ID: PMRREP33742| 180 Pages | 3 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

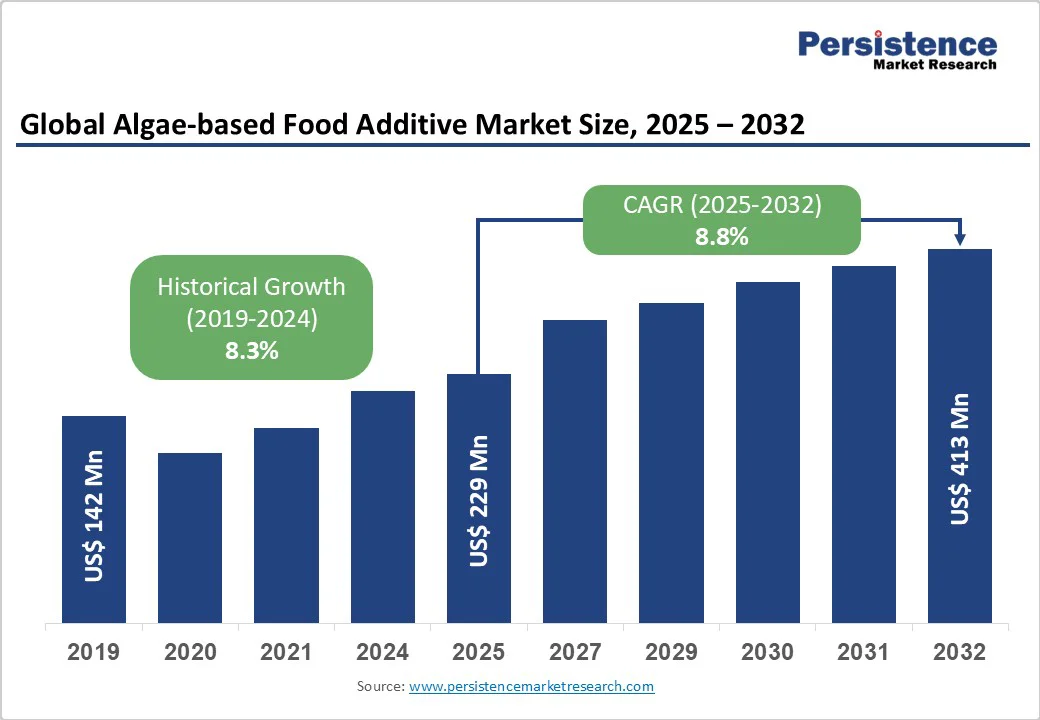

The global algae-based food additive market size is likely to be valued at US$ 229 Mn in 2025. It is expected to reach US$ 413 Mn by 2032, growing at a CAGR of 8.8% during the forecast period from 2025 to 2032, driven by the rising consumer demand for natural and sustainable ingredients, increasing awareness of health benefits from algae-derived products, and advancements in biotechnology for algae cultivation.

| Key Insights | Details |

|---|---|

|

Algae-Based Food Additive Market Size (2025E) |

US$ 229 Mn |

|

Market Value Forecast (2032F) |

US$ 413 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

8.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.3% |

The rising deployment of health-focused algae products is a major driver of market expansion, fueled by growing consumer awareness of natural and functional nutrition. Algae, including spirulina, chlorella, and Dunaliella salina, are rich in proteins, omega-3 fatty acids, vitamins, and antioxidants that support immunity, cardiovascular health, and anti-inflammatory responses. As health concerns such as obesity, diabetes, and lifestyle-related disorders rise globally, consumers are turning to algae-based nutraceuticals and functional foods as preventive solutions. For instance, spirulina-enriched dietary supplements are increasingly promoted for their high protein content and immune-boosting potential, while chlorella is being marketed for detoxification and gut health.

In the food and beverage industry, algae-derived ingredients are now incorporated into smoothies, snacks, and plant-based meat alternatives to enhance nutritional value. Additionally, algae-based omega-3 supplements are gaining traction as a sustainable alternative to fish oil, addressing both vegan preferences and environmental concerns. The expanding applications across nutraceuticals, fortified foods, and personal care products underline the shift toward natural wellness, making algae a pivotal element in the development of health-centric consumer goods.

The high costs associated with developing and regulating algae-based food additives hamper market growth. Algae cultivation requires specialized infrastructure such as photobioreactors, advanced harvesting systems, and controlled environmental setups, which significantly increase capital expenditure. Moreover, scaling production from laboratory to commercial levels often leads to high operational costs, making it difficult for small and medium enterprises to compete.

Regulatory compliance adds another layer of complexity, as algae-based food and nutraceutical products must undergo rigorous safety, efficacy, and quality assessments before approval. For instance, in the United States, the FDA requires Generally Recognized as Safe (GRAS) certification for algae-derived additives, while in Europe, EFSA enforces strict novel food regulations, which can delay product launches and increase costs. Companies such as Cyanotech and AlgaEnergy have invested heavily in R&D and regulatory processes to meet compliance standards, highlighting the financial challenges involved. These high entry barriers can limit innovation, discourage new market entrants, and slow the pace of commercialization, thereby restraining overall market growth.

Advancements in modular cultivation systems and AI-integrated technologies are creating significant opportunities in the algae-based products market. Modular photobioreactors and biorefinery units allow for scalable, flexible, and cost-efficient algae production, enabling companies to expand capacity in stages without incurring massive upfront investment. These systems also optimize space utilization, making algae farming feasible in urban and industrial settings. Integrating artificial intelligence and machine learning further enhances productivity by monitoring growth parameters such as light, temperature, and nutrient supply in real time.

AI-driven analytics can predict optimal harvest cycles, reduce energy consumption, and detect contamination risks early, thereby lowering operational costs. For instance, companies are deploying AI-powered sensors to automate algae cultivation, improving yields and product consistency for applications in nutraceuticals, biofuels, and animal feed. Startups in Europe and Asia are experimenting with modular container-based algae farms that can be deployed near food processing or aquaculture facilities, reducing logistics costs. As sustainability and efficiency remain central to global markets, the convergence of modular design and AI-driven precision management positions algae technology as a high-potential growth opportunity.

Spirulina dominates, expected to account for approximately 43% of the share in 2025. Its dominance stems from its exceptional protein content, rapid biomass accumulation, and ease of integration into functional foods and supplements. Spirulina-based additives, such as those offered by Cyanotech Corporation and Kemin Industries, enable antioxidant enrichment, immune support, and vibrant natural coloring, making them a preferred choice for industries such as nutraceuticals and food & beverages. Their scalability in open ponds also reduces upfront costs, driving adoption among startups and SMEs.

The chlorella segment is the fastest-growing, driven by industries with detoxification and detox requirements, such as wellness and animal feed. Chlorella additives offer greater chlorophyll density and nutrient absorption, appealing to brands with clean-detox missions. The growing focus on gut health and heavy metal chelation, such as in DSM’s initiatives, is accelerating the adoption of chlorella extracts in regions such as North America and Europe, with significant growth potential in high-efficacy applications.

Powder leads the algae-based food additive market, holding a 38% share in 2025. The segment’s dominance is driven by the need for versatile, easy-to-incorporate formats in dry mixes, supplements, and baking, particularly in shelf-stable products. Powder formulations streamline the integration of algae actives, reduce moisture-related degradation, and improve handling efficiency, making them critical for providers such as DuPont and Valensa International.

The liquid segment is the fastest-growing, fueled by the rapid growth of ready-to-drink beverages and liquid supplements. The rise in on-the-go nutrition and the increasing demand for bioavailable delivery have spurred the adoption of liquid algae additives in this sector. The Asia Pacific region, with its booming functional drink market, is driving rapid adoption in this segment.

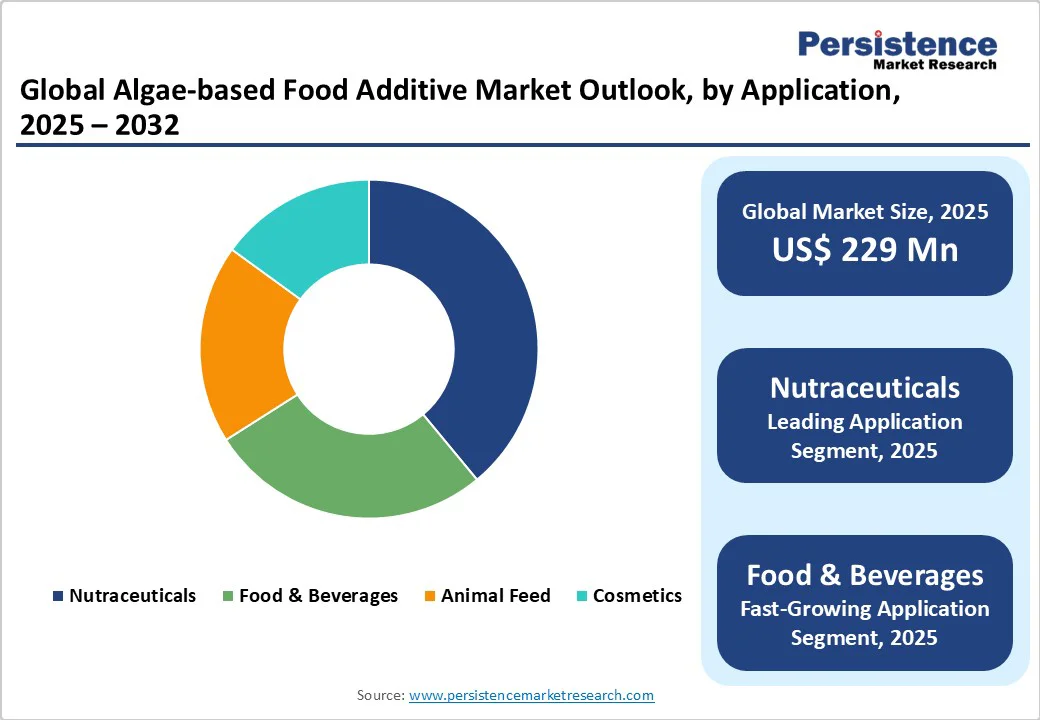

Nutraceuticals hold the largest market share, accounting for approximately 39% of revenue in 2025. Nutraceutical applications allow vendors such as DSM and Ocean Harvest Technology to maintain close relationships with customers, offer tailored extracts, and provide dedicated efficacy support. This application is particularly dominant in health-focused segments, such as immune boosters and omega-3 capsules, where customized algae solutions are critical.

The food & beverages application is the fastest-growing, driven by the increasing adoption of natural colorants and thickeners and the rise of plant-based formulations for snacks and dairy alternatives. These platforms offer seamless access to algae additives, enabling faster innovation and integration with other clean-label ingredients. The growing popularity of algae-enriched products among consumers and brands is accelerating the adoption of algae solutions through this application, particularly in North America and the Asia Pacific.

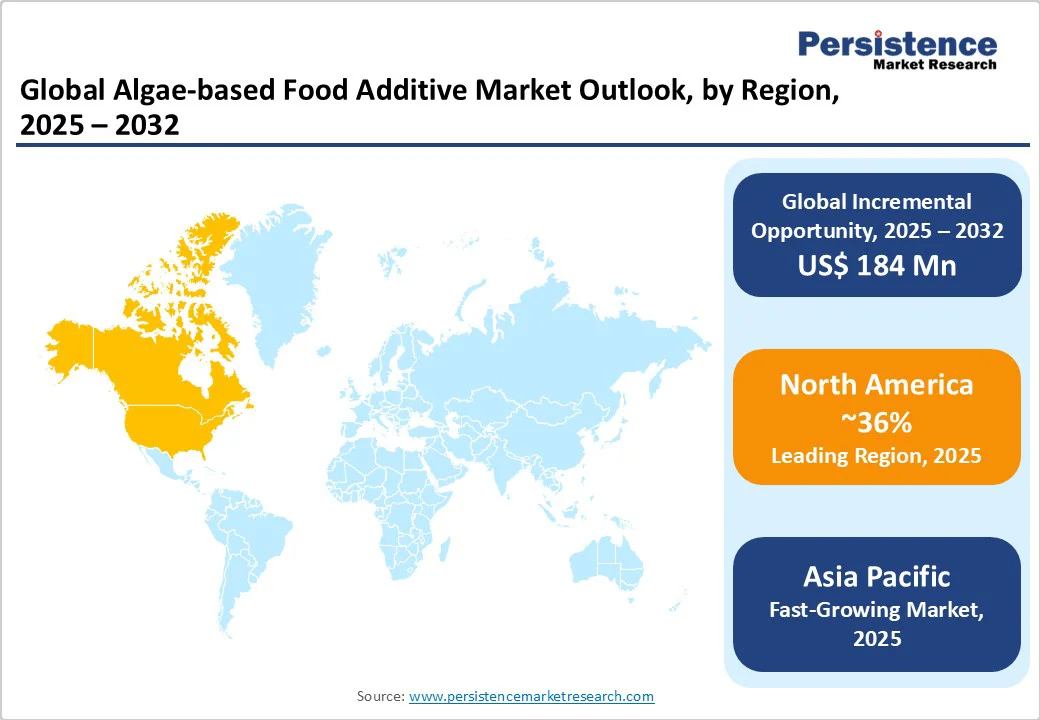

North America is expected to hold a 36% share of the global algae-based food additive market in 2025, making it one of the leading regional contributors. The United States, in particular, serves as the hub for innovation, research, and commercialization, supported by a strong nutraceutical and functional food industry. The region’s growing preference for natural, clean-label products is a major factor driving demand for algae-derived additives such as spirulina, chlorella, and carrageenan. These additives are increasingly utilized for their dual role as nutrient enhancers and natural colorants, replacing synthetic alternatives in beverages, snacks, and dietary supplements.

The rising popularity of omega-3-enriched products, derived from microalgae, also contributes significantly to market expansion, especially as vegan and vegetarian populations grow. For instance, U.S.-based companies are commercializing algae-sourced DHA and EPA oils as sustainable alternatives to fish oil, addressing both health-conscious and environmentally aware consumers. Additionally, strong regulatory support for plant-based and functional foods, combined with investments from key players such as Cyanotech and Corbion, further strengthens the region’s leadership position in the algae-based food additive market.

Europe is emerging as a significant player in the algae-based food additive market, supported by strong institutional frameworks and collaborative sustainability programs. The European Food Safety Authority (EFSA), along with national agencies such as the UK Food Standards Agency, ANSES (France), and BfR (Germany), is driving extensive investments in natural additive approvals for food fortification, nutraceuticals, and eco-friendly cosmetics. These initiatives are fueling demand for advanced and sustainable algae extracts capable of supporting multi-functional requirements.

The region is also home to leading biotech companies, including DSM (with European operations), Marinova, and Algaia, which are at the forefront of developing cutting-edge algae technologies. With a focus on organic certifications, circular economy principles, and AI-optimized extraction, European manufacturers are increasingly catering to both commercial and regulatory end-users. Europe’s growing emphasis on green deal compliance and reducing reliance on synthetic preservatives is encouraging greater R&D in additives that enhance nutrition and shelf life. The rising demand for algae-based texturants in bakery and dairy, as well as navigation services such as EU-funded algae farms, further strengthens Europe’s market position, ensuring steady growth in the coming years.

Asia Pacific is emerging as the fastest-growing market for algae-based food additives, supported by rapid urbanization, population expansion, and evolving dietary preferences. Countries such as China, India, and Japan are at the forefront of this growth, driven by rising health awareness and a shift toward natural, plant-based nutrition. Government initiatives promoting sustainable agriculture and alternative protein sources are further accelerating adoption. For instance, China has increased investments in algae cultivation technologies to meet domestic demand for functional foods and nutraceuticals, while India is witnessing growing startup activity in spirulina-based supplements targeting malnutrition and vegetarian protein needs.

The region’s rising disposable incomes and urban lifestyles are fueling demand for fortified beverages, snacks, and dietary supplements enriched with algae-derived proteins, antioxidants, and natural pigments. In addition, algae-based omega-3 products are gaining momentum as consumers seek alternatives to fish oil due to sustainability and dietary preferences. Collaborations between local producers and international players are also enhancing technology transfer and production capacity. Together, these factors position Asia Pacific as a dynamic growth engine in the algae-based food additive market.

The global algae-based food additive market is characterized by intense competition, regional strengths, and a mix of global and niche players. In developed regions such as North America and Europe, large firms such as DuPont, DSM, and Cyanotech Corporation dominate through scale, advanced R&D capabilities, and established partnerships with food agencies. In the Asia Pacific, rapid wellness developments and increasing demand for natural additives are attracting significant investments from both international players, such as Kemin Industries and Valensa International, and regional vendors. Companies are focusing on product innovation, sustainable sourcing, and strategic alliances to gain a competitive edge. The development of AI-optimized and organic-certified algae extracts has emerged as a key differentiator, enabling faster adoption in nutraceuticals, food & beverages, and cosmetics sectors. Strategic collaborations, acquisitions, and digital-first approaches for supply chain and marketing are further intensifying the competitive landscape. The industry exhibits a dual nature, consolidated at the top by global giants while remaining fragmented across numerous regional and niche players catering to local preferences and cost-sensitive segments.

The global algae-based food additive market is projected to reach US$ 229 Mn in 2025.

The increasing deployment of health-focused algae products is a key driver.

The algae-based food additive market is expected to witness a CAGR of 8.8% from 2025 to 2032.

Advancements in modular and AI-integrated algae technologies are a key opportunity.

DuPont, Valensa International, Ocean Harvest Technology, DSM, and Cyanotech Corporation are key players.

|

Report Attribute |

Details |

|

|

Historical Data/Actuals |

2019 - 2024 |

|

|

Forecast Period |

2025 - 2032 |

|

|

Market Analysis |

Value: US$ Mn, Volume: As Applicable |

|

|

Geographical Coverage |

|

|

|

Segmental Coverage |

|

|

|

Competitive Analysis |

|

|

|

Report Highlights |

|

|

By Source Type

By Formulation Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author