ID: PMRREP29293| 196 Pages | 18 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

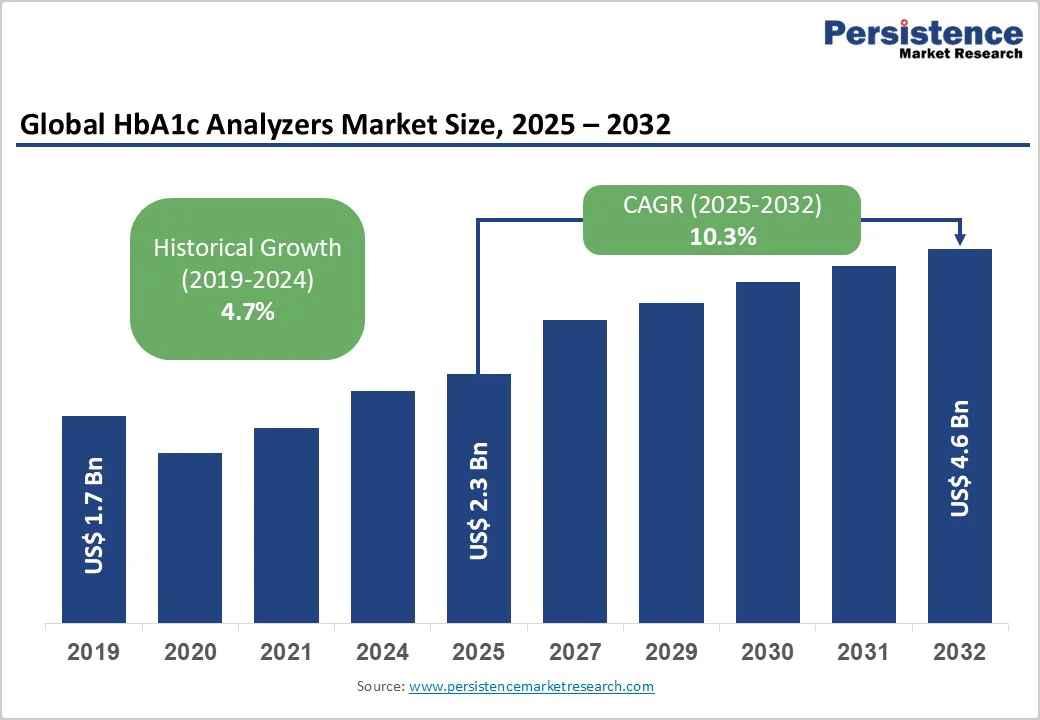

The global HbA1c analyzers market size is likely to be valued at US$2.3 Billion in 2025, and is estimated to reach US$4.6 Billion by 2032, growing at a CAGR of 10.3% during the forecast period 2025−2032, driven by increasing diabetes prevalence, advancements in point-of-care (POC) diagnostic technology, and expanding demand for rapid blood testing.

This acceleration is underpinned by shifting healthcare paradigms emphasizing decentralized diagnostics and home-based testing, particularly across emerging economies. The integration of artificial intelligence (AI) and digital health technologies is fostering enhanced analyzer accuracy and operational efficiency, catalyzing expanded adoption across clinical and non-clinical settings.

| Key Insights | Details |

|---|---|

|

HbA1c Analyzers Market Size (2025E) |

US$2.3 Bn |

|

Market Value Forecast (2032F) |

US$4.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

10.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.7% |

The global shift toward integrating continuous glucose monitoring systems with HbA1c analyzers is shaping a new frontier in diabetes management. The International Diabetes Federation (IDF) estimates that by 2045, over 700 million individuals will live with diabetes, which is likely to accelerate the demand for comprehensive glycemic control tools that provide both instantaneous glucose level tracking and long-term glycation status, measurable via HbA1c. This integration enhances clinical accuracy by correlating average glucose levels with HbA1c results, enabling personalized patient care plans. Recent innovations led by industry pioneers are embedding CGM readouts with HbA1c data analytics through cloud-based platforms, enabling real-time therapeutic decisions.

Regulatory bodies are witnessing a surge in approvals for combined CGM + HbA1c diagnostic devices, marked by diverse standards across the U.S. Food and Drug Administration (FDA) and the European Union (EU)’s in vitro diagnostic medical devices (IVDs) directives. As digital health infrastructure expands and reimbursement policies adapt, this hybrid diagnostic approach is nurturing significant market growth. This intersection is creating a holistic disease monitoring ecosystem, which bridges episodic HbA1c testing with continuous glucose data, augmenting clinical outcomes and patient adherence markedly.

The HbA1c analyzers market growth is being increasingly challenged by fragmented reimbursement frameworks across key markets, leading to variable adoption rates and pricing pressures. In heterogeneous healthcare systems, particularly in emerging regions, payer reimbursement policies are inconsistent or absent for innovative testing formats such as POC and home-based diagnostics.

For instance, Europe’s multiple health technology assessment (HTA) agencies employ divergent evaluations affecting device pricing and market entry, complicating multi-country launches. Similarly, in the U.S., reimbursement disparities between Medicare, Medicaid, and private insurers generate complexity in coverage decisions, especially for novel integrated CGM-HbA1c diagnostic devices. This regulatory patchwork introduces risk factors in the form of delayed product launches and revenue leakage due to reimbursement denials or underpayments. The combination of these constraints tempers growth potential by limiting scalability and discouraging innovation investment where payer clarity is lacking.

Emerging convergence of AI with HbA1c analyzers presents a compelling growth frontier. AI algorithms enable enhanced precision by autonomously interpreting complex assay data and predicting glycemic trends, facilitating proactive diabetes management. Coupled with telemedicine and mobile health platforms, this integration extends disease monitoring beyond clinic walls.

Home-based dried blood spot (DBS) collection kits address unmet needs for accessible, user-friendly testing modalities. DBS kits facilitate remote sample collection, reducing patient burden and improving follow-up adherence. Policies supporting telehealth reimbursement mechanisms and evolving regulatory acceptance of home-based diagnostics amplify this opportunity. Strategic investments focusing on AI-enabled home testing platforms are thus positioned to yield lucrative returns and redefine diabetes care.

Point-of-care testing devices are expected to dominate with a commanding 76.5% of the revenue share in 2025. Their ascendancy reflects a growing preference for decentralized, rapid testing aligned with patient-centric care models. POC analyzers leverage portability, ease of use, and faster turnaround times, often delivering results within minutes, boosting clinical workflows and enabling timely therapeutic interventions. Immunoassay-based technologies underpin many POC devices, contributing to their enhanced specificity and robustness in non-laboratory settings. Market data reveals POC devices are extensively adopted across outpatient clinics, community pharmacies, and increasingly in homecare contexts, where ease of access and immediacy are paramount. Ongoing advances in miniaturization, digital integration, and user-friendly interfaces continue to spur adoption, facilitating rapid diagnosis and chronic disease management outside traditional laboratory confines.

The remote HbA1c testing segment is projected to be the fastest-growing between 2025 and 2032, boosted by the rising demand among patients for convenient, non-invasive testing options compatible with telehealth and chronic disease management programs. Home-based DBS collection kits, augmented by AI-driven result interpretation, are revolutionizing accessibility, particularly in underserved or remote populations. These technologies reduce patient burden by enabling self-collection, improving compliance, and supporting continuous health monitoring frameworks. The convergence of these devices with digital health ecosystems and evolving reimbursement models further fuels growth.

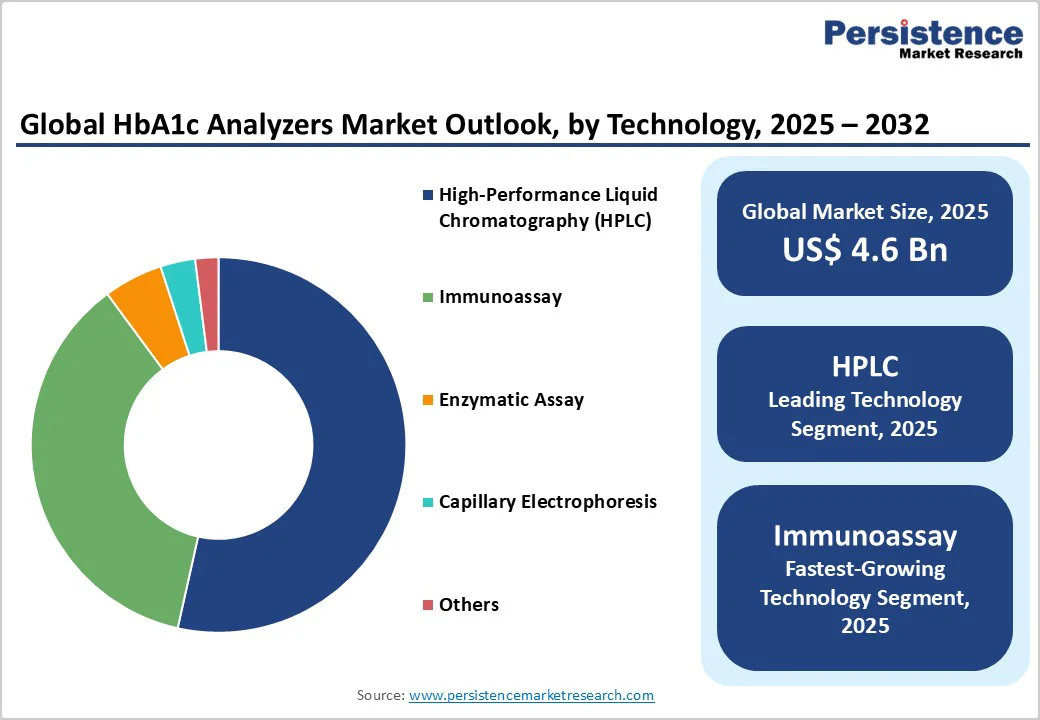

HPLC is set to retain its leadership as the preeminent technology for HbA1c analysis with an estimated 53.3% market share in 2025. Widely recognized for its high accuracy and sensitivity, HPLC is particularly indispensable in laboratories and specialty clinical settings that necessitate precise quantitation, including hemoglobin variant detection, critical for thalassemia and sickle cell disease populations. This technology's robustness provides clinicians with confidence in diagnostic data, sustaining its market leadership despite growing competition. HPLC analyzers also benefit from established certification protocols set by the National Glycohemoglobin Standardization Program (NGSP) and the International Federation of Clinical Chemistry (IFCC), solidifying their scientific and regulatory foundation.

Immunoassay is likely to emerge as the fastest-growing segment from 2025 to 2032, attributable to the adaptability of the technology across decentralized and point-of-care applications, including portable analyzers and home-use kits. Immunoassays offer rapid results with high specificity and reduced complexity compared to chromatography methods, enabling broader accessibility and reducing the need for specialized laboratory infrastructure. Innovations incorporating immunoassay principles into smartphone-enabled and wireless devices are expanding market penetration. The cost-efficiency of this technology, combined with regulatory approvals favoring simplified testing modalities, positions immunoassay as a pivotal growth driver. Its capacity to address unmet demand in emerging markets and remote settings aligns with global trends toward democratized healthcare diagnostics.

Diagnostic laboratories and reference centers are poised to command the largest end-user revenue share at approximately 47.3% in 2025. These facilities underpin the backbone of centralized HbA1c testing, equipped with sophisticated analyzers and high throughput capacity, enabling standardized and precise diagnostics. Their critical role is emphasized by adherence to rigorous quality controls, regulatory compliance, and integration with clinical workflows governing patient management. These centers primarily serve hospitals, specialty clinics, and research institutions, making them essential contributors to overall market revenue. Despite the rise of decentralized testing, diagnostic laboratories maintain critical market relevance through their ability to handle complex assays, variant detection, and bulk testing.

Homecare end-users represent the fastest-growing segment with a projected CAGR from 2025 to 2032. This growth correlates directly with the proliferation of telehealth services, patient empowerment initiatives, and innovations in sample collection such as DBS kits. Home testing solutions decrease healthcare system burdens by enabling frequent monitoring outside clinical environments and fostering proactive disease management. Increased regulatory acceptance and reimbursement reform further promote accessibility. Digital linkage of home testing devices to electronic health records and remote monitoring platforms can accelerate clinical adoption and reshape traditional patient pathways.

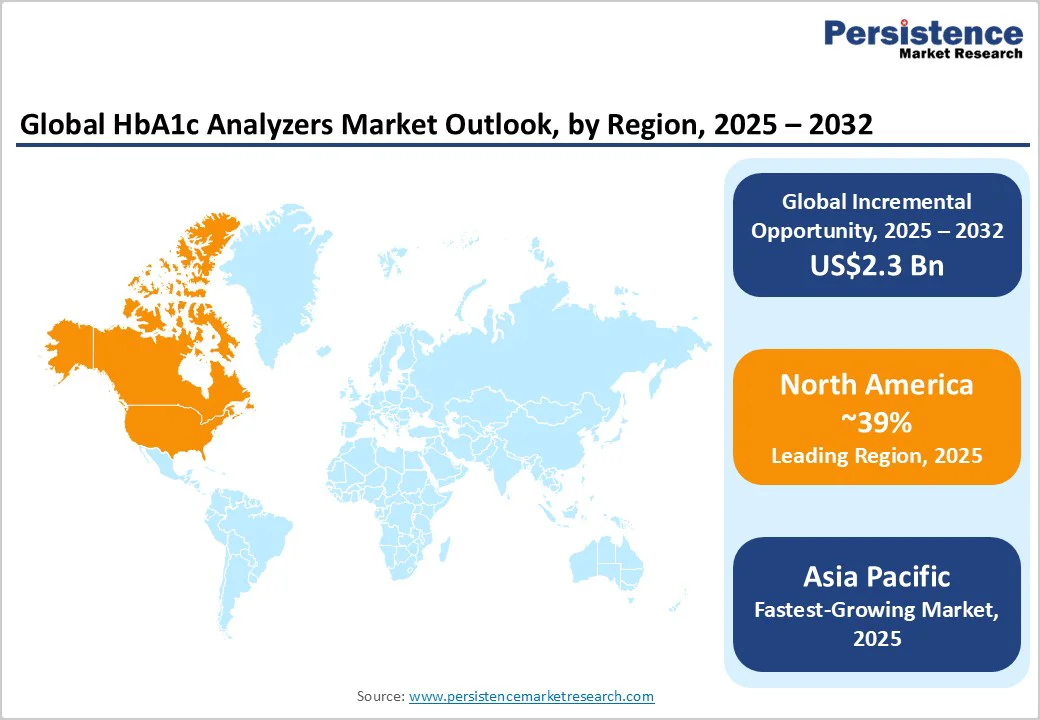

North America holds a commanding position with an approximate 39% of the HbA1c analyzers market share in 2025, anchored by the U.S. healthcare ecosystem’s robust infrastructure, innovation capacity, and extensive preventive care initiatives. The regulatory landscape, led by the FDA’s streamlined approval pathways for in vitro diagnostic devices, has vastly improved market access for novel HbA1c testing solutions, including POC and AI-integrated platforms. The region’s reimbursement environment, propelled by Medicare and Medicaid policies, has incentivized the adoption of rapid diagnostics.

High diabetes prevalence, chronic disease management programs, and adoption of telehealth are the prominent drivers for the regional market, which are synergizing to augment demand. The competitive landscape here features incumbent market leaders investing in next-generation analyzer technologies and strategic collaborations with digital health innovators. Investment focus on precision diagnostics, integration with CGM, and remote patient monitoring platforms will further enhance market resilience and growth.

Europe is anticipated to capture roughly 28% of the HbA1c analyzers market share in 2025, led by Germany, the U.K., France, and Spain. The regional market benefits from a harmonized regulatory environment under the IVD regulation, which standardizes quality and safety requirements across member states despite complex, heterogeneous reimbursement frameworks.

The Europe market is fueled by a rapidly aging population, increasing diabetes screening campaigns, and investment in digital health transformation. The regional competitive ecosystem is characterized by collaboration among multinational manufacturers, healthcare providers, and technology startups focusing on decentralized diagnostic solutions and integration with electronic health records. Cross-border initiatives facilitating clinical trial harmonization and market access support innovation diffusion, while investments are directed toward the development of cutting-edge immunoassay and AI-powered analyzers aligned with stringent EU standards.

Asia Pacific is poised to be the fastest-growing regional market for HbA1c analyzers between 2025 and 2032. Growth drivers include expanding diabetic populations, government-led healthcare infrastructure modernization, and increasing adoption of telemedicine and digital diagnostics. China, India, Japan, and ASEAN member states exhibit heterogeneous healthcare dynamics, balancing urban sophistication with rural accessibility challenges.

Manufacturing competitiveness and favorable cost structures amplify regional growth potential. Regulatory modernization efforts focusing on convergence with global IVD standards expedite product introductions. Industry investments prioritize local production capabilities, technology transfer partnerships, and the establishment of regional service networks. This strategic focus enables rapid capture of the growing market, particularly for decentralized and home-based testing solutions meeting diverse patient needs.

The global HbA1c analyzers market structure exhibits moderate consolidation. Roche Diagnostics leads as the preeminent player by revenue, followed by Abbott Laboratories, Siemens Healthineers, Bio-Rad Laboratories, and Tosoh Corporation. These incumbents dominate especially in laboratory-grade analyzers and cutting-edge point-of-care devices, leveraging expansive portfolios and global footprints. The market features a clear dichotomy: oligopolistic dominance in high-throughput systems and more fragmented competition in emerging POC and homecare segments.

Emerging technology specialists and startups focused on AI-enabled diagnostics and remote monitoring complement incumbent strengths, creating a dynamic, competitive ecosystem. Market entry barriers include regulatory complexity, capital intensity, and distribution access, placing a premium value on strategic partnerships, innovation pipelines, and geographic diversification.

The global HbA1c analyzers market is projected to reach US$2.3 Billion in 2025.

Surging prevalence of diabetes worldwide, advancements in point-of-care POC diagnostics, and growing demand for rapid blood testing are driving the market.

The HbA1c analyzers market is poised to witness a CAGR of 10.3% from 2025 to 2032.

Shifting healthcare paradigms emphasizing decentralized diagnostics and home-based testing, particularly across emerging economies, and integration of AI and digital health technologies for enhanced accuracy and operational efficiency are key market opportunities.

Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers are some of the key players in the HbA1c analyzers market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Technology

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author