ID: PMRREP34570| 219 Pages | 4 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

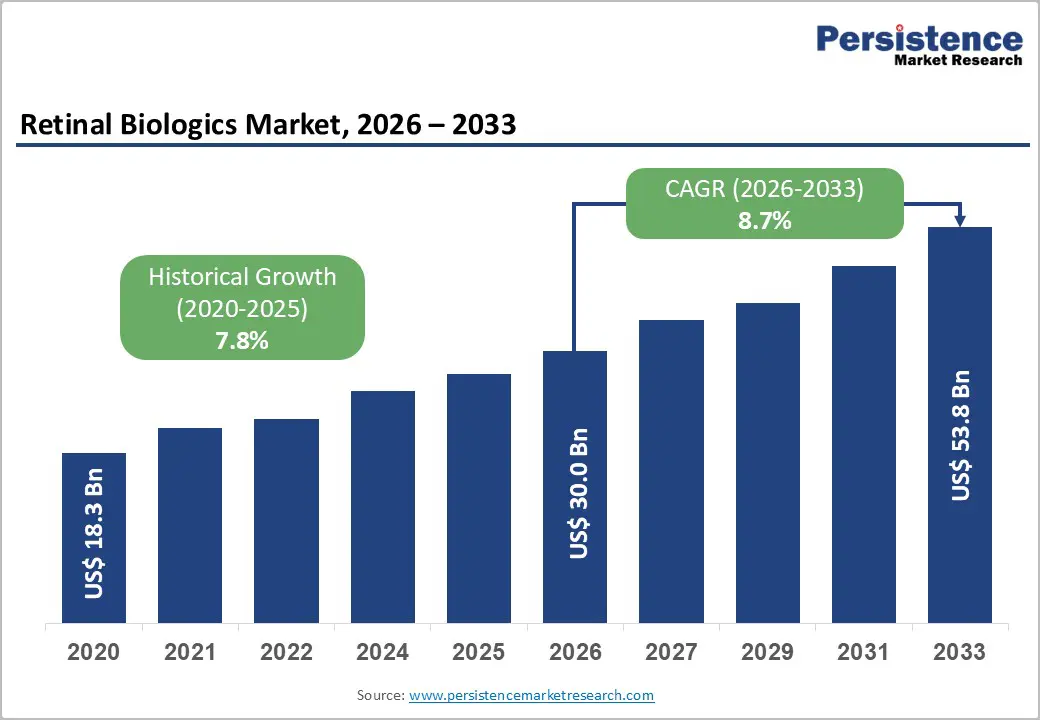

The global retinal biologics market is estimated to grow from US$ 30.0 Bn in 2026 to US$ 53.8 Bn by 2033. The market is projected to record a CAGR of 8.7% during the forecast period from 2026 to 2033.

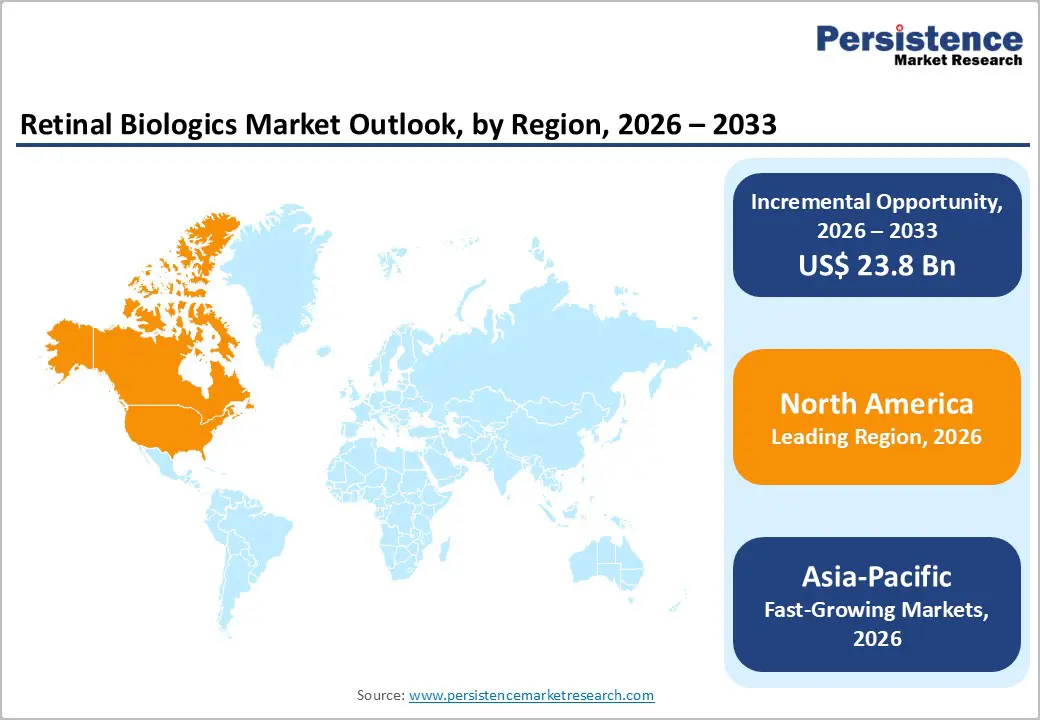

The global retinal biologics market is experiencing steady growth, driven by rising demand for targeted therapies, advancements in biologic drug development, and expanding access to digital healthcare. North America leads due to strong healthcare infrastructure, regulatory frameworks, and manufacturing capabilities, while Asia-Pacific is the fastest-growing region, supported by improving healthcare systems, government initiatives, growing patient awareness, and increased investment in ophthalmic diagnostics and biologics production.

| Global Market Attributes | Key Insights |

|---|---|

| Global Retinal Biologics Market Size (2026E) | US$ 30.0 Bn |

| Market Value Forecast (2033F) | US$ 53.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.8% |

Retinal biologics are increasingly in demand due to the growing burden of retinal diseases such as age-related macular degeneration (AMD) and diabetic retinopathy (DR). According to World Health Organization (WHO) estimates, about 196 million people worldwide were living with AMD in 2020, and approximately 146 million adults were affected by diabetic retinopathy in the same period, reflecting significant global eye health challenges. In the U.S., CDC data show nearly 20 million adults aged 40 and older had AMD in 2019, with prevalence rising sharply with age (to over 46% in those aged 85+). Diabetic retinopathy prevalence among people with diabetes can reach approximately 28.4% in those aged 65–79, making it a major cause of visual impairment and blindness.

These high disease burdens are critical drivers for retinal biologics, particularly anti-VEGF therapies which target abnormal blood vessel growth and inflammation in the retina. As populations age and the global incidence of diabetes continues to rise, the need for effective, targeted biologic treatments also rises. In addition to the absolute number of affected individuals increasing, advancements in diagnostic imaging and screening are contributing to higher detection rates, further expanding the market demand for biologic interventions in retinal diseases.

One of the key challenges restraining growth in the retinal biologics market is patient compliance with frequent intravitreal injections, the standard administration route for many biologic therapies. A real-world study from India tracking over 50,000 recommended intravitreal injections found that only about 51.4% of patients received the first recommended injection at the initial visit, with compliance improving only after follow-up visits. This indicates that nearly half of patients initially defer biologic treatment despite clinical recommendation often due to factors like cost, discomfort, fear of repeated eye injections, and logistical challenges associated with frequent clinic visits.

Intravitreal injections, typically administered monthly or bi-monthly for conditions like neovascular AMD and diabetic macular edema pose burdens both on patients and caregivers. They require multiple visits to ophthalmology clinics, impose transportation and time costs, and can cause anxiety related to pain or perceived risk. These factors cumulatively contribute to lower adherence, particularly among those paying out-of-pocket or with limited insurance coverage. Additionally, frequent injections increase cumulative risk of complications such as endophthalmitis and retinal detachment, which can further deter regular treatment adherence and reduce long-term outcomes. Reduced compliance can limit the real-world effectiveness of retinal biologics, thus restraining market penetration despite strong clinical efficacy.

The emergence of biosimilar retinal biologics represents a substantial opportunity to expand access and lower treatment costs in the retinal biologics market. Biosimilars are biologic medical products that are highly similar to an existing approved reference product in terms of safety, efficacy, and quality, but typically offered at a lower cost once patents for the originator biologics expire. For example, the U.S. FDA approved biosimilar versions of a major anti-VEGF biologic used to treat retinal diseases in May 2024, including biosimilars to Eylea such as Yesafili and Opuviz. These products address a critical need because originator biologics like aflibercept and ranibizumab historically carry high price points that can limit patient access and treatment intensity.

Multiple biosimilar candidates of ranibizumab and aflibercept are already in development or approved across major markets, reflecting growing manufacturer interest and regulatory support. The availability of biosimilars can reduce healthcare system costs and potentially improve adherence by making chronic retinal biologic therapy more affordable for patients and payers. Evidence from real-world studies with biosimilar ranibizumab indicates similar clinical outcomes to reference biologics, supporting their adoption.

By lowering cost barriers and broadening treatment accessibility, biosimilars offer a significant growth lever for the retinal biologics market, particularly in emerging economies and health systems with budget constraints. They also encourage competitive pricing, stimulate innovation in next-generation biologic therapies, and can help address unmet needs in personalized retinal disease management.

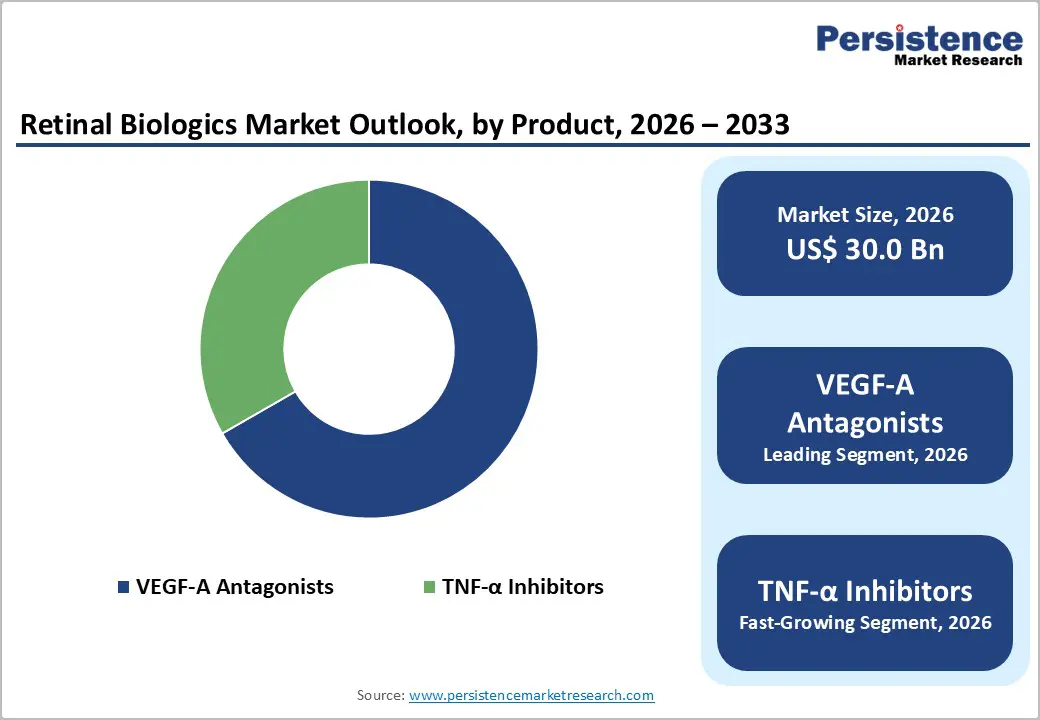

VEGF-A Antagonists 66.7% share of the global market in 2025, because they directly target the pathological mechanism underlying the most common vision-threatening retinal diseases. Vascular endothelial growth factor A (VEGF-A) drives abnormal blood vessel growth and leakage in conditions such as wet age-related macular degeneration (AMD) and diabetic retinopathy. Widely used anti-VEGF drugs like ranibizumab (Lucentis) and aflibercept (Eylea) have become standard of care due to established clinical efficacy in reducing central retinal thickness and improving visual outcomes. Their dominance is reflected in market analyses, where VEGF-A antagonists held the largest share over 65% in 2023, and are projected to sustain growth due to broad clinical adoption and approvals. The strength of this class is reinforced by extensive real-world and clinical evidence demonstrating significant vision stabilization in a large proportion of treated patients.

Macular degeneration, particularly age-related macular degeneration (AMD), dominates the indication segment of the retinal biologics market because it is one of the leading causes of irreversible vision loss worldwide, especially among older adults. WHO-aligned estimates show AMD affects around 200 million people globally, with projections nearing 288 million by 2040 due to aging populations. The burden of AMD, particularly the neovascular (wet) form that responds well to biologic intervention creates substantial demand for targeted therapies like anti-VEGF treatments. Market data indicate that the macular degeneration segment accounted for around 40% of the market share in 2023, exceeding other retinal disorders like diabetic retinopathy. These trends reflect both high prevalence and the critical need for effective treatments that can slow disease progression and preserve vision in elderly populations.

North America dominates the retinal biologics market with 41.7% share in 2025, because of its advanced healthcare infrastructure, robust diagnostic capabilities, and high disease burden of retinal conditions such as AMD and diabetic retinopathy. The region accounted for over 40% of the global retinal biologics market share in 2024, with the United States representing the largest contributor thanks to widespread adoption of anti-VEGF therapies and substantial clinical research activity. Public health systems, broad insurance coverage, and early integration of innovations like AI-assisted retinal imaging enable timely diagnosis and treatment. Moreover, high awareness of vision health and extensive screening programs in the elderly, where AMD prevalence is significant drive consistent demand for targeted biologic treatments, reinforcing North America’s leadership globally.

Europe holds a significant position in the retinal biologics market due to well-established universal healthcare systems, strong patient screening programs, and supportive public health policies that facilitate early detection and treatment of retinal diseases. Countries like Germany, France, and the UK maintain high rates of regular retinal examinations, improving outcomes for conditions such as AMD and diabetic retinopathy. Europe accounted for approximately 29–30% of related retinal treatment markets, reflecting solid adoption of advanced therapies and extensive reimbursement support that improves biologic accessibility. Furthermore, significant investment in ophthalmic research and clinical trials, coupled with aging populations across the region, sustains demand for innovations in biologics and supports Europe as a key strategic region in global ocular healthcare.

Asia-Pacific is the fastest-growing region in the retinal biologics market due to its large population base, rising prevalence of diabetes and age-related retinal diseases, and rapid improvements in healthcare access. With increasing urbanization and lifestyle-related conditions like diabetes becoming more common, China reports diabetic retinopathy prevalence as high as up to 43.1% among some diabetic populations the need for effective retinal therapies is expanding rapidly. Government initiatives in countries like India to scale eye screening programs and investments in modern diagnostic technologies are enhancing early detection and treatment uptake. Furthermore, the region’s healthcare infrastructure is modernizing quickly, boosting affordability and availability of biologic treatments. Consequently, Asia-Pacific’s retinal biologics market is projected to grow at the highest compound annual growth rate (CAGR), outpacing both North America and Europe.

The retinal biologics market features a competitive landscape dominated by established pharmaceutical companies focusing on anti-VEGF therapies, biosimilars, and long-acting formulations. Competition is driven by strong R&D pipelines, strategic collaborations, regulatory approvals, pricing strategies, and geographic expansion to strengthen market presence and address growing retinal disease prevalence globally.

The global retinal biologics market is projected to be valued at US$ 30.0 Bn in 2026.

Rising retinal disease prevalence, aging populations, strong anti-VEGF efficacy, innovation in biologics, and expanding treatment access.

The global retinal biologics market is poised to witness a CAGR of 8.7% between 2026 and 2033.

Biosimilar development, long-acting biologics, combination therapies, emerging market expansion, and improved retinal care access.

Spark Therapeutics, Inc., F. Hoffmann-La Roche Ltd., Regeneron Pharmaceuticals, Inc., AbbVie Inc., Amgen Inc., Novartis Pharma AG.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author