ID: PMRREP3191| 186 Pages | 1 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

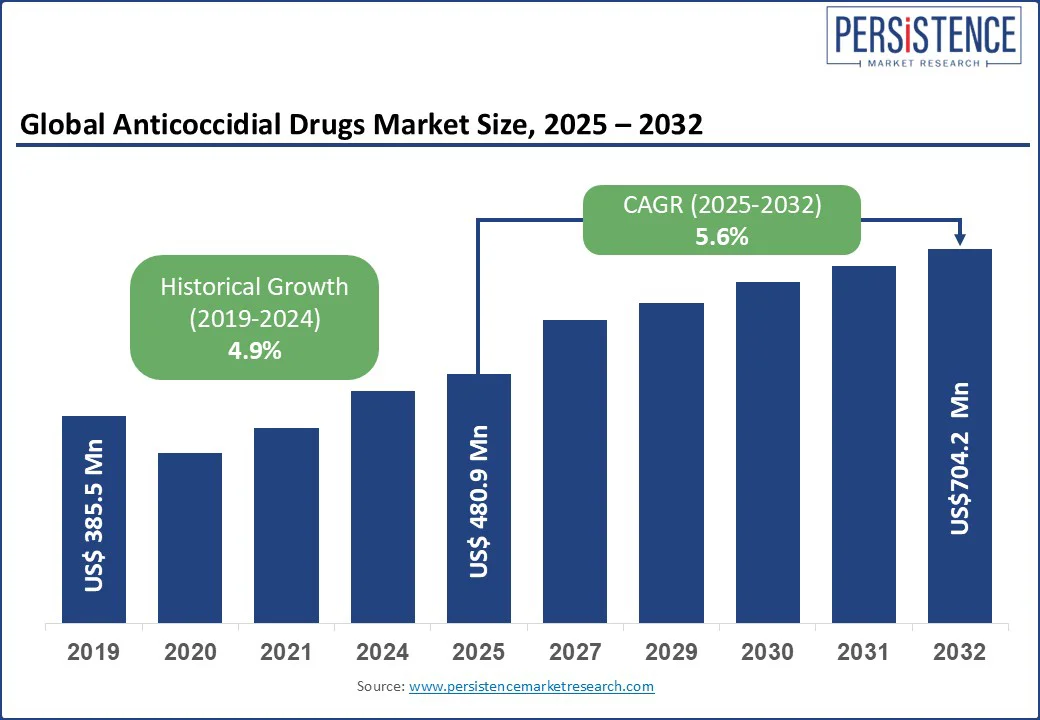

The global Anticoccidial Drugs Market is poised for steady growth, with an estimated market size of US$ 480.9 million in 2025, projected to reach US$ 704.2 million by 2032, exhibiting a compound annual growth rate (CAGR) of 5.6% during the forecast period.

This Anticoccidial Drugs market plays a vital role in animal health, particularly in combating coccidiosis, a parasitic disease caused by protozoan parasites of the genus Eimeria. The disease significantly impacts livestock, especially poultry, leading to substantial economic losses due to reduced growth rates, poor feed conversion, and mortality.

The increasing global demand for high-quality animal protein, coupled with rising livestock production, drives the need for effective anticoccidial drugs. Additionally, growing awareness of animal welfare, advancements in veterinary pharmaceuticals, and stricter regulations on food safety and antibiotic use are shaping market dynamics. The competitive landscape is marked by innovation, with leading players focusing on developing eco-friendly and sustainable drug solutions to address resistance concerns and meet regulatory standards.

Rising Global Demand for Animal Protein:

Rising global demand for protein-rich diets is significantly boosting the poultry industry, with poultry meat consumption increasing at an annual rate of 3%, according to the Food and Agriculture Organization (FAO, 2023). This surge is driven by population growth, urbanization, and rising income levels, particularly in developing nations. Poultry, being a cost-effective and accessible protein source, is increasingly preferred over red meat for health and environmental reasons. However, this rapid growth is also heightening challenges such as disease management, most notably coccidiosis, a parasitic disease that affects up to 80% of poultry flocks worldwide. If left untreated, coccidiosis can cause severe intestinal damage, reduced growth, lower feed conversion, and increased mortality, leading to estimated annual economic losses of over USD 13 billion globally. For instance, the U.S. Department of Agriculture (USDA) highlights the importance of anticoccidial drug programs and biosecurity measures to safeguard poultry health, ensure food security, and maintain sustainable production.

Stringent Regulatory Frameworks:

Stringent regulatory frameworks play a crucial role in ensuring food safety, animal health, and sustainable poultry farming practices. Governments across the globe have implemented comprehensive standards that mandate the use of approved veterinary medicines to prevent and control diseases such as coccidiosis. For instance, the U.S. Department of Agriculture (USDA) invested through its National Animal Health Monitoring System (NAHMS) to enhance veterinary services, focusing on early disease detection, control, and treatment, including support for anticoccidial drug programs. This initiative aims to improve biosecurity and ensure the health of livestock, especially in poultry production. Similarly, the European Union enforces strict guidelines under the Veterinary Medicines Regulation, which promotes the responsible use of poultry health drugs and bans prophylactic use of antibiotics, indirectly encouraging safer anticoccidial treatments. These regulatory measures not only protect public health by reducing foodborne risks but also support farmers in maintaining high production standards across global markets.

High Development Costs and Resistance Concerns:

The high cost of developing new anticoccidial drugs poses a significant barrier. Additionally, the emergence of drug-resistant Eimeria strains is a growing concern. Studies estimate that resistance to traditional ionophores has increased over the past decade, necessitating continuous R&D to develop new formulations. These costs and resistance issues limit market accessibility for smaller players and increase the price of advanced drugs, particularly in cost-sensitive regions.

Regulatory and Environmental Challenges:

Stringent environmental regulations, particularly in Europe, restrict the use of certain synthetic drugs due to their potential ecological impact. For instance, the disposal of ionophore residues in poultry waste has raised concerns about soil and water contamination. Compliance with these regulations increases production costs, which can deter manufacturers from entering or expanding in highly regulated markets, slowing overall market growth.

Growth in Emerging Economies:

Rising livestock farming in India for veterinary drugs, particularly for poultry. From 2020 to 2024, poultry production in India witnessed a 10% growth, supported by increasing urban consumption of affordable protein sources such as chicken and eggs. This surge in production brings with it the need for cost-effective veterinary drugs to maintain flock health and productivity. Coccidiosis, a prevalent parasitic disease in poultry, significantly impacts poultry health and farm economics. Consequently, there is growing adoption of the best anticoccidial drugs for chickens in 2025, including ionophores and chemical coccidiostats, to combat disease and prevent productivity losses.

For instance, the Department of Animal Husbandry and Dairying (DAHD) under the Ministry of Fisheries, Animal Husbandry & Dairying has launched the National Livestock Mission to support livestock health through better disease management, including coccidiosis. These government-backed initiatives create a conducive environment for the veterinary pharmaceutical industry to expand its reach in India.

Innovative Animal Feed Additives:

Innovative animal feed additives are reshaping livestock health management by providing effective alternatives to antibiotics. Synergistic blends such as probiotics, prebiotics, enzymes, and phytogenics enhance gut health, immunity, and nutrient absorption, reducing the need for conventional antibiotics. These additives align with regulatory frameworks for animal health that emphasize minimizing antimicrobial resistance. For instance, the Food Safety and Standards Authority of India (FSSAI) supports the reduction of antibiotics in animal feed and encourages the use of safer, natural alternatives. Additionally, the U.S. FDA’s Guidance for Industry promotes phasing out medically important antibiotics in livestock, reinforcing the role of feed additives in sustainable farming.

Synthetic drugs, including ionophores and chemical-based compounds, dominate the market with a 68.2% share in 2024, owing to their high efficacy and widespread use in poultry farming. These drugs are cost-effective and provide rapid control of coccidiosis, making them a preferred choice in intensive farming systems.

The segment is also the fastest-growing, driven by advancements in drug formulations and increasing demand for efficient disease management in large-scale livestock operations.

Poultry holds the largest market share, driven by the global scale of poultry farming and the high prevalence of coccidiosis in chickens. The segment is also the fastest-growing, fueled by rising poultry meat consumption and the adoption of advanced anticoccidial drugs to enhance productivity in both developed and emerging markets.

Companion animals are growing rapidly due to Pet Adoption and demand for Coccidiosis Treatment in Companion Animals.

Veterinary hospitals and pharmacies account for 65.4% of the market share in 2024, serving as the primary distribution channel due to their accessibility and role in providing prescription-based drugs.

Retail pharmacies are growing rapidly, driven by access to Anticoccidial Drugs for Pet Health through Veterinary Services.

The Anticoccidial Drugs Market is highly competitive, with key players focusing on broad-spectrum efficacy, cost-effective formulations, and global supply chains. Zoetis leads with robust R&D and combination therapies targeting poultry. Elanco offers ionophores and synthetic drugs, supported by integrated animal health services. Boehringer Ingelheim expands across the Asia Pacific through feed-integrated solutions. Huvepharma strengthens its position in Europe with in-feed anticoccidials and localized production. Bayer (acquired by Elanco) enhances reach in Latin America. These companies leverage innovation, regulatory compliance, and strategic partnerships with poultry producers to ensure effective disease control and market expansion.

The Anticoccidial Drugs Market is expected to grow from US$ 480.9 million in 2025 to US$ 704.2 million by 2032, with a CAGR of 5.6%.

Synthetic drugs lead with a 68.2% share in 2024 and are the fastest-growing segment, driven by advancements in formulations and high efficacy.

Poultry dominates with a 78.5% share, driven by high global production volumes and the prevalence of coccidiosis.

Veterinary hospitals and pharmacies hold a 65.4% share and are the fastest-growing, driven by improved veterinary infrastructure.

North America leads, while Asia Pacific is the fastest-growing region, driven by China and India’s expanding livestock sectors.

Zoetis Inc., Elanco, Phibro Animal Health Corporation, Vetoquinol SA, and Virbac are leading players, focusing on innovative and sustainable solutions.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

2025 (E) |

US$ 480.9 Mn |

|

2032 (F) |

US$ 704.2 Mn |

|

Historical CAGR |

4.9% |

|

Projected CAGR |

5.6% |

|

Geographical Coverage |

|

|

Segment Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon Request |

By Drug Type

By Animal Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author