ID: PMRREP33682| 188 Pages | 3 Oct 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

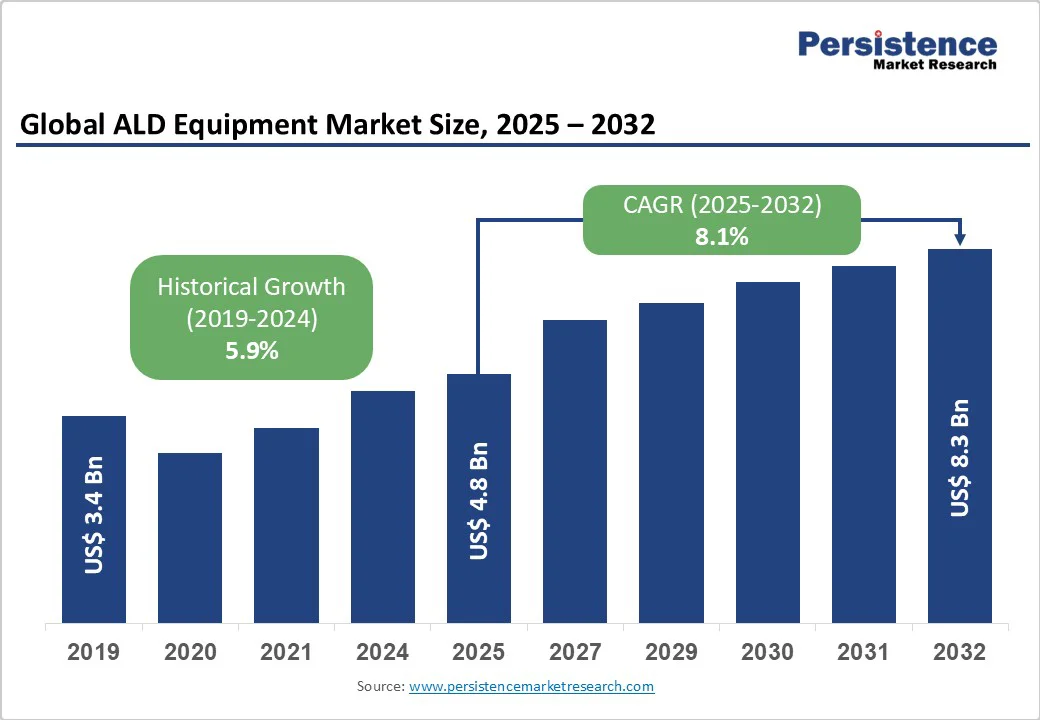

The global ALD (atomic layer deposition) equipment market size is likely to be valued at US$ 4.8 Bn in 2025, is expected to reach US$ 8.3 Bn by 2032, growing at a CAGR of 8.1% during the forecast period from 2025 to 2032, fueled by the increasing demand for advanced semiconductor manufacturing, the rise of nanotechnology applications, and the growing adoption of ALD in emerging sectors such as energy devices and biomedical applications. The ALD equipment market is driven by the need for precise, high-quality thin-film deposition techniques critical for producing next-generation semiconductor devices, advanced packaging solutions, and innovative energy storage systems.

| Key Insights | Details |

|---|---|

|

ALD Equipment Market Size (2025E) |

US$ 4.8 Bn |

|

Market Value Forecast (2032F) |

US$ 8.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.9% |

The growing demand for advanced semiconductor manufacturing is a key driver for the ALD equipment market. As semiconductor devices become smaller, faster, and more power-efficient, manufacturers increasingly rely on ALD technology for precise thin-film deposition at the atomic scale.

This precision is essential for next-generation logic chips, memory devices, and 3D NAND structures, where uniformity and conformality of layers directly impact device performance, reliability, and yield. ALD enables the deposition of ultra-thin films on complex 3D structures, making it indispensable for scaling advanced semiconductor nodes. For instance, TSMC’s 3-nanometer process, including N3B and N3E nodes, is expected to account for over 20% of the company’s revenue in 2024, with major clients such as Apple, AMD, and Intel adopting the technology for upcoming processors. Similarly, Samsung’s 3-nanometer Gate-All-Around (GAA) process, introduced in 2022, significantly improves transistor density and power efficiency, supporting high-performance logic and memory applications. As demand for AI processors, 5G devices, automotive electronics, and IoT continues to rise, the adoption of ALD equipment remains critical to meet advanced semiconductor manufacturing requirements worldwide.

High initial investment and operational costs remain a significant restraint for the ALD equipment market. ALD systems are sophisticated and highly precise, requiring advanced hardware, vacuum technology, and automation to achieve atomic-scale thin-film deposition. These systems often cost several million dollars per unit, making it a substantial capital expenditure for semiconductor manufacturers, especially small and mid-sized enterprises.

In addition to procurement costs, operational expenses, including maintenance, energy consumption, and specialized labor, further increase the total cost of ownership. For instance, maintaining high-vacuum ALD chambers and replacing expensive precursor chemicals can be costly, impacting profit margins. Startups or companies entering the semiconductor manufacturing sector may find it difficult to justify such high upfront costs, slowing market adoption. Furthermore, the complexity of ALD tools necessitates skilled technicians and engineers for operation and process optimization, adding to operational costs. As a result, despite ALD’s technological advantages in precision and uniformity, the high capital and ongoing expenditures can hinder market growth, particularly in developing regions with budget constraints, limiting the rapid deployment of advanced ALD equipment.

The expansion of ALD in emerging applications presents a significant opportunity for market growth. While ALD is well-established in semiconductor manufacturing, its precision and ability to deposit ultra-thin films on complex 3D structures make it highly suitable for a range of new industries. For instance, in energy storage, ALD is being used to enhance the performance and durability of lithium-ion and solid-state batteries by creating conformal coatings on electrodes, improving cycle life and efficiency.

In flexible electronics, wearable devices, and OLED displays, ALD enables uniform thin films on bendable substrates, supporting the development of next-generation consumer electronics. Additionally, biomedical applications, such as implant surface functionalization, benefit from ALD coatings that improve biocompatibility and reduce corrosion. The adoption of ALD in automotive sensors, advanced driver-assistance systems (ADAS), and power electronics further expands its reach into high-growth sectors. As industries increasingly demand high-performance materials and precise nanometer-scale coatings, the versatility of ALD provides manufacturers with opportunities to innovate and diversify applications beyond traditional semiconductor uses, driving long-term market growth globally.

Thermal ALD dominates, accounting for approximately 42% share in 2025. Its dominance stems from its widespread use in high-volume semiconductor manufacturing, where it provides reliable and cost-effective solutions for depositing uniform thin films. Thermal ALD systems, offered by companies such as ASM International and Tokyo Electron, are favored for their compatibility with a wide range of materials and applications, including logic and memory chip production. Their scalability and established presence in foundries make them a preferred choice for large-scale semiconductor manufacturers.

The plasma-enhanced ALD segment is the fastest-growing, driven by its ability to deposit films at lower temperatures, enabling applications in temperature-sensitive substrates such as flexible electronics and advanced packaging. PE-ALD’s enhanced deposition rates and improved film quality are critical for emerging technologies such as 5G devices and IoT sensors. The growing adoption of PE-ALD in research and niche applications, supported by companies such as Oxford Instruments and Veeco Instruments, is accelerating its market penetration.

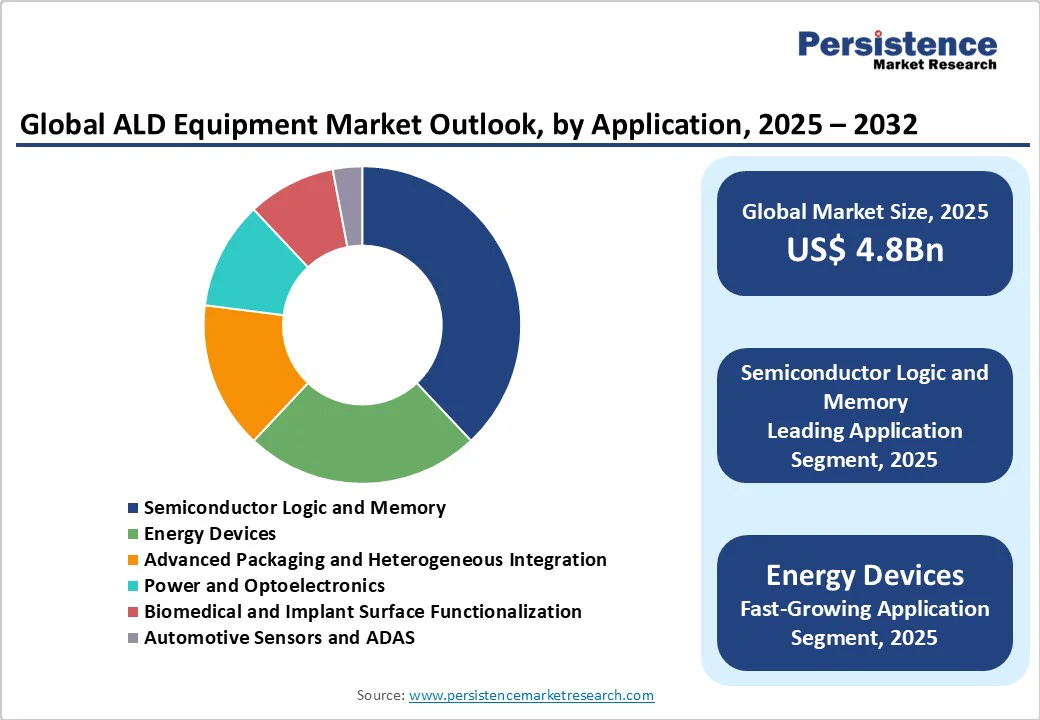

Semiconductor logic and memory lead the ALD equipment market, holding a 38% share in 2025. This segment’s dominance is driven by the critical role of ALD in manufacturing advanced chips for AI, 5G, and IoT applications. The need for precise, conformal coatings in complex chip architectures, such as 3D NAND and DRAM, fuels demand for ALD equipment. Companies such as Applied Materials and Lam Research provide tailored ALD solutions to meet the stringent requirements of leading foundries such as TSMC and Intel.

The Energy devices segment is the fastest-growing, propelled by the increasing use of ALD in solid-state batteries, photovoltaics, and fuel cells. The global push for sustainable energy solutions, coupled with government incentives for renewable energy, is driving demand for ALD equipment to enhance the performance and durability of energy storage systems. For instance, ALD-coated electrodes in lithium-ion batteries improve cycle life and safety, making this application a key growth driver in regions such as the Asia Pacific and Europe.

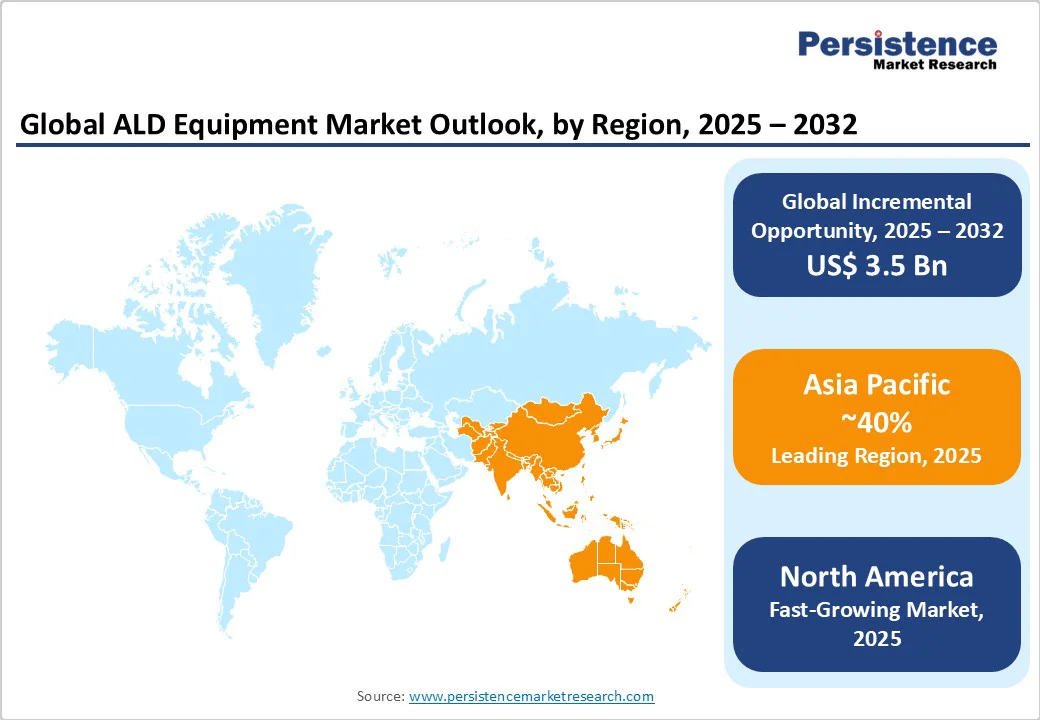

North America is emerging in the ALD equipment market, fueled by advanced semiconductor manufacturing, growing adoption of MEMS and optoelectronics, and strong research and development investments. The region hosts major semiconductor companies such as Intel, Applied Materials, and Lam Research, which drive the demand for high-precision ALD tools to support next-generation logic chips, memory devices, and advanced packaging solutions. ALD technology enables ultra-thin, conformal film deposition on complex 3D structures, which is essential for the production of high-performance semiconductor devices.

The growing adoption of MEMS sensors, optoelectronic components, and power electronics in applications such as autonomous vehicles, IoT devices, and data centers has further boosted demand. The region’s strong R&D ecosystem, supported by government initiatives and private sector investments, accelerates the development of innovative ALD applications across energy storage, flexible electronics, and biomedical devices. This combination of technological expertise, manufacturing capabilities, and emerging applications positions North America as a significant and fast-growing market for ALD equipment, supporting global advances in semiconductor and high-tech industries.

Europe is a significant player in the ALD equipment market, supported by strong institutional frameworks and collaborative research programs. Leading countries such as Germany, the Netherlands, and Finland drive market growth through their advanced manufacturing capabilities and focus on innovation. The Netherlands, home to ASM International, is a hub for ALD technology development, particularly for semiconductor applications. Germany’s leadership in automotive sensors and ADAS, supported by companies such as Aixtron, fuels demand for ALD equipment in precision coating applications.

Finland’s Picosun is a pioneer in biomedical ALD solutions, contributing to the region’s growth in emerging applications. The European Union’s Horizon Europe program, with a budget for research and innovation, supports advancements in ALD for energy and biomedical sectors. Europe’s emphasis on sustainability and precision manufacturing ensures steady demand for ALD equipment, particularly in energy devices and automotive applications.

Asia Pacific is expected to hold approximately 40% of the global ALD equipment market share, driven by the region’s dominance in semiconductor manufacturing, strong government support, and the rapid adoption of emerging applications. Countries such as China, Japan, South Korea, and Taiwan serve as major semiconductor hubs, housing leading foundries such as TSMC, Samsung, and SMIC, which drive demand for advanced ALD systems. Government initiatives, particularly in China, have further accelerated investment in domestic chip manufacturing, with policies aimed at reducing reliance on imports and boosting local production capabilities.

The adoption of ALD in emerging applications such as energy storage, flexible electronics, biomedical devices, and automotive sensors is expanding rapidly in the region. For instance, ALD coatings are increasingly used in lithium-ion and solid-state batteries to improve efficiency and durability, while in flexible electronics and OLED displays, they provide uniform thin films on bendable substrates. Combined with a growing focus on research and development, Asia Pacific’s strategic investments, technological advancements, and diversified applications position it as the leading and fastest-growing market for ALD equipment globally.

The global ALD equipment market is highly competitive, comprising both international and regional players. In developed regions such as North America and Europe, major companies such as ASM International, Applied Materials, Tokyo Electron, and Veeco Instruments dominate through strong R&D capabilities, advanced manufacturing infrastructure, and established collaborations with semiconductor manufacturers. Meanwhile, in the Asia Pacific, rapid growth in semiconductor fabrication, government-backed initiatives, and rising demand for emerging applications such as energy storage, flexible electronics, and biomedical devices are attracting investment from both global and local vendors. Market participants are emphasizing technological innovation, process optimization, and strategic partnerships to maintain a competitive advantage. The development of next-generation ALD systems for 3D NAND, logic chips, and MEMS applications has become a key differentiator, promoting faster adoption in high-performance semiconductor production. While leading firms drive innovation with high-precision and high-throughput systems, smaller regional players focus on cost-effective solutions, resulting in a semi-fragmented yet rapidly evolving ALD equipment market landscape.

The global ALD equipment market is projected to reach US$ 4.8 Bn in 2025.

The growing demand for advanced semiconductor manufacturing is a key driver.

The ALD equipment market is expected to witness a CAGR of 8.1% from 2025 to 2032.

Expansion of ALD in emerging applications such as energy devices and biomedical surface functionalization is a key opportunity.

ASM International, Applied Materials, Tokyo Electron, Veeco Instruments, and Lam Research are among the key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Equipment Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author