ID: PMRREP35335| 190 Pages | 20 May 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

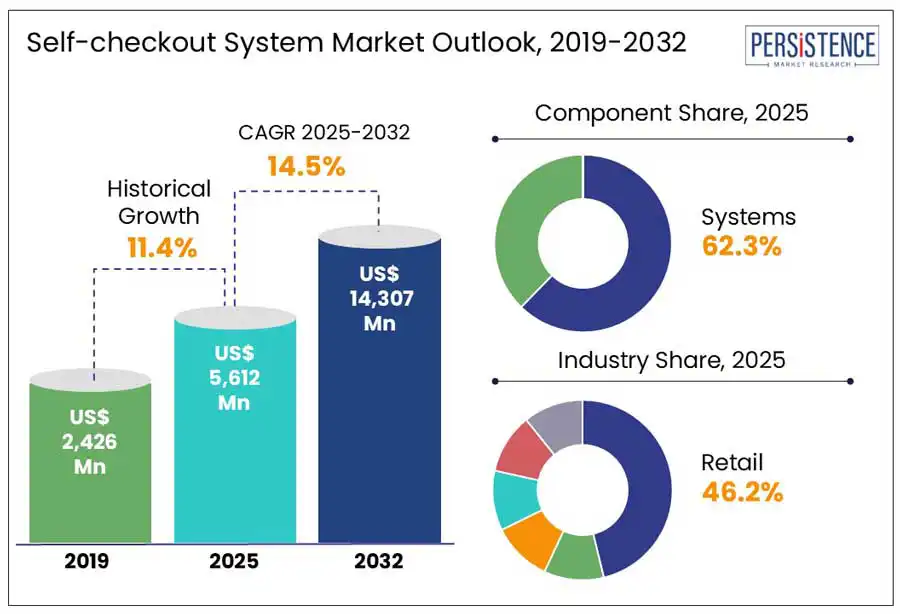

The global self-checkout system market size is predicted to reach US$ 14,307.0 Mn in 2032 from US$ 5,612.0 Mn in 2025. It will likely witness a CAGR of around 14.5% in the forecast period between 2025 and 2032, finds a Persistence Market Research report.

Self-checkout systems have changed how customers interact with retail environments, providing an efficient way to complete transactions. These systems have become immensely popular across a range of industries due to their ability to enable customers to scan, pay for, and bag their items without the requirement of cashier assistance. A recent survey by Zebra Technologies revealed that around 61% of shoppers say they prefer self-checkout over conventional cashier lanes, highlighting the efficiency and popularity of these systems.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Self-checkout System Market Size (2025E) |

US$ 5,612.0 Mn |

|

Market Value Forecast (2032F) |

US$ 14,307.0 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

14.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

11.4% |

Apparel retailers are expected to propel the self-checkout system market growth in the foreseeable future. It is attributed to their rising focus on enhancing operational efficiency and customer experience. Marks & Spencer (M&S) has already started trials of smart checkouts in select stores. It has been using embedded chips in price tags to automatically identify and total products in a shopper’s basket. With this innovation, the company reported a 40% reduction in transaction times compared to standard self-checkout systems. In addition, M&S planned to launch self-checkout kiosks in the fitting rooms of its 180 clothing stores by 2028, enabling customers to scan items, request different colors or sizes, and pay in the fitting area.

The adoption of mobile self-checkout solutions is another trend among fashion retailers. These systems allow customers to scan and pay for products using their smartphones, providing a convenient and personalized shopping experience. Features such as integration with loyalty programs, personalized promotions, and real-time inventory updates help improve customer satisfaction and engagement. Also, mobile self-checkout lowers the requirement for conventional cash registers, allowing retailers to assign staff to more value-added tasks and enhance store layouts.

The rise in theft and shrinkage related to self-checkout systems has become a significant issue for retailers, affecting the pace and extent of their adoption. A few studies highlight that self-checkout kiosks experience a shrink rate of nearly 3.5% of sales, which is 16 times higher than the 0.21% observed at conventional cashier lanes. This discrepancy is mainly attributed to partial shrinkage where customers either intentionally or unintentionally fail to scan all products. Such losses are likely to hinder profit margins, specifically in sectors such as grocery retail, where net margins tend to be narrow.

The financial impact of self-checkout-related theft is significant. According to Capital One Shopping, theft increases by up to 65% at self-checkout compared to conventional cashier lanes in the U.S. Additionally, 15% of consumers admit to using self-checkout to steal, whereas more than 20 Mn individuals have stolen from a self-checkout kiosk. In response to these challenges, some retailers have started investing in innovative technologies to strengthen security at self-checkout stations. Dollar General, for example, has eliminated self-checkout options from about 12,000 stores, whereas Target has introduced a norm limiting self-checkout transactions to 10 products or fewer. Similarly, the Co-op has utilized AI-based surveillance systems to monitor self-checkout transactions, aiming to enhance safety by lowering theft.

The hospitality industry will likely create new opportunities for self-checkout system manufacturers. They are anticipated to embrace self-service kiosks to meet changing guest expectations and improve efficiency. Hotels are now leveraging AI-backed kiosks to optimize check-in processes, thereby reducing staffing requirements and waiting times. Criterion Hospitality's Zedwell hotels in London have leveraged AI-powered kiosks, lowering average check-in times from 10 minutes to just 2.5 minutes. This adoption has enabled the company to reduce its reservations team by 66%, reallocating staff to more personalized guest services.

Self-service kiosks also improve the guest experience by providing features such as contactless payments and facial recognition for secure check-ins. At the same time, these are being integrated with property management systems for real-time updates. Similar innovations are highly offering valuable data analytics and improving operational workflows, allowing hotels to provide promotions and services based on individual guest preferences. This includes smooth integration with loyalty programs and the booming hotel gift card market. It further enables the guests to purchase or redeem gift cards directly through kiosks, enhancing convenience with rising ancillary revenue.

Based on component, the market is bifurcated into systems and services. Among these, systems are predicted to hold around 62.3% of the self-checkout system market share in 2025. This is attributed to the increasing initial demand for hardware installations across multiple retail formats. Businesses and retailers are investing huge sums in self-checkout terminals, kiosks, and supporting hardware to enhance their stores and customer experience. Demand for user-friendly and reliable systems capable of supporting various payment methods, integrating with existing point-of-sale infrastructure, and handling high transaction volumes is also pushing the segment.

The services segment, on the other hand, is expected to witness a considerable CAGR from 2025 to 2032. It is due to the rising requirement for system integration, maintenance, training, and software upgrades related to self-checkout kiosks. Retailers demand continuous technical support as they implement increasingly intricate and personalized self-checkout systems to guarantee system compatibility, data security, and peak performance. This demand is associated with trends in the data-centric security market, where safeguarding sensitive consumer and transaction data across decentralized systems is becoming important. Increasing adoption of software-as-a-service (SaaS) and cloud-based models for self-checkout software is also estimated to create new avenues for data analytics, remote monitoring, and managed services.

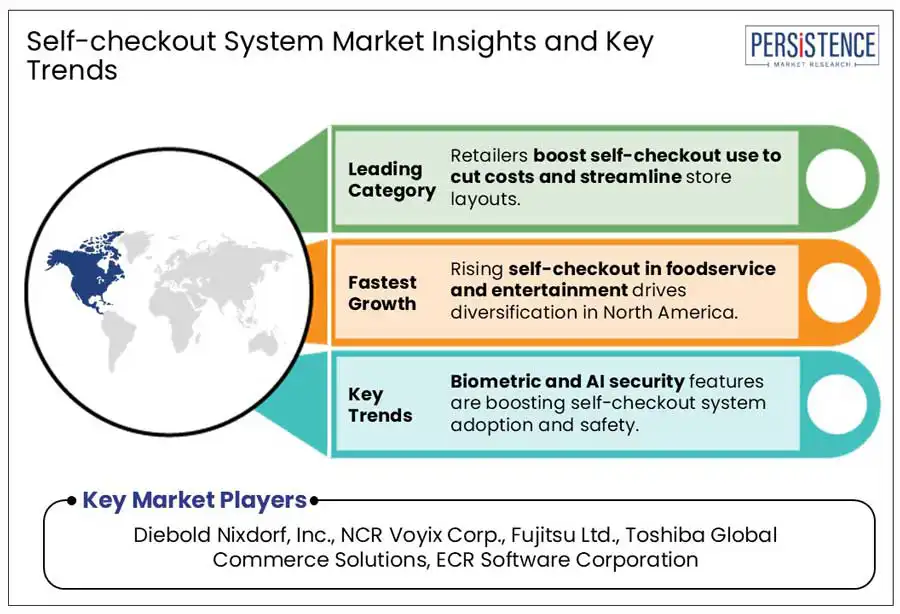

In terms of industry, the market is segregated into retail, travel, entertainment, healthcare, and financial services. Out of these, retail has emerged as the most significant end-user of self-checkout systems with a share of 46.2% in 2025. A key driver is substantial cost savings in labor. According to WorldMetrics.org, self-checkout systems can reduce staffing costs for retailers by up to 50%, enabling a single attendant to oversee multiple kiosks instead of staffing each checkout lane individually. This superior efficiency is beneficial in high-traffic retail environments where quick transaction processing is significant. The integration of self-checkout kiosks with wide digital ecosystems, such as the retail cloud solutions market is further allowing retailers to update systems and monitor performance remotely.

The entertainment industry, on the other hand, is poised to showcase a steady CAGR from 2025 to 2032. In venues such as sports arenas, amusement parks, and cinemas, self-checkout kiosks enable patrons to purchase tickets, merchandise, and concessions without waiting in long queues. This allows venues to serve more customers in less time and improves customer experience, thereby propelling revenue potential.

For instance, in May 2024, Marvel Stadium installed 26 AI-powered self-checkout kiosks developed by Mashgin. These allow fans to buy food and beverages quickly, improving the event experience and reducing wait times. Similarly, Zippin collaborated with Aramark UK to launch DUPLO Coffee Co., a cashierless and frictionless store at LEGOLAND Windsor Resort. This initiative enables guests to buy products and exit without conventional checkout processes.

North America is projected to generate nearly 44.3% share in 2025. It is speculated to be driven by the U.S. self-checkout system market due to rising consumer demand for quick shopping options as well as widespread retail digitization. Innovations such as touchless payment options and AI-backed systems are also creating new opportunities in the country. Michigan-based grocery chain Wesco, for instance, extended its deployment of Mashgin AI-powered kiosks in 2024. These eliminate the requirement for barcode scanning, enhancing customer experience and operations by allowing for quick checkouts.

Significant sports venues are further seeing robust growth in the interactive and self-service kiosk market to improve fan experience. The Seattle Seahawks' Lumen Field, for example, has more Amazon Just Walk Out locations than any other venue worldwide, with 9 stores equipped with self-service technology. These stores have witnessed a 60% surge in customer throughput and a 112% growth in total sales per game compared to conventional concession stands. Fan satisfaction ratings for food and beverage services have also enhanced by 11% since the deployment of these systems.

In Europe, the U.K. is anticipated to outpace the other countries with the surging adoption of self-checkout systems. Sainsbury’s, for example, is trialing an upgrade to its SmartShop system in Kempston and Richmond. It is enabling shoppers to pay directly via upgraded handsets by tapping their card, helping them bypass conventional checkout queues. This development is predicted to simplify the shopping process, save mobile phone battery, and enhance customer convenience while offering the retailer valuable customer flow data through heatmapping.

The automated drug kiosk market is exhibiting a boom across Europe with various unique solutions being developed to enhance pharmaceutical services. Grab2Go, a start-up based in Estonia, for instance, recently developed a fully autonomous, unmanned robotic pharmacy that operates 24/7. Pharmathek in Italy also unveiled a unique automated dispensing robot called GENESI, which is designed to fit into existing pharmacy counters. The compact system automates stock management without requiring dedicated space, making it ideal for pharmacies with limited room or those in listed buildings.

In Asia Pacific, China is currently seeing decent growth with the government’s push for digital infrastructure development and increasing adoption of cloud services across both private and state-owned enterprises. Renowned retailers in the country are investing in self-checkout solutions to meet the unmet customer demand for contactless and quick shopping experiences. JD.COM, for example, has extended its network of unmanned retail stores equipped with facial recognition and AI systems. These enable customers to shop and pay independently. Alibaba’s Freshippo grocery stores have also deployed innovative self-checkout technologies, blending mobile payments and facial recognition to streamline the shopping experience.

The market in India is evolving at a steady pace, with various notable developments across different sectors. For example, retailers, including Decathlon and Pantaloons, have launched self-checkout kiosks in select stores. BigBasket, one of the country's one of most prominent online grocery platforms, also announced the integration of AI into its physical stores. It opened a 5,000 sq. ft. supermarket in Hyderabad that features automated self-checkout systems. The store stocks around 4,000 SKUs and employs computer vision to identify items, enhancing the billing process.

The self-checkout system market houses a few leading companies that focus on generating high shares with robust service networks, long-term retail partnerships, and integrated software-hardware solutions. They are also leveraging AI-powered remote support tools, real-time analytics, and computer vision solutions to differentiate their products, mainly for high-volume retail environments such as hypermarkets and supermarkets.

The market has recently witnessed increased fragmentation due to the surge of region-specific firms and start-ups. They strive to target niche segments, including micro-markets, specialty retail, and convenience stores. A few emerging companies are launching frictionless checkout models that rely on image recognition and AI instead of barcode scanning to identify products.

The market is projected to reach US$ 5,612.0 Mn in 2025.

Rising demand for contactless payments and the integration of AI are the key market drivers.

The market is poised to witness a CAGR of 14.5% from 2025 to 2032.

Increasing consumer preference for highly convenient shopping experiences and surging expansion across emerging areas are the key market opportunities.

Diebold Nixdorf, Inc., NCR Voyix Corp., and Fujitsu Ltd. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Component

By Transaction Type

By Model Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author