ID: PMRREP4364| 185 Pages | 28 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

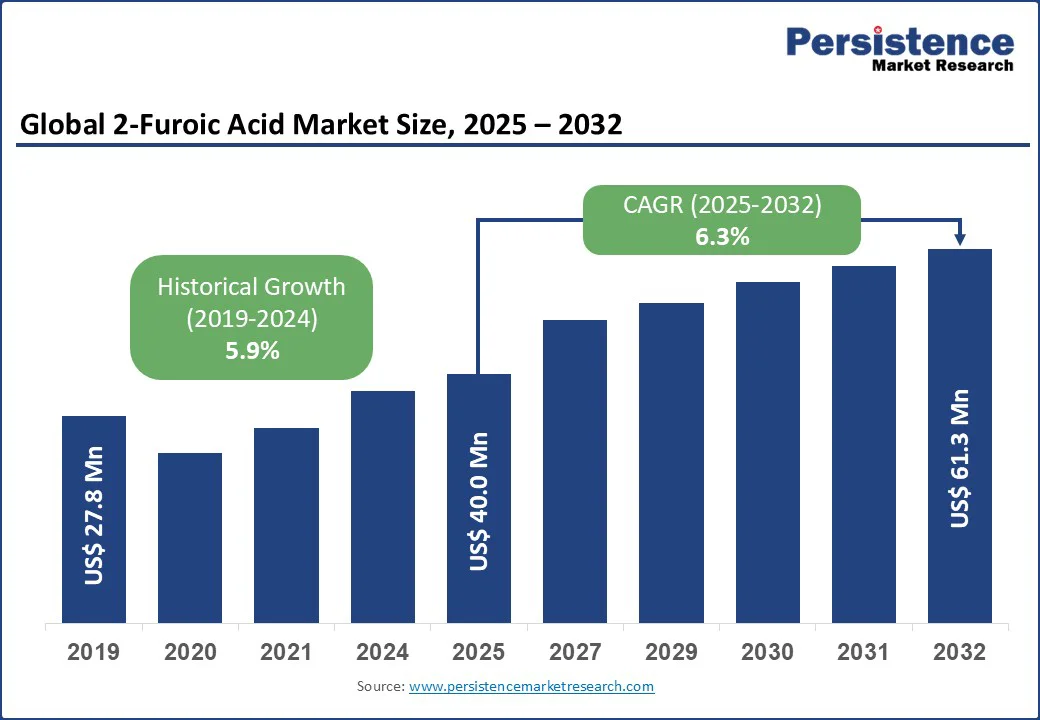

The global 2-furoic acid market size is likely to be valued at US$ 40.0 Mn by 2025 and is estimated to reach US$ 61.3 Mn by 2032, growing at a CAGR of 6.3% from 2025 to 2032.

Rise in use of chemical applications in pharmaceuticals, agrochemicals, and food preservatives, along with the growing shift toward bio-based and sustainable chemicals indicates growth. Its renewable production from agricultural residues supports eco-friendly manufacturing, aligning with green chemistry initiatives worldwide. Increasing use as an intermediate in drug formulation, fungicides, and flavoring agents also fuels demand. Moreover, government support for sustainable practices and the expansion of the specialty chemicals sector are key drivers.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

2-Furoic Acid Market Size (2025E) |

US$ 40.0 Mn |

|

Market Value Forecast (2032F) |

US$ 61.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.9% |

The demand for bio-based and sustainable chemicals is rising as governments and industries adopt eco-friendly strategies. For instance, the global bio-economy expanded to US$165.7 Bn in 2024, highlighting how policy measures and investments are accelerating renewable, low-carbon chemical adoption. The recently approved BioE3 Policy further promotes large-scale bio-manufacturing of bio-based chemicals and polymers, strengthening the transition toward sustainable industrial growth.

Government-backed initiatives in energy, such as increased ethanol blending in petrol, also support this trend by reducing fossil fuel dependence and driving demand for renewable chemical inputs. Together, these efforts demonstrate how sustainability goals and industrial growth are increasingly aligned, positioning bio-based solutions as a key driver.

The 2-furoic acid market is witnessing growth due to rising environmental concerns and stricter regulatory frameworks across industries. Authorities worldwide are increasingly restricting the use of synthetic preservatives and hazardous agrochemicals, creating space for safer, bio-based alternatives. For instance, regulatory bodies are promoting renewable and eco-friendly inputs in food, agriculture, and pharmaceuticals, which directly support the adoption of 2-furoic acid. These measures reduce ecological risks and drive industries toward sustainable production practices that align with evolving safety standards.

In addition, global initiatives on carbon reduction and circular economy models are reshaping the specialty chemicals sector. For instance, compliance with emission-control policies encourages manufacturers to adopt renewable, low-carbon intermediates such as 2-furoic acid. The compound’s bio-based origin and compatibility with green chemistry principles make it a preferred choice in regulated markets. As industries transition toward sustainable inputs, environmental and regulatory pressures will remain a key driver.

The growing emphasis on green chemistry is creating significant opportunities for the 2-furoic acid market. Derived from renewable biomass, 2-furoic acid is increasingly being explored as a sustainable intermediate in the development of eco-friendly polymers, resins, and coatings. For instance, its application as a building block in bio-based polymers supports the production of materials with reduced environmental impact. This aligns with global initiatives promoting biodegradable and recyclable materials, making 2-furoic acid a valuable contributor to the sustainable chemicals sector.

At the same time, rising investments in research and development are accelerating new uses of 2-furoic acid in high-performance materials. For instance, its integration into advanced polymer formulations enhances durability and thermal stability, providing industries with greener alternatives to petrochemical-derived products. As the demand for sustainable materials expands across packaging, automotive, and construction, emerging applications in green chemistry and polymers present a strong growth pathway.

The 98% purity segment currently dominates the 2-furoic acid market, accounting for nearly 45% of the total share in 2025. Its leadership is attributed to cost-effectiveness and versatility across industries such as agrochemicals, polymers, and flavoring agents. With production costs around 10% lower than the 99% purity grade, it has become the preferred choice for large-scale industrial processes. In 2024, global consumption of 98% purity reached approximately 50 million tons, reflecting its widespread adoption and reliability for mass applications.

On the other hand, the 99% purity segment represents the fastest-growing category, driven by its expanding role in pharmaceuticals and fine chemicals. This grade is highly valued for advanced applications where stringent quality and regulatory standards are required. For instance, nearly 80% of pharmaceutical manufacturers favor high-purity grades for active pharmaceutical ingredient (API) synthesis. By 2032, this segment is expected to generate revenues of nearly US$20 Bn.

The industrial grade segment dominates the 2-furoic acid market, holding around 50% share in 2025. Its strong position is supported by widespread use in resin and polymer production, as well as agrochemical formulations. Industrial grade accounts for nearly 60% of applications such as plasticizers, surface coatings, and additives, highlighting its versatility and scalability. Its ability to deliver consistent performance at a cost-effective rate makes it the preferred choice across large-scale manufacturing sectors.

The food-grade segment is emerging as the fastest-growing category, fueled by the rising need for natural preservatives in the food and beverage sector. In 2024, approximately 30% of processed food manufacturers adopted food-grade 2-furoic acid due to its antimicrobial properties. For instance, it has been shown to extend the shelf life of dairy and bakery products by up to 30%, making it an attractive alternative to synthetic preservatives and supporting cleaner-label food production.

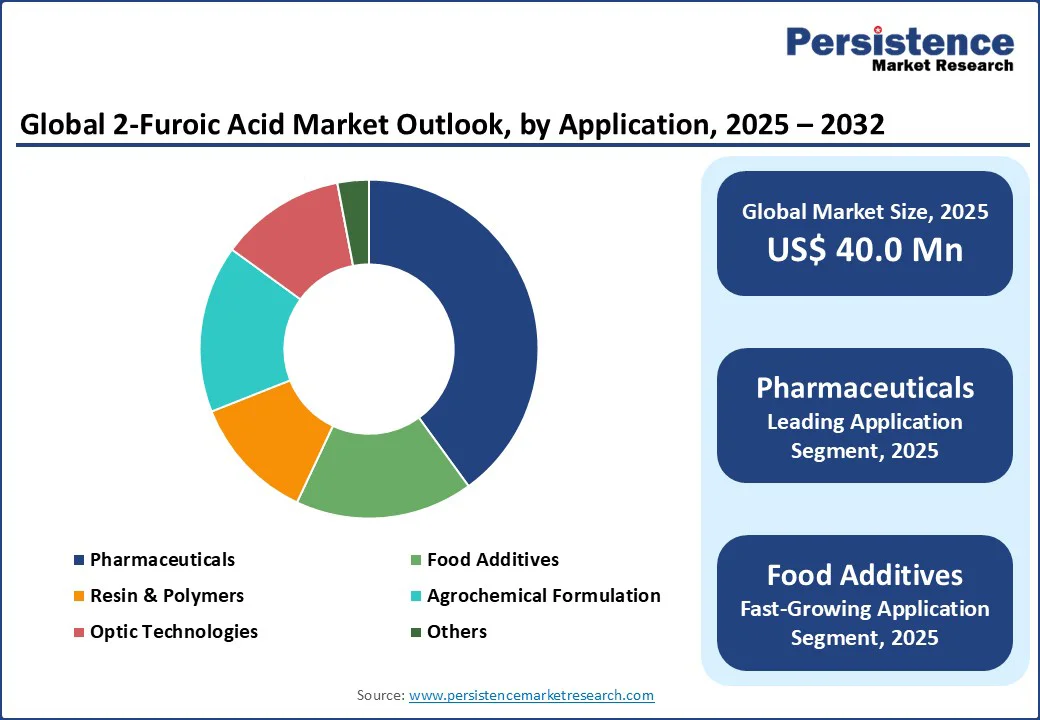

The pharmaceuticals segment leads the 2-Furoic Acid market, accounting for nearly 40% share in 2025. This dominance is attributed to its role as a vital intermediate in the synthesis of anti-inflammatory, antibacterial, and antifungal drugs. The segment growth is supported by robust global pharmaceutical R&D investments, which reached approximately US$250 Bn in 2024. With continuous innovation in drug discovery and the rising need for effective treatments, the demand for 2-furoic acid in pharmaceutical applications is expected to remain strong.

The food additives segment is emerging as the fastest-growing application area, driven by increasing consumer demand for clean-label and organic preservatives. By 2032, the segment is projected to generate nearly US $186 Bn, supported by the rising shift toward natural food protection solutions. In 2024, around 20% of organic food brands adopted bio-based 2-furoic acid preservatives, which are proven to extend shelf life while meeting regulatory and consumer expectations for safer, eco-friendly ingredients.

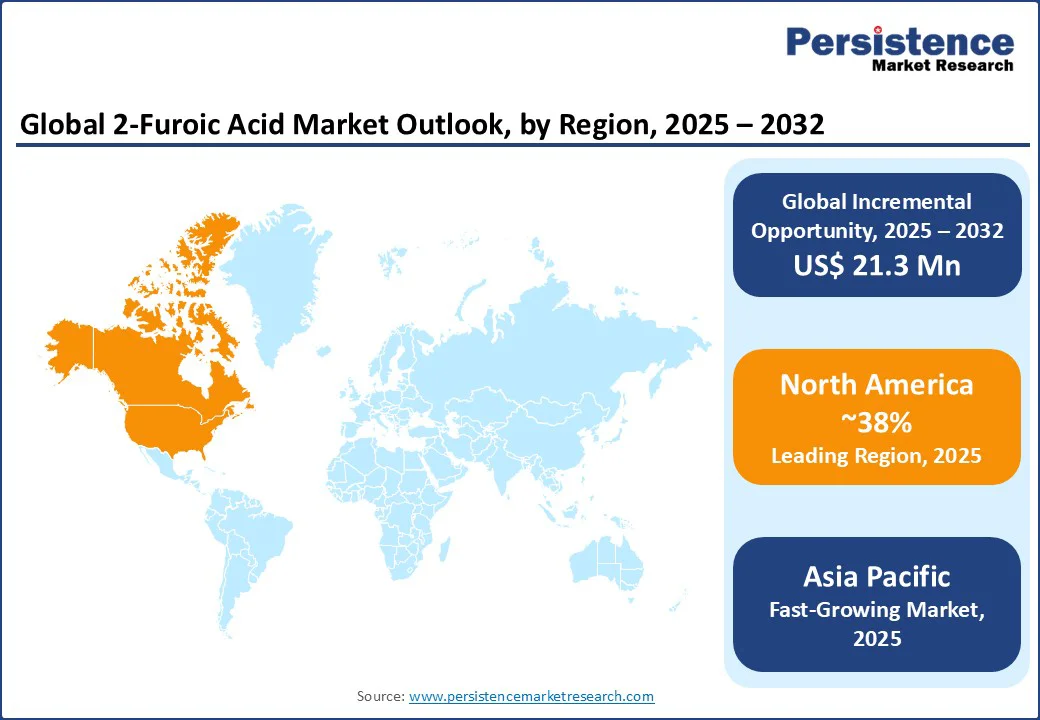

North America dominates the 2-furoic acid market, holding a 38% share in 2025, supported by strong pharmaceutical and food industries. The United States leads the region, generating nearly US$14.4 Bn in revenue, driven by FDA regulations that encourage the use of bio-based chemicals and a 25% rise in pharmaceutical R&D investments in 2024. This regulatory push and research growth have positioned the U.S. as the largest consumer of high-purity 2-furoic acid for drug synthesis and food preservation. Canada is witnessing notable expansion in sustainable polymer applications, with the adoption of 2-furoic acid-based resins increasing by 15%. Government incentives for green chemistry further enhance the region’s role in shaping global demand for renewable, eco-friendly chemical intermediates.

Europe represents the second-largest market for 2-furoic acid, supported by its strong chemical and pharmaceutical base. Germany leads the region, contributing nearly US$10 Bn in 2024, driven by advanced R&D and large-scale use in drug formulations and specialty chemicals. The European Union’s Green Deal, allocating US$1.2 Bn in funding, is accelerating demand for bio-based 2-furoic acid in polymers and agrochemicals as industries shift toward low-carbon solutions.

U.K. is also emerging as a growth hub, with sales rising 12% in 2024, supported by major launches such as Merck KGaA’s bio-based preservatives. With increasing adoption of renewable chemical intermediates, Europe maintains a significant market share and remains central to the global transition toward sustainable chemistry.

Asia Pacific is the fastest-growing region in the 2-furoic acid market, driven by rapid industrialization, expanding agriculture, and rising pharmaceutical demand. China leads with approximately US $12 Bn in market revenue, supported by its dominant role in global furfural production, accounting for nearly 50% of output. This strong raw material base, coupled with increasing pharmaceutical manufacturing, positions China as a key growth engine for the region. India is also emerging as a major contributor, with agrochemical demand rising by 30% in 2024. The expansion of production facilities by companies such as Hongye Chemical boosted 2-furoic acid supply by nearly 20%, reinforcing the country’s role in meeting growing domestic and international demand. Together, these factors make Asia Pacific a vital hub for future market expansion.

The global 2-furoic acid market is highly competitive, driven by advancements in sustainable production, efficiency improvements, and innovation in high-purity grades. Manufacturers are increasingly focusing on renewable feed stocks, eco-friendly processes, and compliance with stringent environmental regulations to strengthen their market position. Expanding production capacities and regional facilities help meet growing demand from pharmaceuticals, agrochemicals, and polymers. At the same time, investments in research and development are enabling the creation of bio-based solutions with improved performance and scalability. This emphasis on sustainability, technological progress, and global expansion is shaping a dynamic and rapidly evolving.

The 2-furoic acid market is projected to reach US$40.0 Mn in 2025, driven by demand in pharmaceuticals and food additives.

Key drivers include rising demand for bio-based chemicals, regulatory support for sustainable preservatives, and growth in the pharmaceutical and agrochemical sectors.

The 2-furoic acid market is expected to grow at a CAGR of 6.3% from 2025 to 2032, reaching US$61.3 Mn.

Opportunities include emerging applications in green chemistry, sustainable polymers, and eco-friendly agrochemicals.

Leading players include Ashland, BASF, Avantium, Mitsubishi Chemical, Hongye Chemical, Alfa Aesar, Meryer Chemical Technology, and J & K Scientific.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Purity Type

By Grade

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author