ID: PMRREP11104| 199 Pages | 7 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

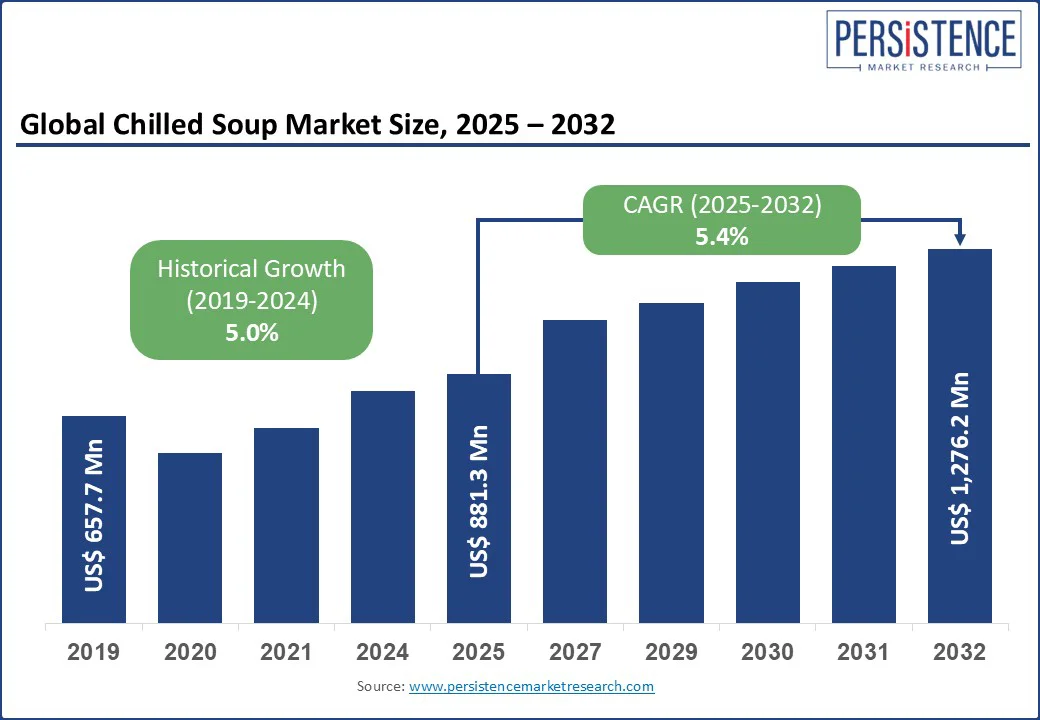

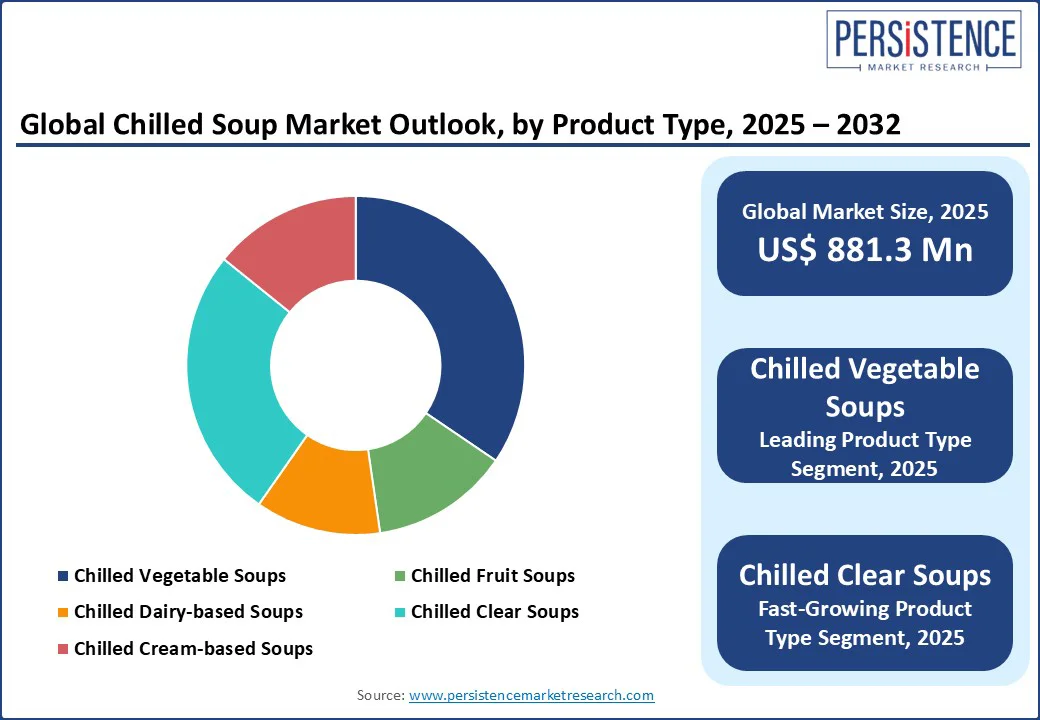

The global chilled soup market size is likely to be valued at US$ 881.3 Mn in 2025 and is estimated to reach US$ 1,276.2 Mn in 2032, growing at a CAGR of 5.4% during the forecast period 2025-2032. The chilled soup market growth is driven by the rising demand for convenient, refreshing, and health-conscious meal options, especially plant-based and clean-label formulations. Chilled soups are emerging as a unique category in the premium convenience food segment, providing a unique combination of health appeal and convenience. Additionally, the consumer preference for minimally processed, plant-based soups is attracting more demand across retail and e-commerce, and improved refrigeration has transformed chilled soups into a year-round opportunity for both DTC startups and established FMCG brands.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Chilled Soup Market Size (2025E) |

US$ 881.3 Mn |

|

Market Value Forecast (2032F) |

US$ 1,276.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

Increasing demand for plant-based and vegan diets is spurring chilled soup market growth in the West, where clean eating and meat reduction are becoming mainstream behaviors. The appeal goes beyond ethical eating as consumers are associating vegan chilled soups with digestibility, low-fat content, and functional nutrition. Plant-based chilled soups also benefit from better cold-chain stability. Unlike meat or dairy-heavy formulations, these soups tend to have fewer perishability issues and deliver longer refrigerated shelf lives without artificial preservatives.

The operational edge makes them highly attractive for both online and physical retailers. The compatibility of vegan and plant-based chilled soups with evolving wellness trends is further driving demand. Brands are using this opportunity to launch new products infused with nutrient-dense ingredients such as kale, turmeric, ginger, and activated charcoal. Vegan chilled soups are also opening doors for inclusion in wellness subscription models and detox packages.

One of the key barriers to cold soup consumption is the sensory compromise that certain ingredients undergo when served cold. Vegetables such as potatoes, eggplants, and green beans tend to lose their natural texture and become grainy or rubbery once chilled. This usually alters the mouthfeel in a way that many consumers find unappetizing. It has limited the flavor palette available to brands, specifically in regions where warm and starchy soups are the cultural norm.

Flavor volatility is another issue. Aromatic herbs such as basil and coriander often lose potency when chilled. This tends to make soups taste bland unless artificial flavor enhancers are used, something that runs counter to the clean-label positioning most chilled soup brands pursue. This challenge further deters product development in certain regions. In Asia Pacific, where spice-forward and umami-rich profiles dominate soup culture, replicating that intensity in a chilled format has proven difficult.

The chilled soup segment is seeing new growth opportunities as brands strive to meet with sustainability and ethical sourcing goals. Modern consumers are scrutinizing, i e in 2025, owing to their du origins, packaging waste, and production practices in premium food categories. As a result, brands are investing in local vegetable sourcing, regenerative farming partnerships, and carbon-neutral manufacturing processes. So Shape, a brand based in France, recently launched a range of chilled soups made exclusively from vegetables grown within 150 km of its production facility, cutting transportation emissions by 38%.

Packaging development is also opening new avenues. U.K.-based Re:Nourish, for example, claims to have created the world's first microwaveable and fully recyclable soup in a bottle. This has positioned the brand as a leader in the functional soup segment, mainly among Gen Z buyers who value measurable environmental impact. Similarly, in the Netherlands, Soupalicious partners with food banks to donate one bowl of soup for every unit sold, tapping into ethical consumption trends while promoting social responsibility. These shifts are not only helping brands win over new consumer bases but also opening B2B collaborations with health stores, co-working cafes, and wellness-focused retailers.

By product type, the market is divided into chilled vegetable soups, chilled fruit soups, chilled dairy-based soups, chilled clear soups, and chilled cream-based soups. Among these, chilled vegetable soups are poised to hold nearly 34.5% share in 2025, owing to their dual positioning as both a convenient meal and a functional health product. These soups appeal to health-conscious consumers looking for low-calorie and nutrient-dense options that require minimal preparation. They are often vegan, gluten-free, and compatible with keto or paleo diets. This enables brands to target multiple consumer segments with a single SKU.

Chilled clear soups are gaining momentum as consumers shift toward light, hydrating, and functional meal options that can double as wellness beverages. Clear soups, mainly those made with bone broth or vegetable infusions, are being positioned as low-calorie and protein-rich options suitable for in-between meals or post-exercise recovery. Consumers concerned about heavy processing are drawn to transparent products that resemble homemade broths. Functional positioning, transparent packaging, and clean labeling have allowed brands to penetrate health stores and yoga cafés beyond typical supermarket channels.

By distribution channel, the market is segregated into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and direct sales. Out of these, supermarkets/hypermarkets are speculated to account for around 36.1% of the chilled soup market share in 2025, due to their established cold-chain infrastructure and high shopper footfall in fresh food sections. These retail formats provide the refrigeration space required for perishable goods and allow brands to maintain product visibility. The role of in-store promotions and sampling is another key factor, which works well for chilled soups as consumers often hesitate to try unfamiliar cold product lines.

Online retail is becoming a key distribution channel for chilled soups, backed by its ability to target health-conscious consumers with personalized marketing and flexible delivery models. Direct-to-consumer (DTC) brands benefit from bypassing traditional retail hurdles such as shelf space and seasonal placement. Subscription models are another reason why online retail is gaining traction. Chilled soup brands often maintain customer retention through recurring deliveries, primarily for functional soups made for detox, immunity, or gut health.

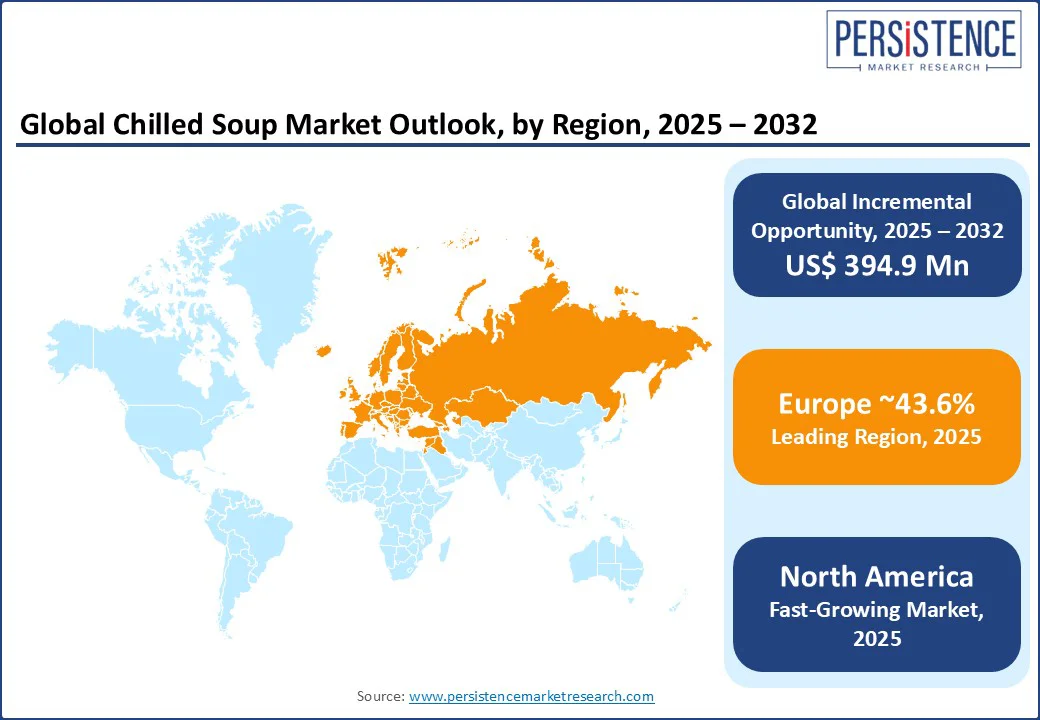

In 2025, Europe is predicted to account for approximately 43.6% of the market share due to surging consumer acceptance of cold and ready-to-consume soups. Spain leads the regional market, augmented by the cultural popularity of gazpacho. Domestic brands have extended their cold soup ranges beyond gazpacho to include salmorejo and beet-based blends, bolstering year-round consumption through value packs and resealable bottles.

In France, key players have extended their chilled product ranges by focusing on organic and additive-free variants. The U.K. market has evolved with brands promoting heatable and drink-from-the-bottle soups in fully recyclable packaging. These are now stocked in Waitrose, Booths, and Ocado, exhibiting retailer confidence in the category. A key trend in Europe is the co-branding of chilled soups with celebrity chefs and fitness influencers. In addition, chilled soup sales spike during warm months, but local retailers counter seasonality by delivering protein-rich blends and meal-replacement soups during the colder season.

In North America, the chilled soup segment is at a nascent stage compared to shelf-stable or canned soups. Consumer demand for fresh, ready-to-eat, and clean-label options is spurring slow but steady interest. Chilled soups are primarily confined to premium grocers, including Whole Foods and Sprouts, as well as a few regional health-focused chains. The U.S. chilled soup market is predicted to witness developments from niche players such as Tio Gazpacho and ZÜPA NOMA. Both have been providing cold-pressed and drinkable soups marketed as healthy snacks.

The brands, however, have faced expansion challenges owing to high perishability and limited mainstream demand. Seasonality remains another key challenge for players. Chilled soups perform best between late spring and early fall, with noticeable dips in winter months when hot soups dominate. Retailers are hesitant to allocate valuable refrigerated space to a category that does not move year-round. As of mid-2025, development has shifted toward hybrid products such as chilled bone broth smoothies and high-protein gazpachos.

In Asia Pacific, chilled soups are still in the early stages of market development, with limited visibility across mainstream retail channels. The category is mainly confined to high-income urban pockets in Japan, South Korea, and Australia. In these countries, Western dietary influences and premium health trends have gained impetus. In Japan, chilled corn and pumpkin soups are often sold in convenience stores such as FamilyMart and 7-Eleven. However, these are usually small portions consumed more as snacks than meal replacements.

South Korea has seen some experimentation with chilled vegetable-based soups, specifically in meal kits and convenience store-ready meals. High-sodium shelf-stable options currently lead in terms of consumer preference. Australia-based brands have tested chilled SKUs in retailers, including Harris Farm and Woolworths. They, however, face challenges with logistics and shelf-life. Most of these products are seasonally available, primarily during the Southern Hemisphere’s warmer months from November to February.

The global chilled soup market is characterized by premium positioning, seasonal demand, and a niche but surging consumer base seeking convenience without compromising on health. The market is consolidated in Western Europe, especially in Spain, the U.K., and France. Leading players have embraced novel cold chain logistics and long-standing retailer partnerships to maintain product freshness and visibility.

Private labels are competitive as retailers such as Tesco provide their chilled soup variants that match branded products in quality while being priced affordably. This puts pressure on leading players to differentiate through gourmet ingredients or functional claims such as immunity-boosting or high-protein.

The chilled soup market is projected to reach US$ 881.3 Mn in 2025.

Surging demand for grab-and-go refrigerated food and rising health awareness among millennials are the key market drivers.

The chilled soup market is poised to witness a CAGR of 5.4% from 2025 to 2032.

Incorporation of gut-friendly ingredients and collaborations with fitness influencers are a few key market opportunities.

The Billington Group, The Hain Daniels Group, and Soupologie are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Shelf Life

By Packaging

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author