ID: PMRREP30517| 190 Pages | 18 Nov 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

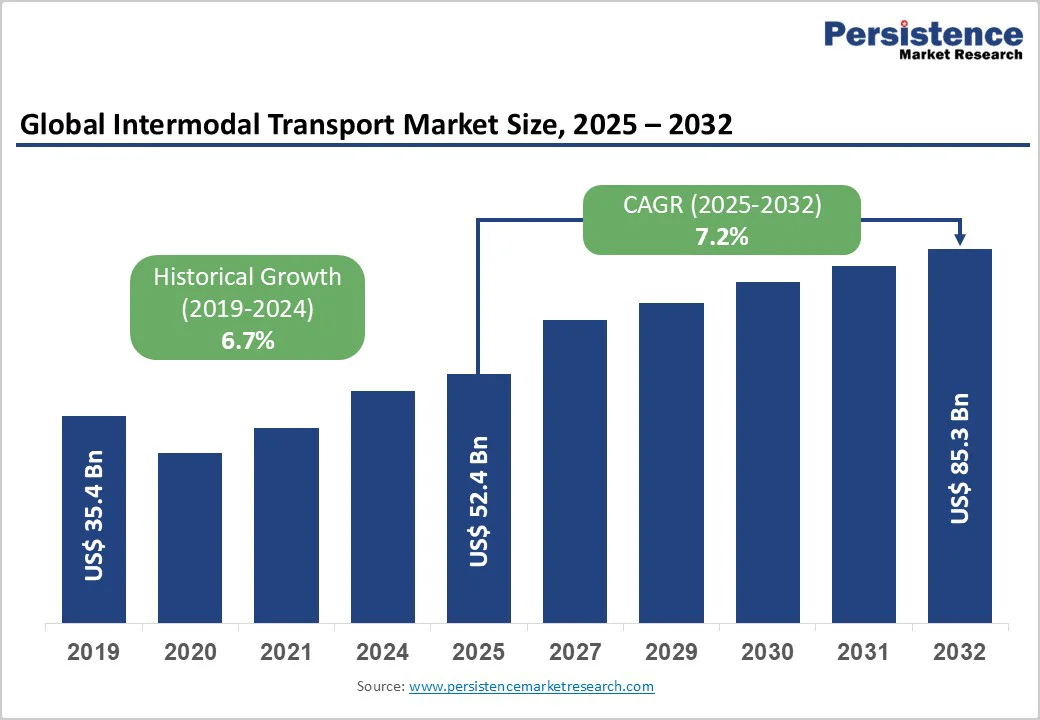

The global intermodal transport market size is likely to value at US$ 52.4 billion in 2025 and is projected to reach US$ 85.3 billion, growing at a CAGR of 7.2% between 2025 and 2032.

The market has demonstrated resilient expansion, reflecting sustained momentum driven by accelerating e-commerce penetration, globalization of supply chains, and strategic modal shift initiatives aimed at decarbonizing freight logistics.

| Key Insights | Details |

|---|---|

| Intermodal Transport Market Size (2025E) | US$ 52.4 Bn |

| Market Value Forecast (2032F) | US$ 85.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.7% |

The exponential expansion of business-to-business e-commerce represents a foundational driver reshaping global logistics, with intermodal transport playing a central role in meeting the evolving demand for efficient, scalable, and flexible freight movement.

Asia Pacific dominates this transformation, capturing 80% of global B2B eCommerce GMV in 2026, while North America experiences gradual market share compression due to APAC’s accelerated digitalization. This digital procurement revolution necessitates transport systems capable of handling fluctuating volumes, diverse cargo types, and compressed delivery timelines. Intermodal transport enables seamless integration of rail, truck, and maritime modes to address these requirements efficiently.

The United States' flexible packaging industry generated $41.5 billion in sales in 2022, reflecting the scale of containerized goods requiring multimodal distribution. India’s packaging sector, valued at over US$86 billion in 2024 and growing at 22-25% annually, combined with the country’s position as the third-largest packaging market globally, further reinforces the Asia Pacific intermodal freight trajectory.

The automotive sector's production volumes and international trade patterns constitute critical demand generators for intermodal freight services. Global car sales reached 74.6 million units in 2024, marking a 2.5% increase, with China accounting for approximately 31% of global sales through 23 million units sold.

Global car manufacturing totaled 75.5 million units, with China capturing 35.4% of production share through a 5.2% output increase. The European Union maintained an €81 billion trade surplus in automotive goods, positioning it as a major exporter despite a 5.9% year-over-year decline. India's automobile industry crossed 31 million units in total vehicle production during FY25, with exports surging 19% to over 5.3 million units, demonstrating robust international shipment requirements.

The United States witnessed new car sales rise 2.3% year-over-year to 1.46 million units in August 2025, with light truck sales advancing 5.1% to 1.22 million units. These production and trade volumes necessitate efficient, cost-competitive intermodal solutions for moving finished vehicles, automotive components, and manufacturing equipment across continental and intercontinental corridors, driving sustained demand for rail-to-truck and truck-to-ship intermodal services.

Despite significant investments, infrastructure capacity limitations and operational bottlenecks continue to constrain intermodal growth potential across critical trade corridors. Port congestion, terminal throughput constraints, and rail network capacity shortages create systemic delays affecting service reliability and shipper confidence.

The Port of Vancouver experienced sustained on-dock footage increases at key terminals, with CN Railway's footage doubling at Vanterm during April 2024, necessitating additional westbound platform movements to alleviate congestion.

Rail infrastructure maintenance and renovation projects on important trunk lines, such as the Hamburg-Berlin corridor in Germany, temporarily reduce available capacity and complicate scheduling for intermodal operators.

European combined transport experienced only 2.85% growth in Q4 2024, with industry sentiment indicators defined as "neutral" for 2025 due to economic slowdown and extensive infrastructure renovation work. Terminal automation adoption remains inconsistent, particularly among smaller facilities struggling with fundamental data management, leading to poor visibility, miscommunication, and suboptimal yard utilization.

The intermodal transport chain's inherent complexity, requiring seamless coordination across multiple modes and operators, amplifies the impact of any single bottleneck, creating cascading delays that erode the competitive advantage against direct trucking alternatives.

The integration of advanced digital technologies presents transformative opportunities to enhance operational efficiency, customer experience, and competitive differentiation across intermodal networks.

Digital twin simulations and AI-assisted routing tools enable streamlined intermodal planning, optimized train slot allocation, and predictive congestion forecasting, allowing operators to dynamically adjust capacity deployment and reduce response times.

Terminal Operating Systems incorporating real-time data platforms, predictive analytics, and IoT-enabled smart containers provide unprecedented shipment visibility, allowing stakeholders to monitor location, temperature, and condition parameters throughout the intermodal journey.

Blockchain technology enhances transparency and security by creating immutable records of transactions, shipment status updates, and documentation transfers, reducing fraud risk and improving traceability for cross-border movements.

DB Schenker introduced an AI-powered optimization tool in January 2024 to reduce costs and improve transit times in intermodal freight services, exemplifying the practical deployment of intelligent systems. Vehicle Booking Systems and automated gate operating software integrate seamlessly with terminal management platforms, reducing truck turnaround times and eliminating manual data entry errors.

The deployment of autonomous freight handling systems at terminals and depots promises further efficiency gains by improving equipment utilization and reducing labor dependency. These technological enablers collectively position intermodal operators to deliver truck-competitive reliability, superior customer communication, and data-driven continuous improvement, capturing market share from less transparent, less agile logistics alternatives.

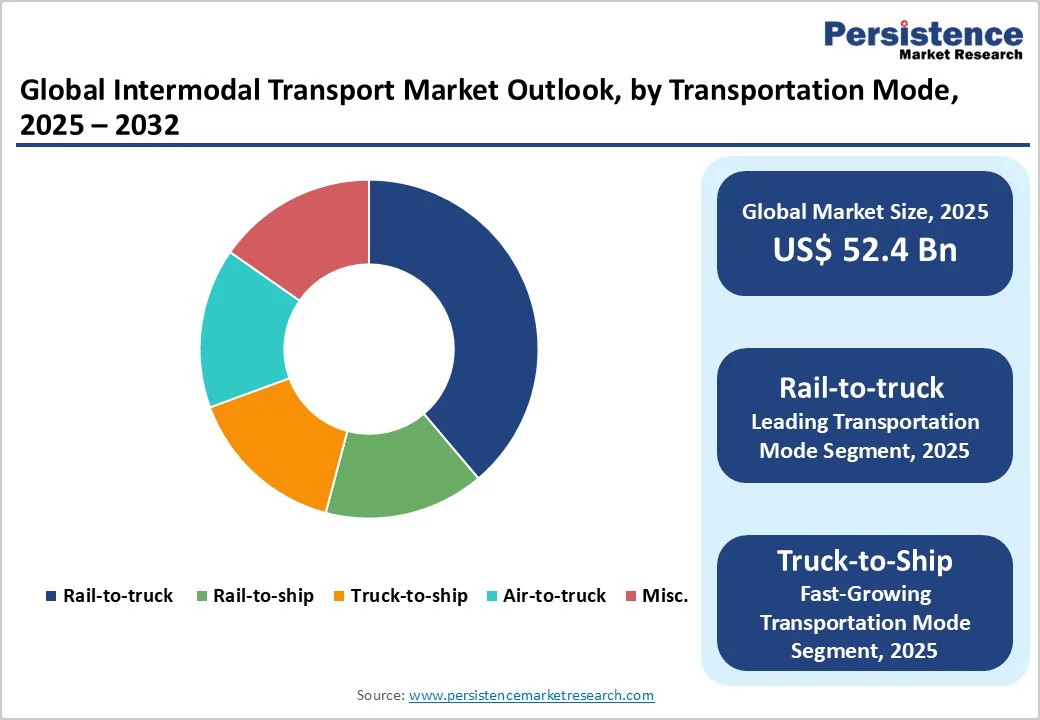

Rail-to-truck intermodal dominates the global market, capturing 43.0% share in 2025, driven by its optimal balance of long-haul rail efficiency and last-mile truck flexibility. This configuration leverages rail's fuel efficiency for distances exceeding 750-1,500 miles while utilizing trucking for terminal access and final delivery, creating cost savings of 10-30% compared to over-the-road trucking, particularly for moves over 500 miles.

The rail-to-truck segment benefits from infrastructure investments in double-stacking capabilities and automated terminals, with North American logistics firms adopting this solution to avoid driver shortages and rising fuel costs. J.B. Hunt, the largest domestic intermodal operator handling nearly 25% of all domestic intermodal shipments, relies primarily on rail-to-truck configurations through its exclusive partnership with BNSF Railway in the West and relationships with Norfolk Southern and CSX in the East.

Intermodal Freight Transport commands 34% market share in 2025, representing the core transportation execution services that physically move containerized cargo across rail, truck, maritime, and occasionally air modes. This segment encompasses the operational management of container movements, equipment provision, and coordination of modal transitions at intermodal terminals, forming the foundation upon which specialized value-added services are built.

Major intermodal freight transport providers including J.B. Hunt, Hub Group, Schneider, and STG Logistics operate large domestic container fleets and maintain strategic partnerships with Class I railroads to offer coast-to-coast service.

The segment's market leadership reflects the fundamental nature of physical transportation as the primary service shippers require, with asset-based intermodal marketing companies controlling equipment fleets and capacity to ensure reliable execution.

Freight Routing & Scheduling is experiencing the fastest growth among service type categories, driven by digital transformation initiatives and the deployment of AI-powered optimization tools that deliver measurable efficiency gains and cost reductions.

Automated routing software uses AI and real-time data to create optimal delivery routes based on multiple factors including traffic conditions, delivery time windows, vehicle capacities, driver schedules, and dynamic disruptions, reducing fuel costs by 10-20% and improving on-time delivery performance.

East Asia commands 18% of the global intermodal transport market, driven by China's dominant manufacturing base, expanding export volumes, and strategic investments in rail-truck connectivity supporting both domestic distribution and international trade flows.

China strengthened its position as the largest automobile producer in 2024, increasing output by 5.2% and capturing 35.4% of global production share, generating substantial intermodal freight demand for automotive components, finished vehicles, and manufacturing equipment. CMA CGM's intermodal operations in Asia processed 2 million TEU in 2023, with 81% moving via greener rail and barge modes, reflecting the region's infrastructure capacity and modal integration.

China Railway Container Transport Co., Ltd. provides comprehensive container railway transportation, container multimodal transportation, and international freight forwarding services, leveraging the country's extensive rail network for inland distribution.

The Trans-China Railway service delivers cargo from Vietnam, Thailand, Korea, and Japan ports to Russia, Belarus, and Central Asian countries via Chinese ports including Dalian, Tianjin, and Lianyungang, demonstrating East Asia's role as a critical intermodal hub linking Pacific trade lanes with Eurasian corridors.

The region's containerized export model, supporting global supply chains for electronics, automotive, machinery, and consumer goods, creates sustained intermodal demand as goods move from manufacturing clusters to coastal ports via rail-truck combinations before ocean shipment.

Europe captures 24% of the global intermodal transport market, supported by well-established combined transport networks, extensive rail freight corridors, and strong policy commitment to modal shift as a decarbonization strategy. Combined transport in Europe recorded 2.85% growth in Q4 2024, with the resumption of traffic on key trunk lines including the St. Gotthard Base Tunnel and railway lines in Spain's Valencia region contributing to improved performance.

The European Union's Trans-European Transport Network (TEN-T) corridors are receiving substantial investment to enhance cross-border connectivity and boost capacity, with projects like the Brenner Base Tunnel enabling longer, heavier trains to traverse Alpine bottlenecks more efficiently after 2030 completion.

Rail Baltica, designed to connect the Baltic States with the rest of Europe, will become a key component of the North Sea-Baltic Corridor once operational around 2030, opening new intermodal opportunities and improving north-south freight flow.

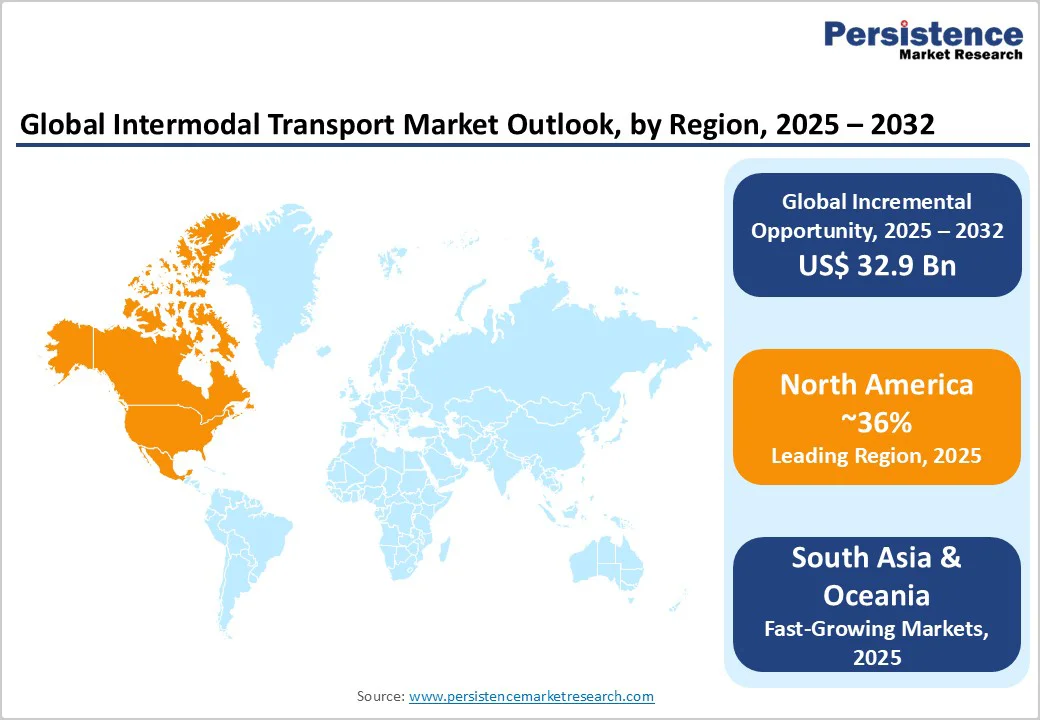

North America dominates the global intermodal transport market with 36% share, reflecting the region's mature Class I railroad infrastructure, extensive intermodal terminal networks, and strong shipper adoption driven by cost competitiveness, capacity advantages, and sustainability benefits.

Total U.S. intermodal volume rose 9.8% year-over-year in Q3 2024, marking the fourth consecutive quarter of growth, with economic rebound, supply chain diversification, and government support for green logistics infrastructure driving adoption.

The Southwest region experienced the highest intermodal volume increase at 19% in 2024, attributed to higher import volumes from Mexico and the ports of Los Angeles and Long Beach. J.B. Hunt, the largest domestic intermodal operator, handles nearly 25% of all domestic intermodal shipments through its exclusive partnership with BNSF Railway in the West and relationships with Norfolk Southern and CSX in the East.

Canada's intermodal rail infrastructure demonstrated robust performance, with CN Railway and CPKC combined moving 96,719 containers eastbound from western ports in April 2024, representing a 56.5% increase over April 2023.

Canadian Class I freight traffic increased 7% in Q2 2024, measured by revenue-ton-miles, with growth led by grain & fertilizers, energy, chemicals and plastics, and automotive, reflecting broad-based intermodal demand across commodity categories.

The global intermodal transport market exhibits an oligopolistic structure, characterized by the dominance of a few large-scale logistics and shipping companies with integrated multimodal capabilities. Maersk Line, J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., XPO Logistics, Hub Group, Inc., and Schneider National represent leading players leveraging technology-driven intermodal solutions to enhance connectivity across rail, road, and maritime networks.

These companies maintain strong global footprints through strategic collaborations and asset-based networks, enabling seamless freight integration and cost optimization. CMA CGM Group (CEVA Logistics) and Deutsche Bahn AG (DB Schenker) further strengthen the competitive intensity by expanding their multimodal and terminal operations.

The global intermodal transport market is likely to value at US$ 52.4 Bn in 2025.

The Rail-to-truck segment is expected to hold around 43% market share by Transportation Mode in 2025. This leading position is driven by its cost efficiency, extensive domestic connectivity, and suitability for long-haul freight movement between major industrial hubs and distribution centers.

The intermodal transport market is expected to witness a CAGR of 7.2% from 2025 to 2032.

The growth of the intermodal transport market is driven by the surge in e-commerce and digital trade, expanding automotive production and exports, and large-scale investments in dedicated freight corridors and intermodal infrastructure.

Key market opportunities in the Intermodal Transport market include the adoption of digitalization and real-time visibility solutions alongside sustainability mandates and modal shift incentives that enhance efficiency, transparency, and decrease comparison across global freight networks.

The leading global players in the Intermodal Transport market are Maersk Line, Hub Group, Inc., Schneider National, J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., XPO Logistics, CMA CGM Group (CEVA Logistics), CSX Transportation, Deutsche Bahn AG (DB Schenker), and Rhenus Logistics.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Transportation Mode

By Service Type

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author