ID: PMRREP32308| 198 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

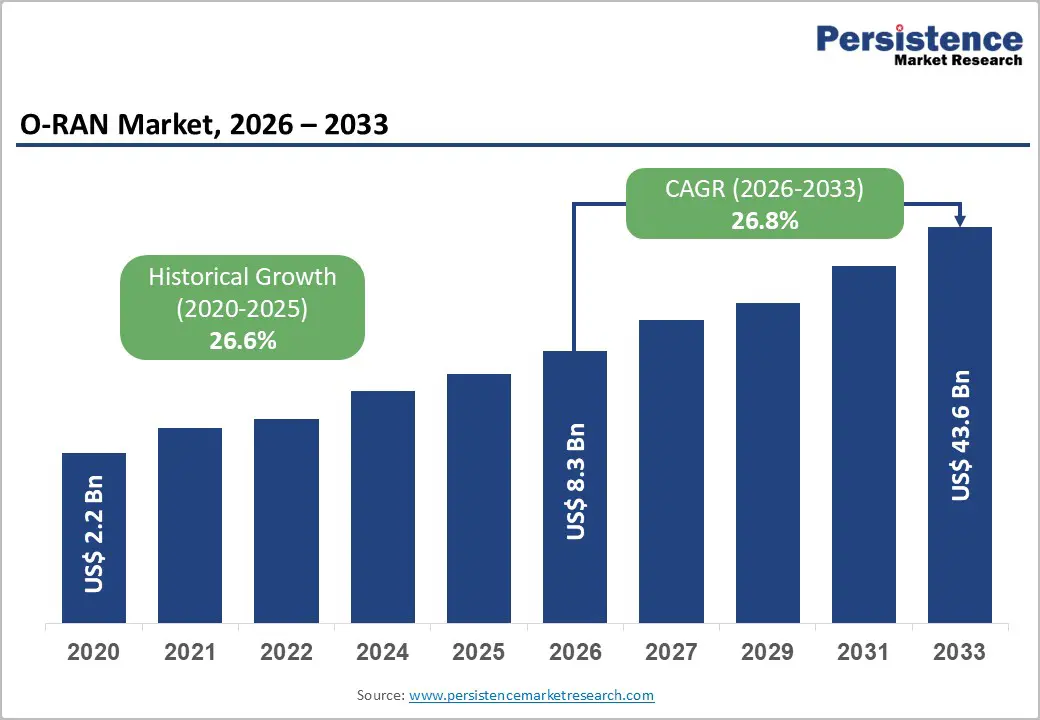

The global O-RAN market size is likely to be valued at US$8.3 billion in 2026 and is expected to reach US$43.6 billion by 2033, growing at a CAGR of 26.8% during the forecast period from 2026 to 2033, driven by the rapid deployment of 5G networks, the shift toward multi-vendor and disaggregated network architectures, the demand for cost-efficient and interoperable solutions, and industry initiatives led by the O-RAN Alliance promoting open interfaces and cloud-native RAN implementations.

The accelerated rollout of 5G networks, the growing need to diversify vendors and reduce reliance on proprietary systems, and the demand for cost-efficient, interoperable network solutions are the key industry drivers. O-RAN allows operators to optimize both capital and operational expenditures while enabling greater network flexibility, scalability, and innovation. Emerging technologies such as AI-based RAN optimization and edge computing integration are improving performance, automation, and ultra-low-latency capabilities, unlocking new growth opportunities for both vendors and network operators.

| Key Insights | Details |

|---|---|

| O-RAN Market Size (2026E) | US$8.3 Bn |

| Market Value Forecast (2033F) | US$43.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 26.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 26.6% |

5G deployment requires high-capacity, low-latency, and ultra-reliable connections, which traditional proprietary RAN architectures struggle to deliver efficiently at scale. O-RAN, with its open, standards-based design, enables operators to decouple hardware and software components, allowing for multi-vendor interoperability and flexible network upgrades. This disaggregated approach reduces capital expenditure (CAPEX) by leveraging commercial off-the-shelf (COTS) hardware and minimizes operational expenditure (OPEX) through automated, software-defined management. Regions such as North America and Asia Pacific are leading this trend, with operators such as AT&T and China Mobile conducting large-scale O-RAN trials.

Network disaggregation, the separation of network functions into modular units such as Distributed Units (DU) and Centralized Units (CU), accelerates O-RAN adoption. By decentralizing data processing to the DU while centralizing control functions at the CU, operators can optimize traffic management, improve latency, and scale resources based on demand. Disaggregated networks also promote multi-vendor ecosystems, mitigating dependency on a single supplier and encouraging competitive pricing and innovation. This flexibility is particularly beneficial for dense urban deployments, industrial IoT, and private 5G networks, where high traffic volumes and low-latency requirements are critical. Network disaggregation aligns with cloud-native and virtualization trends, enabling operators to integrate AI analytics, predictive maintenance, and automated orchestration across the RAN.

O-RAN relies on a disaggregated approach where hardware and software components are sourced from multiple vendors. While this enables flexibility and cost savings, it introduces technical difficulties in integrating diverse equipment, such as Remote Radio Units (RRUs), Distributed Units (DUs), and Centralized Units (CUs). Ensuring seamless communication between components while maintaining high network performance, low latency, and reliability is technically demanding. Operators must invest in rigorous testing, validation, and orchestration frameworks to prevent service degradation, particularly in dense urban deployments and high-traffic scenarios. Network staff require specialized skills to manage multi-vendor systems, which increases operational complexity and training costs.

Interoperability challenges restrain the O-RAN market, as standardization across vendors is still evolving. Variations in software protocols, hardware specifications, and vendor-specific features can create compatibility issues, leading to performance inconsistencies and operational inefficiencies. Multi-vendor ecosystems require robust interface definitions and conformance testing to ensure seamless operation, which is still developing under O-RAN Alliance guidelines. Integrating advanced features such as AI-driven RAN optimization, network slicing, and cloud-native orchestration can exacerbate these challenges, as not all vendors support uniform implementations. Security concerns also arise from interoperability gaps, as inconsistent integration can expose network vulnerabilities.

Greenfield networks, built from scratch without the constraints of legacy infrastructure, allow operators to design fully open, disaggregated architectures tailored to modern requirements. This enables seamless integration of O-RAN components, such as Remote Radio Units (RRUs), Distributed Units (DUs), and Centralized Units (CUs), while leveraging cloud-native solutions and AI-driven network management. Greenfield deployments are particularly attractive in regions with rapidly expanding urban centers and underserved areas, such as parts of Asia Pacific, the Middle East, and Africa, where telecom operators can implement cost-effective, scalable, and future-ready 5G networks.

The growing demand for private 5G networks also drives the O-RAN market, particularly in industrial, manufacturing, logistics, and enterprise sectors. Private networks require dedicated, secure, and highly customizable connectivity, which O-RAN enables through modular and vendor-agnostic deployments. Companies can leverage private 5G to improve operational efficiency, enable real-time automation, and support autonomous vehicles. The flexibility of O-RAN allows enterprises to integrate advanced features such as AI-driven network optimization, edge computing, and predictive maintenance, while retaining control over network performance and security. Government-backed initiatives and incentives in regions such as Europe, Japan, and India are accelerating private 5G adoption, creating additional revenue opportunities for O-RAN vendors and system integrators.

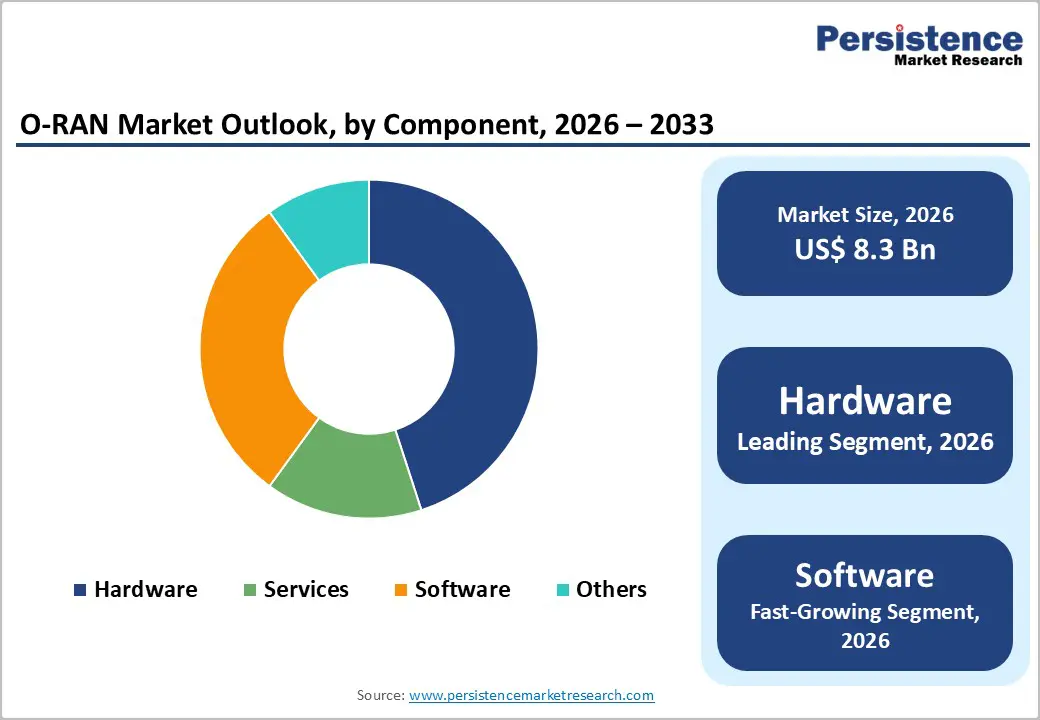

The hardware segment is projected to dominate the O-RAN market, contributing around 46.2% of total revenue in 2026. This leadership is driven by the essential role of physical network components, such as Remote Radio Units (RRUs), baseband units, and antennas, in delivering high-performance, low-latency 5G services across both urban and rural deployments. Major telecom operators, including AT&T in the U.S., have adopted multi-vendor O-RAN hardware for greenfield 5G launches and urban network densification, underscoring the segment’s practical significance. As hardware reliability has a direct impact on network performance, particularly in high-traffic urban areas, operators place strong emphasis on robust equipment to support low-latency applications, enhanced mobile broadband, and massive IoT connectivity under 5G standards.

The software segment is expected to be the fastest-growing, fueled by trends such as virtualization, AI adoption, and cloud-native RAN architectures. Software solutions allow operators to manage, orchestrate, and optimize multi-vendor networks more efficiently while lowering long-term operational costs. For instance, Mavenir’s AI-enabled O-RAN software platforms support dynamic resource allocation, network slicing, and predictive maintenance, demonstrating how software enhances network flexibility and automation. Cloud-native RAN software further enables rapid deployment of network functions, scalable performance management, and seamless integration with edge computing. Growth in this segment is also driven by operators’ increasing focus on automation and real-time analytics to monitor traffic, optimize coverage, and maintain service quality in dense urban and enterprise environments.

Distributed Unit (DU) is projected to lead the market, capturing around 50% of the total revenue share in 2026, supported by its vital role in data aggregation, real-time baseband processing, and low-atency operations that are central to O-RAN architecture. DUs perform key functions such as scheduling, error correction, and resource allocation between the radio units (RUs) and centralized units (CUs), enabling efficient and flexible signal transmission in a disaggregated network. For instance, Vodafone’s Open RAN deployment in the U.K. utilizes cloud-native distributed unit (DU) software to dynamically manage network resources, supporting both rural coverage expansion and urban densification. This approach has delivered notable performance gains while enabling multi-vendor interoperability across different sites. The example highlights the essential role of DUs in providing scalable 5G capacity and consistent performance across varied network environments.

Centralized Units (CUs) are likely represent the fastest-growing segment, driven by cloud-native RAN architectures that centralize control functions, enable AI-driven network optimization, support advanced features such as network slicing, and allow operators to efficiently manage multi-vendor 5G deployments. Centralized Units (CUs) are responsible for non-real-time functions such as mobility management, session control, and coordination among distributed units, enabling operators to optimize network performance at scale. For example, NEC Corporation has developed cloud-native CU platforms that incorporate AI-based orchestration and predictive analytics to improve network efficiency while lowering operational costs. Growth in the CU segment is driven by expanding 5G deployments, the rise of private networks, and increasing demand for multi-vendor interoperability, all of which rely on centralized control for effective load balancing, service optimization, and seamless connectivity.

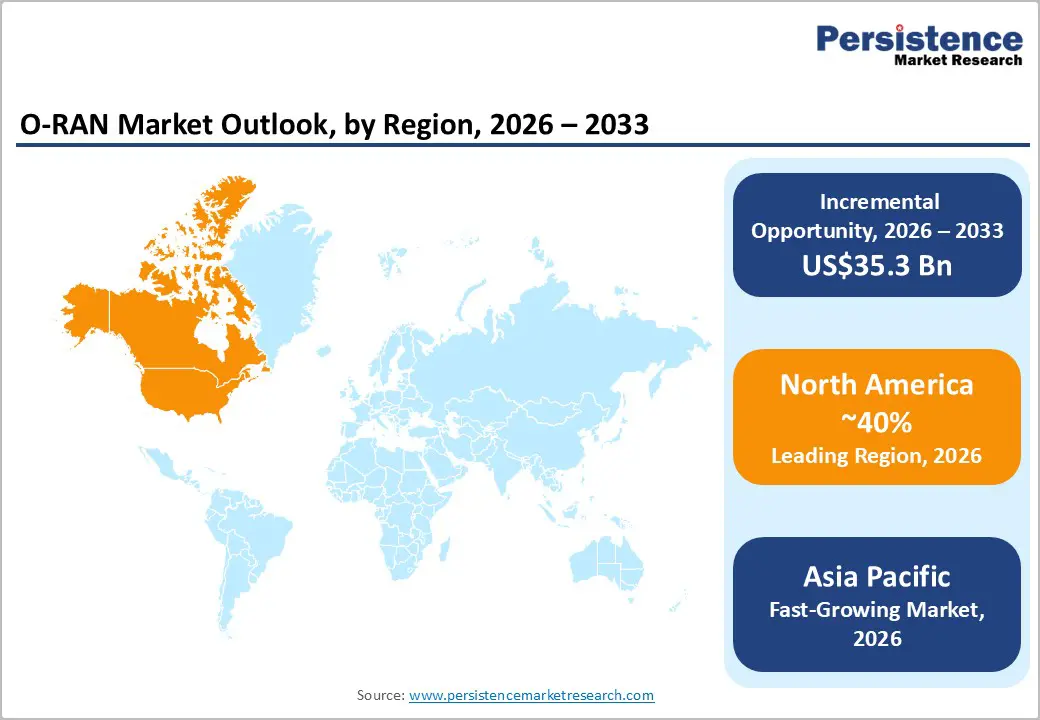

North America is anticipated to be the leading region, accounting for a market share of 40% in 2026, driven by rapid 5G expansion, strong regulatory support for open and interoperable network architectures, and heavy investments in next-generation telecom infrastructure. Operators and vendors in the region are accelerating O-RAN deployments to reduce reliance on traditional proprietary systems and to build more flexible, cost-efficient networks that can support diverse 5G use cases, including IoT, enhanced mobile broadband, and edge computing. The mature cloud ecosystem and availability of advanced virtualization and orchestration technologies further enable operators to adopt cloud-native O-RAN components and to scale deployments more effectively.

The region’s strong position as a center for O-RAN innovation and commercialization is reinforced by the presence of leading technology vendors, advanced R&D capabilities, and supportive policy frameworks designed to promote competition and strengthen supply chain resilience. A notable example is Dish Network’s cloud-native O-RAN deployment in the U.S., where the operator has built an open RAN-compliant 5G broadband network using a broad partner ecosystem that includes Altiostar, Mavenir, Fujitsu, Intel, and Nokia. This deployment demonstrates how North American operators are adopting multi-vendor O-RAN solutions to enhance network agility, create competitive differentiation, and deliver advanced 5G services. Dish’s initiative also highlights how open interfaces and virtualization enable the seamless integration of diverse vendor technologies into a unified network architecture.

Europe is likely to be a significant market for O-RAN in 2026, due to strong regulatory support for open and interoperable networks, widespread 5G rollout initiatives, growing emphasis on vendor diversification, and collaborative deployments by major telecom operators across the region. The European Union’s Digital Decade initiative and similar national strategies aim to accelerate 5G coverage and digital sovereignty, encouraging operators to explore alternatives to traditional proprietary RAN systems. European telecom groups such as Vodafone, Deutsche Telekom, Orange, and Telefónica have publicly committed to advancing O-RAN deployment through collaborative frameworks that drive interoperability, shared testing, and multi-vendor ecosystems, addressing fragmentation and supply chain resilience.

Operators are deploying O-RAN in both urban densification and rural coverage initiatives as they modernize networks, improve performance, and enable advanced services such as network slicing and edge computing. For example, Deutsche Telekom’s commercial O-RAN deployments in Germany, where the operator has partnered with vendors including Nokia, Fujitsu, and Mavenir to introduce multi-vendor, open fronthaul networks across several sites. These deployments showcase how major European carriers are moving beyond pilot tests to real operational environments that leverage open interfaces and disaggregated components for enhanced flexibility and performance.

The Asia Pacific region is expected to be the fastest-growing market for O-RAN in 2026, driven by rapid 5G infrastructure expansion, supportive government initiatives, and rising demand for cost-effective, interoperable network solutions. Telecom operators across the region are increasingly adopting open RAN to improve network flexibility and minimize vendor lock-in, particularly in high-growth markets such as Japan, India, South Korea, and Vietnam, where next-generation mobile services are scaling quickly. Japan has emerged as a global benchmark for O-RAN progress, with operators such as Rakuten Mobile deploying one of the world’s largest open RAN-enabled networks and proving the viability of cloud-native, disaggregated architectures at scale.

The Asia Pacific region is seeing growing investments and ecosystem collaboration that further accelerate O-RAN adoption. For instance, Samsung Electronics Co., Ltd. has been chosen by KDDI in Japan to provide 5G O-RAN-compliant, virtualized RAN solutions, demonstrating how major vendors are adapting open RAN technologies to meet local operator requirements while improving performance and energy efficiency. This development reflects the transition of O-RAN from pilot projects to large-scale commercial networks, supported by advanced hardware and software capabilities. Governments and industry organizations in countries such as India are actively encouraging open RAN adoption through trials and regulatory support, with the goal of fostering domestic innovation and strengthening telecom self-reliance.

The global O-RAN market exhibits a moderately fragmented structure, driven by the coexistence of established telecommunications equipment vendors and emerging cloud-native specialists competing to define the future of open, disaggregated radio access networks. Vendors are investing heavily in research and development, strategic partnerships, and alliances with chipset manufacturers and system integrators to deliver flexible, scalable, and AI-enabled O-RAN platforms. Many vendors emphasize open interface compliance and participation in the O-RAN Alliance to strengthen interoperability and ecosystem adoption.

With key leaders including Mavenir, NEC Corporation, Nokia Corporation, Fujitsu Limited, Samsung Electronics Co., Ltd., Radisys Corporation, Parallel Wireless, ZTE Corporation, AT&T Inc., and Casa Systems, Inc., the market reflects a broad mix of hardware, software, and services expertise that spans public and private network deployments. These players compete through continuous innovation, expanding product portfolios, and strategic collaborations that enhance multi-vendor support and reduce integration complexity for operators. Differentiation strategies include AI-driven network automation, cloud-native orchestration, energy-efficient designs, and support for advanced features such as network slicing and edge computing.

The global O-RAN market is projected to reach US$8.3 billion in 2026.

The O-RAN market is propelled by accelerated 5G rollouts, the demand for cost-effective and interoperable network architectures, and the increasing need for vendor diversification via open, cloud-native RAN solutions.

The O-RAN market is expected to grow at a CAGR of 26.8% from 2026 to 2033.

Key market opportunities include the rise of greenfield 5G deployments, the rapid expansion of private and enterprise networks, and the growing adoption of AI-enabled, cloud-native open RAN solutions.

Mavenir, NEC Corporation, Fujitsu Limited, Nokia Corporation, and Samsung Electronics Co., Ltd. are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Unit

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author