ID: PMRREP26755| 219 Pages | 13 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

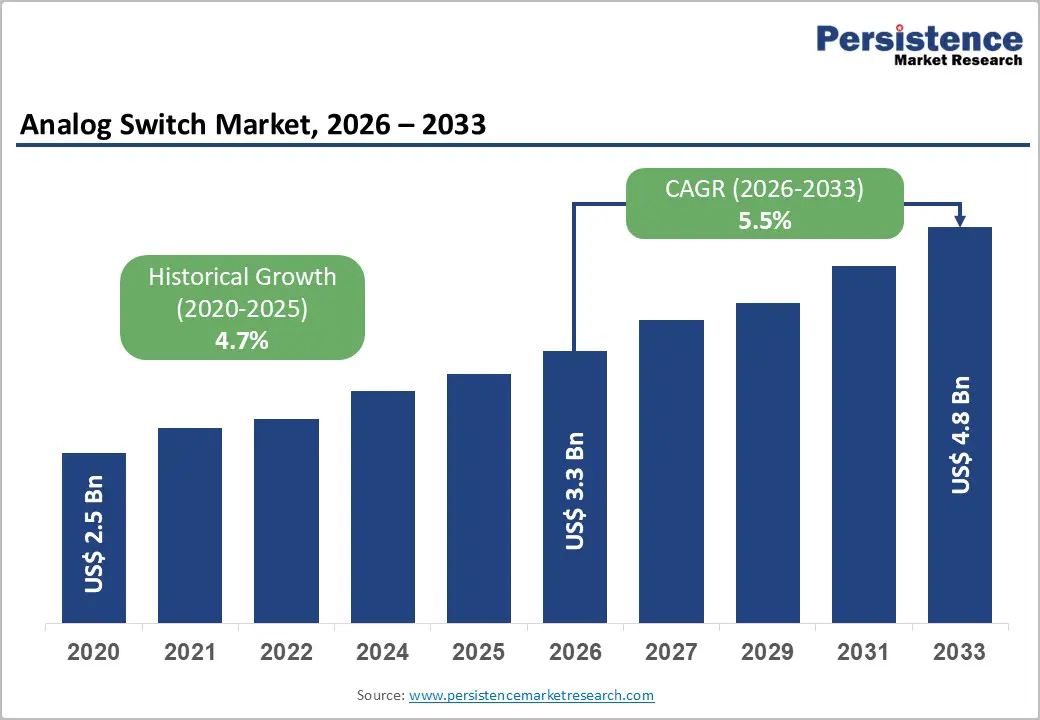

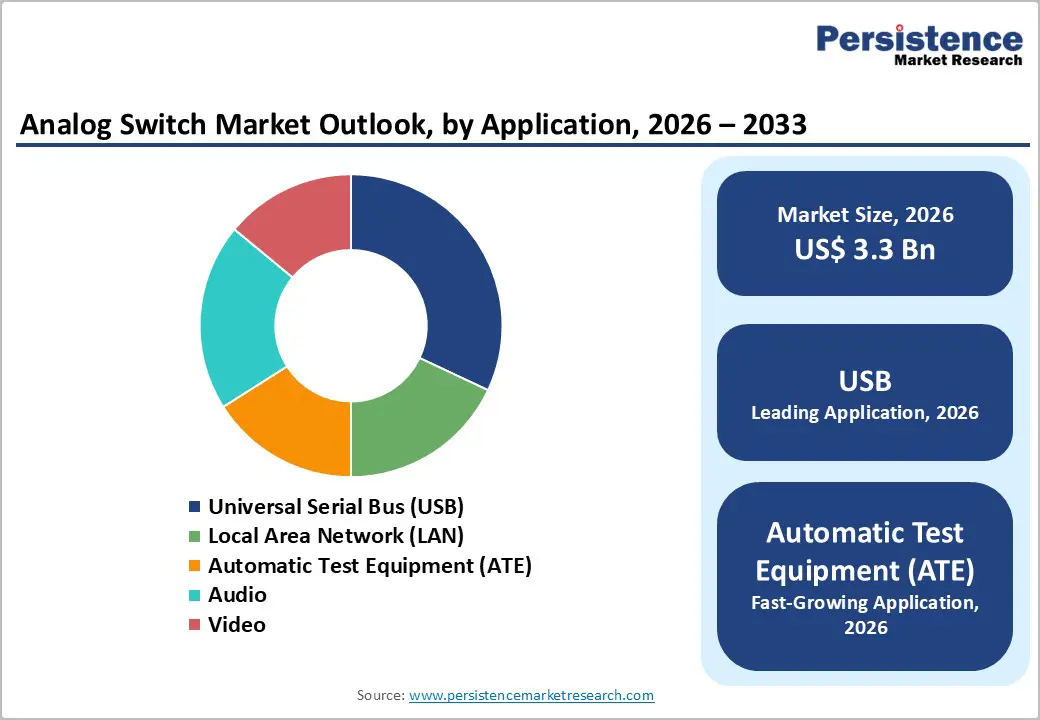

The global analog switch market size is likely to be valued at US$ 3.3 billion in 2026, and is projected to reach US$ 4.8 billion by 2033, growing at a CAGR of 5.5% during the forecast period of 2026–2033. The market expansion is primarily driven by rising signal-routing requirements in consumer electronics, increasing deployment of high-speed data interfaces, and the growing complexity of test and measurement systems across semiconductor manufacturing. Sustained investments in data centers, USB-C and high-definition audio-video interfaces, and automated test equipment (ATE) infrastructure continue to reinforce long-term demand. The market demonstrates moderate fragmentation, with innovation-led differentiation and voltage-specific specialization shaping competitive dynamics.

| Key Insights | Details |

|---|---|

|

Analog Switches Market Size (2026E) |

US$ 3.3 Bn |

|

Market Value Forecast (2033F) |

US$ 4.8 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.7% |

The rapid proliferation of high-speed data interfaces such as USB-C, Thunderbolt, HDMI 2.1, and advanced LAN standards across consumer and computing electronics has become a primary driver for the analog switch market. In 2025, global shipments of USB-enabled devices exceeded 6.5 billion units, with USB-C accounting for over 70% of new consumer electronics launches, reflecting its role as a universal data and power interface. Analog switches are essential in enabling signal multiplexing, port orientation detection, power–signal coexistence, and low-loss routing within compact device architectures. Demand is therefore concentrated around low-voltage and medium-voltage switches, where performance parameters such as low ON-resistance, minimal signal distortion, and EMI suppression directly influence device reliability and user experience.

At the infrastructure level, sustained growth in semiconductor testing and data center deployment further reinforces this demand. The leading cloud service providers expanded hyperscale data centers to support AI workloads and edge computing, increasing the need for efficient LAN routing, monitoring systems, and redundancy architectures where analog switches are embedded. The advanced semiconductor manufacturing, driven by sub-5 nm nodes and chiplet-based designs, has increased test complexity and channel density, elevating the role of analog switches in automated test equipment. Notably, several governments in Asia and North America announced new semiconductor and data center investment programs in 2025, aimed at strengthening digital infrastructure resilience, which is expected to sustain long-term demand for high-reliability analog switching solutions.

Analog switches continue to face pricing and margin pressure due to increasing integration within mixed-signal and system-on-chip designs, particularly in cost-sensitive consumer electronics. OEMs increasingly favor integrated solutions to reduce bill-of-materials complexity and assembly costs, which has resulted in annual average selling price erosion of 3–5% for commodity analog switches during 2025. Suppliers without clear performance differentiation, such as ultra-low ON-resistance, signal integrity optimization, or voltage specialization, find it difficult to protect margins. This structural shift places sustained pressure on standalone analog switch vendors, especially those heavily exposed to high-volume consumer segments.

The supply chain volatility in mature-node semiconductor manufacturing continues to constrain operational flexibility. Analog switches rely on 180 nm to 65 nm process nodes, where capacity tightening followed post-pandemic fab rationalization. During 2024–2025, over 30% of analog IC suppliers experienced lead-time extensions beyond 12 weeks, increasing fulfillment risk for original equipment manufacturers (OEMs). In response, leading semiconductor manufacturers announced capacity stabilization and long-term wafer supply agreements, while regional governments in Asia and North America outlined new investments to secure mature-node fabrication. These initiatives aim to improve supply resilience but reinforce competitive advantages for vertically integrated players with secured manufacturing access.

The accelerating shift of electronics manufacturing toward emerging hubs such as India, Vietnam, and Indonesia presents a significant opportunity for analog switch suppliers. These countries recorded double-digit growth in electronics manufacturing output, supported by targeted government incentive programs, including India’s Production Linked Incentive (PLI) scheme. OEMs assembling smartphones, consumer electronics, and computing devices in these regions are increasingly prioritizing local sourcing of analog components to reduce lead times and manage supply risk. This trend opens pathways for regional supply partnerships, localized packaging, and long-term volume contracts for analog switch manufacturers.

Performance-driven demand is rising across industrial, automotive, and premium consumer applications. The global investments in automotive and industrial test systems exceeded US$ 9 billion, driven by EV powertrain validation, electrification, and factory automation requirements that rely on high-voltage analog switches operating above 15V. The leading consumer electronics brands emphasized miniaturization and signal integrity optimization for high-resolution audio and video devices, supporting demand for ultra-low leakage and low parasitic capacitance switches. In response, several leading semiconductor companies announced new product roadmaps and capacity investments in 2025 focused on advanced analog designs, signaling a sustained opportunity for value-based differentiation rather than volume-led growth.

Low-voltage analog switches (up to 5V) are expected to continue to dominate the market, accounting for approximately 45% of revenue in 2026, due to their extensive use in battery-powered consumer electronics. These switches are critical in smartphones, wearables, laptops, and tablets, where low power loss, compact footprints, and signal stability directly affect device performance. They are widely deployed for USB-C signal routing, audio path management, and peripheral switching. Apple and Samsung expanded USB-C standardization across smartphones and notebook lines, increasing the number of low-voltage switches integrated per device. As device designs grow thinner and multifunctional ports become standard, the role of low-voltage switches continues to expand. High shipment volumes ensure sustained demand and revenue stability for suppliers focused on this segment.

Medium-voltage switches (5V–15V) are expected to represent the fastest-growing voltage category, registering a CAGR above 6% through 2033, as they support higher power delivery and mixed-signal requirements. Growth is driven by USB Power Delivery, docking stations, and enterprise peripherals that require higher voltage tolerance than traditional consumer electronics. These switches are increasingly used in laptops, monitors, and connectivity hubs that combine power, data, and display signals. Intel-led ecosystem upgrades emphasizing USB-C and Thunderbolt interoperability accelerated adoption of medium-voltage switching solutions. Semiconductor suppliers responded by prioritizing medium-voltage product platforms to address evolving interface standards. This segment benefits from crossover demand between consumer and light-industrial electronics.

USB application is expected to lead in 2026, accounting for nearly 32% of the analog switch market revenue share, reflecting the central role of high-speed connectivity in modern electronics. Analog switches enable critical functions such as role swapping, alternate mode switching, signal isolation, and path optimization in USB-C and LAN architectures. Their importance has increased as single ports handle multiple functions, including data transfer, charging, and video output. Enterprise laptop refresh programs by HP and Dell relied heavily on USB-C-centric designs, increasing analog switch content per system. LAN switching demand is also supported by networking equipment used in enterprise and industrial environments. Together, these factors ensure consistent, high-volume demand across device categories.

Automatic test equipment (ATE) applications are projected to be the fastest-growing, expanding at a CAGR above 6.5% through 2033, due to rising semiconductor design and manufacturing complexity. Advanced nodes, chiplet architectures, and heterogeneous integration require precise and repeatable signal routing during testing. Analog switches are essential for wafer probing, device characterization, and long-term reliability validation. TSMC and Samsung Electronics expanded advanced-node test capacity to support next-generation semiconductor production, increasing demand for high-reliability analog switches. These applications require long lifecycle support and high performance, favoring established suppliers. As test intensity increases, ATE remains a structurally strong growth driver.

Consumer electronics is likely to remain the largest end-user segment, contributing over 50% of the global market revenue in 2026, supported by large-scale production of smartphones, laptops, tablets, and audio devices. Analog switches are embedded across multiple subsystems, including charging interfaces, audio paths, display outputs, and peripheral connectivity. High shipment volumes provide predictable baseline demand, even during cyclical market slowdowns. Chinese OEMs such as Xiaomi and OPPO increased domestic manufacturing output, integrating multiple analog switches per device to support advanced connectivity features. OEMs also emphasize multi-sourcing strategies to reduce supply risk. This segment continues to anchor market stability and scale.

Data centers are expected to be the fastest-growing end-users, driven by the rapid expansion of cloud computing, AI workloads, and edge infrastructure. Analog switches are deployed in LAN routing, redundancy systems, monitoring modules, and signal conditioning hardware, where uptime and signal integrity are critical. Amazon Web Services, Microsoft Azure, and Google Cloud announced new hyperscale data center investments across North America and Asia Pacific. These facilities require high-density, modular server architectures, increasing switching requirements. Long replacement cycles and predictable procurement patterns make data centers an attractive growth market. This segment supports sustained, high-value demand for advanced analog switching solutions.

North America remains a strategically important market for analog switches due to its strong concentration of semiconductor design leaders and advanced system OEMs. The United States continues to drive demand from applications such as automatic test equipment, enterprise networking, and high-performance computing platforms. Texas Instruments expanded its analog product roadmap, focusing on high-reliability switches optimized for industrial and data infrastructure use cases. Similarly, Analog Devices strengthened lifecycle support programs for precision analog components used in test and measurement systems. Hyperscale cloud operators increased infrastructure upgrades, indirectly supporting demand for signal routing and monitoring components. The region favors application-specific, high-performance analog switches over commoditized devices. This focus sustains stable demand across industrial, defense, and enterprise electronics segments.

From a policy perspective, semiconductor ecosystem development continued under the U.S. CHIPS and Science Act during 2025. Government-backed investments supported domestic fabrication, advanced packaging, and semiconductor workforce expansion. Although the act primarily targets leading-edge nodes, mature-node analog ICs benefit from improved supply resilience. These measures reduce fulfillment risks for analog switch suppliers serving long-term OEM contracts. North American customers prioritize IP security, traceability, and long-term availability in procurement decisions. As a result, supplier relationships tend to be long-standing and design-in driven. This environment supports sustained innovation in premium analog switching solutions.

Europe plays a critical role in the analog switch market due to its strong automotive electronics and industrial automation base. Countries such as Germany, France, and the U.K. anchor demand through advanced manufacturing and embedded systems development. Infineon Technologies expanded its mixed-signal development initiatives aligned with automotive safety and industrial control applications. NXP Semiconductors also advanced analog platforms supporting signal routing and diagnostics in automotive test systems. Analog switches are widely deployed in factory automation, power electronics testing, and vehicle validation environments. Reliability and compliance remain key purchasing criteria across European OEMs. These factors sustain consistent regional demand.

Government support continued to strengthen Europe’s semiconductor ecosystem. Programs aligned with the European Union (EU) Chips Act directed funding toward R&D, pilot production, and electronics manufacturing infrastructure. These initiatives reinforced long-term component availability for industrial and automotive supply chains. European customers favor suppliers offering ISO-certified manufacturing and extended lifecycle assurance. Regulatory harmonization across the EU further simplifies adoption of compliant analog switching solutions. Investment priorities remain centered on safety-critical and industrial-grade devices. This positions Europe as a quality-driven market rather than a volume-led one.

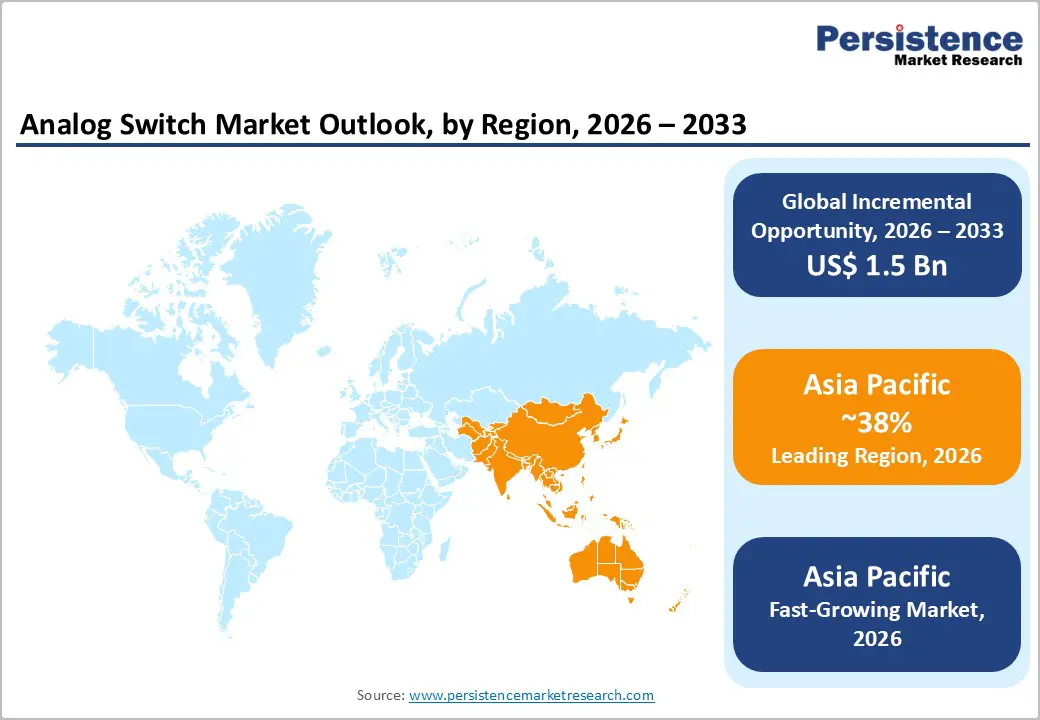

Asia Pacific is anticipated to account for over 38% of the analog switch market share in 2026. Regional market growth is driven by large-scale consumer electronics production and expanding semiconductor capacity across multiple countries. China, India, and ASEAN nations collectively anchor global volume consumption. Samsung Electronics and SK Hynix expanded semiconductor manufacturing investments, strengthening regional mixed-signal output. Analog switches are extensively used in smartphones, laptops, networking devices, and ATE systems manufactured in the region. Proximity to OEM assembly hubs accelerates design wins and production ramp-ups. These factors reinforce Asia Pacific’s leadership position.

Government policy continues to amplify regional momentum through targeted incentives. China expanded domestic semiconductor support programs, including analog and mixed-signal device manufacturing. India strengthened its Production Linked Incentive framework, encouraging local sourcing of electronic components. Southeast Asian countries such as Malaysia and Vietnam also advanced tax and infrastructure incentives. Regional suppliers increasingly invest in differentiated analog switch portfolios. This shift supports higher value capture beyond commoditized components. Asia Pacific is expected to remain the primary growth engine through 2033.

The global analog switch market structure is moderately consolidated, led by Texas Instruments, Analog Devices, onsemi, NXP Semiconductors, and Infineon Technologies. These players benefit from strong OEM relationships, broad mixed-signal portfolios, and long lifecycle support capabilities. Continuous R&D investment focuses on improving signal integrity, voltage handling, and power efficiency. Integrated analog platforms help secure multi-generation design wins across consumer, industrial, and data-centric applications. This scale-driven positioning allows leading vendors to withstand pricing pressure.

Regional and niche suppliers such as Renesas Electronics, Skyworks Solutions, and Diodes Incorporated target specialized applications and regional customers. Entry barriers remain moderate due to analog design complexity and qualification requirements. Mature-node manufacturing enables smaller players to compete with differentiated offerings. Strategic partnerships with ATE manufacturers and consumer OEMs are increasing. Gradual market consolidation is expected through acquisitions and technology-focused collaborations.

The global analog switch market is projected to reach US$ 3.3 billion in 2026.

Key drivers include widespread adoption of high-speed data interfaces (USB-C, LAN), rising semiconductor test complexity, and expanding data center infrastructure requiring efficient signal routing.

The market is poised to witness a CAGR of 5.5% from 2026 to 2033.

Opportunities arise from electronics manufacturing expansion in emerging Asia, increasing demand for high-voltage switches in ATE and EV testing, and miniaturization needs in premium consumer electronics.

Major players include Texas Instruments, Analog Devices, onsemi, NXP Semiconductors, Infineon Technologies, Renesas Electronics, and Skyworks Solutions.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Voltage Rating

By Application

By End-User

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author