ID: PMRREP23521| 212 Pages | 5 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

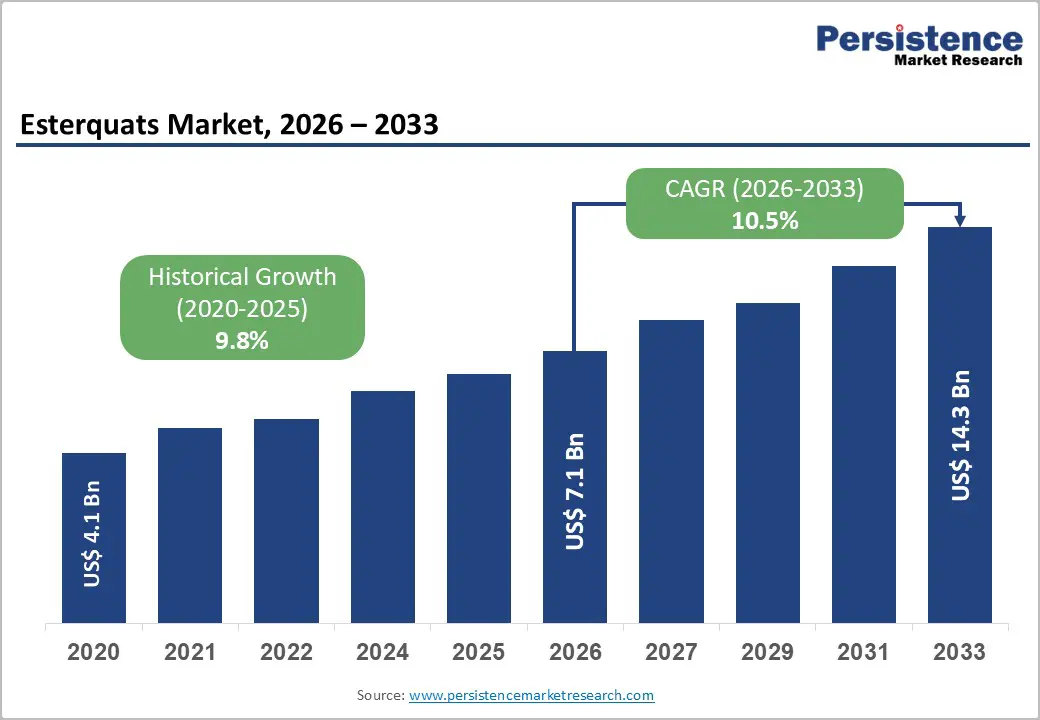

The global esterquats market is projected to reach US$ 7.1 billion in 2026 and US$ 14.3 billion by 2033, growing at a CAGR of 10.5% over the forecast period.

Market expansion is driven by rising demand for biodegradable fabric care products, the rapid growth of premium personal and hair care categories, and the expansion of manufacturing in the Asia-Pacific region, supported by increasing sustainability awareness.

| Key Insights | Details |

|---|---|

| Esterquats Market Size (2026E) | US$ 7.1 Billion |

| Market Value Forecast (2033F) | US$ 14.3 Billion |

| Projected Growth CAGR (2026 - 2033) | 10.5% |

| Historical Market Growth (2020 - 2025) | 9.8% |

The global shift toward environmental sustainability is strongly influencing the fabric care industry, driving manufacturers to replace traditional quaternary ammonium compounds with more eco-friendly esterquats. Increasing regulatory pressure and growing consumer awareness around environmental safety are accelerating this transition. Regulations such as the European Union Detergents Regulation (648/2004) require all surfactants used in detergent products to meet strict aerobic biodegradability standards, which clearly favor esterquats due to their superior environmental performance.

Compared to older surfactants like DHTDMAC, esterquats offer lower aquatic toxicity, faster biodegradation, and improved safety profiles, making them more suitable for long-term regulatory compliance. As a result, esterquats have become the preferred choice in North America and Europe for fabric softener formulations. Leading consumer goods companies are increasingly launching plant-based and concentrated products using esterquats to strengthen eco-friendly brand positioning. For example, Procter & Gamble introduced plant-based Downy fabric softeners in October 2023, reflecting strong market alignment with sustainability-driven consumer demand.

The fast-growing hair care and personal care industries are becoming major drivers of esterquat demand, supported by changing lifestyles and rising expectations for premium, multifunctional products. Consumers increasingly prefer advanced formulations such as conditioning masks, deep repair treatments, leave-in conditioners, serums, and styling creams that deliver visible results while remaining gentle on hair and skin. Esterquats are widely used in these products due to their lightweight texture, non-greasy feel, strong conditioning performance, and excellent compatibility with modern formulations. These benefits allow brands to position products at premium price points while meeting performance expectations.

Younger consumers, in particular, are drawn to products that combine hydration, protection, and styling benefits in a single solution. In addition, shampoo formulations are evolving from basic cleansing products toward nourishing and moisturizing variants, further increasing the use of conditioning ingredients. This trend is significantly expanding esterquat usage across both rinse-off and leave-in personal care applications.

Despite strong demand, esterquat adoption is constrained by high production costs and technically complex manufacturing processes. The production of esterquats requires advanced chemical synthesis, including fatty acid esterification followed by quaternization reactions, which demand specialized equipment and skilled technical expertise. These requirements increase capital investment and limit participation from smaller manufacturers. Historically, tallow-based feedstocks have dominated the market due to their ideal carbon chain length and strong softening performance.

However, tallow supply is subject to volatility in livestock production and agricultural pricing, leading to rising raw material costs. This cost pressure affects overall product pricing and reduces affordability in price-sensitive markets, particularly in emerging economies. Additionally, limited feedstock flexibility restricts manufacturers’ ability to quickly adjust production during demand fluctuations. As a result, while esterquats offer strong performance and sustainability benefits, cost and manufacturing complexity remain key barriers to broader market penetration.

The esterquats market also faces challenges related to increasingly complex and evolving regulatory frameworks. Global regulations governing chemical safety, biodegradability, and environmental impact continue to tighten, increasing compliance costs for manufacturers. In Europe, REACH regulations require extensive chemical registration, toxicological testing, and safety documentation for esterquats, extending product development timelines and raising operational expenses.

In addition, growing regulatory focus on identifying persistent, bioaccumulative, and toxic (PBT) substances creates uncertainty around the long-term acceptance of certain feedstocks and manufacturing routes. Companies may be required to reformulate products or redesign production processes to remain compliant with future standards. This uncertainty can delay investment decisions and increase financial risk for both manufacturers and end-use formulators. While regulations support sustainability goals, the pace of regulatory change adds complexity and compliance burden across the esterquats value chain.

Rising consumer preference for natural and environmentally responsible products is creating strong opportunities for bio-based esterquat development. Manufacturers are increasingly investing in sustainable alternatives to traditional tallow-based feedstocks to enhance brand credibility and premium positioning. Vegetable oil-based esterquats, particularly those derived from palm oil and palm kernel oil, offer performance levels comparable to tallow-based variants while supporting renewable sourcing claims. These bio-based options align well with eco-conscious consumer expectations and sustainability-focused marketing strategies.

Leading chemical companies are actively supporting this transition; for instance, BASF introduced a bio-based esterquat for fabric softener applications in 2021, highlighting industry commitment to greener solutions. Palm-based esterquats also demonstrate excellent biodegradability and conditioning efficiency, enabling their use in both fabric care and personal care products. Manufacturers offering certified sustainable sourcing and traceable raw materials can achieve competitive differentiation and capture higher-margin segments in premium household and personal care markets.

The rapid expansion of manufacturing infrastructure across Asia Pacific is creating significant growth opportunities for the esterquats market. Countries such as China, India, and several Southeast Asian nations are emerging as key production and consumption hubs due to strong industrial capabilities, expanding consumer markets, and improving supply chain networks. Asia Pacific currently dominates global esterquat production, supported by cost-effective manufacturing and readily available raw materials.

China is witnessing strong market growth with an estimated CAGR of 12.4%, driven by large-scale detergent and textile care production. India is also experiencing robust expansion at around 11.5% CAGR, supported by urbanization, rising disposable incomes, and increased awareness of premium household and personal care products. Strategic collaborations between global ingredient suppliers and regional manufacturers are accelerating technology transfer and formulation adoption. These partnerships are strengthening local capacity development while supporting long-term regional market expansion.

TEA-quats (Triethanolamine Ester Quaternary Ammonium Compounds) hold an estimated 43% market share in 2025, reflecting their strong commercial acceptance and proven performance across applications. Their chemical structure provides high cationic activity, resulting in excellent softening and conditioning efficiency in both fabric care and personal care products. TEA-quats are also recognized for their superior biodegradability and mildness, making them suitable for environmentally compliant formulations.

Well-established manufacturing processes and long-standing application history have built strong confidence among formulators and brand owners. These factors support widespread adoption across mass-market and premium product categories. The MDEA and other esterquat variants segment accounts for the remaining 57% market share, offering greater formulation flexibility. These alternatives allow manufacturers to tailor performance characteristics, improve feedstock compatibility, and meet varying regulatory requirements, supporting customized solutions across diverse end-use industries.

Liquid esterquats represent the dominant form segment due to their high compatibility with modern fabric softeners and personal care formulations. Their excellent water solubility enables uniform dispersion, accurate dosing, and consistent performance in liquid detergents, conditioners, and rinse-cycle applications. Liquid forms are particularly well-suited for concentrated fabric softeners and premium hair care products, where stability and ease of formulation are critical.

Their ability to deposit effectively on fabrics and hair surfaces enhances conditioning efficiency and consumer-perceived performance. Solid and paste esterquats account for approximately 25% of market share and are mainly used in specialized applications. These include dryer sheets and heat-activated fabric conditioning systems, where thermal energy helps release esterquat molecules during drying cycles. While smaller in volume, this segment remains important for specific regional and application-driven requirements.

Tallow-based esterquats continue to dominate the market with approximately 68% share, supported by their optimal carbon chain length ranging from C12 to C22 fatty acids. This structure delivers superior softening and conditioning performance, particularly in fabric care applications. Despite growing sustainability concerns, tallow-based variants remain widely used due to consistent performance, established supply chains, and formulation familiarity.

However, vegetable oil-based esterquats are steadily gaining traction and currently account for around 32% of the market. Feedstocks such as palm oil and palm kernel oil offer comparable conditioning efficiency while enabling improved sustainability positioning. These alternatives support reduced environmental impact and align with corporate sustainability commitments. As brands increasingly promote eco-friendly and renewable sourcing claims, vegetable-based esterquats are expected to gain stronger adoption, especially in premium and environmentally conscious product categories.

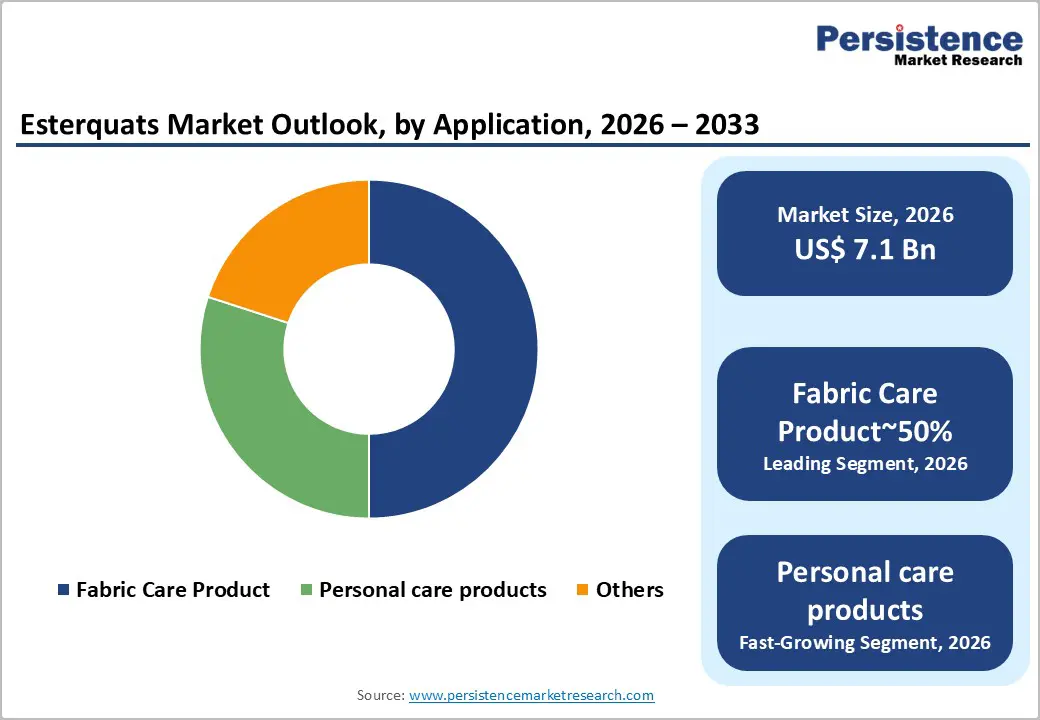

Fabric care remains the largest application segment, accounting for approximately 50% of total esterquat demand. Esterquats are extensively used in liquid fabric softeners, dryer sheets, and concentrated conditioning products, where their superior softness, antistatic properties, and biodegradability deliver strong performance advantages over traditional surfactants. Their ability to enhance fabric feel while meeting environmental standards supports continued dominance in this segment.

Personal care represents the fastest-growing application area, with estimated growth of 14% CAGR. Rising demand for premium hair conditioners, treatment masks, shampoos, and specialty body care products is driving this expansion. Esterquats provide lightweight conditioning without greasy residue, making them ideal for modern personal care formulations. This dual demand across household and personal care applications ensures sustained long-term market growth.

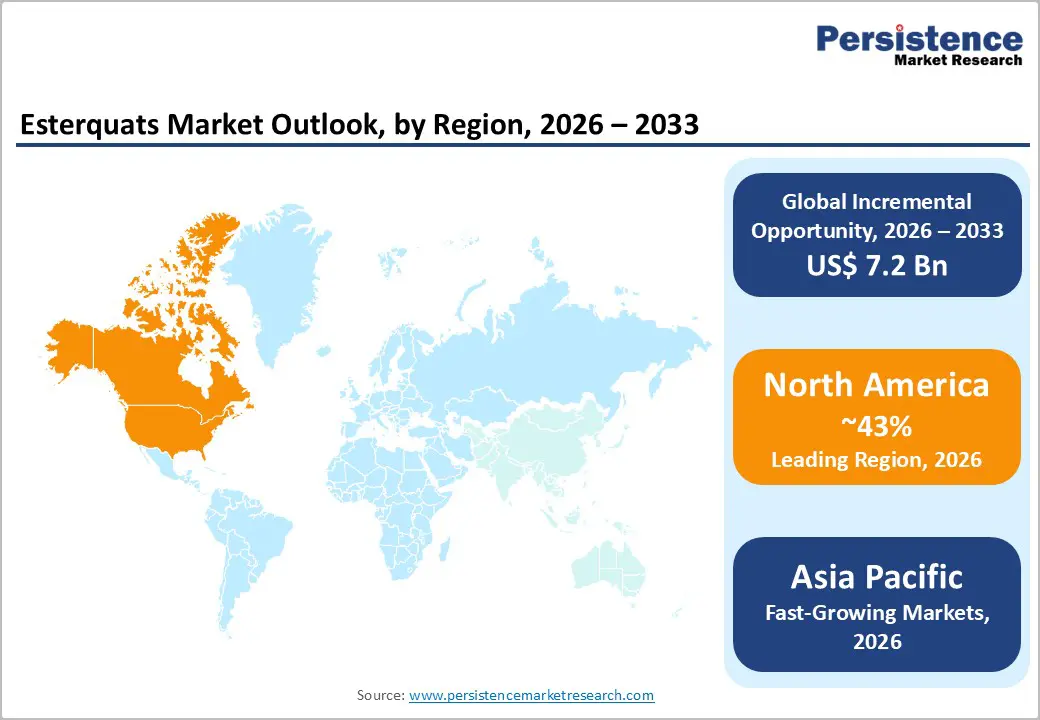

North America remains a key market for esterquats, supported by mature fabric care and personal care industries and strong consumer preference for sustainable products. The region has largely transitioned away from DHTDMAC-based softeners toward esterquat-based formulations due to improved biodegradability and lower aquatic toxicity. Regulatory emphasis on environmental protection and chemical safety further supports this shift. In the United States, manufacturers increasingly focus on premium, concentrated, and plant-based fabric softeners to strengthen product differentiation.

The growing popularity of eco-labeled and high-performance household products continues to drive esterquat demand. In personal care, expanding categories such as conditioning treatments, hair masks, and styling products are boosting usage. Affluent consumer demographics and high awareness of ingredient safety support ongoing adoption, positioning North America as a stable and innovation-driven esterquats market.

Europe represents one of the most advanced and regulation-driven esterquats markets globally. Stringent environmental standards, particularly the EU Detergents Regulation (648/2004), strongly favor biodegradable surfactants, accelerating the replacement of legacy compounds. Countries such as Germany, the United Kingdom, France, and Spain maintain highly developed fabric care and personal care industries with strong focus on sustainability and premium product design. European consumers actively prioritize environmentally responsible products, encouraging manufacturers to invest in green formulation technologies.

Northern European countries play a leading role in environmental research and innovation, supporting continuous improvement in esterquat performance and sustainability credentials. Harmonized regulations across EU member states also simplify regional distribution and supply chain integration. These factors collectively support consistent esterquat demand and reinforce Europe’s position as a key market for sustainable surfactant solutions.

Asia Pacific is the largest and fastest-growing regional market for esterquats, supported by strong manufacturing expansion and rapidly rising consumer demand. The region benefits from large-scale production facilities, competitive manufacturing costs, and growing household and personal care industries. China leads the market with approximately 12.4% CAGR growth, driven by extensive detergent manufacturing, textile care operations, and increasing use of advanced surfactants.

India is also emerging as a high-growth market with around 11.5% CAGR, supported by urbanization, rising disposable incomes, and increasing awareness of premium care products. Strategic collaborations between global ingredient suppliers and regional manufacturers are accelerating esterquat adoption. The expansion of e-commerce and direct-to-consumer platforms is further improving product accessibility, enabling faster market penetration beyond traditional retail channels across Asia Pacific.

The global esterquats market shows moderate consolidation, with a mix of multinational leaders and strong regional manufacturers. Tier 1 companies such as BASF SE, Evonik Industries, Stepan Company, and Kao Corporation collectively account for approximately 50-60% of global market share. Their leadership is supported by advanced manufacturing capabilities, broad product portfolios, and continuous investment in research and development. Tier 2 and regional players, including Akzo Nobel, Clariant, Italmatch Chemicals, and several Asia Pacific manufacturers, contribute around 25-30% market share.

These companies focus on regional strength, customized solutions, and cost-competitive production. Competitive differentiation increasingly centers on sustainability credentials, bio-based feedstocks, regulatory compliance, and performance documentation. Ongoing investment in renewable raw materials and next-generation formulations is shaping long-term competition and supporting the market’s transition toward environmentally responsible growth.

The global esterquats market is expected to reach US$ 14.3 billion by 2033, growing at 10.5% CAGR driven by sustainability-focused fabric and personal care demand.

Market growth is driven by sustainable fabric care adoption, rapid expansion of premium hair and personal care products, and strong Asia Pacific manufacturing growth.

TEA-quats lead the market with around 43% share, supported by strong conditioning performance, biodegradability, and wide industry acceptance.

Asia Pacific leads the global esterquats market due to high production capacity and strong growth in China and India.

Major opportunities include bio-based feedstock development and rapid manufacturing expansion across Asia Pacific markets.

The market is led by BASF, Evonik, Stepan, Kao Corporation, and Akzo Nobel, supported by strong sustainability-driven innovation.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By Feedstock

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author