ID: PMRREP10882| 198 Pages | 26 Sep 2025 | Format: PDF, Excel, PPT* | Banking, Financial Services, & Insurance (BFSI)

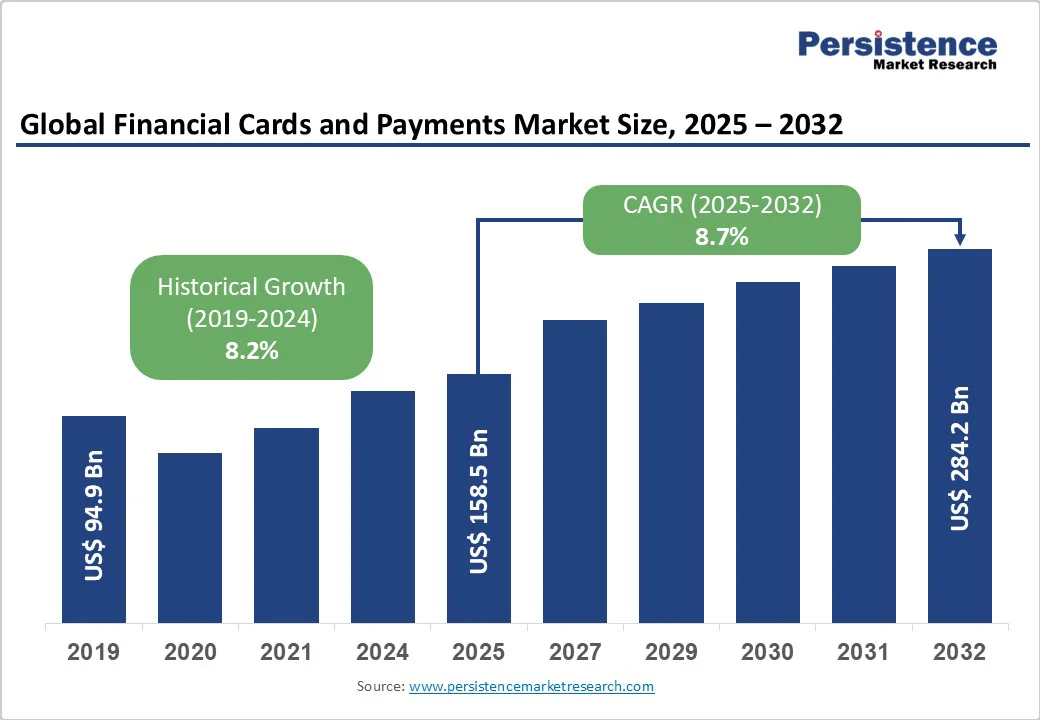

The global financial cards and payments market size is likely to be valued at US$158.5 Bn by 2025, projected to reach US$284.2 Bn by 2032, registering a robust CAGR of 8.7% during the forecast period from 2025 to 2032.

The market is driven by the rapid shift toward digital payments, increasing smartphone penetration, and the growing adoption of contactless payment technologies. The surge in e-commerce, coupled with innovations in payment security, such as biometric authentication and blockchain, has accelerated the adoption of financial cards and digital payment systems.

| Key Insights | Details |

|---|---|

| Financial Cards and Payments Market Size (2025E) | US$158.5 Bn |

| Market Value Forecast (2032F) | US$284.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.2% |

The exponential growth of e-commerce is a primary driver for the financial cards and payments market. As online shopping becomes a mainstream consumer habit, digital payment solutions are increasingly preferred over traditional cash transactions. Mobile payment apps such as Apple Pay, Google Pay, and WeChat Pay have transformed consumer behavior, with 50% of global consumers using mobile payments in 2025.

The rollout of 5G networks, covering 60% of the global population by 2025, enhances transaction speeds, driving adoption in regions such as Asia Pacific. Enhanced connectivity and lightning-fast transaction speeds provided by 5G are creating seamless, real-time payment experiences that encourage consumers and merchants alike to embrace digital payments. Government initiatives, such as India’s Unified Payments Interface (UPI), processed 120 Bn transactions in 2025, promoting cashless economies and boosting demand for financial cards.

The rise in credit card fraud, with global losses estimated at US$ 33 Bn in 2025, poses a significant restraint. High-profile data breaches, such as the Air Europa incident in 2023, expose sensitive financial information, eroding consumer trust. The Identity Theft Resource Center (ITRC) reported a 20% increase in financial sector breaches in 2025, deterring adoption in regions with high fraud concerns.

Financial institutions and payment providers are being forced to invest heavily in fraud detection, AI-driven risk management, and advanced authentication technologies such as biometrics and tokenization. While these measures enhance security, they also increase operational costs and can slow down seamless payment experiences.

Emerging economies such as India, China, and Nigeria offer significant growth opportunities due to large unbanked populations and government-led financial inclusion programs. India’s UPI and National Common Mobility Card (NCMC) initiatives have driven digital payment adoption.

Platforms like Alipay and WeChat Pay dominate the urban landscape, while new programs are extending services to underserved communities, ensuring broader participation in the digital economy. Regulatory frameworks encouraging cashless policies, combined with rising smartphone penetration, are creating fertile ground for growth.

Fintech companies can leverage these markets to introduce affordable payment solutions. By leveraging mobile-first platforms, biometric authentication, and government-backed digital ID systems, fintech players can bridge the financial inclusion gap while capturing significant market share.

Bank cards dominate the financial cards and payments market, accounting for 65% of the market share in 2025. Debit and credit cards, issued by major providers such as Visa and Mastercard, are widely accepted globally, with 90% of merchants supporting card payments.

Their robust security features, such as EMV chip technology, and integration with digital platforms such as Apple Pay drive their dominance. Loyalty programs, offering 5-10% cashback on average, further encourage consumer adoption.

Recharge spending cards are the fastest-growing segment. Prepaid and gift cards, such as those offered by Amazon and Starbucks, cater to consumers seeking flexible payment and gifting options. The rise of digital gift cards, with 30% of gift card sales being digital, fuels this segment’s growth, particularly among younger consumers.

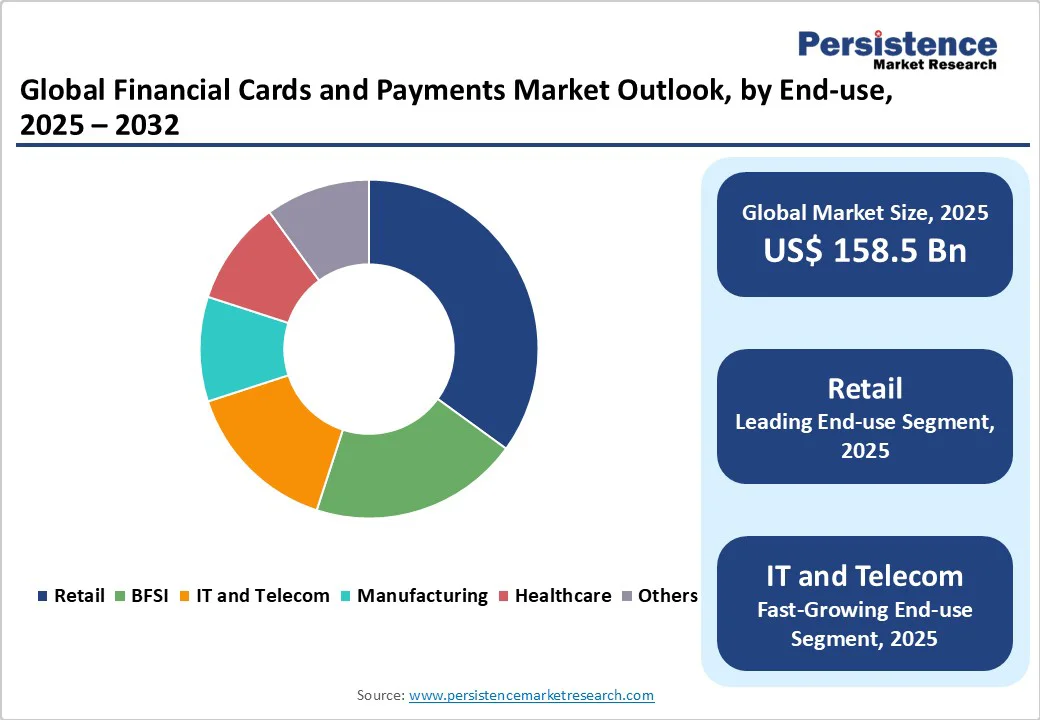

Retail leads the application segment, contributing 35% of market revenue in 2025. The surge in e-commerce, with global online retail sales reaching US$5.8 Tn in 2025, drives demand for financial cards and digital wallets. Contactless payments, used in 60% of in-store retail transactions globally, further boost this segment, supported by retailers upgrading to NFC-enabled terminals.

IT & Telecom is the fastest-growing application segment. The rise of subscription-based services, such as Netflix and Spotify, and telecommunications platforms requiring recurring payments fuels demand for efficient payment systems. The expansion of 5G networks, covering 60% of global populations by 2025, supports seamless digital transactions in this segment.

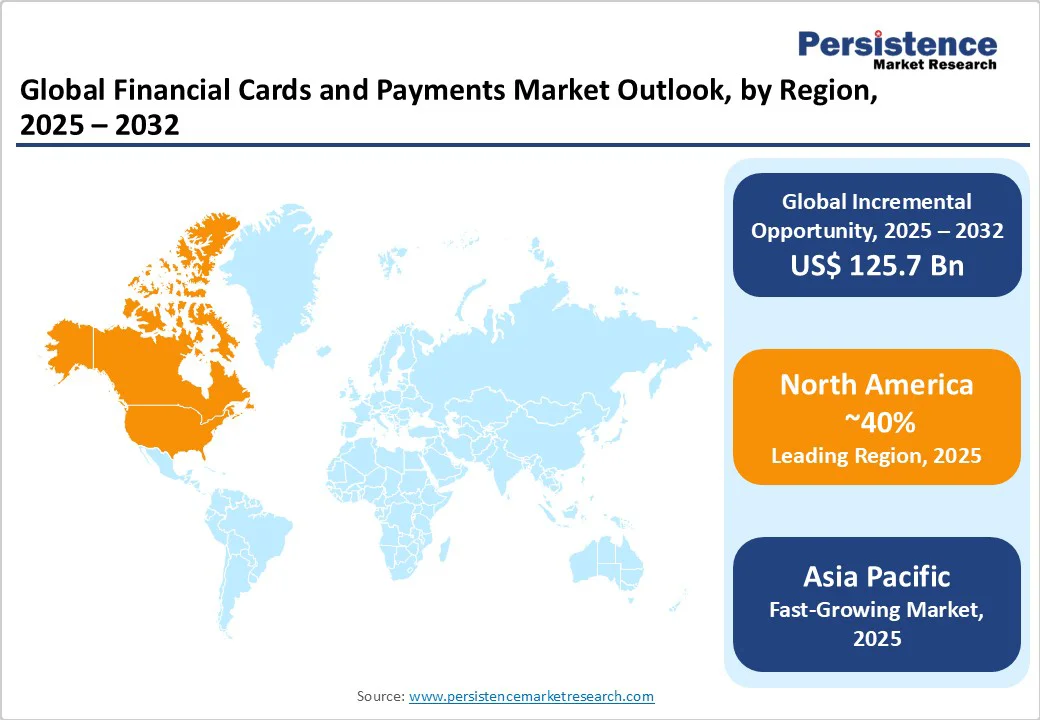

North America holds a 40% market share in 2025, driven by its advanced financial services infrastructure and high consumer adoption of digital payments. The region’s leadership is supported by widespread smartphone penetration and a robust e-commerce ecosystem. The U.S market growth. is driven by the rapid adoption of contactless payments and digital wallets.

Retailers such as Walmart and Target have upgraded payment terminals, with 70% of in-store transactions being contactless. Although part of Europe, the U.K.’s market is noteworthy. The retail sector drives demand, with 80% of transactions being contactless, supported by loyalty programs offering 5% cashback on average. Government initiatives to reduce cash usage, such as the Faster Payments System, and the rise of digital wallets such as PayPal, enhance market growth.

Europe accounts for 25% of the market share in 2025, with leading countries including Germany, France, and the U.K. Germany’s market is driven by the increasing adoption of contactless cards and mobile payments. The country’s strong financial services sector and consumer preference for secure transactions.

France’s focus on payment security, with 40% of payment cards incorporating biometrics, drives market growth. The retail and hospitality sectors’ adoption of contactless payments is supported by EU sustainability goals. The rise of e-commerce, stringent regulatory frameworks, and increasing loyalty programs are key growth drivers in Europe.

Asia Pacific is the fastest-growing region, holding a 20% market share in 2025, driven by rapid digitalization and government initiatives promoting cashless economies. China’s market is led by mobile payment platforms such as Alipay and WeChat Pay, which processed US$5 Tn in transactions in 2025.

India’s payment market is propelled by initiatives such as UPI and NCMC. The large unbanked population and growing smartphone penetration, with 900 Mn smartphone users. High mobile penetration, expanding e-commerce, and financial inclusion programs are key growth factors in the Asia Pacific.

The global financial cards and payments market is highly dynamic, shaped by a mix of global financial institutions, payment network providers, technology companies, and emerging fintech players. Established players such as Visa, Mastercard, American Express, and UnionPay continue to dominate card issuance and payment processing, leveraging their extensive global networks and trusted brand presence.

At the same time, technology-driven companies such as Apple, Google, Samsung, and regional leaders such as Alipay and WeChat Pay are reshaping consumer payment habits by integrating financial services into digital ecosystems.

Fintech startups are also playing a disruptive role, offering innovative solutions such as buy-now-pay-later services, contactless cards, mobile wallets, and blockchain-based payment platforms. Collaborations between banks, fintechs, and governments are becoming increasingly common to strengthen security, improve interoperability, and accelerate digital inclusion.

The global Financial Cards and Payments Market is projected to reach US$158.5 Bn in 2025.

The rise of e-commerce, mobile payment adoption, and government initiatives for cashless economies drive the market.

The market is expected to grow at a CAGR of 8.7% from 2025 to 2032.

Expansion in emerging markets and financial inclusion initiatives offer significant growth potential.

Thales Group, Giesecke & Devrient, IDEMIA, CPI Card, and Tianyu are key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author