ID: PMRREP24787| 198 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

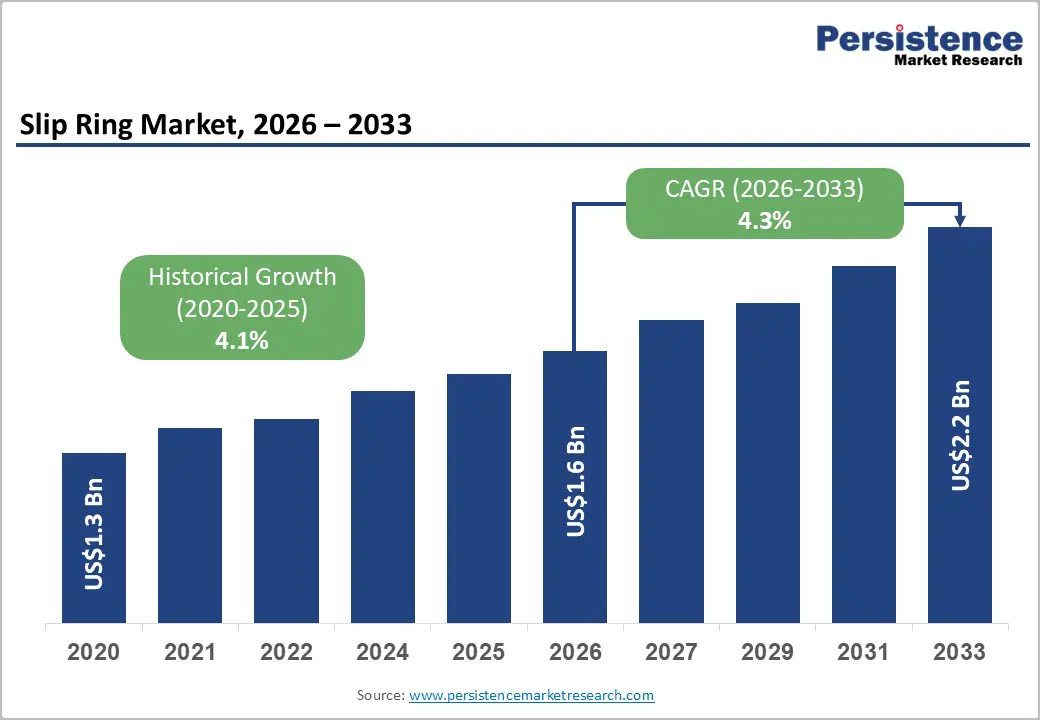

The global slip ring market size is likely to be valued at US$1.6 billion in 2026 and is expected to reach US$2.2 billion by 2033, growing at a CAGR of 4.3% during the forecast period from 2026 to 2033, driven by the increasing adoption of slip rings in renewable energy applications, particularly wind turbines, where they play a critical role in pitch control and condition monitoring.

The rapid growth in automation, robotics, and advanced manufacturing is boosting demand for reliable, high-performance rotary electrical interfaces. The wider use of slip rings in medical imaging, aerospace and defense, and material handling is expanding market adoption, while innovations such as fiber-optic, wireless, and hybrid designs are improving data speeds and reducing maintenance.

| Key Insights | Details |

|---|---|

|

Slip Ring Market Size (2026E) |

US$1.6 Bn |

|

Market Value Forecast (2033F) |

US$2.2 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

4.3% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.1% |

Industries such as automotive, electronics, packaging, food and beverage, and pharmaceuticals are increasingly deploying automated production lines to improve efficiency, precision, and throughput. Slip rings play a critical role in these systems by enabling uninterrupted transmission of power, control signals, and data between stationary and rotating components in robotic arms, rotary tables, indexing systems, and automated inspection equipment. As manufacturers focus on reducing downtime and enhancing operational reliability, demand for high-performance, low-maintenance slip rings with improved durability and signal integrity continues to rise.

The rapid expansion of industrial robotics is strengthening market demand, particularly in applications requiring multi-axis rotation and continuous motion. Modern robots used in welding, painting, material handling, and assembly rely on compact and high-speed slip rings to support seamless motion without cable twisting or signal loss. Improvements in robotics, including collaborative robots (cobots) and smart factory concepts under Industry 4.0, are driving the need for advanced slip ring solutions such as fiber optic and wireless designs. Fiber optic and wireless technologies enable high data transmission rates, support real-time monitoring, and improve system flexibility, reinforcing the slip ring market’s long-term growth trajectory.

Slip rings rely on continuous physical contact between brushes and rotating rings to transmit power and signals, which leads to gradual abrasion, debris formation, and surface degradation over time. In demanding applications such as wind turbines, industrial automation, and heavy machinery, this wear accelerates under high rotational speeds, fluctuating loads, and harsh operating conditions. As a result, system reliability can decline, increasing the risk of signal loss, power interruptions, and unplanned equipment downtime. These maintenance challenges translate into higher operational and lifecycle costs, limiting adoption in cost-sensitive industries.

Frequent inspections, brush replacements, and cleaning schedules raise labor and service expenses, particularly in remote or hard-to-access installations such as offshore wind farms or automated production lines. Downtime for maintenance can disrupt continuous operations and reduce overall productivity. Although manufacturers are addressing this challenge through improved materials, precious metal contacts, and enhanced sealing technologies, the higher upfront cost of these advanced solutions can limit adoption among cost-sensitive end-users. Inconsistent maintenance practices across industrial facilities often lead to premature wear and failures, which negatively impact system reliability and reduce operational efficiency in demanding slip ring applications.

Traditional slip rings operate through physical contact between brushes and rings, which causes mechanical wear, requires frequent maintenance, and may lead to operational downtime. Contactless designs, including inductive and wireless slip rings, eliminate this physical contact, significantly reducing wear and maintenance needs while enhancing system reliability and longevity. These advantages make them particularly suitable for high-speed, high-precision, and harsh-environment applications across industries such as industrial automation, robotics, aerospace, and defense.

Wireless slip rings facilitate high-speed data transmission and multi-channel signal integration, supporting real-time control and monitoring in complex rotating systems. This capability is increasingly demanded in wind turbines, medical imaging equipment, and smart factory setups where precision and continuous operation are essential. As industries transition toward Industry 4.0 and automation, the adoption of contactless and wireless slip rings is expanding, offering opportunities for manufacturers to deliver high-performance, low-maintenance, and reliable solutions. Wireless slip rings also enable compact and flexible designs, allowing integration into space-constrained applications such as robotic arms and aerospace systems.

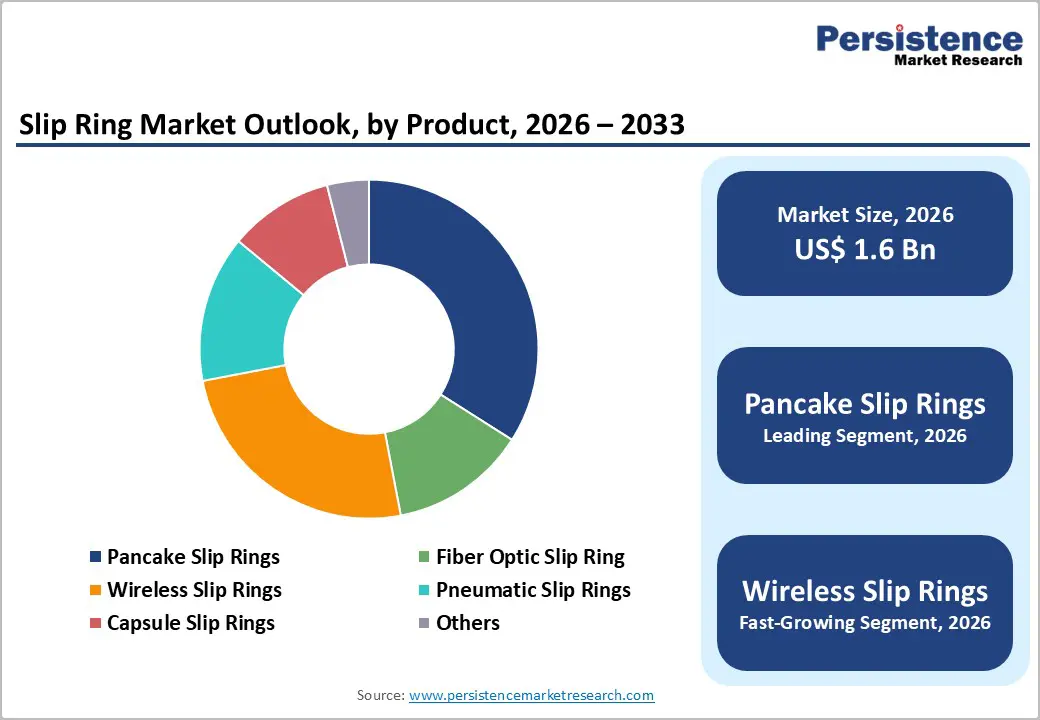

Pancake slip rings are expected to lead the slip ring market, accounting for approximately 35% of total revenue in 2026, due to their compact, flat design ideal for space-constrained applications. These slip rings are particularly prominent in defense and aerospace, where weight reduction and space efficiency are critical. For example, radar systems in military aircraft utilize pancake slip rings because their flat profile reduces weight, allowing for better system integration. Their versatility extends to industrial robotics and automated machinery, where compact designs help accommodate multi-axis movement without increasing the machine footprint. Pancake slip rings support multi-channel power and signal transmission, ensuring reliable operation in harsh environments.

Wireless slip rings are likely to represent the fastest-growing segment in 2026, due to advancements in contactless technology and the increasing adoption of industrial automation and robotics. Unlike traditional slip rings, wireless designs transmit power and signals without direct physical contact, eliminating mechanical wear and reducing maintenance costs. For example, robotic arms in automotive manufacturing rely on wireless slip rings to enable continuous rotation and high-speed data transmission for precision assembly lines. Wireless slip rings also support multiple signal channels and real-time monitoring, enhancing operational efficiency while minimizing downtime.

Gold-based slip rings are expected to dominate the market, accounting for nearly 40% of total revenue in 2026, supported by their superior conductivity, corrosion resistance, and stable performance in harsh operating conditions. They are widely used in applications such as CT and MRI scanners, where uninterrupted and accurate signal transmission is essential. Gold contacts minimize signal loss, maintain consistent conductivity over repeated rotations, and endure long-term operational stress, making them critical for medical, aerospace, and defense applications where reliability and precision are paramount. Their proven performance across demanding environments reinforces gold’s leadership in the material segment.

Copper-based slip rings are projected to be the fastest-growing segment in 2026, driven by their cost efficiency, strong electrical conductivity, and advancements in alloy formulations. Wind turbines, for instance, rely on copper slip rings to efficiently transmit power and data to rotating blades. Compared with precious metals, copper offers a balance of high performance and lower cost, making it well-suited for large-scale industrial, renewable energy, and automation applications. Improved durability through protective coatings and alloys is further accelerating adoption in manufacturing and robotics, where continuous rotation and dependable signal transmission are essential.

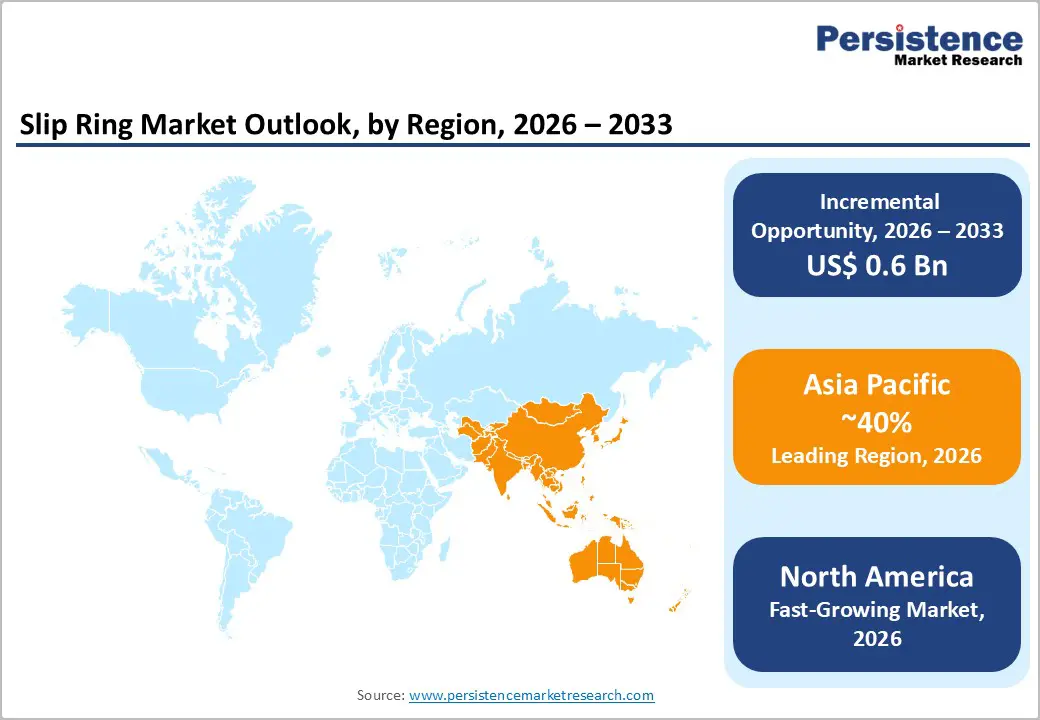

North America is likely to be the fastest-growing region in the slip ring market in 2026, driven by strong aerospace and defense demand, technological innovation, renewable energy investments, and increasing adoption of automation and EV-related applications. The region benefits from well-established industrial automation, aerospace, and defense sectors, where slip rings are critical for enabling continuous power and signal transmission in rotating systems. For example, companies such as Moog Inc. in the U.S. develop high-performance slip ring assemblies for aerospace, defense, and renewable energy applications, leveraging advanced materials and fiber-optic integration to meet stringent reliability standards in radar systems and wind turbines. Significant R&D investments and regulatory emphasis on energy efficiency and robust system performance help sustain strong demand for advanced slip ring solutions across critical applications.

North America has a broadening application base beyond traditional sectors. While aerospace and defense remain dominant, increasing adoption of slip rings in industrial automation, robotics, and renewable energy, particularly wind turbine installations, has expanded market scope. Slip rings are now widely used in automated manufacturing lines, requiring high-speed data transfer and uninterrupted power for continuous operation, as well as in next-generation renewable systems that demand durable, low-maintenance solutions. Advancements in contactless and hybrid technologies that offer superior lifespan and reduced service requirements make slip rings more attractive to manufacturers focused on uptime and operational efficiency.

Europe is likely to be a significant market for slip rings in 2026, supported by advanced manufacturing, renewable energy expansion, and high-precision engineering capabilities. The region holds a significant share of the global slip ring landscape, driven by strong demand in industrial automation, aerospace, and wind energy applications in countries such as Germany, the U.K., and France. For example, Schleifring GmbH’s onshore wind turbine systems, aerospace platforms, and industrial automation equipment demonstrate the region’s engineering expertise and focus on quality solutions for demanding applications.

Europe focuses on the shift toward advanced and maintenance-free technologies, including contactless and hybrid systems, as manufacturers seek to lower lifecycle costs and enhance reliability. The aerospace and defense sectors continue to adopt high-precision slip rings for radar, communication, and surveillance systems, while industrial automation drives the demand for solutions that support real-time data transfer and continuous operation. The expansion of smart manufacturing under Industry 4.0 encourages the integration of intelligent slip ring solutions with condition monitoring and IoT capabilities to improve productivity and predictive maintenance outcomes.

Asia Pacific is anticipated to be the leading region, accounting for a market share of 40% in 2026, driven by rapid industrialization, expanding manufacturing sectors, and significant investments in renewable energy infrastructure. Countries such as China, India, Japan, and South Korea are at the forefront, with strong demand arising from automation in automotive, electronics, and machinery manufacturing. For example, MOFLON Technology, a China-based slip ring manufacturer supplying a wide range of products to industrial automation, wind energy, and railway sectors, reflects the region’s growing focus on localized supply and technology development.

The Asia Pacific market is seeing an increasing participation of regional technology providers in strategic partnerships and capacity expansions. Companies are investing in research and development to tailor slip ring solutions for specific applications such as robotics, packaging machinery, and medical devices, which are seeing increased deployment across regional industries. Government support for infrastructure development and automation, coupled with relatively lower manufacturing costs, continues to attract foreign and domestic investments. The region is also accelerating the adoption of advanced slip ring technologies, such as fiber-optic and contactless designs, to meet the requirements of high-speed data transfer and improved system reliability in automated environments.

The global slip ring market exhibits a moderately fragmented structure, driven by a mix of large multinational corporations and specialized regional manufacturers competing for share across industrial, aerospace, renewable energy, and automation applications. While no single player dominates the entire industry, the top tier of companies collectively holds a significant portion of total market output, reflecting focused expertise and long-term partnerships with major OEMs and system integrators. Advanced engineering capabilities and application-specific solution portfolios are critical differentiators in this landscape, with firms investing heavily in R&D to meet the complex demands of high-performance sectors such as defense and energy.

With key leaders including Moog Inc., Schleifring GmbH, Mersen S.A., Conductix-Wampfler, and Cavotec SA, the market is anchored by companies with strong reach and deep technology portfolios that serve demanding environments and high-reliability systems. These players compete through continuous product innovation, enhanced material technologies such as fiber-optic and hybrid slip rings, broad application coverage, and strategic geographic expansion, often supported by partnerships and acquisitions to strengthen market presence.

The global slip ring market is projected to reach US$1.6 billion in 2026.

The market is driven by the growing adoption of industrial automation, robotics, and renewable energy systems that require reliable power and signal transmission in rotating equipment.

The slip ring market is expected to grow at a CAGR of 4.3% from 2026 to 2033.

Key market opportunities include the adoption of contactless and wireless slip ring technologies, expansion of renewable energy applications, particularly wind turbines, growth in industrial automation and robotics, and increased utilization in medical imaging, aerospace, and electric vehicle systems.

Moog Inc., Mersen, Moflon Technology, Conductix-Wampfler, and Combinent Oy Ab are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Material

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author