ID: PMRREP33351| 223 Pages | 8 Jan 2026 | Format: PDF, Excel, PPT* | Semiconductor Electronics

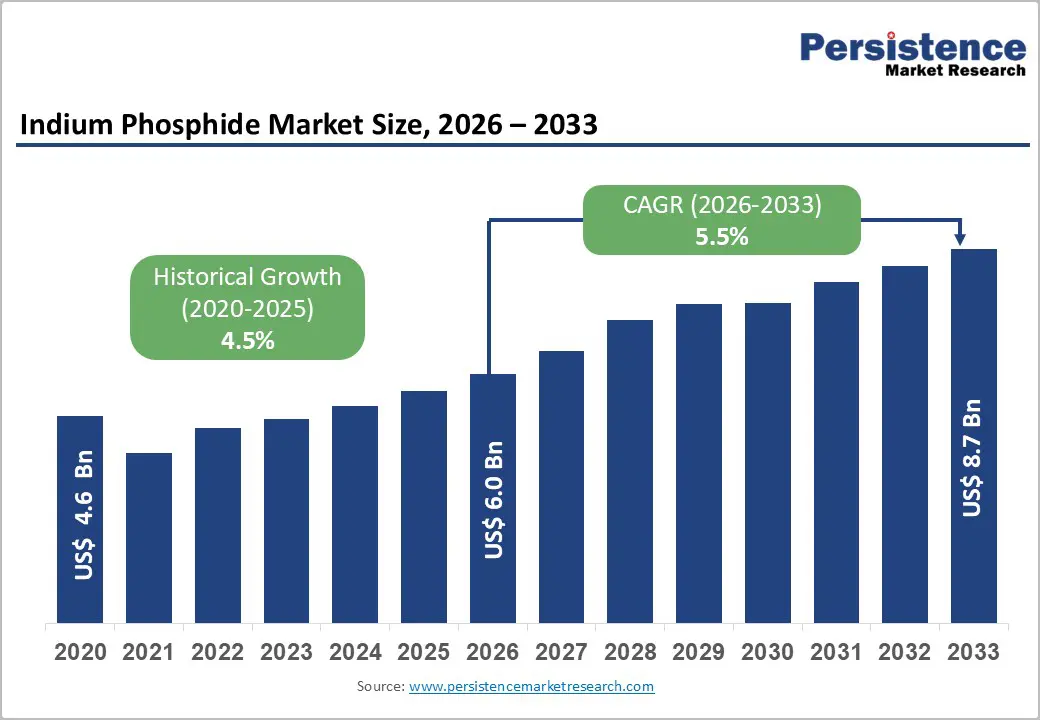

The global Indium Phosphide (InP) market size is expected to reach US$ 6.0 billion by 2026. It is projected to further expand to US$ 8.7 billion by 2033, growing at a 5.5% CAGR over the forecast period from 2026 to 2033. The growth is primarily driven by rising requirements for high-speed optical communication infrastructure, the rapid rollout of 5G and emerging 6G networks, and increasing adoption of photonic integrated circuits (PICs) in telecom and datacom systems. The telecommunications sector, which contributes over 40% of total revenue, remains the core demand driver, driven by continuous network upgrades.

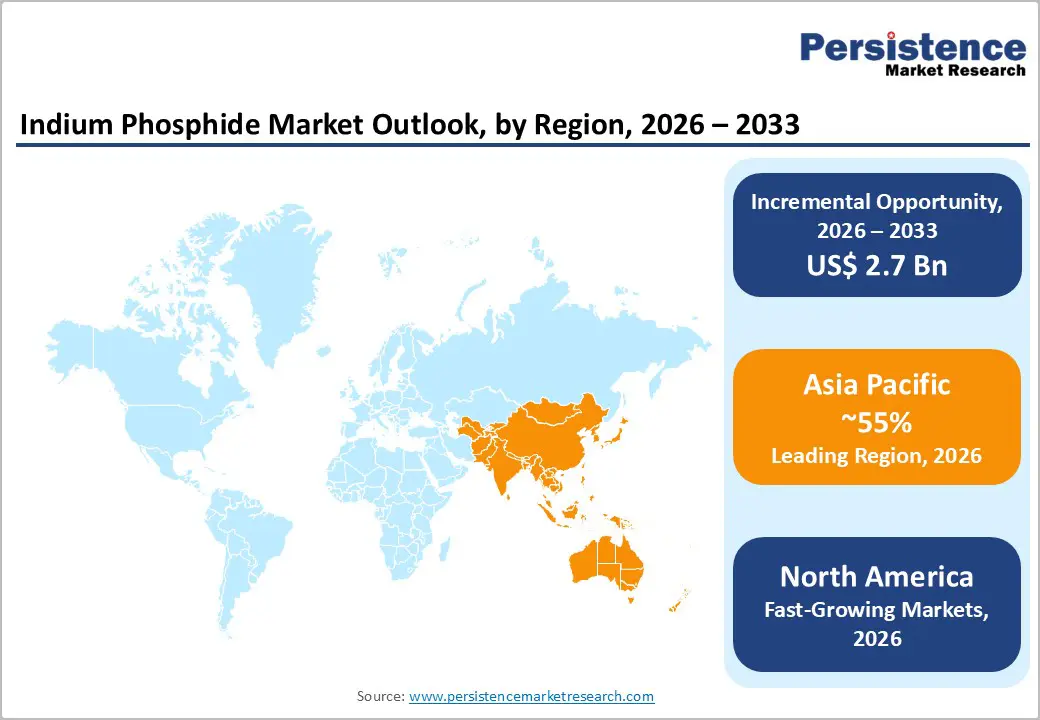

Meanwhile, emerging applications in consumer electronics, automotive, and aerospace & defense are creating new growth avenues. Asia Pacific, accounting for more than 55% of global revenue, dominates the market due to strong compound semiconductor manufacturing capabilities and sustained investments in optical networks. Despite cost and manufacturing challenges, InP is well-positioned to benefit from long-term trends in digital connectivity, advanced sensing, and autonomous technologies, with future market expansion hinging on cost optimization, ecosystem maturity, and OEM adoption strategies.

| Key Insights | Details |

|---|---|

|

Indium Phosphide Market Size (2026E) |

US$ 6.0 Bn |

|

Market Value Forecast (2033F) |

US$ 8.7 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

5.5% |

|

Historical Market Growth (CAGR 2020 to 2025) |

4.5% |

The rapid expansion of cloud-based services, artificial intelligence, and big data analytics is significantly increasing global data transmission requirements across international communication networks. To manage this surge, modern data centers are deploying ultra-high-speed optical transceivers supporting 800 Gbps and next-generation 1.6 Tbps data rates, which depend heavily on indium phosphide (InP)–based photonic technologies. As a result, hyperscale cloud service providers have restructured their network architectures to incorporate high-capacity coherent optical modules, sustaining strong demand for InP wafers and epitaxial materials.

According to the International Telecommunication Union (ITU), global IP traffic is expected to grow at a compound annual rate exceeding 26% through 2027, directly driving increased consumption of InP-based lasers, modulators, and photonic integrated circuits. Market assessments indicate that data center operations account for approximately 35–38% of total telecommunications segment revenue, with photonic integrated circuits the fastest-growing application area within this domain. In parallel, hyperscale data center operators are investing heavily, with annual capital expenditures estimated at US$180–200 billion, ensuring sustained procurement of advanced compound semiconductor materials required for coherent optical transceiver production.

The broader data center industry continues to expand rapidly. The World Economic Forum estimates the global data center market at US$242.7 billion, projecting growth to over US$584 billion by 2032. Leading technology companies such as Amazon, Google, Microsoft, and Meta are driving this expansion, with the number of hyperscale data centers doubling roughly every five years. These facilities now manage more than 95% of global internet traffic and are increasingly regarded as strategic infrastructure, reinforcing long-term demand for high-performance InP-based optical communication solutions.

Indium Phosphide production depends critically on high-purity phosphorus and refined indium sourcing, materials subject to escalating geopolitical trade restrictions and supply concentration risks. China's 2024 expansion of export controls to indium-bearing compounds and antimony derivatives introduced unprecedented procurement uncertainty, forcing Western semiconductor manufacturers to qualify alternative supplier networks and accelerate vertical integration investments.

The processing requirements for semiconductor-grade phosphorus and indium demand specialized metallurgical capabilities concentrated in a limited number of geographic regions, creating supply chain bottlenecks resistant to rapid remediation. Industry reports indicate that lead-time extension for high-purity InP source materials increased from 8-12 weeks to 16-20 weeks during 2024, directly constraining manufacturing output and marginal profitability. Semiconductor equipment manufacturers have reported that MOCVD (metal-organic chemical vapor deposition) reactor utilization rates for InP production declined by 12-15% as procurement delays disrupted production scheduling. The commercial urgency for supply chain diversification has compelled InP manufacturers to implement price increases ranging from 15-22% on certain product specifications, creating temporary demand suppression in cost-sensitive application segments.

The indium phosphide (InP) market is poised to unlock significant new growth opportunities as its application base expands beyond traditional telecom and datacom segments into quantum technologies, advanced consumer electronics, and defense modernization programs. One of the most promising long-term opportunities lies in quantum computing and quantum photonics, where InP is uniquely suited for single-photon sources and detectors operating at telecommunications wavelengths around 1550 nm. Substantial government-backed investments in quantum technologies across North America, Europe, and the Asia Pacific, amounting to US$8–10 billion, are accelerating the development of InP-based quantum photonic integrated circuits. As commercial quantum hardware manufacturers formalize multi-year supply partnerships, quantum photonics is expected to account for 8–12% of global InP wafer demand by 2033, representing an incremental US$600–750 million opportunity.

In parallel, the integration of short-wavelength infrared (SWIR) sensing into mainstream consumer electronics is creating a high-volume growth avenue. InP-based InGaAs sensors are increasingly adopted for biometric authentication and advanced imaging in premium smartphones, with consumer demand for SWIR projected to grow at a 12.8% CAGR through the early 2030s. The addressable market for consumer-grade SWIR components is estimated at US$1.2–1.5 billion by 2032, supported by large-scale smartphone production and improving cost economics.

Additionally, defense and aerospace modernization initiatives are reinforcing long-term demand stability. Re-shoring mandates, multi-year military procurement programs, and dedicated funding for III–V semiconductors, particularly InP, are strengthening domestic supply chains and creating resilient, high-value opportunities for InP manufacturers engaged in strategic government partnerships.

Electronics-grade Indium Phosphide dominates the global market, accounting for more than 65% of total revenue through 2033, supported by its extensive use in mature, high-volume applications. This grade comprises ultra-high-purity InP materials designed for photonic integrated-circuit epitaxy and RF device manufacturing, meeting stringent performance benchmarks, including ultra-low free-electron concentration and minimal dislocation density. Its leadership position is reinforced by long-standing supply agreements with telecommunications equipment manufacturers, semiconductor foundries, and consumer electronics component suppliers, which have standardized their production processes to electronics-grade specifications. Market consolidation among leading wafer producers, including Sumitomo Electric Semiconductor Materials, IQE plc, and AXT Inc., further strengthens supply chain dependence on this grade. Stable pricing, predictable performance, and high production yields of 92–95% enhance procurement confidence and support economically sustainable manufacturing at scale.

In contrast, industrial-grade Indium Phosphide represents the fastest-growing segment, expanding at a projected CAGR of 6.1%. With relaxed purity requirements and lower costs, it is increasingly adopted for quantum photonics research, infrared detector development, and advanced RF prototyping. Strong demand from research institutions and government-funded university programs is driving rapid adoption, while ongoing commercialization of these technologies positions industrial-grade InP as a feeder segment for future electronics-grade demand.

The telecommunications sector remains the dominant end-use industry for Indium Phosphide, accounting for over 40% of total market revenue due to its structural reliance on InP-based optical transmission technologies. This leadership spans long-haul optical networks, metro network infrastructure, and next-generation pluggable optical transceiver modules that support network densification and cost-efficient capacity upgrades. Global telecom operators have committed more than US$ 500 billion in cumulative capital expenditure through 2027 for optical network modernization, directly reinforcing long-term demand for InP components. Leading equipment vendors such as Nokia, Ciena, and ZTE have established strategic manufacturing partnerships with InP wafer suppliers, embedding multi-year procurement visibility across the supply chain. Critically, alternative material platforms cannot support 800G and 1.6T transmission speeds, ensuring InP’s continued indispensability in advanced optical systems.

In parallel, data centers are the fastest-growing end-use vertical, projected to expand at a CAGR of 6.7%. Hyperscale cloud providers are rapidly upgrading internal interconnect architectures from 400G to 800G and 1.6T between 2025 and 2028, driving accelerated adoption of InP-based transceivers. High-speed optical interconnects deliver measurable capital efficiency gains, justifying premium pricing and supporting favorable economics for InP material suppliers. Industry milestones, including Coherent Corporation’s 3.2T transceiver ramp, further validate large-volume demand, with global data center optical interconnect spending projected to exceed US$ 18–22 billion by 2032.

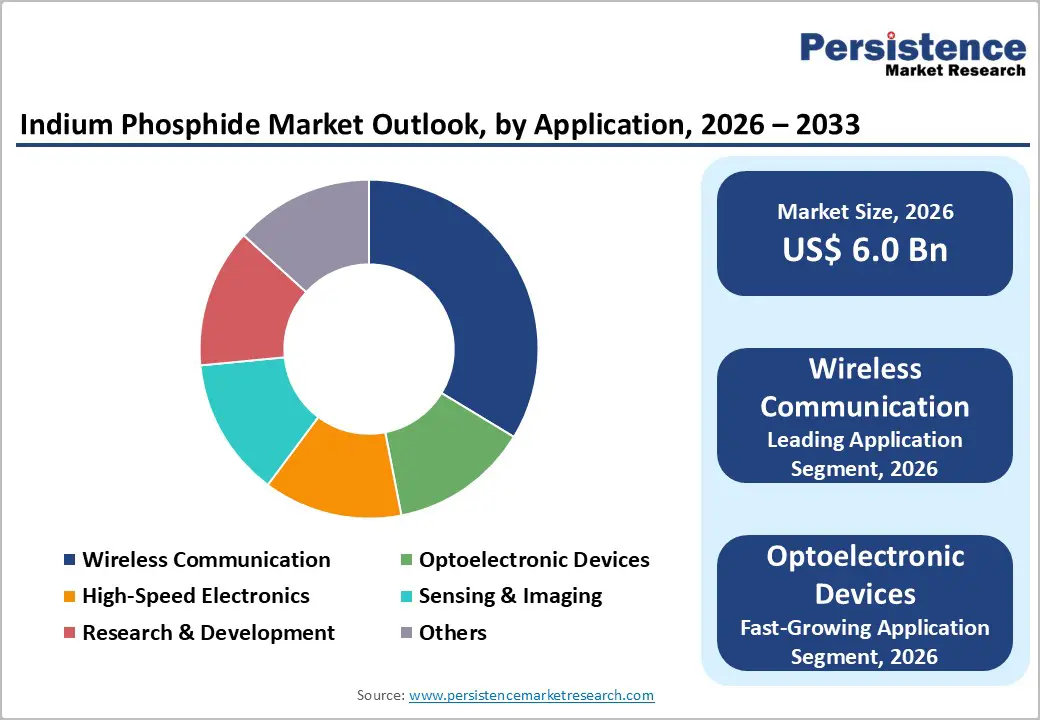

Wireless communication remains the dominant application segment for Indium Phosphide, accounting for over 45% of total market revenue, driven primarily by its extensive use in RF power amplifiers for 5G infrastructure and early-stage 6G platform development. InP’s superior electron mobility, high-frequency performance, and power efficiency enable telecom operators to meet stringent spectrum efficiency and performance requirements. The global 5G RF component market is valued at approximately US$ 12–15 billion annually, with InP-based RF amplifiers occupying the highest-margin segment. Looking ahead, global 6G research programs have formally identified InP as a preferred material for sub-THz RF devices, reinforcing long-term demand visibility.

Optoelectronic devices represent the fastest-growing application segment, projected to expand at a 6.5% CAGR through the forecast period. This growth is driven by rising adoption of photonic integrated circuits across data communication and telecom networks, supporting sustained demand independent of wireless infrastructure investment cycles. The transition toward integrated photonics enhances this segment’s structural resilience.

Meanwhile, high-speed electronics applications such as HBTs and HEMTs continue to generate stable demand from aerospace and defense sectors. Sensing and imaging applications, including infrared detectors and quantum photonics, are expanding at 8–10% annually, while research and development activities, supported by government-funded quantum and photonics initiatives, provide additional revenue stability and innovation-driven growth.

Asia Pacific continues to dominate the global market, accounting for over 55% of total revenue, supported by its deeply entrenched semiconductor manufacturing ecosystem and its strategic role in global telecommunications and digital infrastructure supply chains. The region’s leadership is underpinned by China’s position as the world’s largest hub for telecommunications equipment manufacturing, which drives substantial consumption of indium phosphide (InP) for optoelectronic components serving both domestic and export markets. China’s scale advantage is further reinforced by its rapidly expanding data-center footprint, with 449 facilities recorded by the end of 2023, and its growing energy footprint, as the International Energy Agency reports China represented 25% of global data-center electricity consumption in 2024, second only to the United States.

Japan strengthens regional resilience through vertically integrated production of indium and phosphorus raw materials, led by companies such as JX Nippon Mining & Metals, thereby lowering sourcing risks and stabilizing costs. Japan also hosts 251 data centers across 33 markets, supporting sustained demand for high-performance photonic materials. Taiwan’s advanced foundry capabilities and photonics-focused manufacturers maintain long-term partnerships with InP wafer suppliers, while South Korea’s semiconductor leaders, including Samsung and SK Hynix, drive demand for high-specification InP materials.

Southeast Asia represents the fastest-emerging growth pocket. According to the US-ASEAN Business Council, the region hosts over 370 data centers yet remains 55–70% underpenetrated, with demand projected to grow at a 20% CAGR through 2028, creating an US$11 billion addressable market. Singapore, Indonesia, Malaysia, Thailand, and Vietnam are rapidly positioning themselves as regional digital hubs. India further amplifies regional momentum, with hyperscale data centers expanding beyond metros, led by Mumbai (41%), Chennai (23%), and Delhi NCR (14%), reinforcing Asia Pacific’s long-term dominance.

North America is emerging as one of the fastest-growing regions in the global Indium Phosphide market, supported by its strong innovation ecosystem and favorable policy environment. The region currently accounts for around 22–25% of global revenue and is projected to grow at a robust 6.7% CAGR through 2033, outpacing the overall market average. Growth is led overwhelmingly by the United States, which contributes nearly 75–80% of regional demand, underpinned by its concentration of semiconductor research institutions, defense contractors, and hyperscale cloud service providers.

At the country level, the U.S. drives consumption through advanced manufacturing of optical communication equipment and next-generation RF device development. Substantial government funding via agencies such as the NSF and DARPA has accelerated InP adoption in photonics, RF, and quantum technologies. The CHIPS and Science Act has further strengthened domestic semiconductor manufacturing, explicitly supporting compound semiconductor platforms, including InP.

Defense modernization programs and large-scale optical transceiver upgrades by North American data center operators remain key growth catalysts. Additionally, rising investments in quantum photonics research and strong venture capital inflows into photonic integrated circuit startups continue to expand InP demand, positioning North America as a high-growth, high-value regional market.

The InP ecosystem is currently led by established photonics players with deep expertise in epitaxy and compound semiconductor manufacturing. Many of these companies are evaluating downstream expansion into consumer and automotive markets. At the same time, competitive pressure from gallium arsenide (GaAs) remains significant, particularly in cost-sensitive, high-volume applications.

The global Indium Phosphide market exhibits a moderately consolidated competitive structure dominated by five to eight major suppliers controlling approximately 70-75% of global InP wafer production capacity. Market leadership concentrates among specialized compound semiconductor manufacturers rather than large-scale silicon wafer producers, reflecting distinct manufacturing process requirements and technical expertise barriers. The competitive landscape is characterized by technology-driven differentiation focused on material purity specifications, epitaxial layer uniformity, and process innovation rather than price competition, supporting relatively stable pricing dynamics.

InP faces structural challenges, including higher wafer costs (3–4× GaAs), smaller wafer diameters, and lower manufacturing yields. These factors constrain mass-market scalability and emphasize the importance of process innovation, yield improvement, and potential migration to larger wafer formats over time.

The Indium Phosphide market is estimated to be valued at US$ 6.0 Bn in 2026.

The key demand driver for the Indium Phosphide market is the rapid expansion of high-speed optical communication, data centers, and 5G/6G networks requiring high-performance optoelectronic and photonic devices.

In 2026, the Asia Pacific region will dominate the market with an exceeding 55% revenue share in the global Indium Phosphide market.

Among applications, Wireless Communication has the highest preference, capturing beyond 45% of the market revenue share in 2026, surpassing other applications.

Sumitomo Electric Industries, AXT Inc., JM Gallium, Showa Denko, II-VI Incorporated, Semiconductor Wafer Inc., Wafer World, Inc., and IQE plc. are a few leading players in the Indium Phosphide market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Grade

By Industry

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author