ID: PMRREP33824| 200 Pages | 21 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

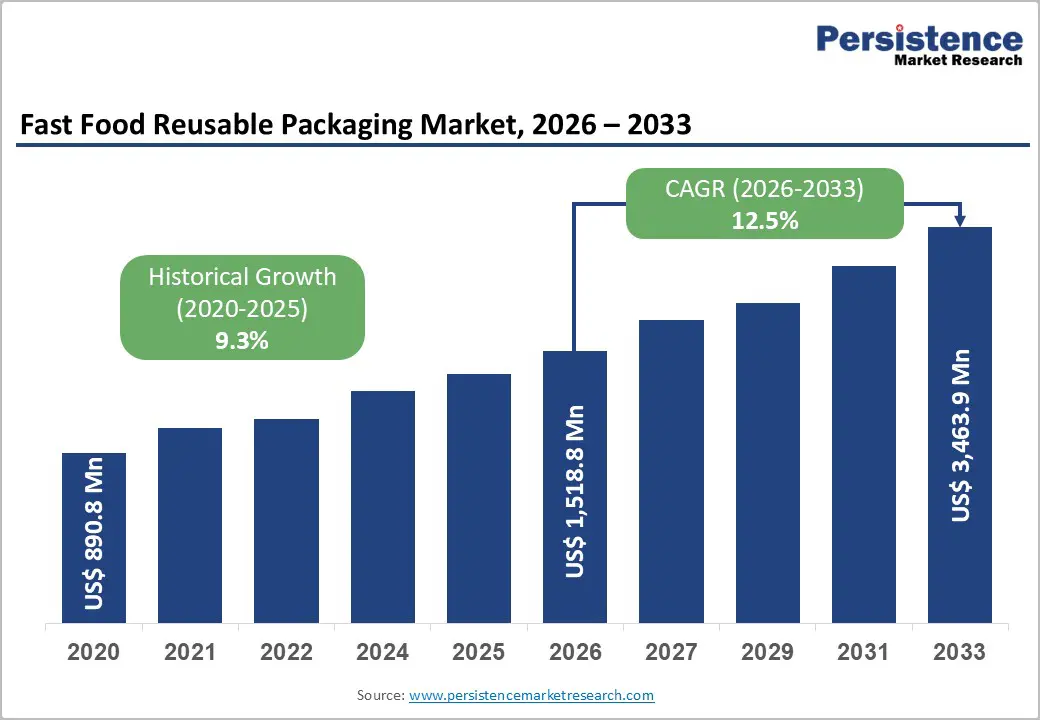

The global fast food reusable packaging market size is supposed to be valued at US$ 1,518.8 million in 2026 and is projected to reach US$ 3,463.9 million by 2033, growing at a CAGR of 12.5% between 2026 and 2033.

The market's robust expansion is primarily driven by stringent regulatory mandates targeting single-use plastics across multiple jurisdictions, as well as escalating consumer demand for environmentally responsible dining solutions. The European Union's Packaging and Packaging Waste Regulation (PPWR), which mandates that 10% of beverages be offered in reusable packaging by 2030 and 40% by 2040, alongside similar restrictions across 60 jurisdictions in North America, is compelling fast-food operators to accelerate their transition toward circular-economy models. Corporate sustainability commitments from major quick-service restaurant (QSR) chains, combined with the economic imperative of reducing the $24 billion annual expenditure on disposable packaging, are further catalyzing market growth.

| Key Insights | Details |

|---|---|

| Fast Food Reusable Packaging Market Size (2026E) | US$ 1,518.8 Mn |

| Market Value Forecast (2033F) | US$ 3,463.9 Mn |

| Projected Growth CAGR (2026 - 2033) | 12.5% |

| Historical Market Growth (2020 - 2025) | 9.3% |

Growing awareness of plastic pollution has accelerated the adoption of reusable packaging solutions among fast-food chains. Surveys reveal that more than 65% of environmentally conscious consumers prefer glass or metal packaging due to its safety and recyclability. This trend aligns with the broader sustainable packaging movement, where brands strengthen customer loyalty by reducing waste.

Leading quick-service restaurant (QSR) chains such as McDonald’s and Starbucks have advanced significant initiatives through the NextGen Consortium, investing $10 million to develop reusable systems and enhance recycling infrastructure. Burger King’s pilot of returnable cups with up to 200 reuse cycles underscores the technical feasibility of durable solutions. Manufacturers, including Tetra Pak, are further driving momentum by designing renewable and recyclable packaging. Increasing consumer focus on circular economy principles positions reusable systems as strategic differentiators rather than mere compliance measures.

The enforcement of comprehensive legislation restricting single-use plastics is a pivotal growth driver for the fast-food reusable packaging market. The European Union’s Packaging and Packaging Waste Regulation (PPWR), adopted in December 2024, mandates that operators in the HORECA (Hotel, Restaurant, Catering) sector allow customers to use their own reusable containers without additional charges and ensure that at least 10% of products are offered in reusable formats within 36 months of implementation.

Similarly, in North America, California’s SB 54, effective January 1, 2025, prohibits the use of expanded polystyrene foam containers in restaurants. Furthermore, jurisdictions such as Seattle, Washington, D.C. and approximately 60 others have enacted bans on plastic straws and utensils. These measures, taken together, eliminate reliance on single-use packaging, creating a mandatory demand for reusable alternatives.

Transitioning to reusable packaging systems requires significant upfront investment, including container procurement, tracking technologies, washing facilities, and reverse logistics infrastructure. Unlike single-use packaging with predictable per-unit costs, reusable models demand capital for IoT-enabled tracking devices, industrial-grade washing equipment compliant with food safety standards, and collection point networks. Restaurants face challenges such as uncertain demand and return patterns, which complicate inventory management and can lead to shortages during peak periods or to excess idle stock. The lack of standardized packaging formats limits economies of scale, while customer behavior changes needed for container returns add operational complexity. Additionally, maintaining hygiene across multiple use cycles necessitates validated cleaning protocols and robust quality assurance systems, further increasing costs and implementation hurdles.

The success of reusable packaging systems relies heavily on robust collection, cleaning, and redistribution infrastructure, which remains underdeveloped in many regions. The National Restaurant Association has emphasized that insufficient recycling and composting facilities pose a major barrier, noting that comprehensive infrastructure must precede effective regulatory enforcement. Regulatory fragmentation further complicates compliance for multi-location operators, as requirements vary significantly across jurisdictions.

While the European Union seeks harmonization through PPWR, markets such as China face challenges due to the absence of standardized regulations despite rapid urbanization driving demand. Cultural differences also influence return rates, with preferences in countries like Japan creating adoption hurdles despite advanced technology and environmental awareness. This infrastructure gap is most pronounced in emerging economies, where limited waste management systems restrict the scalability of reusable packaging programs.

The adoption of smart tracking technologies, such as QR codes, RFID tags, and IoT sensors, offers a transformative opportunity to streamline reusable packaging operations while generating actionable data insights. These systems provide real-time visibility into container location, usage patterns, and return rates, enabling dynamic inventory management and reducing losses that have historically impacted system economics. Digital platforms also support deposit-refund programs via mobile applications, incentivizing customer participation and automating transactions. Data collected from tracked containers facilitates predictive analytics for demand forecasting and inventory optimization.

Furthermore, blockchain-based verification ensures the integrity of the cleaning cycle and compliance with food safety standards, addressing key hygiene concerns. Sustainability-focused start-ups are collaborating with food service providers to create integrated solutions combining tracking, customer engagement, and logistics optimization, positioning early adopters for data-driven competitive advantage and regulatory alignment.

Asia Pacific offers significant growth potential for the fast food reusable packaging market, driven by rapid urbanization, a growing middle class, and stricter environmental regulations. China, with a 15% growth momentum, combines government initiatives to curb plastic waste with the world’s largest food service market, creating substantial demand. India is experiencing the fastest regional expansion, supported by rising food delivery penetration, café proliferation, and the adoption of reusable solutions.

Japan’s advanced technology ecosystem and sustainability-focused consumers, reinforced by the Packaging Recycling Act and EPR mandates, create a premium segment. Regulatory measures in cities like Shanghai and Seoul mandating biodegradable or compostable packaging further favor reusable alternatives. Dense urban centers enhance the efficiency of return logistics, while Australia’s 2024 regulatory overhaul on recycled content accelerates restaurant adoption of reusable programs.

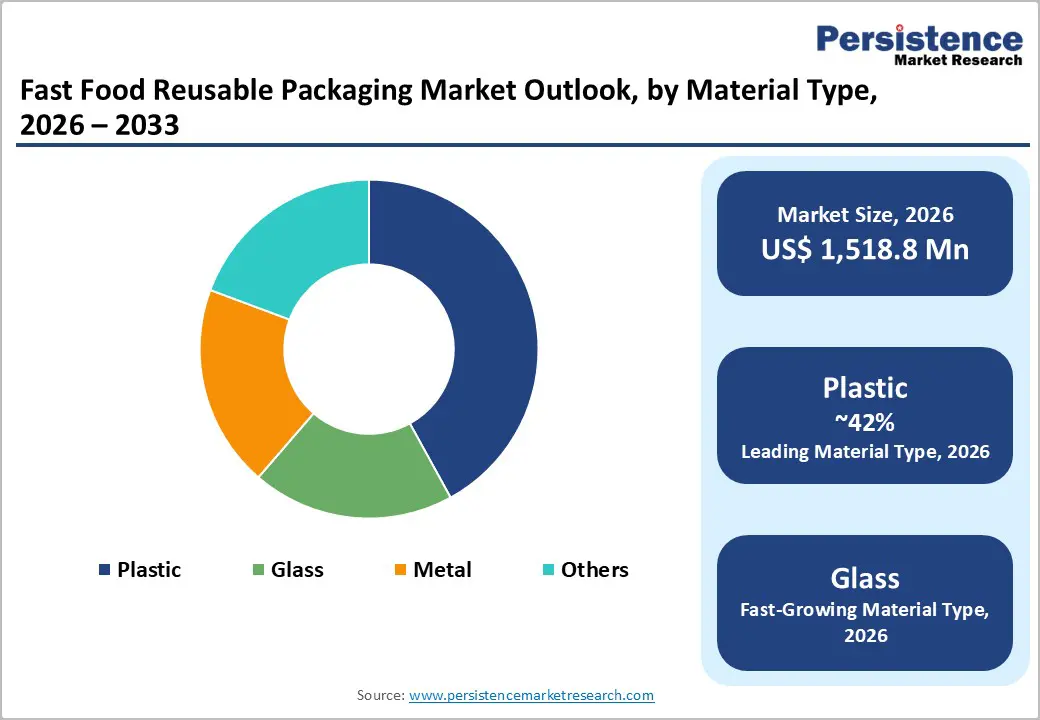

Plastic materials account for approximately 42% of the fast food reusable packaging market, driven by their durability-to-weight ratio, cost efficiency, and design flexibility. Polypropylene (PP) and high-density polyethylene (HDPE) dominate container production due to their thermal resistance, chemical stability across diverse food types, and compatibility with industrial dishwashing processes. Industry leaders such as Amcor are advancing sustainability by incorporating 10% post-consumer recycled (PCR) plastic by 2025, supported by significant procurement of recycled materials.

Innovations like Burger King’s returnable cups, designed for up to 200 reuse cycles, highlight the potential of advanced plastic formulations for extended service life. However, regulatory pressures, such as the EU’s PFAS ban effective August 2026, pose challenges by eliminating certain grease-resistant coatings. Ongoing developments in plastic packaging continue to enhance recyclability and end-of-life processing.

Containers account for approximately 38% of the fast food reusable packaging market, serving as the core component of reusable systems due to their versatility across diverse menu items and meal formats. Their dominance reflects the widespread use of bowl and clamshell designs for entrees, sides, and combination meals, ensuring secure transport for delivery and takeaway. Innovations such as Graphic Packaging International’s insulated, double-walled fiber containers for Chick-fil-A highlight the technical sophistication required to meet operational needs, including heat retention, structural integrity, and customer convenience.

Premium glass containers complement this segment for health-focused and upscale quick-service concepts, reinforcing quality positioning. To support multiple reuse cycles, containers must maintain durability, aesthetic appeal, and resistance to staining and odor. Regulatory mandates targeting single-use containers and smart technologies like tracking chips further enhance functionality through deposit-refund systems and inventory management.

Food applications account for approximately 59% of the fast-food reusable packaging market, driven by the greater complexity and contamination risks associated with solid menu items compared to beverages. Food packaging must withstand temperature variations, prevent cross-contamination, resist oil and sauce penetration, and maintain structural integrity during transport, making its performance requirements more demanding than those for beverage containers. The $24 billion in annual disposables expenditure, primarily for food packaging, underscores the economic significance of this segment.

Regulatory measures have focused on food packaging, with bans on single-use items such as expanded polystyrene containers and plastic cutlery. Transitioning to reusable solutions requires addressing hygiene concerns, as direct food contact heightens sanitation issues. Innovations such as barrier coatings, compartmentalized designs, and ventilation features aim to preserve food quality, though most advances still target single-use formats.

Restaurants account for approximately 46% of the fast food reusable packaging end-user market, making them the largest and most established channel for implementing reusable systems. Full-service and quick-service restaurants possess operational infrastructure such as dishwashing facilities, storage capacity, and trained staff, enabling efficient adoption. Leading chains, including McDonald’s, have pledged to source 100% of guest packaging from renewable, recycled, or certified materials by 2025, with reusable solutions forming a key strategy to achieve these goals.

The NextGen Consortium’s $10 million investment in partnerships with Starbucks and McDonald’s underscores the sector’s leadership in advancing reusable systems and supporting infrastructure. Controlled environments and historical use of reusable service ware reduce implementation barriers, while EU PPWR regulations mandate reusable options for takeaway, making compliance essential. Restaurants also leverage deposit-refund programs, incentives, and customer education to drive container returns, facilitating system viability and economies of scale.

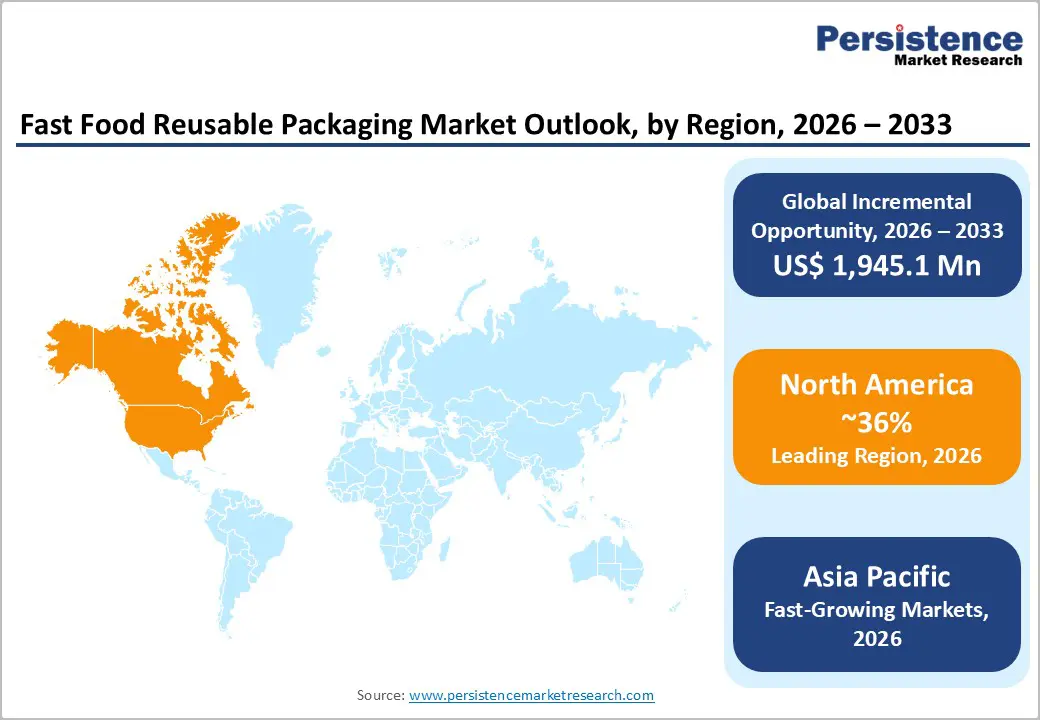

North America leads in fast food reusable packaging innovation, driven by the United States’ proactive regulatory frameworks, strong corporate sustainability commitments, and well-established environmental advocacy. California set the precedent with AB 1162, effective January 1, 2024, banning single-use plastic bags and expanded polystyrene containers while introducing a 10-cent fee on paper bags. This model has since been adopted by approximately 60 jurisdictions, with Seattle pioneering the first major ban on plastic straws and utensils in 2008, followed by Washington D.C. and municipalities across California, Florida, and New York.

The region’s innovation ecosystem is reinforced by the NextGen Consortium, which unites leading brands such as McDonald’s and Starbucks through a $10 million investment to advance reusable systems and recycling infrastructure. With U.S. food-service businesses spending $24 billion annually on disposables, potential savings exceeding $10 billion create strong economic incentives for adoption, while industry groups actively engage policymakers to align regulatory timelines with infrastructure development.

Europe is at the forefront of global fast food reusable packaging regulation, driven by the European Union’s Packaging and Packaging Waste Regulation (PPWR), adopted on December 16, 2024. This framework introduces the world’s most ambitious mandatory targets, requiring final distributors to offer at least 10% of beverages in reusable packaging by January 1, 2030, rising to 40% by 2040. The regulation also mandates that HORECA operators accommodate customer-provided containers at no additional cost and that takeaway outlets provide 10% of products in reusable formats within 36 months of enforcement.

Germany, the U.K., France, and Spain exhibit varied implementation strategies, with Germany leading through deposit-refund systems. Additional measures include a PFAS ban effective August 12, 2026, and forthcoming minimization standards in Q4 2026. Municipal initiatives in cities such as Paris and Brussels further strengthen infrastructure, positioning Europe as the fastest-growing market for reusable packaging adoption.

The Asia Pacific region is projected to experience the fastest growth in the fast food reusable packaging market, driven by rapid urbanization, a rising middle class, and increasingly stringent environmental regulations. China’s initiatives to reduce plastic waste and promote eco-friendly practices, alongside mandates in cities such as Shanghai requiring biodegradable or compostable packaging in public institutions, are creating strong regulatory momentum despite the absence of uniform national standards.

Japan combines advanced technology integration with sustainability-focused consumer preferences, supported by the Packaging Recycling Act and extended producer responsibility (EPR) mandates, enabling premium reusable packaging solutions despite cultural challenges related to hygiene and convenience. India leads regional growth with expanding urbanization, food delivery penetration, and café proliferation, while Vietnam and China’s EPR mandates further align with global frameworks, reinforcing regulatory drivers comparable to Europe.

The fast food reusable packaging market is moderately fragmented, with established packaging manufacturers expanding into reusable solutions while specialized circular economy start-ups develop integrated tracking and logistics platforms. Companies are prioritizing R&D in food-safe, durable materials, smart tracking integration, and multi-cycle designs, supported by collaborations between restaurant chains and packaging suppliers to accelerate innovation. Emerging models such as packaging-as-a-service shift capital costs from restaurants to providers, while strategic partnerships with waste management firms, tech platforms, and industry consortia address systemic infrastructure challenges.

The global fast food reusable packaging market is valued at US$ 1,518.8 Mn in 2026 and is projected to reach US$ 3,463.9 Mn by 2033, growing at a CAGR of 12.5% during the forecast period.

The fast food reusable packaging market is primarily driven by stringent regulatory mandates, including the European Union's PPWR, requiring 10% reusable beverage packaging by 2030 and single-use plastic bans across 60 North American jurisdictions

Plastic materials command approximately 42% market share due to their superior durability-to-weight ratio, cost-effectiveness, and design versatility.

North America leads the market through early-mover regulatory frameworks, corporate sustainability investments, including $10 million by the NextGen Consortium, and established environmental advocacy infrastructure.

The integration of smart tracking technologies using QR codes, RFID tags, and IoT sensors represents the most significant opportunity, enabling deposit-refund mechanisms, real-time inventory optimization, and blockchain-based food safety verification.

Leading market participants include Amcor Pty Ltd., Tetra Pak, Huhtamaki, and Sealed Air Corporation, with companies pursuing strategies emphasizing material innovation, smart tracking integration, and turnkey solution offerings.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author