ID: PMRREP4696| 220 Pages | 14 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

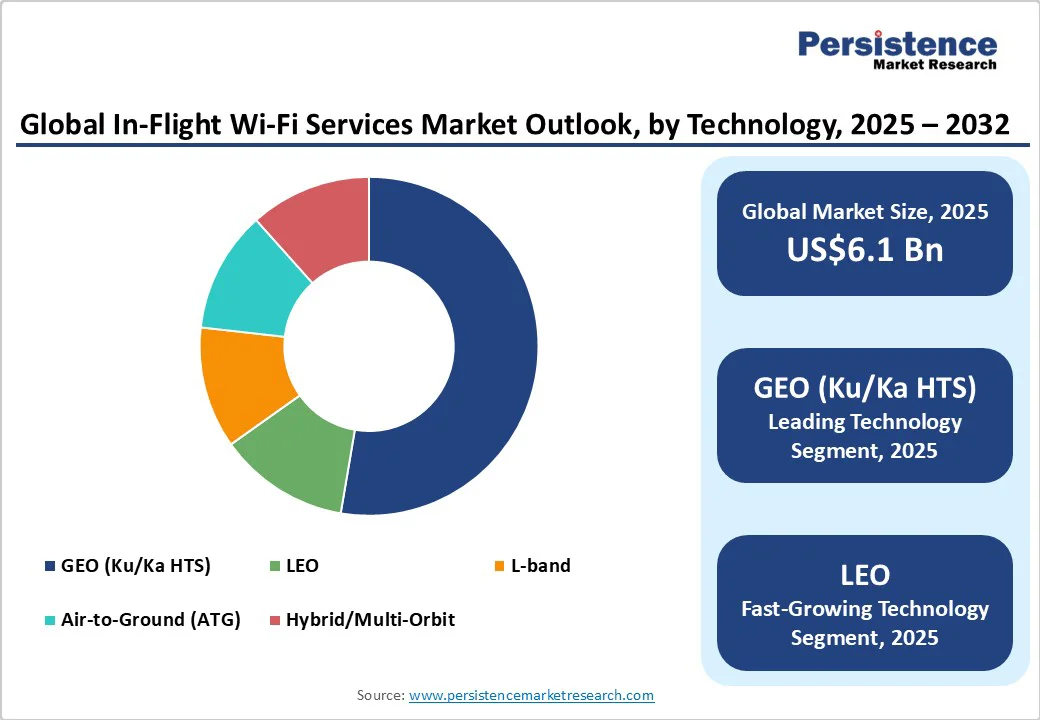

The global In-Flight Wi-Fi Services market size is likely to be valued at US$6.1 Billion in 2025, and expected to reach around US$11.7 Billion by 2032, growing at a CAGR of 9.7% during 2025 to 2032, driven by surging passenger demand for seamless digital connectivity, airline strategies to monetize onboard data services, and rapid technological progress in Low-Earth Orbit (LEO) and High-Throughput Satellite (HTS) systems.

The expansion of long-haul fleets, combined with rising passenger expectations for continuous connectivity, is transforming in-flight Wi-Fi from a premium add-on to a standard amenity. Airlines are increasingly integrating these systems with loyalty programs and ancillary revenue streams to improve yield and passenger satisfaction.

| Key Insights | Details |

|---|---|

| In-Flight Wi-Fi Services Market Size (2025E) | US$6.1 Bn |

| Market Value Forecast (2032F) | US$11.7 Bn |

| Projected Growth (CAGR 2025 to 2032) | 9.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 8% |

Global air travel has returned to and exceeded pre-pandemic levels, creating a sharp increase in demand for onboard digital services. According to international aviation associations, passenger traffic growth surpassed 2019 levels by late 2024.

Passengers are now engaging in high-bandwidth activities such as video streaming, conferencing, and real-time messaging during flights. Higher passenger volumes and rising per-user data consumption directly expand the market for in-flight connectivity, compelling airlines to invest in scalable satellite solutions. The result is an increase in per-aircraft bandwidth requirements and stronger incentives for adopting next-generation Wi-Fi systems.

The deployment of LEO satellite constellations and high-throughput GEO satellites has redefined the performance capabilities of in-flight connectivity. New networks deliver speeds exceeding 100 Mbps per aircraft with reduced latency compared to legacy systems.

Commercial partnerships between airlines and LEO providers, such as Starlink and OneWeb, demonstrate real-world adoption across both short- and long-haul fleets. These advancements lower the technical barriers for airlines to offer free or tiered broadband, enabling new service models and customer experiences. The transition from GEO to multi-orbit hybrid networks marks a structural shift that will sustain long-term industry expansion.

Connectivity is now a strategic revenue driver within airlines’ digital ecosystems. Many carriers report that ancillary revenue linked to digital engagement, such as sponsored Wi-Fi, targeted advertising, and e-commerce, accounts for an increasing share of non-ticket income.

Loyalty programs are being tied to complimentary access tiers, improving retention and brand differentiation. Airlines adopting this approach are experiencing higher net promoter scores and incremental revenue per passenger. Monetization through connected commerce and entertainment services will remain a key factor sustaining growth beyond 2030.

Despite technology gains, the cost of retrofitting aircraft with advanced satellite terminals remains significant. Aviation-grade LEO systems typically cost between US$120,000 and US$200,000 per aircraft, excluding downtime expenses.

For carriers with large fleets, total retrofit programs can run into hundreds of millions of dollars. Smaller airlines, particularly in developing markets, face constrained capital budgets, limiting adoption rates. These costs create a barrier to rapid global rollout and extend return-on-investment timelines, especially for narrow-margin carriers.

Aircraft connectivity systems require certification through Supplemental Type Certificates (STCs) from aviation authorities such as the FAA and EASA. Approval timelines vary by aircraft model, and unanticipated interference or electromagnetic compatibility issues can delay implementation.

Certification delays increase program costs and disrupt fleet availability. Regional differences in spectrum allocation and communication standards complicate cross-border operations. These structural bottlenecks may slow market penetration, particularly for emerging satellite technologies.

As airlines transition toward hybrid networks combining GEO and LEO coverage, service reliability and bandwidth per user improve significantly. Multi-orbit connectivity allows airlines to optimize routes dynamically based on latency, weather, and bandwidth conditions.

This hybrid approach enables streaming-grade service quality and reduces dead zones, supporting high-value offerings such as video conferencing and live television. The opportunity lies in deploying these networks across large fleets, unlocking new subscription-based and sponsored revenue streams estimated to exceed several billion dollars globally by 2032.

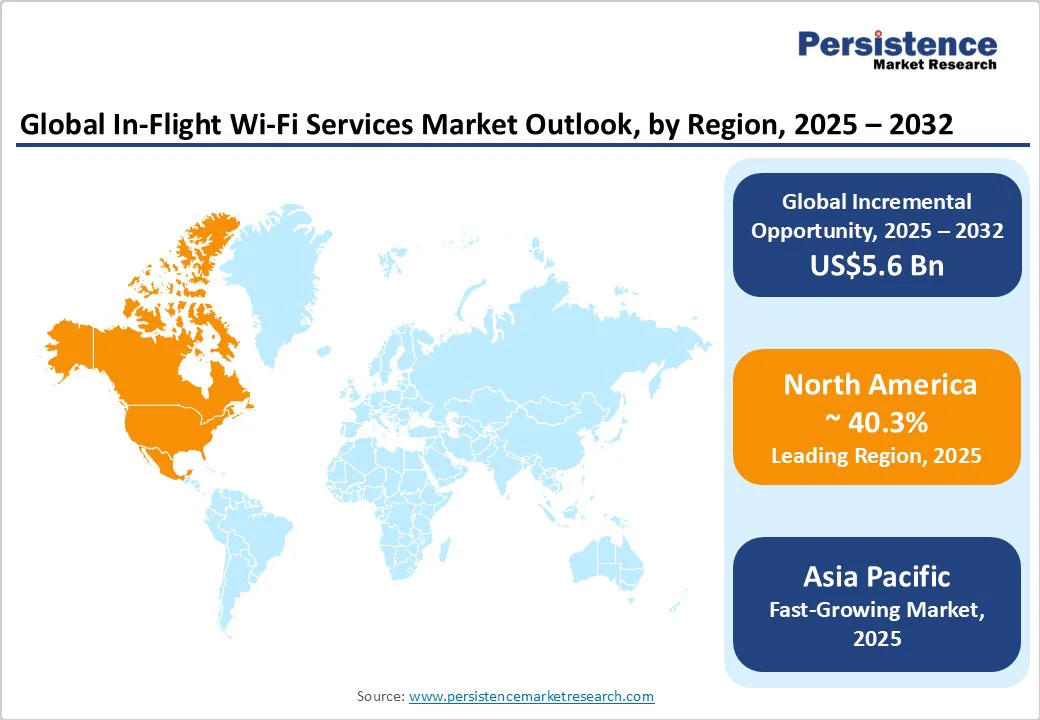

Asia Pacific represents the fastest-growing regional opportunity, fueled by strong passenger growth in China, India, and ASEAN nations. Rising middle-class air travel and increasing long-haul routes are expanding the potential user base for in-flight Wi-Fi.

As regional carriers modernize fleets, they are integrating connectivity systems into both new deliveries and retrofit programs. Market projections indicate that the Asia Pacific could account for nearly one-third of new global installations by 2032, creating a large addressable market for service providers and satellite operators.

Beyond internet access, connectivity platforms support in-flight entertainment, e-commerce, and data analytics. Airlines are monetizing passenger data by delivering targeted ads and real-time shopping experiences through onboard portals.

The ability to combine entertainment, retail, and communications within one digital environment enhances passenger engagement and ancillary revenue. With connected commerce expected to become a standard feature of next-generation aircraft cabins, this segment offers multi-billion-dollar revenue potential through 2032.

As of 2025, GEO/HTS (Ku/Ka band) satellite systems dominate the installed base, representing over 59.8% of market share. These solutions are widely deployed on long-haul fleets because of their broad coverage, reliable signal strength, and proven integration with existing IFEC platforms.

Major integrators such as Panasonic Avionics, Thales, and Viasat continue to expand GEO capacity by adding incremental bandwidth, enabling smoother streaming, video conferencing, and real-time operational communications.

Airlines such as Delta Air Lines and Lufthansa utilize GEO/HTS systems to offer multi-tier Wi-Fi services, ensuring connectivity on transcontinental and intercontinental flights. GEO/HTS remains particularly important for aircraft flying over oceans and remote regions where Air-to-Ground (ATG) coverage is unavailable.

LEO (Low Earth Orbit) and multi-orbit hybrid systems are emerging as the fastest-growing technology. LEO systems, deployed by providers such as Starlink Aviation and OneWeb, offer lower latency (20-40 ms) and higher throughput (50-150 Mbps per aircraft) compared to GEO systems.

Hybrid multi-orbit models combine LEO and GEO coverage, enabling airlines to dynamically switch between satellites to maintain uninterrupted connectivity even during peak traffic or adverse weather.

Airlines such as United Airlines, Hawaiian Airlines, and JSX have already deployed LEO-based solutions for enhanced passenger experiences, particularly on domestic and mid-range routes. The anticipated broader rollout of LEO terminals, including smaller, lighter antennas for narrowbody aircraft, is expected to significantly reshape technology market share over the next five years.

Narrowbody aircraft account for the largest market share of 56% in 2025, due to fleet prevalence and high domestic/regional flight frequency. These single-aisle aircraft, including Boeing 737s, Airbus A320s, and Embraer E2 jets, are the backbone of short- and medium-haul networks. Airlines are standardizing Wi-Fi retrofits for these aircraft, enabling faster installation, reduced downtime, and lower per-aircraft costs.

For example, JetBlue’s Airbus A320 fleet is fully equipped with high-speed Ka-band connectivity, supporting both passenger internet and operational applications. Narrowbody aircraft connectivity not only drives passenger satisfaction but also enables airlines to monetize ancillary services effectively due to high seat density and frequent usage.

Business jets represent the fastest-growing sub-segment. Business jet operators prioritize high-bandwidth, low-latency connectivity for executive passengers who require video conferencing, VoIP calls, and real-time data access. Providers such as Gogo Business Aviation, Viasat, and Honeywell offer tailored solutions for these aircraft, enabling premium in-flight experiences.

Though fleets are smaller than narrowbody or widebody aircraft, per-aircraft spending is higher, creating a profitable niche for both technology providers and airlines seeking premium differentiation. Airlines such as Cape Air (U.S.) and Air India Regional are early adopters, integrating LEO-based Wi-Fi to meet growing passenger expectations.

North America remains the largest regional market for in-flight Wi-Fi services, accounting for nearly 40.3% of global revenue. The U.S. leads the region with a dense domestic flight network and high adoption of LEO satellite connectivity.

Major airlines, including United Airlines, Delta Air Lines, and JetBlue, have implemented extensive fleet upgrade programs to integrate high-speed Wi-Fi into their aircraft, often linking access to loyalty programs or premium service tiers. This integration enhances passenger experience while enabling airlines to generate ancillary revenue through sponsored content and premium connectivity packages.

The regulatory environment in North America is favorable for market growth. The Federal Aviation Administration (FAA) maintains a well-defined certification framework, streamlining Supplemental Type Certificate (STC) approvals for new antenna designs and satellite integration.

This reduces installation time and ensures compliance with aviation safety standards. Airlines are increasingly adopting managed-service contracts, performance-based pricing models, and in-flight advertising platforms to optimize both service quality and revenue.

Recent developments include United Airlines partnering with SpaceX Starlink in 2024 to expand LEO coverage across its mainline and regional aircraft, demonstrating the growing strategic importance of satellite partnerships.

Europe maintains a strong position in the global in-flight Wi-Fi market, supported by a high concentration of premium long-haul carriers and cross-border flight routes. Key markets include the U.K., Germany, France, and Spain, where airlines are progressively adopting high-throughput Ka-band satellite systems to meet the increasing demand for seamless internet connectivity.

Carriers such as Lufthansa, British Airways, and Air France have incorporated advanced Wi-Fi platforms on both widebody and narrowbody fleets, enabling services ranging from video streaming to live business communications. The regulatory environment is structured to facilitate connectivity adoption.

The European Union Aviation Safety Agency (EASA) has streamlined certification processes for satellite terminals, and member states are harmonizing spectrum allocation to minimize interference and optimize coverage.

Market growth drivers include rising passenger demand for digital engagement, a strong presence of technology integrators such as Thales and Inmarsat, and regional initiatives promoting sustainable and energy-efficient aviation technologies.

Airlines are increasingly investing in multi-orbit solutions and expanding ground-based infrastructure to improve network reliability across European flight corridors. In 2025, Lufthansa Group announced the rollout of next-generation Ka-band Wi-Fi on its Airbus A350 and A330 fleets, reinforcing Europe’s leadership in high-performance in-flight connectivity.

Asia Pacific is the fastest-growing regional market, with rapid fleet expansion, increasing middle-class air travel, and rising digital expectations are key factors driving adoption. Countries such as China, India, Japan, and the ASEAN nations are at the forefront of this growth.

China continues to lead with a robust commercial aviation network and a focus on equipping domestic carriers such as China Southern Airlines and Air China with high-speed satellite connectivity. India is modernizing its fleets rapidly, with carriers such as IndiGo and Air India integrating LEO-based Wi-Fi solutions following regulatory approvals. Japan and Australia are leveraging satellite-based internet to enhance passenger experience on long-haul and domestic flights, supporting both business and leisure travel.

Investment focus in the region includes partnerships between multinational service providers and local telecom operators to deploy seamless in-flight-to-ground networks and expand satellite gateway infrastructure.

Recent developments include IndiGo’s 2025 agreement with Viasat to equip its narrowbody fleet with high-speed Ka-band connectivity and Singapore Airlines’ 2024 deployment of Starlink LEO services on select A350 aircraft for enhanced in-flight digital services. Asia Pacific’s growing tech-savvy passenger base and increasing international connectivity demand make it a strategic hub for long-term market expansion.

The global in-flight Wi-Fi services market is moderately concentrated, with the top five players accounting for over half of the total revenue. Established IFEC integrators, Panasonic Avionics, Thales Group, and Collins Aerospace, maintain long-term contracts with major airlines.

Satellite operators such as Viasat, Inmarsat, and Intelsat dominate bandwidth provision, while new entrants such as Starlink and OneWeb are reshaping competition through LEO networks. Competitive advantage now hinges on multi-orbit capability, global coverage, and data-driven service personalization.

Leading players are pursuing multi-orbit integration, managed-service contracting, and loyalty-linked connectivity models. Cost efficiency is achieved through standardized antenna platforms and OEM collaborations. Market differentiation increasingly depends on customer analytics, content partnerships, and cloud-based network management systems.

The market size in 2025 is US$6.1 Billion.

The in-flight Wi-Fi services market is projected to reach US$11.7 Billion by 2032.

Key trends include the rapid adoption of LEO and multi-orbit satellite systems, the growth of free/loyalty-based service models, expansion in Asia Pacific, and the integration of digital ecosystems for ancillary revenue and in-flight entertainment.

By technology, GEO/HTS (Ku/Ka band) systems remain the leading segment, accounting for over 59.8% of installed connected aircraft, especially on long-haul fleets.

The in-flight Wi-Fi services market is expected to grow at a CAGR of 9.7% between 2025 and 2032.

Major players in the in-flight Wi-Fi services market include Panasonic Avionics Corporation, Viasat Inc., Thales Group, Gogo Inc., and Inmarsat.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Service Model

By Aircraft Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author