ID: PMRREP35650| 189 Pages | 24 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

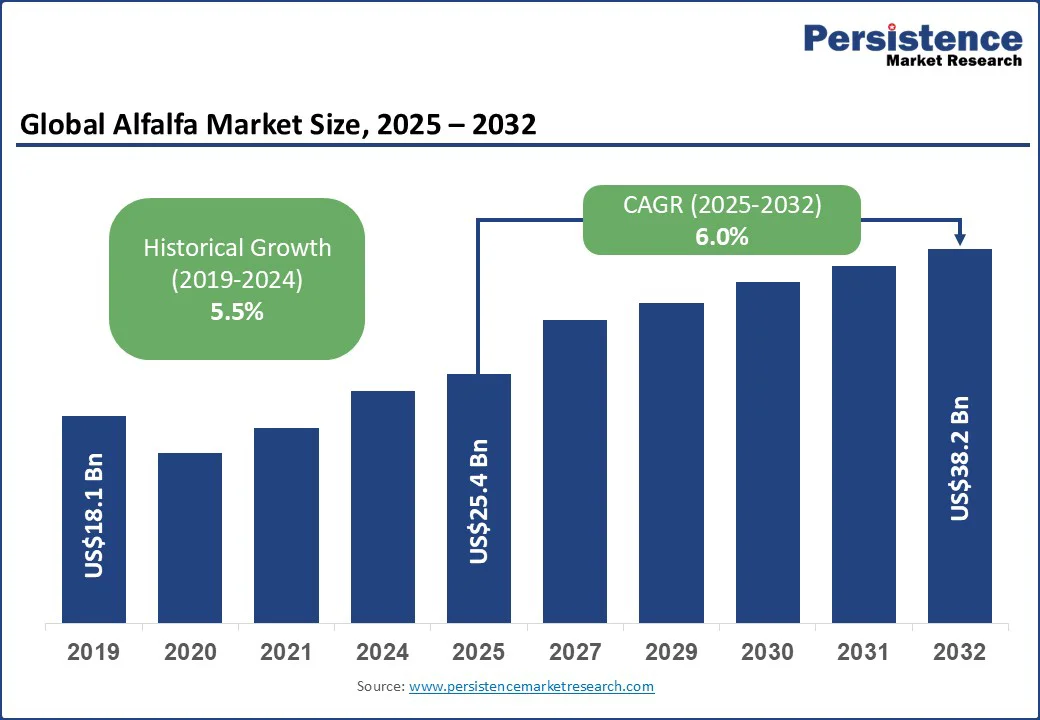

The global alfalfa market size is likely to be valued at US$25.4 Bn in 2025 and is expected to reach US$38.2 Bn by 2032, growing at a CAGR of 6.0% during the forecast period from 2025 to 2032, driven by the increasing demand for nutritious animal feed in ruminant industries, a rising shift toward sustainable farming and organic feed methods, and technological improvements in harvesting, storage, and transportation of alfalfa.

Key Industry Highlights

| Key Insights | Details |

|---|---|

| Alfalfa Market Size (2025E) | US$25.4 Bn |

| Market Value Forecast (2032F) | US$38.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.0% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.5% |

Given that ruminants such as cattle, sheep, and goats require feed high in fiber and protein, alfalfa is a well-suited forage and feed crop. Global beef and dairy consumption trends, especially in Asia and Latin America, are increasing at measurable rates. As over half of the market revenue comes from ruminant livestock in 2025, this segment is driving strong demand on the supply side.

Incentives encourage producers to develop alfalfa varieties with high protein content and better digestibility, as well as to maintain a consistent supply that meets demand. Companies investing in seed technology, improved drying/curing, and transport logistics will likely capture outsized benefits. Ruminant demand also raises the baseline consumption, thereby helping to smooth out seasonal fluctuations and enabling scale efficiencies.

Organic farming methods, while smaller, are growing in demand. Consumers and regulatory environments are pushing for feed that is produced with less chemical use, low emissions, and better resource management. This driver is changing both cost structures and product positioning. Producers adopting sustainable or organic methods face high certification costs, possibly lower yields per acre initially, but can often command premium prices in certain markets.

Sustainable practices tend to reduce risk tied to resource constraints and regulatory penalties. It positions alfalfa businesses to be more resilient in the face of climate policy, trade or import restrictions, and rising consumer concerns over environmental impacts. Revenue and volume from sustainable and organic methods are predicted to surge faster than conventional farming.

Improved storage, transportation, and preservation technologies reduce losses, improve feed quality, and allow more export or international trade. This diversification enables players to serve different livestock requirements, value points, and regions. For example, hay bales may serve proximate, local markets; pallets or cubes (or similarly processed forms) may be more suited for export or premium segments.

Investments in cold or dry storage, moisture control, baling or palletizing equipment, transportation infrastructure, and even digital or logistics systems all reduce spoilage, maintain nutrient values, and hence improve margins. Firms that lead in such technologies will likely increase cost efficiencies, expand reach, and capture high-value markets.

Alfalfa is water-intensive. Its growth is constrained by the availability of irrigation, rainfall, and consistent climatic conditions. In drought conditions or regions facing water scarcity, yields can drop significantly (sometimes 20 to 50%), which impacts both supply and cost. As climate change increases weather extremes, this risk becomes more structural. Producers in water-scarce regions face operational risks. Regulatory restrictions on water use can raise costs or limit acreage.

Costs of fertilizer, labor, energy, transportation, and land are rising in several key producing regions. For farming using organic or sustainable methods, certification adds cost and time. Regulatory frameworks such as pesticide or herbicide restrictions, water usage permits, and organic certification standards vary by country and tend to impose additional compliance costs. These structural barriers can reduce yields or increase unit cost, thereby lowering competitiveness, especially for small producers or in low-margin markets.

Emerging markets are under-penetrated in terms of high-quality alfalfa feed, especially processed forms. With rising disposable incomes, urbanization, and growth in meat as well as dairy consumption, countries including India, China, Brazil, and some ASEAN nations are likely to exhibit growth rates above the global average. If the global market rises from US$25.4 Bn in 2025 to US$38.2 Bn by 2032, regional surges could exceed 7 to 8% CAGR in certain emerging markets.

Companies must invest in local production, processing, and storage infrastructure. They can also form partnerships to manage distribution or set up export hubs. Governments in these regions are expected to deliver incentives in the form of subsidies or infrastructure investment to accelerate adoption. This presents an opportunity not only for increased volume but also for higher margin premiums associated with sustainably, organically produced alfalfa.

Willingness to pay in developed markets or among high-end livestock producers for organic, non-GMO, and low-chemical feed is increasing. Premium pricing could be 10 to 30% over conventional alfalfa, depending on the market. If even 10 to 15% of global production shifts toward premium sustainable and organic products, this could represent a multi-billion-dollar opportunity by 2032.

Producers should invest in certifications, traceability, and supply chain transparency. There is also room for branded feed products targeting high-end dairy, equine, or export markets. Processing and packaging innovations will likely help preserve quality and deliver premium products.

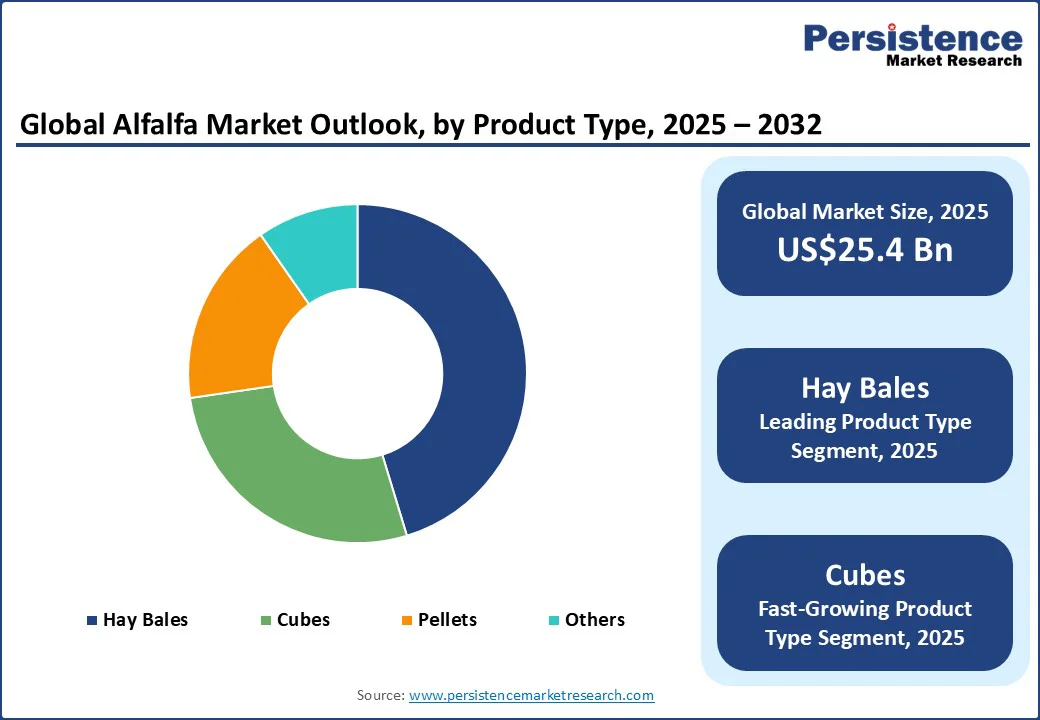

Value addition provides high density, easy transport, and long shelf life, which are beneficial for export and consumer convenience. Within the product segmentation, hay bales are projected to lead the market in 2025; however, cubes and pallets are experiencing faster growth.

Value-added processed alfalfa products are expected to outpace the average CAGR, with processed forms growing at an estimated 7-8% CAGR compared to hay bales at approximately 5-6%. As a result, the market share of processed alfalfa is likely to expand substantially by 2032.

Firms should invest in processing plants, optimize drying/baling/pelleting technologies, improve cold or dry storage, and logistics chain efficiencies. There is also room to explore niche by-products such as extracts, fiber, and bio-materials, though those are likely small currently, but with future potential.

In 2025, hay bales are anticipated to hold approximately 45.3% of the global alfalfa market share under the product type segmentation. The dominance is due to their traditional acceptance, low processing costs, and ease of production, mainly in areas without novel infrastructure. At the same time, their suitability for local consumption in ruminant livestock propels demand.

Cubes, on the other hand, are predicted to witness a CAGR of nearly 6.5% through 2032. This growth is attributed to increasing demand for high transport efficiency, superior export potential, and the presence of well-developed livestock sectors. Underlying drivers include logistics costs, spoilage reduction, consistent feed quality, and premium pricing for convenience and stability.

Ruminants are projected to hold around 53.7% of the global market share in 2025 under the livestock segmentation. This includes cattle (dairy and beef), sheep, and goats. Their nutritional requirements, large scale, and key role in meat and dairy supply chains make them the primary consumer segment of alfalfa feed.

Horses are seeing considerable growth due to the developing equine industry in some developed countries, the rising premium pet/animal feed sectors, and demand for feeds with better forage content. The nutritional benefits of livestock-promoting regenerative agricultural practices are further predicted to propel the segment’s growth.

In 2025, sustainable farming is likely to account for nearly 33.4% of the market share. This is the largest method segment among non-conventional methods, excluding conventional farming. This reflects consumer demand, regulatory pressures, environmental awareness, and rising investment in methods that reduce negative ecological impacts.

Organic farming is speculated to showcase a CAGR of 8.1% in the forecast period from 2025 to 2032. This growth is driven by rising demand in premium markets, export markets with strict residue limits, consumer preferences, and governmental subsidy and support programs for organic agriculture.

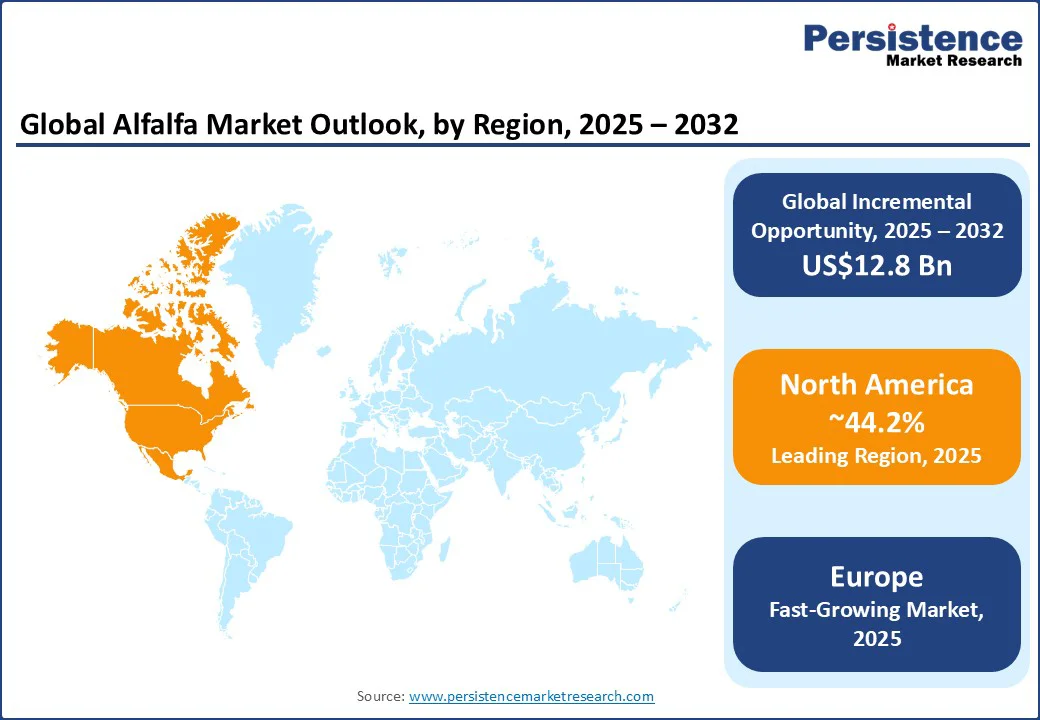

North America is a mature region in the global market. It is anticipated to account for approximately 44.2% of the market share in 2025. The U.S. is the leading country in North America, with states such as California, Idaho, Wisconsin, Montana, and South Dakota among key producers. These states benefit from established dairy and beef industries, strong export capacity, advanced mechanization, and supportive agricultural policies. Canada also plays a significant role, particularly in high-quality alfalfa exports.

U.S. policies around water rights, pesticide or herbicide regulation, organic certification, and environmental sustainability are stringent. Regulations such as the Clean Water Act and regional water management acts exert pressure on producers to adopt efficient irrigation, limit chemical runoff, and ensure sustainability. These regulatory costs tend to raise barriers for small producers but also constitute differentiators for those who comply.

Europe is a significant market for alfalfa, both in terms of domestic consumption and trade. It is estimated to hold nearly 28.6% of the market share in 2025. Germany, the U.K., France, and Spain are among the leading countries. Germany and France have large dairy herds. Spain is a major producer and exporter of alfalfa hay, especially baled alfalfa.

The U.K. also has equine sector demand and premium feed demand. Regulatory harmonization via EU directives impacts these countries significantly. Regional regulation mandates high standards for pesticide/herbicide use, water usage, land use, and biodiversity protection. Organic certification is well-established but costly. Cross-border harmonization helps with standards but increases compliance complexity. Also, EU policies around fertilizer usage, soil health, and carbon footprint affect alfalfa cultivation.

Asia Pacific is considered among the fastest-growing regional markets. China is a large consumer of alfalfa, much of which is imported primarily for dairy, equine, and high-end livestock sectors. The dairy and buffalo sectors in India are seeing increased domestic production and demand, accompanied by growth and scaling among local producers in India and Southeast Asia.

Imports from the U.S., Australia, and Europe are significant, especially for high-quality or processed forms. Investments are seen in processing, storage, cold chain, and in seed and farming technologies.

The global alfalfa market is moderately fragmented, with a mixture of large global or regional producers and multiple small farmers and cooperatives. Leading players are estimated to hold single-digit to low-teens percent shares each, with no one company dominating globally.

Rather, competitive positioning relies heavily on quality, logistics, certifications, and product types. Competitive differentiation arises from processing capabilities, sustainable or organic certifications, regional distribution networks, export capability, and cost-efficiency in production.

Leading companies are emphasizing cost leadership via operational efficiency, premium differentiation through sustainable/organic certifications, and market expansion into emerging geographies. Key differentiators include seed quality, feed nutrient profile, product form, traceability, and environmental credentials.

An emerging business model is vertically integrated operations that cover seed/farm production through processing and distribution, primarily in markets with export potential or premium demand.

The alfalfa market is projected to reach US$25.4 Bn in 2025.

Rising demand for high-protein animal feed and growing preference for sustainable forage crops are the key market drivers.

The alfalfa market is poised to witness a CAGR of 6.0% from 2025 to 2032.

Expansion in Asia Pacific livestock farming and adoption of precision farming methods are the key market opportunities.

Anderson Hay & Grain Inc., Alfalfa Monegros S.L., and Al Dahra ACX Global Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Livestock

By Method

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author