ID: PMRREP31340| 220 Pages | 28 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

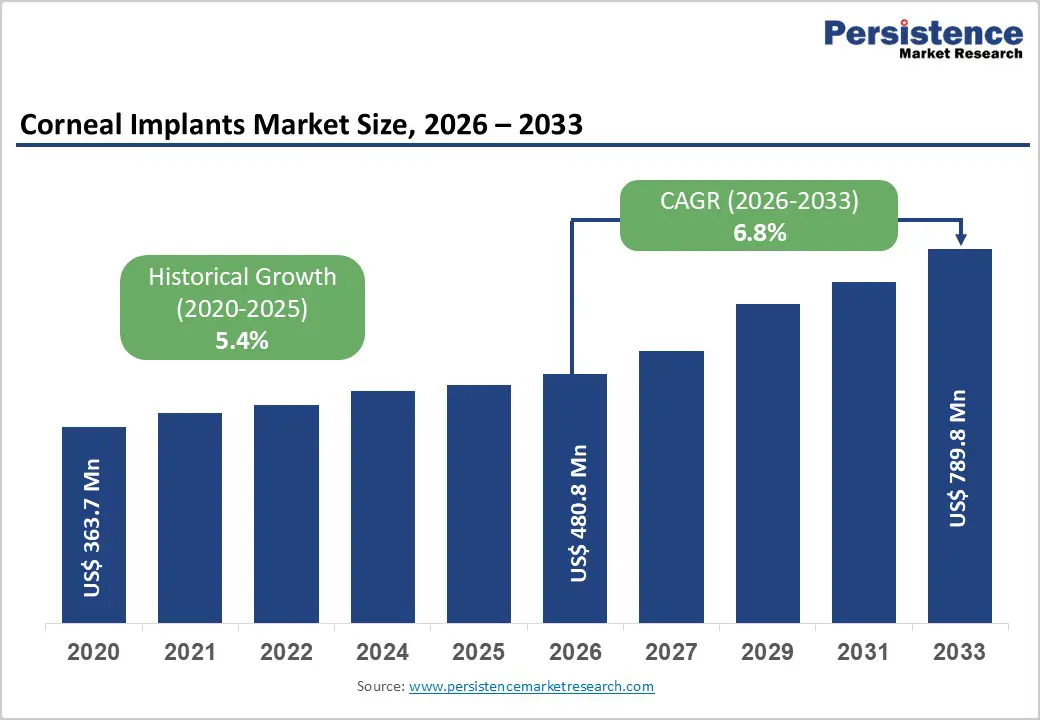

The global corneal implants market size is estimated to grow from US$ 480.8 million in 2026 to US$ 789.8 million by 2033 and is likely to grow at a CAGR of 6.8% from 2026 to 2033.

Global demand for corneal implants is rising steadily, driven by the increasing prevalence of corneal disorders such as Fuchs endothelial dystrophy, keratoconus, infectious keratitis, and corneal scarring, as well as an aging population that is more vulnerable to endothelial dysfunction. Rising surgical volumes for corneal transplantation, improved diagnostic capabilities, and expanding awareness of vision-restoration therapies are driving sustained procedural demand. Increasing access to advanced ophthalmic care, expanding eye banking networks, and expanding tertiary hospitals and specialized ophthalmology centers are accelerating adoption globally. Continuous advancements in keratoplasty techniques, particularly endothelial keratoplasty, are improving visual outcomes, reducing recovery times, and lowering complication rates. In parallel, the ongoing development of synthetic corneal implants to address donor shortages is reinforcing long-term market expansion across both developed and emerging regions.

| Key Insights | Details |

|---|---|

| Corneal Implants Market Size (2026E) | US$ 480.8 Mn |

| Market Value Forecast (2033F) | US$ 789.8 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.4% |

The increasing prevalence of corneal disorders, such as Fuchs endothelial dystrophy, keratoconus, corneal scarring, and infectious keratitis, is a primary driver of sustained global demand for corneal implants. Aging populations, particularly in developed markets, are contributing to a rising incidence of endothelial dysfunction, while higher rates of ocular trauma, infections, and post-surgical complications are expanding the patient pool in emerging regions. As many corneal pathologies progress to irreversible vision impairment, surgical intervention through corneal transplantation remains the definitive treatment, directly supporting consistent procedural volumes.

Additionally, advancements in corneal implant technologies and surgical techniques are strengthening adoption. The shift from full-thickness penetrating keratoplasty to advanced endothelial keratoplasty procedures such as DMEK and DSAEK has improved graft survival, accelerated visual recovery, and reduced complication rates. Improvements in tissue preservation, donor matching, and surgical instrumentation are enhancing clinical outcomes and surgeon confidence. Together, rising disease burden and continued innovation in corneal transplantation techniques are driving steady expansion of the corneal implants market.

Limited availability of high-quality donor corneal tissue remains a major restraint in the global corneal implants market, particularly in low- and middle-income countries. Dependence on eye donation programs, variable tissue utilization rates, and logistical challenges in tissue preservation and distribution restrict the number of procedures that can be performed annually. In many regions, long waiting lists and inadequate eye banking infrastructure delay treatment, directly constraining market growth despite strong underlying demand.

Moreover, post-transplant complications such as graft rejection, endothelial cell loss, infection, and long-term graft failure continue to impact clinical outcomes. These risks necessitate lifelong monitoring, immunosuppressive therapy, and potential repeat transplantation, increasing both clinical and economic burden. Variability in surgical expertise and post-operative follow-up quality further influences outcomes, particularly in emerging markets. Persistent concerns around graft longevity and complication management limit broader adoption and underscore the need for more durable and predictable corneal implant solutions.

Growing innovation in synthetic and bioengineered corneal implants is creating significant growth opportunities in the global corneal implants market. Development of keratoprostheses and advanced biomaterials is addressing donor tissue shortages and expanding treatment options for patients unsuitable for conventional transplantation, including those with repeat graft failures or severe ocular surface disease. Advances in material biocompatibility, optical clarity, and infection resistance are improving long-term outcomes and expanding clinical acceptance of synthetic alternatives.

Furthermore, the expansion of specialized ophthalmic infrastructure is improving access to corneal transplantation across both developed and emerging regions. Growth in tertiary eye hospitals, increased availability of trained corneal surgeons, and investments in eye banking networks are strengthening surgical capacity. Government-led blindness prevention programs and private-sector expansion of specialty ophthalmology centers are narrowing treatment gaps, particularly in the Asia Pacific, Latin America, and the Middle East. These developments are supporting higher procedural volumes and long-term market expansion.

The human cornea segment is projected to dominate the global corneal implants market in 2026, accounting for 86.7% of revenue. Dominance is driven by the unmatched biocompatibility, optical clarity, and long-term visual outcomes provided by donor-derived corneal tissue. Human corneas integrate naturally with host tissue, reducing the risk of chronic inflammation and optical distortion. Well-established eye banking systems, standardized tissue screening and preservation protocols, and strong surgeon preference further support widespread adoption. Despite growing interest in synthetic alternatives, donor corneas remain the clinical gold standard across most corneal pathologies, sustaining segment leadership.

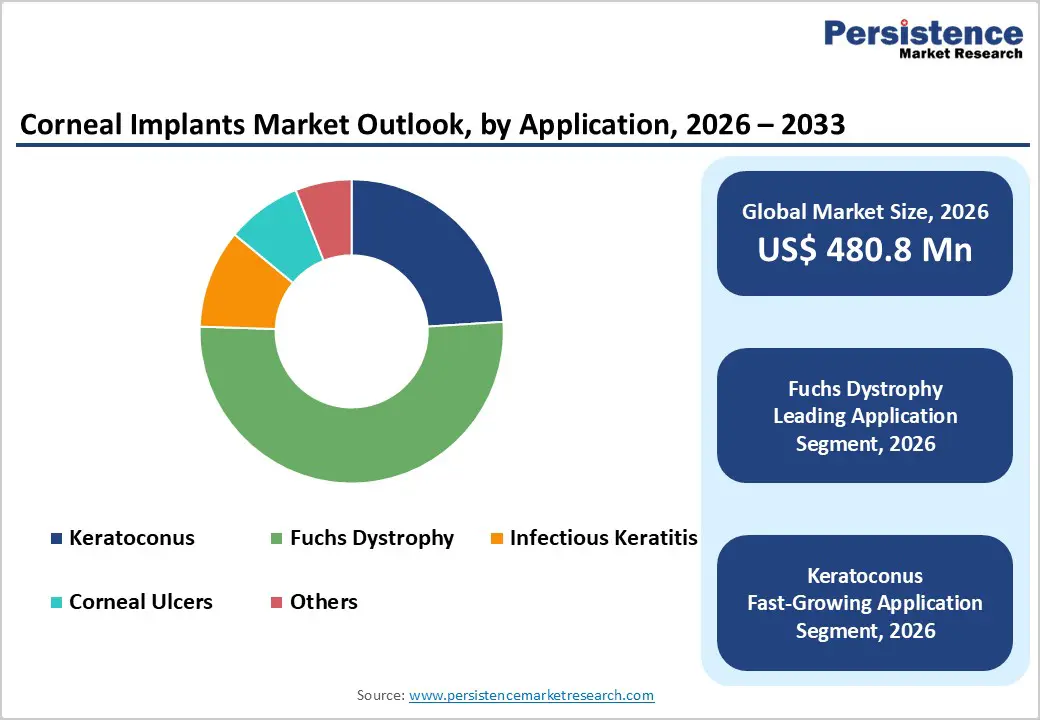

The Fuchs dystrophy segment is projected to dominate the global corneal implants market in 2026, accounting for 51.5% of revenue. Segment leadership is attributed to the progressive nature of endothelial cell loss in Fuchs dystrophy, which frequently necessitates surgical intervention once vision deteriorates. Unlike many other corneal conditions, medical management options are limited, resulting in high conversion rates to corneal transplantation. The condition is particularly prevalent in aging populations, and its strong suitability for endothelial keratoplasty procedures further reinforces sustained procedural demand and segment dominance.

The hospitals segment is projected to dominate the global corneal implants market in 2026, accounting for 56.2% of revenue. Hospitals serve as primary centers for corneal transplantation due to the availability of specialized corneal surgeons, access to operating theaters equipped for microsurgery, and integration with eye banks and tissue coordination services. Complex cases, repeat grafts, and high-risk patients are predominantly managed in hospital settings. In addition, hospitals provide comprehensive perioperative care and long-term follow-up, enabling higher procedural concentration than outpatient facilities.

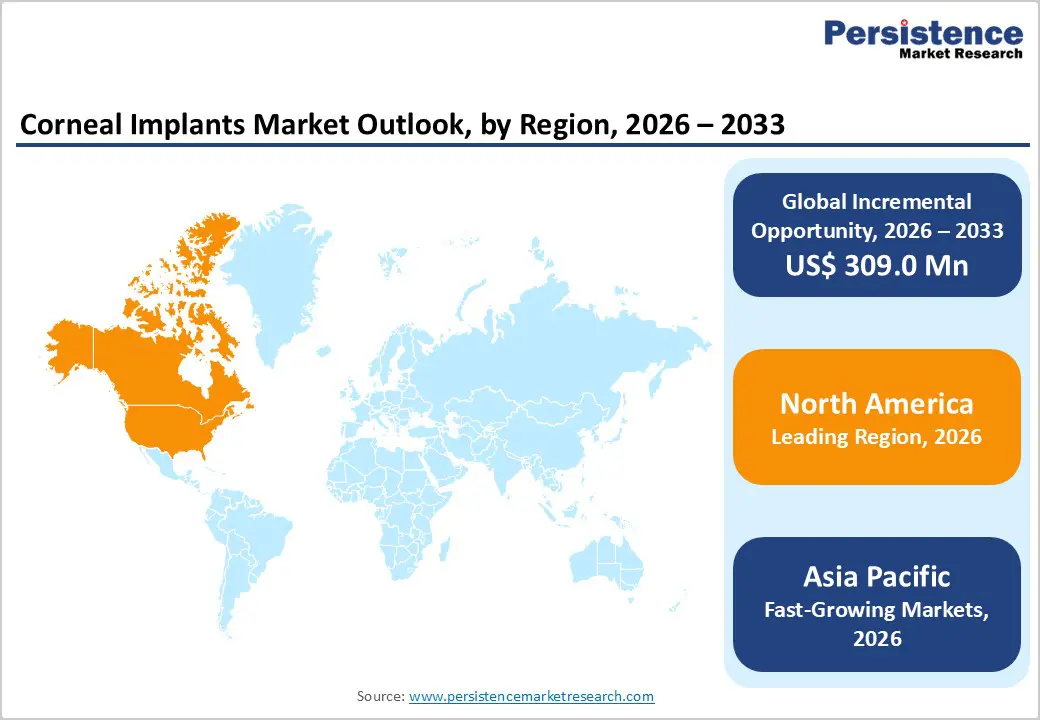

The North America corneal implants market is expected to dominate globally with a value share of 48.7% in 2026, led primarily by the U.S. The region benefits from a highly developed healthcare system, widespread access to advanced ophthalmic diagnostics, and strong clinical awareness of corneal disorders such as Fuchs endothelial dystrophy and keratoconus across both aging and adult populations. High diagnosis rates, favorable reimbursement policies, and early adoption of advanced keratoplasty techniques support sustained market leadership.

The presence of leading eye banks, established hospital networks, and specialized ophthalmic centers further strengthens adoption. Increasing focus on improving graft survival rates, reducing rejection risk, and optimizing post-transplant outcomes is driving demand for high-quality donor tissue and advanced surgical approaches. Growth in structured post-operative follow-up programs and regulatory clarity, including consistent FDA oversight, continues to support commercialization and adoption of next-generation corneal implant solutions, reinforcing North America’s dominant position.

The Europe corneal implants market is expected to grow steadily, supported by an aging population, the rising prevalence of endothelial corneal disorders, and the strong emphasis on evidence-based ophthalmic practices. Countries such as Germany, the U.K., France, Italy, and the Nordic region are key contributors due to well-established public healthcare systems and high access to specialized ophthalmology services. Improved screening, early diagnosis, and expanding transplant programs are driving consistent procedural demand.

European healthcare systems prioritize long-term visual outcomes and cost-effective treatment pathways, encouraging adoption of endothelial keratoplasty techniques that offer faster recovery and lower complication rates. Expanding eye-banking networks, integrated care pathways, and structured follow-up programs are improving the long-term management of patients with corneal disease. Harmonized regulatory frameworks and broad reimbursement coverage for corneal transplantation procedures further support stable market expansion across the region.

The Asia Pacific corneal implants market is expected to register a relatively higher CAGR of around 7.2% between 2026 and 2033, driven by expanding healthcare infrastructure, a large patient pool, and rising prevalence of corneal disorders. Countries including China, India, Japan, South Korea, and Southeast Asian nations are witnessing increasing diagnosis of keratoconus, Fuchs endothelial dystrophy, infectious keratitis, and corneal scarring. The rapid expansion of tertiary hospitals, the growing availability of trained ophthalmic surgeons, and rising healthcare expenditure are improving access to corneal transplantation procedures.

Increasing awareness of early diagnosis and timely surgical intervention is accelerating the adoption of advanced keratoplasty techniques. Expansion of regional eye banking networks, improvements in donor tissue availability, and partnerships with global ophthalmic device companies are enhancing access to products and services. Government initiatives focused on strengthening ophthalmic care infrastructure and preventing avoidable corneal blindness are further supporting sustained regional market growth.

The global corneal implants market is highly competitive, with strong participation from companies such as Florida Lions Eye Bank, Alcon Inc., Aurolab, CorneaGen, and AJL Ophthalmic S.A. These players benefit from established eye banking networks, diversified ophthalmic product portfolios, and ongoing innovation in corneal tissue processing and implant technologies. Competitive focus centers on improving graft quality, enhancing surgical outcomes, reducing rejection and infection risks, and ensuring long-term visual rehabilitation for patients.

Manufacturers and eye banks are prioritizing advancements in donor tissue preservation, endothelial cell viability, and development of synthetic and bioengineered corneal implants to address donor shortages. Strategic initiatives include expansion of tissue procurement networks, clinical evidence generation, surgeon training programs, and deeper penetration into emerging markets. Rising corneal transplant volumes and increasing adoption of advanced keratoplasty techniques continue to intensify competition across hospitals and specialized ophthalmic centers.

The global corneal implants market is projected to be valued at US$ 480.8 Mn in 2026.

Rising prevalence of corneal disorders such as Fuchs dystrophy and keratoconus, increasing corneal transplant volumes, expansion of eye banking infrastructure, and growing adoption of advanced keratoplasty techniques are driving global market growth.

The global corneal implants market is poised to witness a CAGR of 6.8% between 2026 and 2033.

Growing adoption of endothelial keratoplasty, development of synthetic corneal implants to address donor shortages, and expanding access to ophthalmic care in emerging markets present key growth opportunities.

Florida Lions Eye Bank, Alcon Inc., Aurolab, CorneaGen, and AJL Ophthalmic S.A. are some of the key players in the corneal implants market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn Volume (Units) If Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Surgery

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author