow preventers market size was valued at US$501.2 Mn in 2025 and is projected to reach US$668.5 Mn by 2032, growing at a CAGR of 4.2% between 2025 and 2032.

Market expansion is driven by increasingly stringent water safety regulations worldwide, with the Environmental Protection Agency (EPA) and municipal bodies mandating the installation of backflow prevention devices across residential, commercial, and industrial sectors.

Rising awareness of waterborne contamination risks, coupled with substantial investments in upgrading aging municipal water infrastructure, propels sustained market demand for backflow prevention solutions.

| Key Insights | Details |

|---|---|

| Backflow Preventers Market Size (2025E) | US$ 501.2 Mn |

| Market Value Forecast (2032F) | US$ 668.5 Mn |

| Projected Growth CAGR (2025 - 2032) | 4.2% |

| Historical Market Growth (2019 - 2024) | 3.8% |

Stringent Regulatory Compliance and Water Safety Mandates Propels Market Growth

Global regulatory frameworks increasingly mandate the installation and maintenance of backflow prevention devices to protect potable water supplies from contamination. The EPA's Cross-Connection Control Program establishes comprehensive standards requiring municipalities and commercial facilities to install certified backflow preventers meeting specific technical specifications.

North American municipalities including Los Angeles, New York, and Florida enforce annual testing requirements and certified installation protocols, creating sustained demand for compliant backflow prevention systems. Europe's harmonized water safety directives similarly mandate backflow prevention device deployment across member states, with Germany, United Kingdom, and France implementing standardized plumbing codes requiring certified installations.

These regulatory mandates create consistent market demand as building owners and water utilities must comply with evolving standards to avoid penalties and ensure public health protection across residential, commercial, and municipal water systems.

Aging Water Infrastructure Modernization and Cross-Connection Risks Drive Market Growth

Municipal water systems worldwide demonstrate substantial aging infrastructure that requires systematic upgrades and replacements to reduce contamination risks. North America's water infrastructure exhibits an average age exceeding 45 years, creating vulnerability to cross-connections and backflow incidents that contaminate potable supplies.

The American Society of Civil Engineers (ASCE) estimates that trillions of dollars in infrastructure investments are required globally to replace aging distribution systems and implement modern backflow prevention safeguards. Rising concerns about waterborne contaminants, including Legionella, lead, and chemical pollutants, are driving municipal investments in comprehensive backflow prevention systems.

Infrastructure modernization projects across the Asia Pacific region, incorporating new building standards and mandating backflow prevention device integration, create substantial growth opportunities for manufacturers and service providers specializing in water safety solutions and compliance infrastructure.

Backflow preventer installation requires specialized plumbing expertise and certified technician involvement, generating substantial labor costs that limit adoption among cost-conscious residential and small commercial property owners. Reduced Pressure Zone (RPZ) assemblies, representing the most advanced protection category, command premium pricing exceeding US$ 800-1,200 per unit in certain markets, excluding installation labor costs.

Additionally, annual testing and maintenance requirements mandated by regulatory agencies create ongoing operational expenses that discourage adoption among budget-constrained facilities. Testing costs typically range from US$100 to $300 annually per device, representing significant cumulative expenses for facilities operating multiple backflow preventers across complex plumbing systems.

Backflow preventer installation, testing, and maintenance require specialized technical expertise and state-certified technician qualifications that are geographically restricted in many regions. Limited availability of certified technicians in rural and developing areas creates service bottlenecks that delay installations and maintenance compliance.

The technical complexity of backflow preventer selection, sizing, and installation discourages do-it-yourself approaches among property owners, necessitating professional service engagement and increasing overall project costs and extending implementation timelines.

Emerging smart backflow preventer technologies incorporating real-time pressure monitoring, predictive maintenance algorithms, and automated alert systems create premium market opportunities for technology-differentiated manufacturers.

IoT-integrated backflow prevention systems enable remote testing, pressure monitoring, and failure prediction via cloud-based dashboards and mobile applications, reducing on-site technician visits by up to 60% in early adoption studies. These advanced systems offer facility managers comprehensive water safety visibility while lowering maintenance costs and improving regulatory compliance documentation.

Integration with building management systems and smart city infrastructure creates additional revenue opportunities for technology providers targeting municipal water utilities and large commercial facilities managing complex plumbing environments.

The convergence of artificial intelligence and sensor technologies enables predictive failure detection and condition-based maintenance scheduling, generating long-term service revenue streams for manufacturers and integration partners.

Accelerating urbanization across the Asia Pacific, the Middle East, and Latin America regions generates substantial demand for water infrastructure development incorporating modern backflow prevention systems.

India's urban development initiatives targeting 500 million new urban residents by 2050 necessitate large-scale expansion of water distribution networks, with integrated backflow prevention device deployment. China's water safety modernization program prioritizes the implementation of cross-connection control across municipal systems, creating significant procurement opportunities.

Government subsidies and financial incentives supporting water system upgrades in emerging economies reduce acquisition costs and accelerate adoption rates. International development agencies and multilateral funding institutions increasingly mandate the inclusion of backflow prevention systems in water infrastructure project requirements, creating guaranteed market demand for compliant backflow prevention solutions across developing regions.

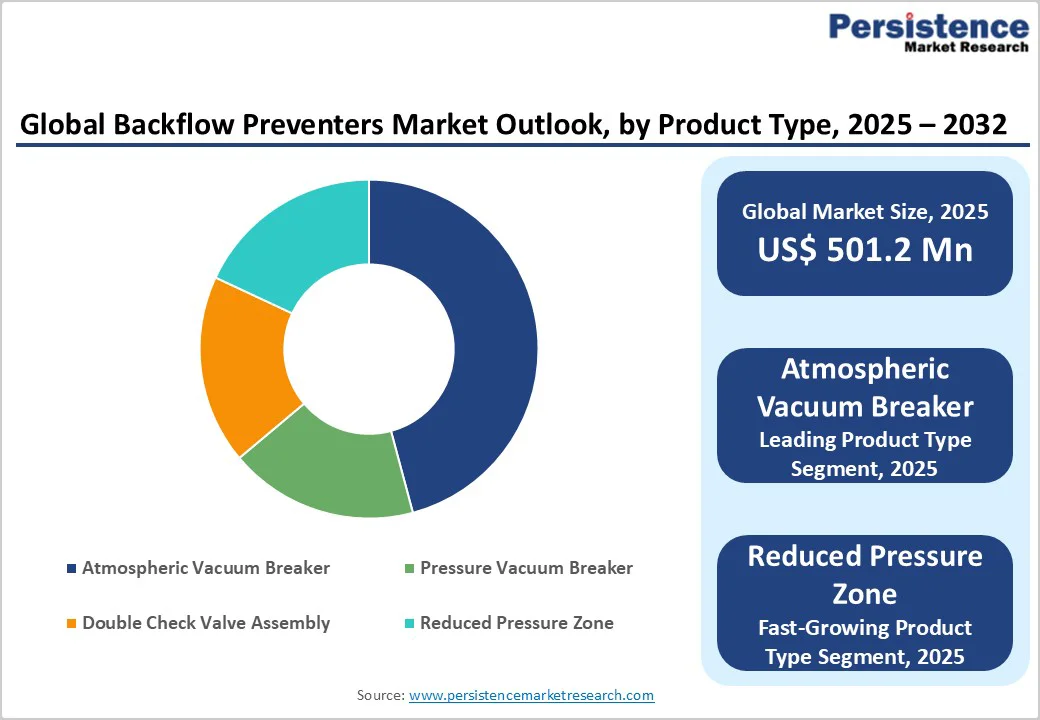

Atmospheric Vacuum Breaker (AVB) devices dominate the backflow preventer market, accounting for approximately 45% of the market based on market composition data. AVB technology is the simplest and most cost-effective backflow prevention solution, featuring gravity-operated air inlet valves that admit atmospheric air during no-flow conditions to prevent back-siphonage.

Their straightforward mechanical design facilitates cost-effective manufacturing and simple installation, requiring no moving parts or spring mechanisms that demand complex maintenance protocols.

AVB devices are standardly specified for residential irrigation systems, outdoor faucets, and low-hazard commercial applications where continuous pressure operation is not required. The overwhelming adoption of AVB technology across residential installations, representing approximately 60% of total residential backflow protection, reflects the technology's simplicity, affordability, and proven reliability across diverse climatic conditions and installation scenarios globally.

Stainless steel backflow preventers represent the fastest-growing material segment, capturing approximately 38% of the market share, driven by superior corrosion resistance and suitability for high-pressure applications. Stainless steel construction enables reliable performance in challenging environments, including chemically treated water systems, industrial applications, and coastal regions with salt-laden water conditions.

The material's durability and minimal maintenance requirements justify a premium price of 25-40% compared to ductile iron alternatives in professional plumbing and industrial applications. Corrosion-resistant properties ensure extended service life of 20-25 years in harsh environments where traditional materials would require frequent replacement, making stainless steel the preferred choice for municipal water utilities and industrial facilities prioritizing lifecycle cost optimization and reliability.

Residential applications represent the dominant end-use segment, accounting for approximately 42% of total market demand, driven by widespread regulatory compliance requirements and increasing homeowner awareness of water contamination risks.

United States municipalities mandate the installation of backflow prevention devices for all properties with hose bibs, irrigation systems, or auxiliary water supplies, as standard plumbing code requirements. Residential backflow preventers are typically specified at outdoor faucet connections and irrigation system entry points where back-siphonage risks are highest.

The growth of residential construction globally, coupled with retrofitting requirements for existing properties to achieve compliance with updated plumbing codes, sustains consistent demand growth in the residential segment. Increased public awareness campaigns highlighting waterborne disease risks and contamination incidents further encourage residential property owners to install backflow preventers beyond minimum regulatory requirements voluntarily.

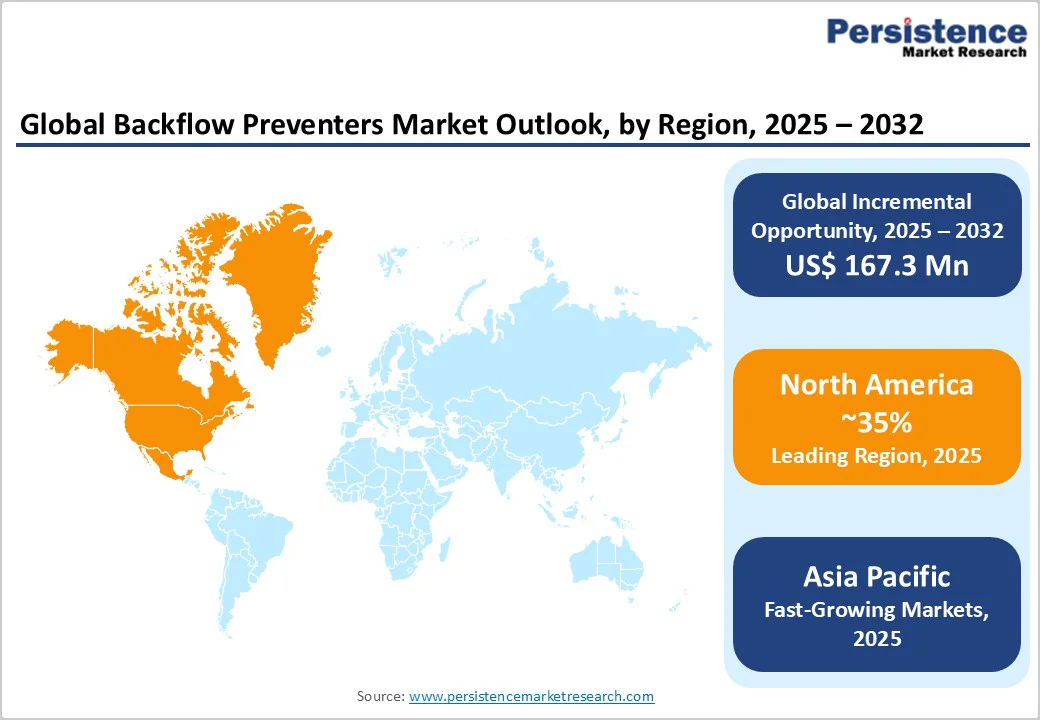

North America maintains a dominant market position through stringent regulatory enforcement, with the EPA's Cross-Connection Control Program mandating backflow prevention installations across municipal water systems. United States municipalities, including Los Angeles, New York, Chicago, and San Francisco, enforce mandatory annual testing requirements and certified installation protocols, creating sustained market demand.

The EPA estimates approximately 25% of North American buildings lack compliant backflow prevention systems, generating substantial retrofit opportunities. Canada's National Plumbing Code similarly mandates compliance with backflow prevention devices across residential and commercial properties, supporting market growth throughout the region.

Smart monitoring technology adoption is accelerating across North America, with leading municipalities, including the Los Angeles Water Department, piloting IoT-enabled backflow prevention systems that offer real-time monitoring and automated compliance verification.

The region's aging water infrastructure, averaging 45+ years old, drives modernization investments incorporating advanced backflow prevention systems. Investment in municipal water system upgrades exceeded US$50 billion annually during 2024 - 2025, supporting steady demand growth for compliant backflow prevention solutions and professional installation services across the region.

Europe demonstrates mature market characteristics with established regulatory frameworks harmonized across member states. Germany leads the European market with the DIN EN 12922 standard, which mandates backflow prevention device certification across building categories, capturing approximately 28% of European market demand.

United Kingdom, France, and Spain implement stringent water safety directives requiring certified backflow prevention installations in new construction and major renovations. European manufacturers emphasize environmental sustainability and energy efficiency in backflow preventer designs, with premium products featuring reduced pressure drop characteristics, minimizing energy consumption in municipal distribution systems.

The United Kingdom's water utilities, including Thames Water, mandate backflow prevention compliance across commercial properties and metered residential connections, supporting sustained market demand. The European Union Water Framework Directive emphasizes cross-connection control, driving municipal investment in backflow prevention system upgrades.

Regional players prioritize customer service and rapid response capabilities, with established service networks providing installation, testing, and maintenance support across major metropolitan areas and regional markets.

Asia Pacific emerges as the fastest-growing regional market, driven by rapid urbanization and substantial investments in modernizing water infrastructure. China's water safety modernization program prioritizes the implementation of cross-connection control across municipal systems, with major cities such as Shanghai, Beijing, and Guangzhou mandating compliance with backflow prevention device requirements for new construction.

India's urban development initiatives targeting 500 million new urban residents by 2050 create substantial backflow preventer demand across major metropolitan areas, including Mumbai, Delhi, and Bangalore. Government subsidies supporting water system upgrades reduce device acquisition costs and accelerate adoption rates across residential and commercial sectors.

Japan's earthquake-resilient building code requirements mandate the integration of backflow prevention systems across new construction projects, supporting steady market growth. Southeast Asian countries, including Thailand, Indonesia, and Vietnam, are increasingly adopting international water safety standards, creating emerging market opportunities.

International development agencies prioritize the inclusion of backflow prevention systems in water infrastructure project requirements, thereby guaranteeing market demand for compliant solutions across the region. The convergence of urbanization, infrastructure investment, and regulatory harmonization positions the Asia Pacific for accelerated market expansion exceeding 5.5% CAGR through 2032.

The backflow preventers market exhibits moderate consolidation with three leading manufacturers, Apollo Valves, Watts Water Technologies, and Zurn Industries, collectively commanding approximately 35% market share. These tier-one players dominate through comprehensive product portfolios, established distribution networks, and strong regulatory compliance credentials.

Tier-two manufacturers, including Honeywell International, Schneider Electric, and Mueller Water Products, compete through technological differentiation and emerging market expansion.

Strategic acquisition activity consolidates market position, with leading companies acquiring regional competitors and specialty technology providers. Differentiation strategies emphasize smart technology integration, material innovation, and customer service capabilities. Tier-three and regional players maintain competitive positions through cost-effective solutions tailored to local market requirements and specialized vertical applications.

The global backflow preventers market was valued at US$ 501.2 million in 2025 and is projected to reach US$ 668.5 million by 2032, representing a CAGR of 4.2% during the forecast period.

Primary demand drivers include stringent regulatory compliance enforced by EPA and municipal authorities mandating backflow prevention installations, rising awareness of waterborne contamination risks, and substantial municipal water infrastructure modernization investments.

Atmospheric Vacuum Breaker (AVB) devices command the dominant market segment at approximately 45% market share, driven by simple mechanical design, cost-effectiveness, and widespread residential adoption.

North America maintains market leadership through stringent EPA compliance requirements, established municipal regulatory frameworks, and significant aging infrastructure modernization investments.

Smart IoT-enabled backflow prevention systems featuring real-time monitoring, predictive maintenance, and automated compliance documentation represent the highest-growth opportunity segment.

Market leaders include Apollo Valves (United States), Watts Water Technologies (United States), and Zurn Industries (United States), collectively representing over 30% market concentration,

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author