ID: PMRREP32909| 262 Pages | 29 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

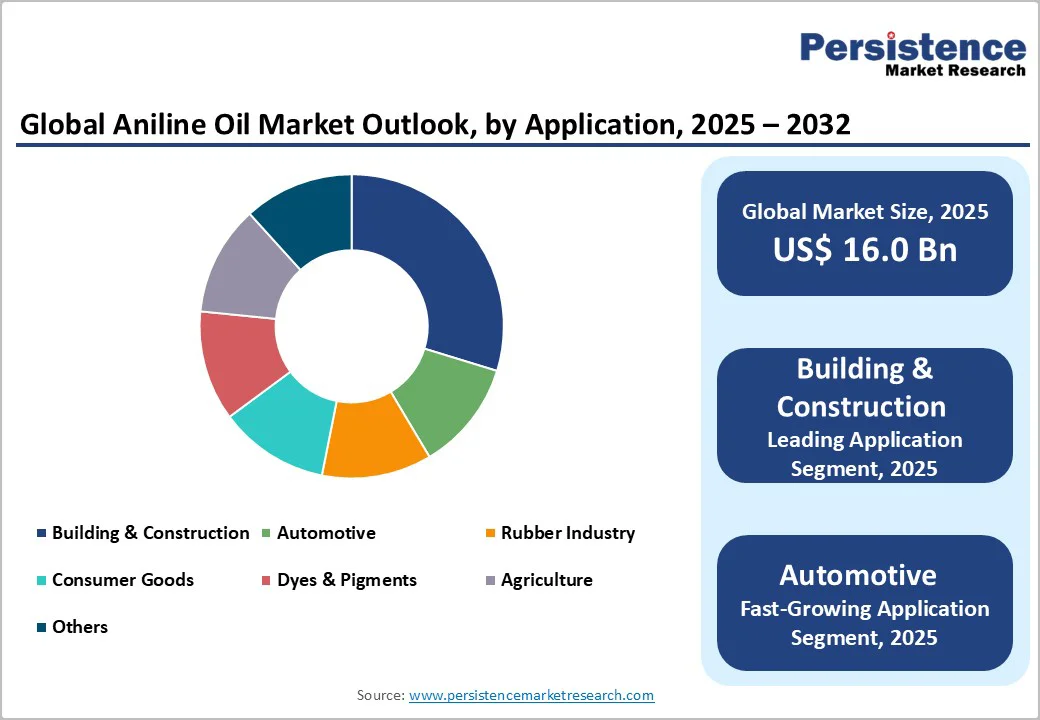

The global aniline oil market size is valued at US$ 16.0 billion in 2025 and is projected to reach US$ 23.7 billion by 2032, growing at a CAGR of 5.7% between 2025 and 2032. The market expansion is primarily driven by robust demand from the polyurethane (PU) foam manufacturing sector, particularly in building and construction, automotive applications, and infrastructure development across emerging economies.

|

Key Insights |

Details |

|

Aniline Oil Market Size (2025E) |

US$ 16.0 Bn |

|

Market Value Forecast (2032F) |

US$ 23.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.9% |

Drivers - Growing Construction Industry and Urbanization Trends

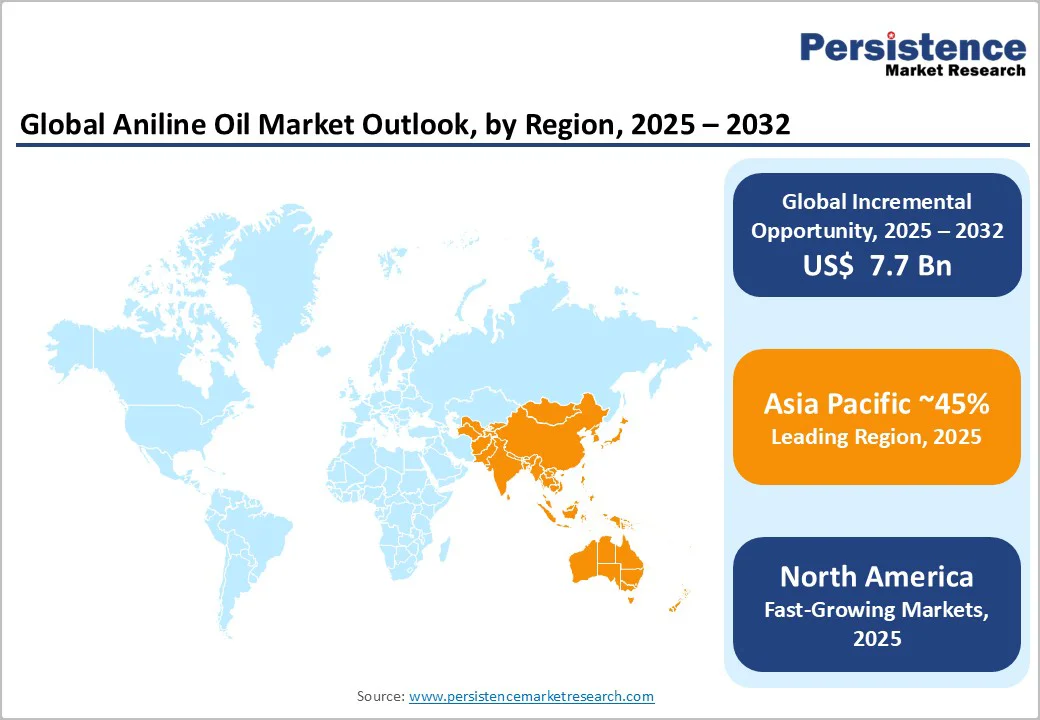

Global construction activity represents the primary engine driving aniline oil demand, with polyurethane foam applications accounting for significant consumption in building insulation and structural components. The construction segment is projected to generate an incremental opportunity of US$ 5.2 Bn between 2022 and 2032, reflecting sustained demand for rigid polyurethane foams. Asia Pacific's rapid urbanization particularly in China, India, and Southeast Asia has created unprecedented demand for residential and commercial infrastructure. Urban population growth is accelerating construction spending, with urbanization rates expected to reach 65% in Asia by 2032. Polyurethane rigid foams derived from aniline oil provide superior insulation, lightweight properties, and chemical stability essential for modern building applications, including pipeline insulation for oil and gas infrastructure and thermal insulation systems for buildings and refrigeration equipmen

Restraint - Environmental and Regulatory Health Concerns

Aniline presents significant occupational health hazards and environmental concerns that constrain market expansion and impose operational compliance costs. Aniline irritates the eyes, skin, and respiratory tract, induces methemoglobinemia impairing oxygen delivery, damages red blood cells causing acute hemolytic anemia, and has been linked to heart, kidney, and liver damage. Escalating environmental norms and regulations continue restricting aniline use, disposal practices, and manufacturing operations, forcing industrial stakeholders to develop environment-friendly substitutes. Regulatory bodies including OSHA and European chemical authorities impose stringent manufacturing protocols, worker protection requirements, and environmental remediation standards, increasing production costs and limiting market penetration in regions with strict regulatory frameworks

Opportunities - Emerging Economies Infrastructure Development and Construction Growth

Developing economies across Asia Pacific, Latin America, and Africa present substantial untapped market opportunities driven by infrastructure modernization initiatives and industrial expansion. China currently accounts for more than 25% of global aniline oil market share, with continued infrastructure investments creating sustained demand.

India, Vietnam, and Indonesia represent emerging high-growth markets with accelerating construction activity, automotive manufacturing expansion, and urbanization drivers. Government infrastructure spending programs, including smart city initiatives and transportation infrastructure development, create substantial polyurethane foam demand opportunities. Market growth rates in these regions exceed developed market CAGR, offering strategic expansion opportunities for manufacturers capable of establishing localized production capacity and supply chain networks.

Application Insights

Methylene Diphenyl Diisocyanate Leads Aniline Oil Demand While Specialty Applications Drive High-Growth Opportunities

The aniline oil market is primarily driven by its extensive use in Methylene Diphenyl Diisocyanate (MDI) production, which accounts for over 55% of total revenue and remains the dominant application segment throughout the forecast period. MDI serves as the key precursor for polyurethane foams used across home furnishings, rigid insulation systems, elastomers, adhesives, sealants, and automotive interiors. Its superior thermal stability, chemical resistance, and mechanical strength compared to alternative polyisocyanates reinforce its strong market position. The MDI segment is projected to grow at a CAGR of 5.6% from 2022 to 2032, reflecting steady demand from global polyurethane producers. Leading chemical manufacturers such as BASF, Covestro AG, and Wanhua Chemical Group continue to expand MDI production capacity, strengthening reliance on aniline oil as a critical feedstock.

In contrast, other applications are emerging as high-growth segments with diverse industrial use cases. These include dyes and pigments, agricultural chemicals, rubber additives, and consumer goods manufacturing each exhibiting growth rates that surpass traditional MDI consumption. Additionally, specialty aniline derivatives used in coatings, adhesives, and advanced material composites are gaining momentum, offering higher margins and attractive opportunities for product portfolio expansion. As manufacturers seek to diversify beyond commodity polyurethane intermediates, these fast-growing applications are expected to play an increasingly influential role in shaping market development.

Industry Insights

Building and Automotive Sectors Drive Ethylene Oxide Demand Across Key End Uses

The building and construction sector is the dominant end-use segment for ethylene oxide derivatives, accounting for over 30% of market revenue. Demand is primarily driven by polyurethane rigid foam applications in building insulation, thermal management systems, and structural components. Growth in this sector is supported by urbanization, infrastructure modernization, and rising living standards in developing economies. Furthermore, energy-efficient building codes and regulatory mandates for thermal insulation performance increase specification requirements for polyurethane foam quality, benefiting aniline oil and related EO derivatives that meet premium material standards.

The automotive sector is the fastest-growing end-use category, projected to expand at a CAGR of 6.1% over the forecast period. Increasing global vehicle production, the shift toward electrification, and consumer demand for lightweight, fuel-efficient vehicles drive rising polyurethane foam consumption. Key applications include seating foam, acoustic insulation, and cushioning components. Premium automotive segments are increasingly adopting aniline leather and advanced polyurethane formulations, which further boosts high-value aniline oil demand. Growth in this segment reflects structural tailwinds from vehicle electrification trends, regulatory fuel economy mandates, and accelerating motorization in emerging markets.

Asia Pacific Leads Global Aniline Oil Market Driven by China and Emerging Economies

Asia Pacific dominates the global aniline oil market, accounting for over 45% of revenue, led by China’s substantial market presence and rapid industrial growth across emerging economies. China alone represents above 30% of the global market, serving as the world’s largest producer and consumer of polyurethanes and a key automotive manufacturing hub. The country’s market leadership is driven by extensive investments in construction, industrial infrastructure, and automobile production, alongside rising urbanization and favorable trade regulations, which collectively sustain strong aniline oil demand.

Beyond China, emerging markets such as India, Vietnam, Indonesia, and Thailand are experiencing accelerating construction, automotive expansion, and infrastructure modernization, with growth rates exceeding those of developed regions. These markets offer strategic opportunities for manufacturers to establish localized production and distribution networks, leveraging government infrastructure programs and rising living standards to capture long-term market potential.

North America’s Aniline Oil Market Remains Stable and Growth-Driven, Led by the United States

North America, led by the United States, represents a mature yet stable aniline oil market, supported by advanced technological capabilities, established manufacturing infrastructure, and stringent regulatory frameworks. The U.S. market is expected to grow at a CAGR of 4.9% between 2022 and 2032, driven by steady demand across key end-use sectors. Canada relies on imports due to the absence of domestic aniline production, reinforcing the United States’ regional leadership in both consumption and production. Market expansion is fueled by growth in the automotive and construction industries, with housing and infrastructure projects particularly driving polyurethane foam applications in seating, insulation, and structural components.

Prominent manufacturers, including BASF and Covestro AG, strengthen North America’s position as a strategic production hub serving both domestic consumption and export markets. Regulatory oversight by the EPA and OSHA ensures product quality and worker safety but increases compliance costs, requiring significant capital investment, limiting smaller competitors, and reinforcing market consolidation among major players.

Key manufacturers of aniline oil account for 40-50% of global market share, indicating moderate market concentration with meaningful competitive participation from mid-sized and regional producers. Leading players, including BASF, Covestro AG, Wanhua Chemical Group Co. Ltd, Laxness, Jinling Chemical Co, and Sumitomo Chemical Co Ltd, maintain substantial production capacity and global distribution networks serving diversified end-use industries. Market structure demonstrates characteristics of an oligopoly tempered by regional producers and specialty manufacturers serving niche applications. BASF and Covestro AG maintain strongest competitive positions in North America and Europe, while Wanhua Chemical Group dominates Chinese and Asian markets

The Aniline Oil market is estimated to be valued at US$ 16.0 Bn in 2025.

The key demand driver for the Aniline Oil market is the rapidly expanding production of methylene diphenyl diisocyanate (MDI). MDI is a critical raw material for polyurethane (PU) foams used extensively in construction, automotive, electronics, furniture, refrigeration, and insulation applications.

In 2025, the Asia Pacific region will dominate the market with an exceeding 45% revenue share in the global Aniline Oil market.

Among applications, Building & Construction has the highest preference, capturing beyond 35% of the market revenue share in 2025, surpassing other end-use industries.

BASF, Covestro AG, Wanhua Chemical Group Co. Ltd, Laxness, Jinling Chemical Co., and Sumitomo Chemical Co. Ltd are a few leading players in the Aniline Oil market.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author