ID: PMRREP35613| 180 Pages | 12 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

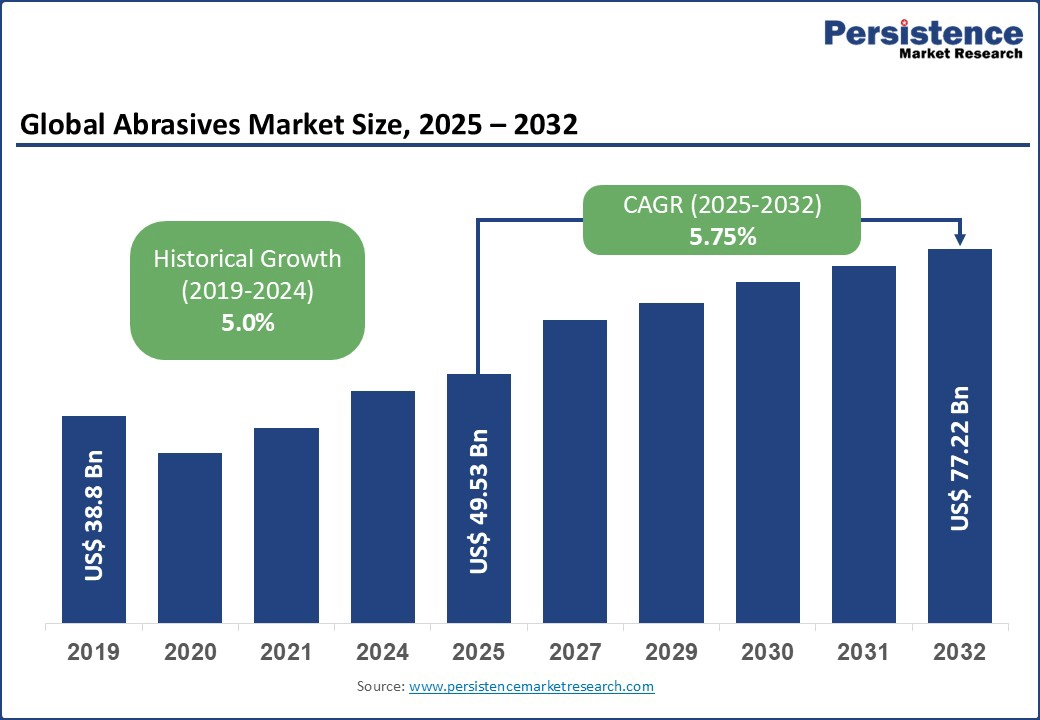

The global abrasives market size is likely to be valued at US$ 49.53 Bn in 2025, and is expected to to reach US$ 77.22 Bn by 2032, growing at a CAGR of 5.75% during the forecast period 2025−2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Abrasives Market Size (2025E) |

US$ 49.53 Bn |

|

Market Value Forecast (2032F) |

US$ 77.22 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.75% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

The increasing use of synthetic abrasives, such as silicon carbide and alumina, is transforming production processes by improving durability and efficiency, thereby creating high-value business opportunities in the market.

The abrasives market growth is accelerated by the rising demand for precision super abrasives as a result of paradigm shifts in the automotive and aerospace industries. The push toward EVs and lightweight aircraft components has elevated the need for abrasives with exceptional durability and cutting precision, such as cubic boron nitride (CBN) and synthetic diamond abrasives.

For instance, in December 2024, researchers at the French National Centre for Scientific Research (CNRS) developed a novel method to synthesize boron carbide ceramics from nanocrystals around 10 nm in size and densely sinter them using high-pressure spark plasma techniques, achieving grain sizes under 20 nm and resulting in a super-hard material with exceptional shock resistance.

In the automotive industry, top suppliers are optimizing machining lines for EV battery housings and rotor shafts using vitrified CBN wheels, yielding substantial reductions in scrap rates and machining cycle times. This demand is further fueled by increased automation and robotics on assembly lines that standardize surface finish quality. Consequently, the market is likely to gain from innovations that integrate precision grinding abrasives, superabrasive tools, and automotive abrasives technologies, enabling higher throughput and material efficiency.

A critical challenge that the abrasives market has to confront originates from the volatile pricing and supply chain uncertainties of key raw materials such as aluminum oxide, silicon carbide, and synthetic diamonds. This price turbulence, driven by current geopolitical tensions between the U.S. and China, fluctuating energy costs, and stringent environmental regulations, has disrupted the consistent availability of abrasives and inflated production expenses.

For example, domestic mining restrictions imposed by the Chinese government have curbed the export of synthetic diamond abrasives, forcing manufacturers worldwide to grapple with increased input costs and supply shortages. This dynamic disproportionately impacts smaller manufacturers lacking the purchasing power for bulk raw materials, hindering scalability and market competitiveness in this highly cost-sensitive industry. Furthermore, such volatility compels firms to balance material quality, affordability, and supply reliability, often compromising profitability and customer retention.

For players in the abrasives market, the opportunity lies in the surging demand for EVs around the globe, which is fundamentally reorienting the established industrial manufacturing and material processing systems. As automakers worldwide transition from internal combustion engines to electric drivetrains, the demand for high-precision abrasives essential for the production of battery housings, motor components, and lightweight chassis has skyrocketed.

For example, the International Energy Agency (IEA) reported that global EV sales topped 17 million units in 2024, with EVs comprising more than 20% of total new car sales. This EV boom sets the scene for a rapidly widening adoption of synthetic, such as silicon carbide and alumina, which deliver superior durability and performance on advanced materials used in EV manufacturing. Moreover, the expansion of EV charging infrastructure, requiring extensive stainless steel fabrication and abrasive treatment, magnifies this opportunity, presenting players in the abrasives market a dual growth trajectory.

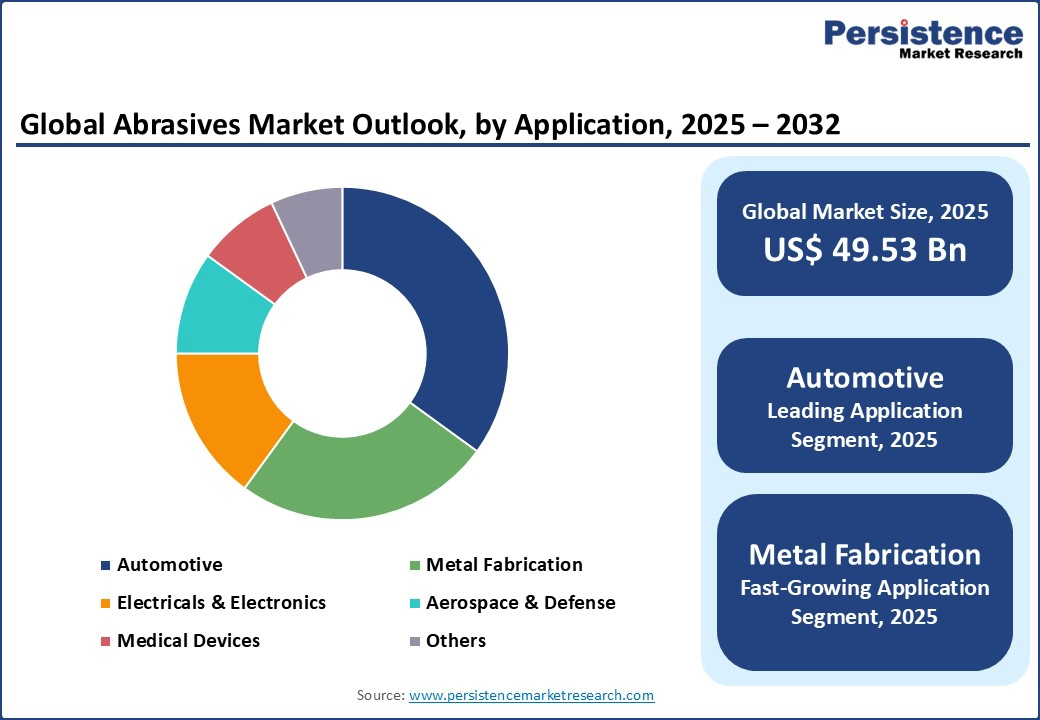

Among applications, the automotive segment is set to dominate the market with approximately 35.0% revenue share due to the extensive use of abrasives in manufacturing, surface finishing, and polishing of automotive components. The huge demand for abrasives in the automotive sector is primarily attributable to the rising production and soaring sales of EVs worldwide, which has necessitated precision grinding of battery housings, rotor shafts, and lightweight materials. Some of the leading automobile suppliers are optimizing machining lines using superabrasives such as cubic boron nitride wheels to reduce scrap rates and enhance throughput, indicating advanced machining innovations that will favor this market in the forthcoming future.

On the other hand, the segment slated to register the highest CAGR of about 4.8% through 2032 is metal fabrication, offering significant growth potential driven by massive industrialization and infrastructure development, especially in Asia Pacific. The demand for precision and superabrasives in metal fabrication applications such as cutting, grinding, and polishing is rising sharply on account of the widespread implementation of large-scale construction projects and expanding machinery production. Advancements in bonded and coated abrasives tailored for metalworking have also catalyzed the adoption of abrasives, as manufacturers continue to seek enhanced cutting efficiency and surface finishes for durable equipment and tools.

The leading raw material is anticipated to be synthetic abrasives, projected to hold the largest market share at around 67.5% in 2025. This dominance is based on the superior consistency, hardness, and thermal stability of these materials compared to their natural counterparts, enabling tighter process control and higher precision in demanding industrial applications. Synthetic abrasives such as silicon carbide, ceramic, and borazon are increasingly preferred in high-performance manufacturing sectors such as automotive, aerospace, and electronics, where mirror-quality finishes and extended tool life are critical. The rapid growth of manufacturing hubs in Asia Pacific, supported by government initiatives and investments in next-gen technologies, is likely to further spike the demand for these abrasive types in the coming years.

Conversely, composite abrasives are expected to display the highest CAGR of approximately 7.5% through 2032. This segment is gaining momentum as composite abrasives present an innovative blending of natural and synthetic materials, providing enhanced wear resistance, eco-friendliness, and cost efficiency. These composites are particularly attractive in sectors facing raw material scarcity or high costs of synthetic abrasives, such as construction and metal fabrication. The emergence of sustainable manufacturing practices and stringent environmental regulations are likely to fuel the adoption of composite abrasives as manufacturers seek alternatives that lower their carbon footprint without sacrificing performance.

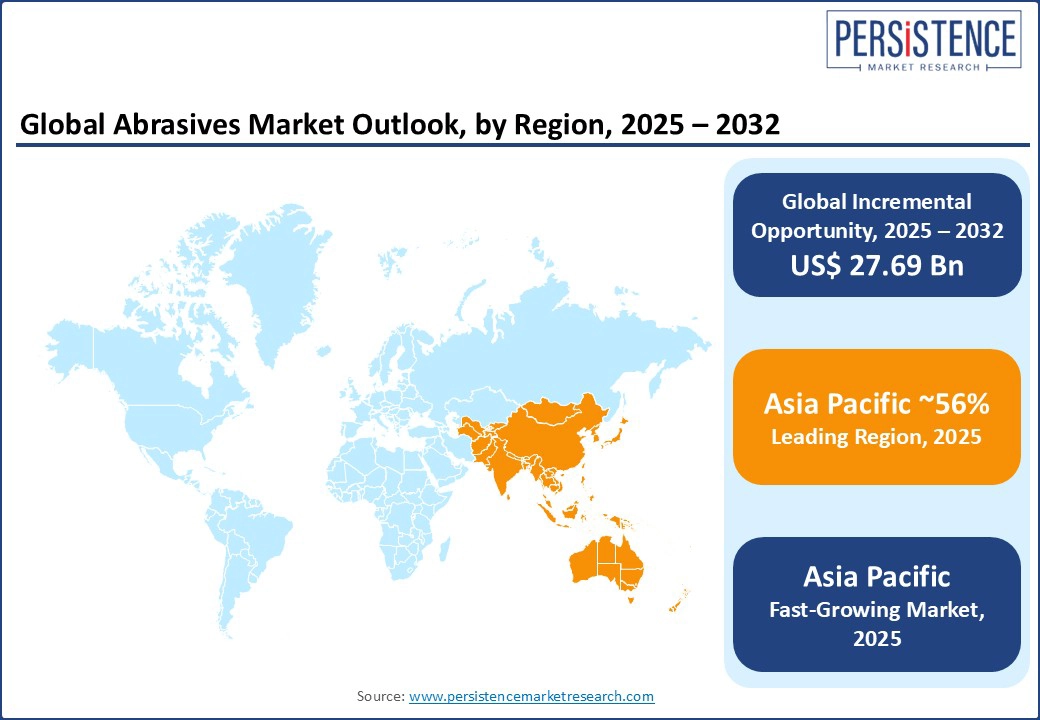

Asia Pacific is forecast to capture the largest abrasives market share at around 56.0% and exhibit the highest CAGR during the forecast period. The growth is driven by rapid industrialization, large-scale manufacturing hubs, and aggressive government initiatives such as Make in India and China's industrial policies. This dominance of region is strongly supported by its bustling automotive, electronics, and metal fabrication sectors demanding precision abrasives.

China's vast electric vehicle manufacturing ecosystem has sustained high demand levels for synthetic superabrasives in battery and motor component finishing. Furthermore, emerging manufacturing bases across Southeast Asia such as Vietnam are gathering unpredented momentum, benefiting from shifting supply chains due to the U.S.-China trade conflict. The adoption of advanced abrasive technologies integrated with IoT and automation and a growing preference for eco-friendly abrasive materials due to rising environmental regulations are two important trends boosting regional market prospects.

North America is likely to command a leading share, led by the U.S. and fueled by the presence of mature automotive, aerospace, and defense industries. The abrasives market here stands to reap benefits from considerable investments in material sciences R&D, the prominent deployment of superabrasive tools, and the ready uptake of advanced manufacturing techniques such as CNC grinding and additive manufacturing. Regulatory pressures towards cleaner technologies are steering innovations such as volatile organic compound (VOC)-free abrasive coatings and water-based coolants. The demand for precision abrasives in medical device manufacturing and electronics will further broaden the market outlook in the region.

In Europe, market dynamics are governed by stringent sustainability regulations and a well-established precision engineering sector. Germany leads in the adoption of superabrasives for automotive and aerospace applications, while the construction sector in Southern European countries drives the demand for coated abrasives in blasting and cutting. Rigid adherence to circular economy principles has propelled the development of recycled-bond abrasives, enhancing the sustainability credentials of market companies. Major suppliers such as Saint-Gobain have championed efforts in reducing carbon intensity and embracing eco-friendly abrasives.

Defined by technological innovation, strategic mergers and acquisitions, and a shift towards sustainable manufacturing practices, the global abrasives market landscape is turning into an arena of aggressive competition. Industry frontrunners, such as 3M Company, Bosch, and Henkel, are investing heavily in advanced abrasive materials such as synthetic superabrasives that deliver unparalleled precision and longevity, finding particular relevance in automotive, aerospace, and semiconductor manufacturing.

Companies are also leveraging digital technologies, incorporating AI and IoT-enabled smart manufacturing systems that enable real-time quality monitoring and predictive maintenance, driving operational efficiency and cost savings. Sustainability is another key driver, pushing incumbents to develop eco-friendly abrasive products and processes with reduced waste and lower carbon footprints to meet stringent global environmental regulations.

The rise of e-commerce platforms has overhauled the existing distribution ecosystem, improving accessibility to customization and pricing transparency, which has further intensified competition. Collectively, these trends compel market players to differentiate through innovation, agility, and sustainability to capture growth across expanding sectors and geographies.

The global abrasives market is projected to reach US$ 49.53 billion in 2025.

The escalating demand for precision super abrasives and the push toward EVs and lightweight aircraft components are driving the market growth.

The market is poised to witness a CAGR of 5.75% from 2025 to 2032.

The surging demand for EVs around the globe, which is fundamentally reorienting the established industrial manufacturing and material processing systems is a key market opportunity.

3M Company, Compagnie de Saint-Gobain S.A., and Robert Bosch GmbH are some key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Raw Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author