ID: PMRREP33844| 199 Pages | 14 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

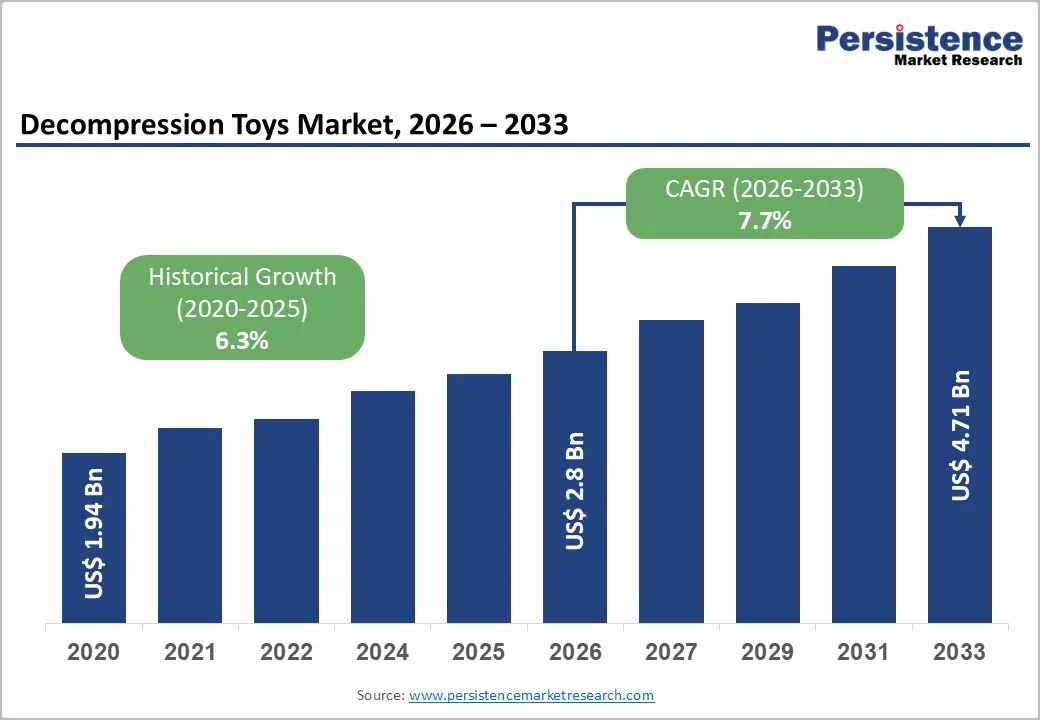

The global decompression toys market size is likely to be valued at US$ 2.8 billion in 2026 and is projected to reach US$ 4.7 billion by 2033, growing at a CAGR of 7.7% between 2026 and 2033.

The market expansion is primarily driven by the rise in workplace stress levels and increasing mental health awareness globally, with 15% of working-age adults experiencing mental disorders and approximately 12 billion working days lost annually to depression and anxiety for US$ 1 trillion per year in lost productivity, according to the World Health Organization. Supporting this, fidget toys such as Pop-Its have witnessed a massive adoption, with ZURU Toys selling over 7 million units in North America from 2020 - 2021 due to TikTok virality exceeding 2.5 billion views.

| Key Insights | Details |

|---|---|

| Decompression Toys Market Size (2026E) | US$ 2.8 Bn |

| Market Value Forecast (2033F) | US$ 4.7 Bn |

| Projected Growth CAGR (2026 - 2033) | 7.7% |

| Historical Market Growth (2020 - 2025) | 6.3% |

The growing prevalence of mental health challenges in professional settings has become a significant driver of demand for decompression toys. According to the Centers for Disease Control and Prevention (CDC), approximately 20% of U.S. adolescents aged 12-17 exhibit symptoms of anxiety. Similarly, the World Health Organization estimates that 4.1% of children aged 10-14 and 5.3% of adolescents aged 15-19 experience anxiety disorders globally.

Furthermore, data from the Annie E. Casey Foundation indicates that 18% of youth in the 12-17 age group have experienced at least one major depressive episode in the past year. These trends underscore a shift in stress-relief products from discretionary purchases to essential wellness tools for individuals actively managing mental health conditions. Supporting this, research published by the National Institutes of Health found statistically significant reductions in anxiety and depression among patients using stress balls, with sustained benefits observed even one month after discontinuation.

The growing recognition of decompression toys as effective therapeutic tools for managing neurodevelopmental conditions is a significant market driver. Educational institutions, therapy centers, and healthcare facilities are adopting sensory toys for children diagnosed with ADHD and Autism Spectrum Disorder. These products provide essential sensory feedback that supports stress management, enhances concentration, and promotes fine motor skill development.

Clinical studies have demonstrated measurable reductions in anxiety among hospitalized children following the use of specialized toys, with post-intervention scores notably lower compared to control groups. The therapeutic benefits of products such as fidget cubes, spinners, chewable items, threading and beading kits, and tactile balls have been validated through multiple research initiatives. This endorsement from the medical and educational sectors has shifted market perception, positioning these products as essential therapeutic aids rather than discretionary entertainment items.

The decompression toys market faces substantial regulatory hurdles, particularly in the European Union, where compliance with the EN71 toy safety standard under the Toys Directive 2009/48/EC is mandatory. The EN71 framework comprises 13 safety requirements covering mechanical properties, flammability, chemical composition, and specific hazards, requiring extensive testing and CE marking certification before market entry. The European Union has introduced stringent toy safety regulations, including bans on endocrine disruptors, skin sensitizers, and PFAS chemicals, as well as mandatory digital product passports to improve traceability and streamline customs procedures.

In the U.S., compliance with the Consumer Product Safety Improvement Act (CPSIA) and ASTM F963 standards requires manufacturers to undergo rigorous safety testing and certification. Additionally, the EU’s REACH regulation (EC No. 1907/2006) mandates comprehensive chemical safety assessments for toys sold within the region. These evolving regulatory requirements necessitate substantial investments in product reformulation, testing infrastructure, and compliance documentation, posing particular challenges for smaller manufacturers with limited resources.

The decompression toys market is experiencing significant challenges due to the proliferation of low-cost alternatives and increasing market saturation. The widespread availability of basic stress balls and conventional fidget spinners at substantially lower price points exerts pricing pressure on manufacturers of premium products. Saturation has become particularly evident in mature markets following the 2017-2018 fidget spinner trend cycle, resulting in consumer fatigue and reduced purchase frequency for certain categories.

Furthermore, the ease of product replication and minimal technological barriers to entry have led to an influx of low-quality imitations, eroding brand equity and compressing profit margins for established players. This commoditization trend complicates efforts to maintain premium positioning and justify higher price points based on superior materials, innovative designs, or validated therapeutic benefits.

The integration of decompression toys with smart technologies and digital connectivity presents a significant growth opportunity for market participants. Recent innovations include smart fidget toys equipped with app-based features for stress tracking and therapeutic monitoring, enabling users to measure stress levels, monitor usage patterns, and receive personalized recommendations. This digitalization trend aligns with rising consumer expectations for connected wellness solutions and creates opportunities for manufacturers to introduce subscription-based services, develop data-driven therapeutic protocols, and strengthen direct consumer engagement through mobile applications.

Furthermore, the development of silent fidget toys tailored for classroom and office environments addresses a key barrier to adoption in professional and educational settings. Companies investing in research and development to incorporate biometric sensors, haptic feedback, and artificial intelligence for personalized stress-relief solutions can differentiate their offerings and justify premium pricing. Furthermore, the inclusion of antimicrobial treatments and easy-to-clean materials, in response to heightened hygiene awareness, enhances product appeal for institutional use.

The growing demand for environmentally responsible products presents significant opportunities for manufacturers focused on sustainability. Introducing biodegradable, eco-friendly decompression toys made from materials such as natural rubber, organic fabrics, and responsibly sourced wood addresses consumer concerns about environmental impact and may meet green procurement requirements in educational and corporate settings. Companies that develop innovative materials offering the tactile quality and durability of traditional plastics, combined with superior environmental performance, can capture market segments prioritizing sustainability.

Furthermore, customizable stress-relief products for corporate wellness programs create attractive B2B revenue streams with higher margins and recurring orders. Strategic partnerships with mental health organizations, occupational therapy associations, and educational institutions can strengthen brand credibility, support product validation, and expand distribution in therapeutic and institutional markets. Implementing take-back and recycling programs can enhance brand positioning, foster customer loyalty, and address environmental considerations at end of life.

Pop-it toys dominate the product type category, commanding an estimated 38% share due to their viral social media popularity and multi-sensory appeal. The tactile satisfaction of pressing silicone bubbles combined with the soft popping sound creates a repetitive, meditative experience that mental health professionals describe as therapeutic for anxiety relief. The product's reusability, affordability, typically priced between US$ 5-15, and portability have sustained demand beyond initial trend cycles.

Manufacturers have capitalized on the success by introducing variations, including glow-in-the-dark editions, jumbo sizes, and licensed character designs featuring Disney, Marvel, and Nickelodeon intellectual properties. The pop-it segment's resilience stems from its dual positioning as both an entertainment and a stress management tool, appealing to parents seeking screen-free activities and professionals seeking discreet workplace stress relief.

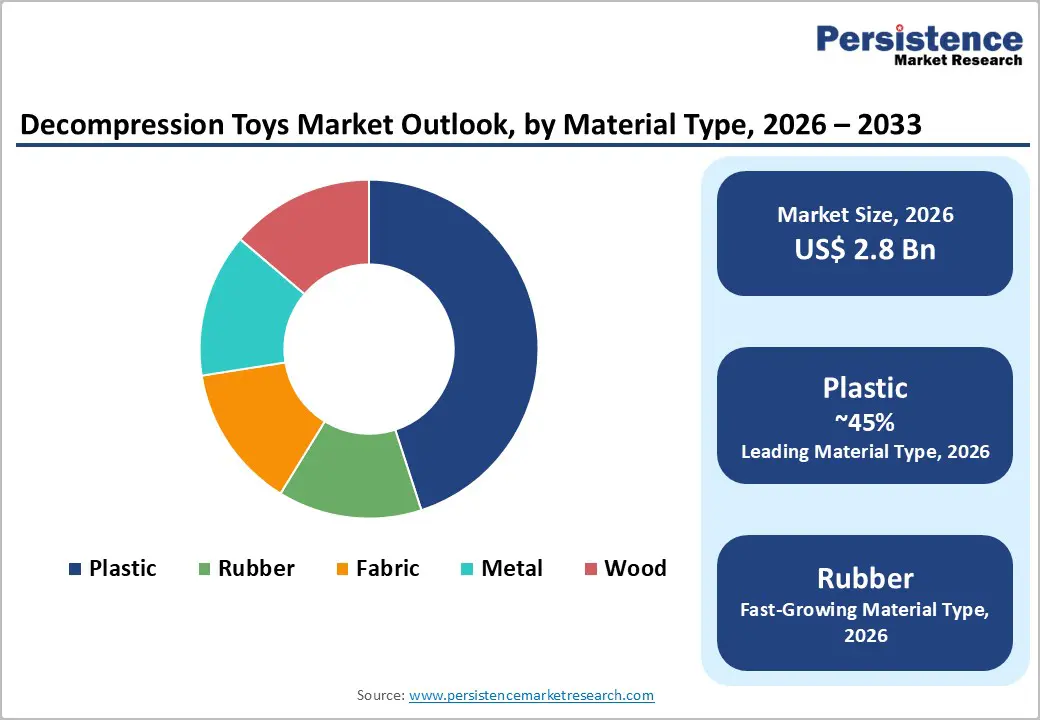

Plastic materials account for approximately 45% of the decompression toys market, primarily due to cost efficiency, design versatility, and compliance with safety standards. China, which produces over 70% of global decompression toys, predominantly uses ABS and silicone-based plastics that meet EN71 safety requirements while maintaining competitive pricing. The moldability of these materials enables complex designs such as multi-surface fidget cubes, varied bubble configurations in pop-it toys, and spinners with optimized weight distribution for extended rotation.

However, increasing environmental awareness is driving manufacturers to explore bio-based and recycled materials. Leading companies, including LEGO Group and Hasbro, Inc., have announced initiatives to transition toward sustainable alternatives. Stringent chemical regulations under the EU’s REACH framework have accelerated the adoption of phthalate-free and BPA-free formulations, which, while raising production costs, strengthen consumer confidence in product safety.

Stress Management leads with 50% share, addressing widespread anxiety needs where the WHO notes 4.4% global prevalence. The segment's leadership is substantiated by clinical research demonstrating measurable stress reduction outcomes, with studies published by the National Institutes of Health showing statistically significant reductions in both anxiety and depression during stress ball intervention periods. Organizations are increasingly recognizing stress management tools as cost-effective interventions for employee well-being, with corporate wellness programs distributing stress balls, fidget cubes, and other decompression toys as part of comprehensive mental health initiatives.

Entertainment applications represent approximately 31% market share, with consumers purchasing decompression toys primarily for recreational enjoyment rather than therapeutic benefits. This segment demonstrates particular strength among younger demographics and social media-influenced consumer segments where product novelty, aesthetic appeal, and shareable viral trends drive purchasing decisions.

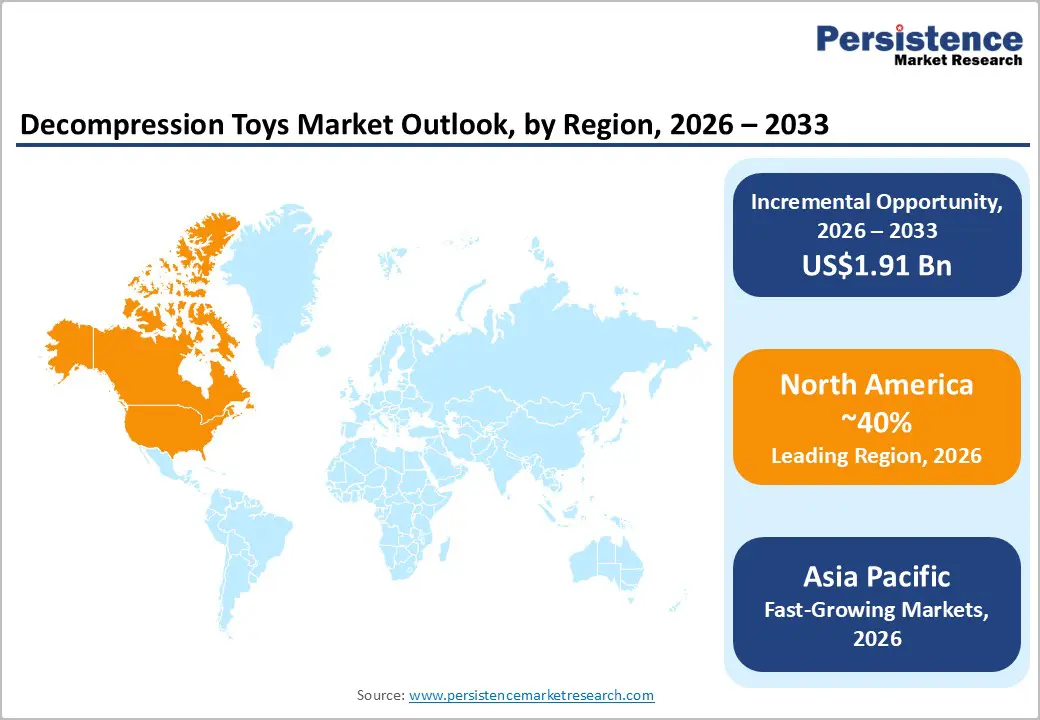

North America maintains market leadership with approximately 40% of global revenue as of 2024, driven by widespread consumer awareness, robust mental health advocacy frameworks, and well-established retail distribution systems. The United States serves as the largest contributor to North America's dominance, having embraced decompression toys not only as recreational items but as therapeutic tools in classrooms, workplaces, and clinical settings. The region benefits from strong regulatory frameworks, including the Consumer Product Safety Improvement Act (CPSIA) and ASTM F963 standards, that ensure product safety while building consumer confidence.

Corporate wellness program adoption has accelerated significantly, with major employers including Google, Microsoft, and Amazon integrating decompression toys into employee benefit packages as cost-effective mental health interventions. Educational institutions across California, New York, and Texas have implemented fidget tool policies for students with ADHD and sensory processing challenges, following research validation from institutions like Johns Hopkins University and clinical recommendations from occupational therapists.

Europe is experiencing steady growth, driven by strict regulatory compliance and greater integration of mental health services. Germany, the U.K., France, and Spain account for 65% of regional demand. The EU’s Toys Directive 2009/48/EC and EN71 safety standards are among the most rigorous global frameworks, requiring significant investment in compliance testing and CE certification. British workplace stress data reveals that 79% of employees experience work-related stress, a 20% increase since 2018, driving corporate adoption of decompression toys as occupational health interventions.

Sustainability remains a key consumer priority, with 68% of buyers favoring eco-friendly materials. Manufacturers are increasingly using biodegradable plastics and recycled rubber to meet this demand. France and Spain show notable adoption in educational settings, particularly for students with special needs, reflecting the region’s commitment to inclusive education and support for neurodiversity.

Asia Pacific is the fastest-growing regional market, driven by China’s manufacturing dominance and rising middle-class demand in India, Japan, and ASEAN countries. China accounts for over 70% of global production, supported by cost efficiencies, advanced infrastructure, and rapid innovation. Domestic demand is increasing alongside economic growth and greater awareness of stress management among urban professionals.

Japan and India are also experiencing strong growth due to heightened mental health awareness and the therapeutic benefits of fidget toys. The region’s large-scale production capabilities ensure affordability and accessibility, while established manufacturers such as Chang Qing Toys and BANDAI provide competitive advantages in product development and supply chain integration, positioning Asia Pacific for sustained market leadership.

The decompression toys market exhibits moderate fragmentation with numerous regional players alongside established multinational corporations, creating intense competition across price segments and distribution channels. Market leaders including ZURU Toys, Spin Master Ltd., and Hasbro, Inc. leverage extensive distribution networks and brand recognition to capture premium segments, while Chinese manufacturers like Chang Qing Toys dominate cost-competitive mass-market categories. Companies are pursuing differentiation strategies through product innovation, licensing partnerships with entertainment franchises, and sustainability initiatives emphasizing eco-friendly materials. E-commerce optimization remains critical, with leading firms enhancing digital platforms, implementing targeted social media marketing, and collaborating with influencers to amplify brand visibility among younger demographics.

The global decompression toys market is projected to reach US$4.7 billion by 2033, growing from US$2.8 billion in 2026 at a compound annual growth rate of 7.7% during the forecast period.

Market growth is primarily driven by escalating workplace stress, increasing mental health awareness, widespread e-commerce adoption, viral social media trends, and validated therapeutic applications for ADHD and autism management.

Pop-it toys command the leading position with approximately 38% market share, driven by viral social media popularity, multi-sensory therapeutic appeal, affordability, and positioning as effective stress-relief tools across all age groups.

North America maintains market leadership with approximately 40% revenue share, attributed to advanced mental health awareness, robust corporate wellness program adoption, and the United States' mature e-commerce infrastructure.

Significant opportunities include integration of AI-driven smart technologies with biofeedback mechanisms, expansion into therapeutic and educational institutional markets validated for ADHD and autism applications, and development of sustainable, eco-friendly products addressing environmental concerns.

Leading companies include ZURU Toys, Spin Master Ltd., Hasbro, Inc., Antsy Labs, The LEGO Group, Tangle Creations, BANDAI, and Mattel Inc., competing through product innovation, licensing partnerships, and e-commerce optimization strategies.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author