ID: PMRREP16261| 201 Pages | 23 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

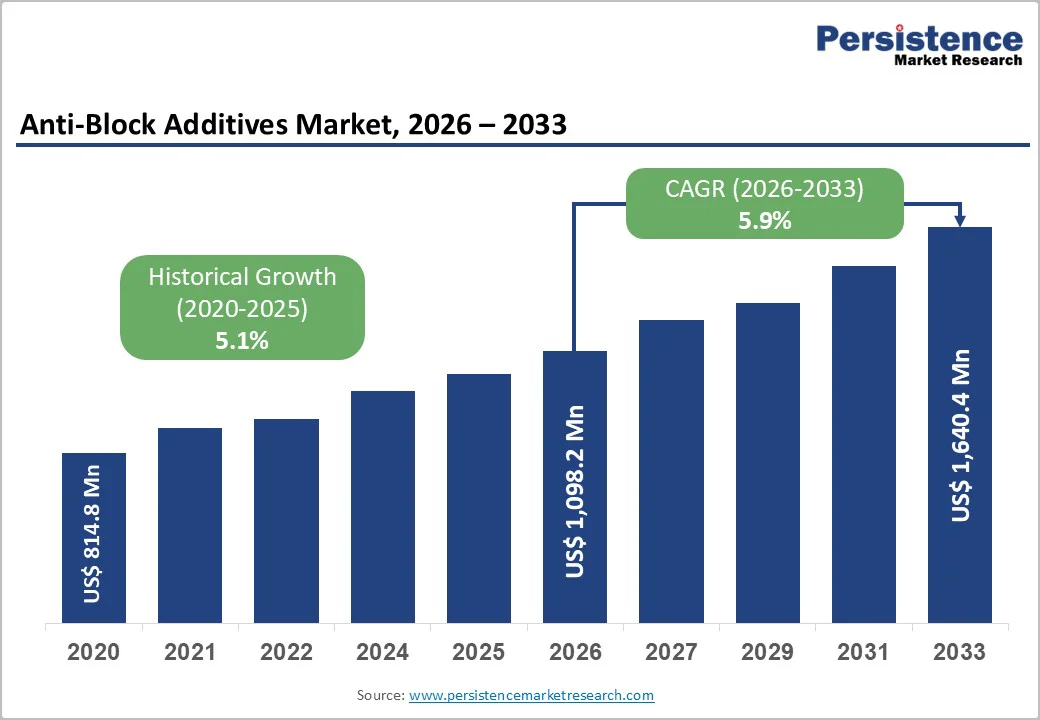

The global anti-block additives market size is likely to be valued at US$ 1,098.2 million in 2026 and is expected to reach US$ 1,640.4 million by 2033, growing at a CAGR of 5.9% during the forecast period from 2026 to 2033.

Robust demand for anti-block additives is being driven by the surge in packaging consumption, especially in the food and pharmaceutical sectors. This upward momentum is reinforced by innovation in sustainable film solutions and increased adoption of advanced polymer processing in fast-growing economies. Furthermore, R&D and regulations promoting safer materials in consumer packaging continue to foster this market’s expansion.

| Key Insights | Details |

|---|---|

| Anti-Block Additives Market Size (2026E) | US$ 1,098.2 million |

| Market Value Forecast (2033F) | US$ 1,640.4 million |

| Projected Growth CAGR (2026 - 2033) | 5.9% |

| Historical Market Growth (2020 - 2025) | 5.1% |

The increasing use of flexible packaging in food, pharmaceutical, and consumer goods is pushing manufacturers to adopt advanced additives that improve film quality and reduce processing problems such as blocking, melt fracture, and production downtime.

As companies focus on efficiency, safety, and regulatory compliance, high-performance anti-block and processing aids have become essential for maintaining smooth operations in film manufacturing lines. This trend highlights the need for solutions that enhance productivity while supporting the growing volume of flexible packaging worldwide.

In 2025, The Dow Chemical Company introduced DOWSIL™ 5-1050 Polymer Processing Aid, designed specifically for blown and stretch film applications. Dow’s official release stated that the additive improves line stability, minimizes die-lip build-up, and meets food-contact standards in the U.S. and Europe, directly reflecting industry demand for more efficient, high-performance film solutions.

The packaging industry is placing stronger emphasis on sustainable materials as environmental regulations tighten and consumers increasingly prefer eco-friendly products.

This shift is driving greater use of bio-based and renewable-feedstock additives that reduce dependence on fossil-derived inputs while still delivering the performance needed for modern packaging. In response, manufacturers are broadening their portfolios with greener solutions that help companies meet carbon-reduction targets without requiring changes to existing production lines.

In 2025, when BASF SE expanded its Biomass Balance (BMB) and Ccycled ranges. Also, BASF confirmed the integration of more renewable and recycled feedstock into key polymer and additive products, enabling converters to reduce environmental impact without altering formulations or equipment.

This clearly reflects the market’s movement toward sustainable, bio-based polymers and highlights the role major chemical producers play in advancing environmentally responsible packaging solutions.

Volatility in raw material prices represents a substantial challenge for the anti-block additives market, primarily because the production of these additives relies on feedstocks such as silica, talc, and various specialty chemicals that are sensitive to global supply-demand dynamics. Fluctuations caused by supply chain disruptions, geopolitical conflicts, trade limitations, and currency instability directly affect procurement costs for manufacturers.

When raw material prices surge, producers often face shrinking profit margins, as passing on the increased costs to end-users is not always feasible due to competitive pressures. This unpredictability can also deter new entrants, who may perceive high cost variability as a barrier to stable operations.

Additionally, downstream industries such as packaging, automotive, and agriculture tend to postpone capital investments during periods of cost uncertainty, further slowing demand for anti-block additives and negatively impacting overall market growth.

Stringent environmental regulations, particularly in regions such as the European Union, are increasingly shaping the anti-block additives market by enforcing strict guidelines around plastic usage, recyclability, and waste management.

These norms compel manufacturers to upgrade product formulations to meet biodegradability and eco-compliance criteria, which demands significant investment in research, testing, and certification. Non-compliance may result in heavy penalties, import restrictions, or product bans, placing additional financial pressure on producers.

As a result, companies are shifting focus toward the development of sustainable and bio-based anti-block additives, which often come with higher production costs and longer development cycles. While this transition fosters innovation, it simultaneously restricts growth for traditional additive categories that are unable to meet evolving standards. The regulatory burden, therefore, acts as a restraint by increasing operational complexity and limiting market expansion opportunities for non-eco-friendly product lines.

Rapid industrialization and urbanization in countries such as China and India are creating enormous opportunities for chemical and additive producers. The growth of manufacturing, packaging, and e-commerce sectors in these regions is driving demand for high-performance additives that improve processing efficiency and product quality.

Local government policies promoting self-sufficiency and technological adoption further support investment in production and innovation. Companies that expand their presence in these markets can benefit from rising consumption, increasing production scale, and a growing need for reliable, locally manufactured solutions.

In 2025, Evonik Industries AG partnered with a Chinese company to build a large hydrogen peroxide production plant in Henan province. This strategic investment not only strengthens Evonik’s local manufacturing capabilities but also positions the company to meet the surging demand from industries such as nylon, packaging, and fibers, capitalizing on Asia’s rapidly expanding industrial and urban landscape.

There is growing demand for multifunctional and specialty additives that offer multiple benefits in a single product, such as improved processing, anti-block properties, UV protection, or environmental compliance.

Industries like medical packaging and high-performance films increasingly require these advanced solutions to enhance product quality, reduce production downtime, and meet strict regulatory standards. Manufacturers that innovate in this space can achieve higher margins while supporting sustainability and efficiency.

In 2025, BYK Additives introduced a PFAS-free polymer processing aid, for polyolefin films and fibers. This additive improves production speed, prevents die build-up, reduces defects, and shortens downtime, all while eliminating harmful chemicals.

By combining multiple functional benefits into one product, BYK demonstrates how specialty additives can address diverse production challenges, support environmental goals, and deliver value to manufacturers, meeting the growing market demand for multifunctional, high-performance solutions in packaging and medical applications.

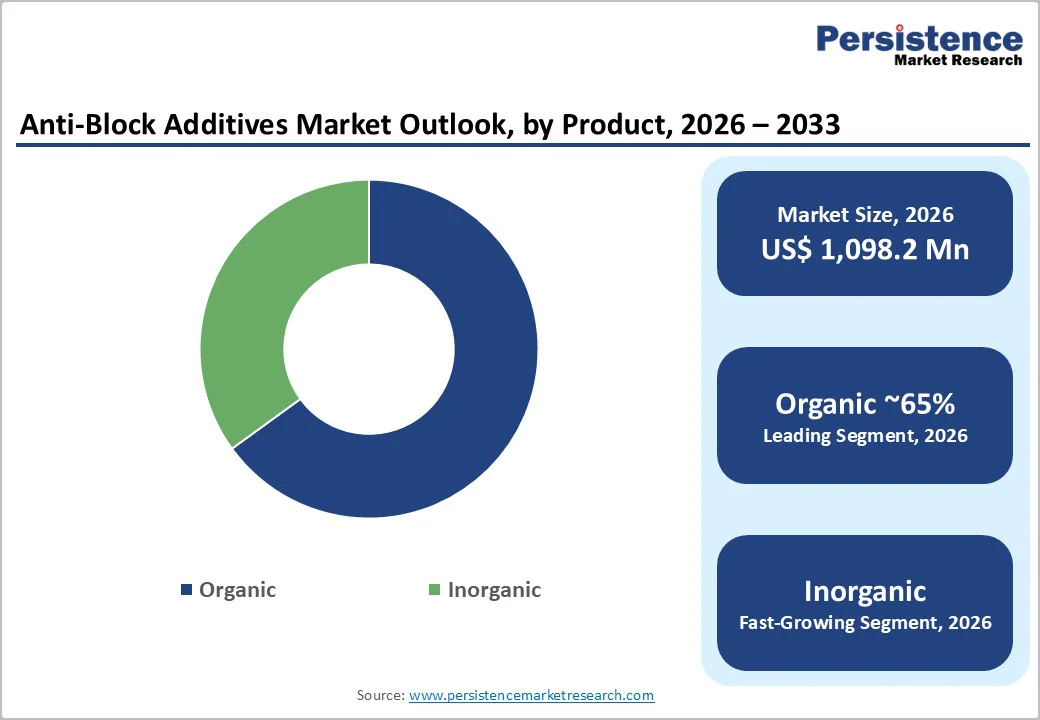

Organic anti-block additives continue to dominate the market, capturing around 65% of the global share due to their strong alignment with sustainability trends and regulatory expectations. These additives, derived from natural waxes, minerals, and plant-based compounds, offer superior biodegradability and reduced toxicity, making them ideal for use in food-contact and healthcare-related films.

Their ability to enhance optical clarity, minimize haze, and maintain the functional integrity of flexible packaging films further boosts their adoption. As brand owners and converters increasingly shift toward eco-friendly packaging solutions to meet consumer expectations and comply with environmental policies, the demand for organic anti-block additives is projected to accelerate, reinforcing their leadership position.

LDPE remains the leading polymer type in the anti-block additives market, representing nearly 40% of total usage due to its widespread application across packaging films, bags, agricultural films, and industrial liners. Its exceptional flexibility, transparency, and ease of processing make it highly compatible with both organic and inorganic anti-block solutions.

Continuous advancements in blown and cast film extrusion technologies have improved LDPE film performance, driving higher incorporation of additives to enhance slip properties, reduce blocking, and optimize production speeds. As demand for lightweight, durable, and cost-effective packaging continues to expand globally, LDPE’s reliance on anti-block agents will grow in parallel, sustaining its dominant market position.

Packaging remains the most influential application segment, accounting for nearly 60% of the demand for anti-block additives. This dominance stems from the global surge in packaged food, pharmaceuticals, consumer goods, and e-commerce shipments, all of which require high-performance films that resist adhesion and ensure smooth processing.

Anti-block additives play a crucial role in preventing film layers from sticking, improving machinability on high-speed packaging lines, and maintaining product quality during storage and transport. With regulatory bodies implementing stricter guidelines on product safety, hygiene, and material performance, manufacturers are compelled to integrate advanced anti-block solutions. The rising popularity of flexible packaging formats further accelerates demand in this segment.

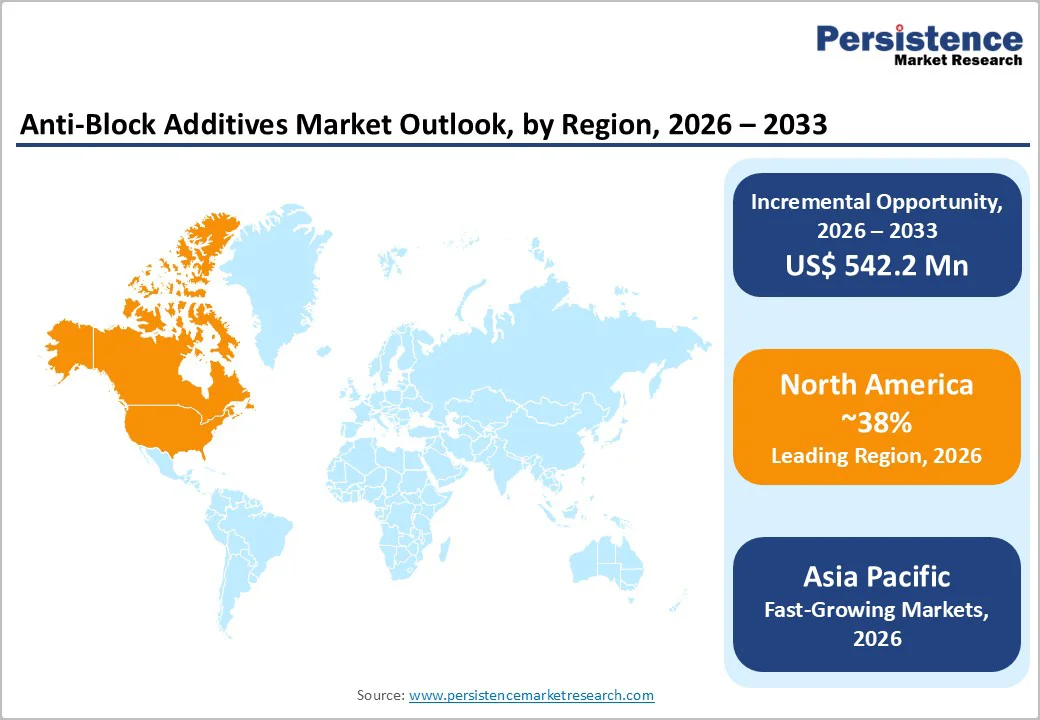

The anti-block additives market in North America is expanding due to increasing demand for high-performance packaging in the food, pharmaceutical, and medical sectors. Strict FDA regulations require additives that ensure film clarity, prevent adhesion, and maintain product safety.

Additionally, the shift toward sustainable packaging, including recycled-content films, has driven the need for innovative additives compatible with post-consumer recycled materials. The region’s strong R&D ecosystem fosters continuous innovation, resulting in next-generation solutions that combine regulatory compliance with superior performance.

In June 2025, Clariant launched its PFAS-free processing-aid line, AddWorks PPA, specifically for polyolefin film extrusion. The product ensures smooth processing, high optical clarity, and compliance with food-contact regulations, while supporting sustainability goals. This launch highlights how North American manufacturers leverage innovation and regulatory adherence to meet growing market demands for advanced anti-block additives.

Europe’s anti-block additives market is growing due to a strong emphasis on performance-driven applications, particularly in automotive and industrial packaging. Regulatory harmonization across the EU, including stricter packaging waste regulations, encourages manufacturers to adopt sustainable and recyclable packaging solutions.

The market also benefits from collaboration and cross-national R&D funding, driving innovation in additives that deliver clarity, smooth film surfaces, and high functional performance.

In October 2025, Sukano introduced a new anti-block masterbatch for compostable BOPLA films at K 2025. The additive allows ultra-thin, high-barrier films to be produced on existing equipment, maintaining surface quality and printability while meeting EU sustainability and compostability standards.

This development illustrates how European regulatory and sustainability priorities are pushing companies to innovate in anti-block additives, balancing performance with environmental compliance

Asia Pacific anti-block additives market is growing rapidly due to the region’s expanding manufacturing sector and rising demand for high-performance, sustainable packaging. Regulatory pressure in countries like China and India is encouraging the use of additives compatible with recyclable and eco-friendly films.

Additionally, technological advancements and local capacity expansions enable manufacturers to produce films efficiently at large scales, supporting the region’s role as both the largest and fastest-growing market.

In 2025, Avient Corporation showcased at ProPak Vietnam 2024 a new range of polymer additives designed for post-consumer recycled (PCR) resins, including flexible-film applications in polyethene and polyolefins. These innovations illustrate how additive suppliers are responding to the region’s sustainability push and recyclability demand, offering solutions that improve processing, enable use of recycled content, and support high-quality film output for packaging.

The anti-block additives space reflects moderate concentration, with the top 10 global suppliers accounting for 45% of industry revenue. Large companies leverage vertical integration, product innovation, and sustainability focus, while regional firms succeed with customized solutions. Recent trends highlight increased mergers, R&D investment, and the launch of multifunctional additive technologies

The global anti-block additives market is anticipated to reach US$ 1,640.4 million in 2033.

Key drivers include surging demand from the packaging sector and the transition toward bio-based and sustainable polymer applications.

Organic anti-block additives are the leading segment, driven by biodegradable properties and regulatory support for eco-friendly solutions.

Asia Pacific is both the largest and fastest-growing region, stemming from strong manufacturing and packaging industry growth.

Development of multifunctional, specialty anti-block additives for post-consumer recycled and high-performance film packaging.

Key players include BASF SE, The Dow Chemical Company, Arkema S.A., Honeywell International Inc., Evonik Industries AG, and Fine Organics.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Polymer Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author