ID: PMRREP33177| 296 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

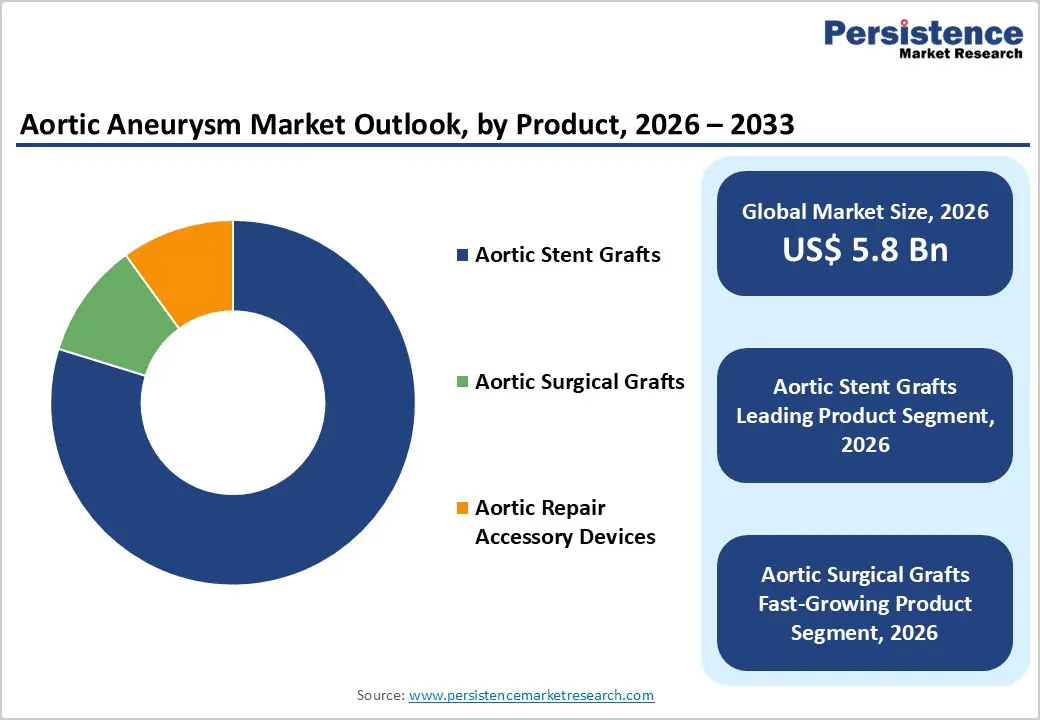

The global aortic aneurysm market size is estimated to grow from US$ 5.8 Bn in 2026 to US$ 9.5 Bn by 2033. The market is projected to record a CAGR of 6.1% during the forecast period from 2026 to 2033.

Global demand for aortic aneurysm treatment solutions is increasing steadily, driven by the rising prevalence of cardiovascular diseases, aging populations, and improved diagnostic capabilities. Increasing incidence of risk factors such as hypertension, smoking, atherosclerosis, and genetic predisposition has significantly expanded the diagnosed patient pool for both abdominal and thoracic aortic aneurysms. Growing use of advanced imaging modalities, including CT angiography and MRI, is enabling early detection and timely intervention. Aortic aneurysm repair devices are widely used across hospitals and specialty care centers to deliver safe, effective, and durable treatment outcomes. The global shift toward minimally invasive endovascular procedures is further accelerating adoption, as EVAR and TEVAR offer reduced perioperative risk, shorter hospital stays, and faster recovery compared to open surgery. Continuous innovation in stent graft design, delivery systems, and anatomical customization is improving procedural success rates and expanding treatment eligibility. Rising healthcare expenditure, increasing access to vascular care, and expansion of advanced hospital infrastructure in emerging markets are reinforcing long-term demand. Additionally, growing clinical awareness, expanding screening initiatives, and favorable reimbursement in developed regions continue to support sustained global market growth.

| Key Insights | Details |

|---|---|

| Aortic Aneurysm Market Size (2026E) | US$ 5.8 Bn |

| Market Value Forecast (2033F) | US$ 9.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.4% |

Growth is primarily driven by the increasing prevalence of cardiovascular risk factors such as hypertension, smoking, obesity, atherosclerosis, and advancing age, all of which significantly elevate the risk of aortic aneurysm development. A rapidly expanding geriatric population worldwide has increased both the incidence and diagnosis rates of abdominal and thoracic aortic aneurysms, driving procedural volumes. Improved access to advanced imaging technologies, including CT angiography and MRI, has enabled earlier and more accurate detection, further supporting intervention rates.

A major growth catalyst is the widespread clinical shift from open surgical repair to minimally invasive endovascular procedures, such as EVAR and TEVAR. These techniques offer reduced perioperative mortality, shorter hospital stays, and faster recovery, making them the preferred option for high-risk and elderly patients. Continuous innovation in stent graft design—such as improved conformability, sealing performance, fenestrated and branched configurations—has expanded treatment eligibility to complex anatomies. Increasing surgeon expertise, favorable reimbursement policies in developed markets, and growing availability of hybrid operating rooms further reinforce adoption. Collectively, these factors are driving sustained demand for advanced aortic aneurysm repair devices and supporting long-term market growth.

The market faces several restraints related to the high cost of advanced endovascular devices and procedures. Aortic stent graft systems, particularly fenestrated and branched variants, are capital-intensive and significantly increase procedural expenses. These costs can limit adoption in price-sensitive healthcare systems, especially in low- and middle-income countries where reimbursement coverage remains limited or inconsistent. Procedural complexity also presents a challenge. Endovascular aneurysm repair requires highly skilled vascular surgeons, advanced imaging infrastructure, and specialized operating environments, which are not uniformly available across all healthcare facilities. Complex cases often demand extensive preoperative planning, custom device selection, and longer procedure times, increasing operational burden.

Additionally, long-term surveillance following EVAR, including routine imaging to monitor endoleaks or graft migration, adds to overall treatment costs. Regulatory requirements for device approval and clinical validation are stringent, often leading to prolonged development timelines and increased compliance costs for manufacturers. In some regions, delayed approvals and variability in regulatory frameworks can restrict market entry. Limited awareness, inadequate screening programs, and underdiagnosis in emerging economies further constrain procedural volumes, collectively moderating market expansion.

Significant growth opportunities are emerging from ongoing technological advancements in stent graft design and endovascular repair techniques. Development of next-generation fenestrated and branched grafts is enabling treatment of complex and previously inoperable aneurysms, expanding the addressable patient population. Improvements in materials, delivery systems, and imaging-guided deployment are enhancing procedural precision, long-term durability, and patient outcomes. Expansion of national aneurysm screening programs presents another major opportunity, particularly for abdominal aortic aneurysms in high-risk populations. Early diagnosis increases elective intervention rates and reduces emergency rupture-related mortality, supporting sustained procedural growth. Increasing adoption of minimally invasive procedures in outpatient and hybrid settings further enhances treatment accessibility.

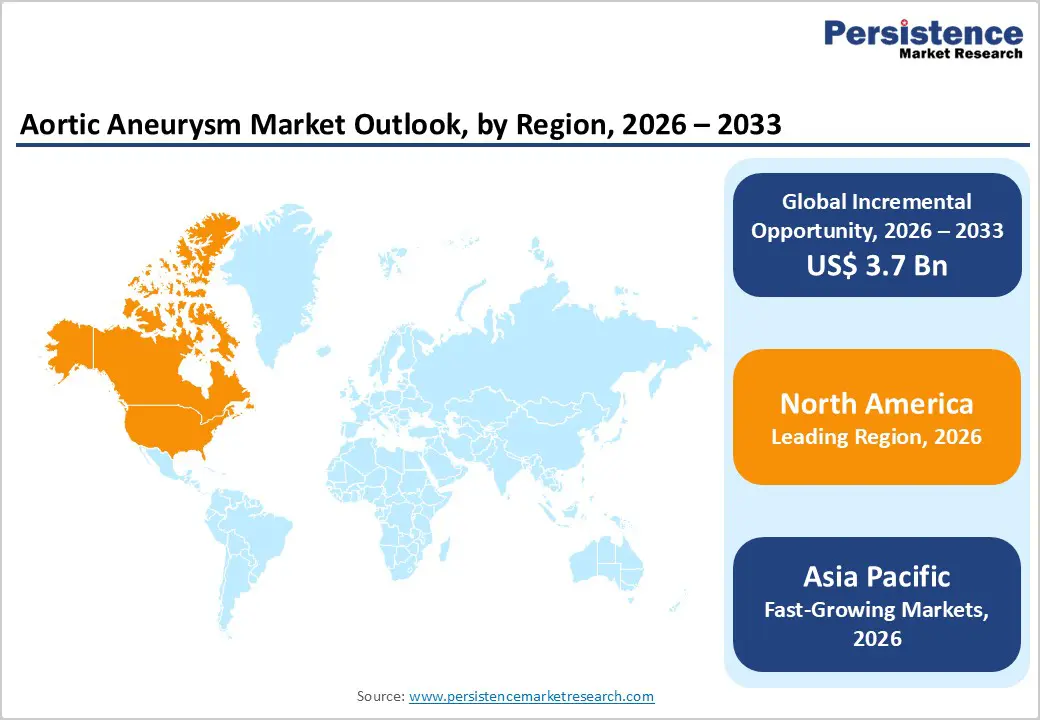

Emerging markets across Asia Pacific, Latin America, and the Middle East offer strong untapped potential due to rising healthcare expenditure, improving hospital infrastructure, and growing availability of trained vascular specialists. Local manufacturing, cost-optimized devices, and favorable government initiatives are improving affordability and access. Additionally, strategic collaborations between device manufacturers, hospitals, and research institutions are accelerating clinical innovation and market penetration. As awareness, screening, and treatment capabilities improve globally, these opportunities are expected to drive long-term expansion and competitive differentiation.

Aortic stent grafts are projected to dominate the global aortic aneurysm market in 2026, accounting for a revenue share of 79.8%. Their dominance is primarily driven by the widespread preference for minimally invasive endovascular procedures over open surgical repair, particularly in elderly and high-risk patient populations. Stent grafts are the core devices used in EVAR and TEVAR procedures, making them indispensable across both abdominal and thoracic aneurysm interventions. Rising clinical adoption is supported by lower perioperative mortality, reduced hospital stays, and faster patient recovery compared to open surgery. Continuous technological advancements—such as improved graft flexibility, enhanced sealing mechanisms, fenestrated and branched designs, and better anatomical compatibility—are expanding treatment eligibility for complex aneurysm cases. In addition, increasing surgeon familiarity, favorable reimbursement frameworks in developed markets, and growing procedural volumes in emerging economies reinforce sustained demand. As endovascular repair continues to replace conventional surgical approaches, aortic stent grafts are expected to retain their leadership throughout the forecast period.

The Endovascular Aneurysm Repair (EVAR) segment is expected to lead the global aortic aneurysm market in 2026, capturing a revenue share of 55.7%. This dominance is attributed to EVAR’s minimally invasive nature, which significantly reduces operative trauma, postoperative complications, and recovery time compared to open surgical repair. EVAR has become the preferred first-line treatment for abdominal aortic aneurysms, particularly among elderly patients and those with multiple comorbidities. The procedure’s compatibility with advanced stent graft technologies and real-time imaging guidance enhances procedural precision and long-term outcomes. Increasing availability of hybrid operating rooms, growing interventional radiology expertise, and improved device designs have further accelerated EVAR adoption. Additionally, rising screening rates for aortic aneurysms and early diagnosis are increasing the eligible patient pool. As healthcare systems prioritize patient safety, procedural efficiency, and cost-effectiveness, EVAR is expected to maintain its leading position over the forecast period.

Hospitals are projected to dominate the global aortic aneurysm market in 2026, accounting for a revenue share of 78.5%. This leadership is driven by the concentration of complex vascular procedures within hospital settings, where advanced imaging systems, hybrid operating rooms, and multidisciplinary surgical teams are readily available. Aortic aneurysm repair particularly EVAR, TEVAR, and complex branched or fenestrated procedures requires specialized infrastructure and skilled vascular surgeons, which are predominantly found in tertiary and quaternary hospitals. Hospitals also serve as primary referral centers for high-risk and emergency aneurysm cases, contributing to consistently high procedure volumes. Furthermore, favorable reimbursement structures, availability of post-operative intensive care, and integration of advanced diagnostic capabilities strengthen hospital-based treatment dominance. Teaching hospitals and large medical centers also play a key role in adopting next-generation devices and participating in clinical trials. As procedural complexity and patient volumes increase, hospitals are expected to remain the primary end-user segment throughout the forecast period.

North America is expected to dominate the global aortic aneurysm market with a value share of 47.3% in 2026, led primarily by the United States. The region benefits from a highly advanced healthcare infrastructure, widespread availability of endovascular treatment options, and early adoption of innovative stent graft technologies. A high prevalence of cardiovascular diseases, smoking-related risk factors, and aging population demographics significantly contribute to aneurysm incidence and diagnosis rates. Strong clinical awareness, routine screening programs for abdominal aortic aneurysms, and well-established referral pathways support early intervention and sustained procedure volumes. North America is also home to several leading medical device manufacturers and research institutions, enabling rapid commercialization of next-generation EVAR, TEVAR, and fenestrated graft systems. Favorable reimbursement policies, particularly under Medicare, further support procedural uptake. In addition, stringent regulatory standards promote the use of clinically validated and high-quality devices. Continuous technological innovation, increasing preference for minimally invasive repair, and growing outpatient endovascular procedures are expected to reinforce North America’s market leadership throughout the forecast period.

The Europe aortic aneurysm market is expected to grow steadily, supported by a strong public healthcare system, high clinical standards, and increasing adoption of minimally invasive vascular procedures. Countries such as Germany, the U.K., France, Italy, and Spain play a central role due to well-established hospital networks and specialized vascular surgery centers. Rising awareness of aneurysm-related mortality and the implementation of national screening programs—particularly for abdominal aortic aneurysms—are improving early diagnosis rates. European healthcare systems emphasize patient safety, long-term clinical outcomes, and cost-effectiveness, which supports the growing preference for EVAR and TEVAR procedures. The region also benefits from strong regulatory oversight, ensuring high-quality device adoption and standardized procedural protocols. Increasing use of fenestrated and branched stent grafts for complex anatomies is expanding treatment scope. Additionally, collaborative clinical research initiatives and continuous training programs for vascular specialists are strengthening procedural expertise. As healthcare modernization continues, Europe is expected to maintain consistent and sustainable growth in the aortic aneurysm market.

The Asia Pacific aortic aneurysm market is expected to register a relatively higher CAGR of around 7.2% between 2026 and 2033, driven by rapid healthcare expansion, rising cardiovascular disease burden, and improving access to advanced vascular treatments. Countries such as China, India, Japan, South Korea, and Australia are witnessing increasing diagnosis rates due to better imaging availability and growing clinical awareness. Expanding hospital infrastructure, rising healthcare expenditure, and government investments in advanced medical technologies are accelerating adoption of endovascular aneurysm repair procedures. The region is also experiencing a shift toward minimally invasive treatments, particularly in urban tertiary hospitals. Growing presence of regional medical device manufacturers and increasing availability of cost-effective stent graft solutions are improving market accessibility. In addition, medical tourism, expanding physician training programs, and improving reimbursement coverage are supporting procedural growth. As diagnostic penetration and treatment capabilities continue to improve, Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

The global aortic aneurysm market is highly competitive, with strong participation from companies such as Medtronic, Endologix LLC, Gore Medical, MicroPort Scientific Corporation, and Cook. These players leverage extensive global distribution networks, strong brand recognition, and broad cardiovascular device portfolios to address the rising demand for effective and minimally invasive aortic aneurysm repair solutions.

Their product offerings focus on advanced stent graft technologies, endovascular repair systems, and accessory devices designed to enhance procedural accuracy, clinical outcomes, and surgeon workflow efficiency across abdominal and thoracic aortic aneurysm treatments. Continuous innovation in device design, regulatory approvals, clinical efficacy, long-term durability, and compliance with international quality and manufacturing standards remains critical for maintaining competitive positioning in the global aortic aneurysm market.

The global aortic aneurysm market is projected to be valued at US$ 5.8 Bn in 2026.

The global aortic aneurysm market is driven by rising geriatric population, increasing prevalence of cardiovascular risk factors, and rapid adoption of minimally invasive endovascular repair procedures.

The global aortic aneurysm market is poised to witness a CAGR of 5.3% between 2026 and 2033.

Key opportunities lie in the development of advanced fenestrated and branched stent grafts, expansion in emerging markets, and growing use of EVAR/TEVAR in ambulatory care settings.

Medtronic, Endologix LLC, Gore Medical, MicroPort Scientific Corporation, and Cook are some of the key players in the aortic aneurysm market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn Volume (in units) If Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Type

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author