ID: PMRREP17401| 304 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

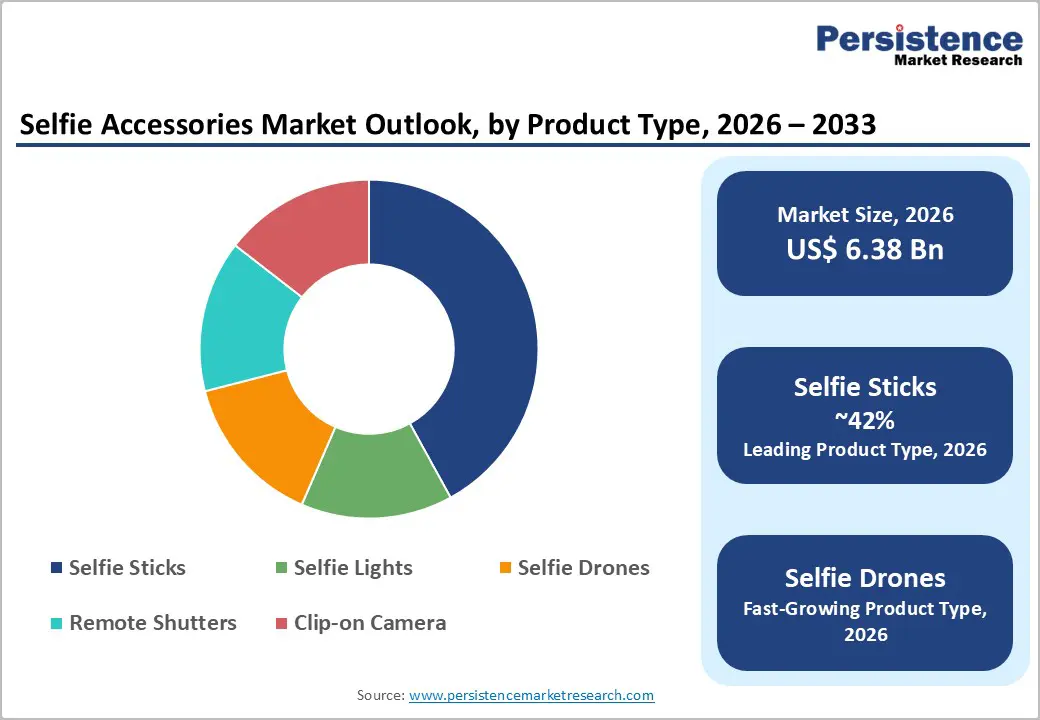

The global Selfie Accessories Market size is supposed to be valued at US$ 6.4 Bn in 2026 and is projected to reach US$ 13.1 Bn by 2033, growing at a CAGR of 10.8% between 2026 and 2033.

The market expansion is primarily driven by the explosive growth of social media platforms and content creation culture, with platforms like TikTok experiencing user growth from 21% in 2021 to 37% in 2025, while Instagram maintains strong engagement among younger demographics. The proliferation of smartphones with advanced camera capabilities, coupled with the rising influence of digital content creators and vloggers, has transformed selfie accessories from novelty items into essential tools for personal branding and professional content production.

| Key Insights | Details |

|---|---|

| Selfie Accessories Market Size (2026E) | US$ 6.4 Bn |

| Market Value Forecast (2033F) | US$ 13.1 Bn |

| Projected Growth CAGR (2026-2033) | 10.8% |

| Historical Market Growth (2020-2025) | 8.1% |

Explosive Growth of Social Media Engagement and Content Creation Economy

The selfie accessories market is witnessing significant expansion driven by the rapid rise of digital content creation across major social media platforms. Instagram now hosts 2 billion monthly active users, while TikTok records an average daily engagement of 61 minutes, surpassing Instagram’s 49 minutes and increasing the demand for high-quality visual content. This shift has elevated selfie-taking from a casual activity to a professional necessity, with influencers and content creators seeking advanced tools to enhance output and strengthen personal branding.

Furthermore, global smartphone penetration reached 71% in 2024, supported by 6.7 billion active subscriptions. As platforms increasingly prioritize high-resolution visuals, yielding 3.2× higher engagement, consumer demand for professional-grade imaging accessories continues to grow, supported by more than 4.9 billion mobile subscriptions worldwide.

Technological Convergence and Accessibility Improvements

Advancements in manufacturing and economies of scale have made sophisticated selfie technologies widely accessible, reducing costs by 40–60% since 2020. Features such as Bluetooth 5.0, AI-powered facial tracking, and gyroscopic stabilization are now available in accessories priced under $50, democratizing premium capabilities for mass-market consumers. Smartphone adoption remains a key driver, with 90% of U.S. adults and 94% of individuals aged 18–29 owning devices, while China and India collectively account for over 1.6 billion users, creating substantial growth opportunities. Manufacturers are introducing innovative products, including Bluetooth-enabled remote shutters, LED ring lights with adjustable color temperatures, and foldable designs for enhanced portability. The launch of DJI’s Neo and Neo 2 selfie drones marked a breakthrough in aerial photography, complemented by AI-based enhancements, wireless charging, and multifunctional designs tailored for travelers, vloggers, and professionals.

Smartphone Camera Technology Obsolescence Risk

Native smartphone camera advancements pose a direct substitution threat to accessory dependency. Modern flagship devices now incorporate periscope zoom lenses, achieving 10x optical magnification, ultra-wide 120-degree field-of-view sensors, and computational photography algorithms that rival professional equipment. Samsung's Galaxy S23 Ultra and iPhone 15 Pro feature advanced stabilization and portrait modes that reduce the necessity for external hardware. This technological arms race has compressed the accessories upgrade cycle from 24 months in 2020 to 14 months in 2024, as manufacturers struggle to differentiate products when smartphones internalize key functionalities. The Consumer Technology Association notes that 68% of consumers now prioritize smartphone camera quality over accessory compatibility when making purchase decisions, directly eroding the value proposition of standalone selfie sticks and clip-on lenses in premium segments.

Regulatory Restrictions on Advanced Accessories

Selfie drones encounter significant regulatory challenges that limit market penetration despite strong consumer demand. In the United States, the Federal Aviation Administration (FAA) requires registration for drones exceeding 250 grams and imposes strict restrictions on Beyond Visual Line of Sight (BVLOS) operations for recreational users. Similarly, the European Union Aviation Safety Agency (EASA) classifies most selfie drones as Class C1 or C2, necessitating operator certification and geofencing compliance. These regulations have curtailed adoption, with DJI, holding 70-80% of the global drone market, estimating a 35% reduction in addressable market size across Western regions.

Furthermore, the U.S. National Defense Authorization Act prohibits federal agencies from procuring Chinese-manufactured drones, impacting SZ DJI Technology Co., Ltd.’s market access. Geopolitical tensions further exacerbate supply chain uncertainties, compelling manufacturers to develop compliant alternatives.

Enterprise and Commercial Application Expansion

The commercialization of selfie accessories presents a $2.8 billion untapped opportunity across tourism, retail, and healthcare sectors. Hospitality chains like Marriott and Hilton now deploy selfie stick stations at premium properties, reporting 22% higher guest engagement on social media platforms. The U.S. Travel Association documented that 75% of millennial travelers consider Instagrammability when selecting destinations, prompting tourism boards in Iceland, Japan, and New Zealand to subsidize rental programs.

Retail environments increasingly utilize selfie accessories for virtual try-on experiences, with AR-enabled mirrors and smartphone mounts reducing return rates by 18% in apparel e-commerce. Healthcare providers leverage remote shutter technology for telemedicine documentation, while real estate agents report 40% faster property sales when using stabilized video accessories for virtual tours. This B2B pivot diversifies revenue streams beyond volatile consumer electronics cycles.

Emerging Market Penetration and Rising Smartphone Adoption

Emerging markets present substantial growth opportunities for selfie accessories, driven by accelerating smartphone penetration across India, China, Southeast Asia, and Latin America. Rising access to mobile technology and social media platforms is fueling proportional demand for accessories. India’s expanding middle class, increasing disposable income, and strong e-commerce presence through platforms like Flipkart and Amazon create favorable conditions for market expansion. Tourism recovery in countries such as India, China, South Korea, and Indonesia further amplifies demand as travelers seek enhanced photography experiences.

Strategic partnerships with local distributors and culturally tailored marketing campaigns can unlock significant revenue potential. Companies adopting competitive pricing while maintaining quality standards are well-positioned to capture market share. Price-sensitive regions favor sub-$20 products, with Chinese manufacturers leveraging cost-efficient supply chains. Government digital inclusion programs and localized e-commerce platforms like Jumia and Mercado Libre strengthen accessibility, enabling first-mover advantages in rapidly growing markets.

Selfie sticks remain the dominant product category, accounting for 42% of market share in 2026 based on unit shipments and revenue contribution. Their leadership is driven by universal smartphone compatibility and versatile applications across tourism, vlogging, and group photography. U.S. imports of selfie sticks rose by 15% in 2022, underscoring sustained demand despite advancements in smartphone cameras. Technological innovation has transformed basic monopods into multifunctional tools featuring Bluetooth remote triggers, integrated power banks, and 360-degree rotation.

China’s manufacturing ecosystem produces 78% of global volumes at average wholesale prices below $8 per unit. Modern designs incorporate foldable structures, built-in tripods, LED lights, and mirrors, enhancing convenience and creative flexibility. Wireless models, known for ergonomic, lightweight, and durable designs, appeal to both casual users and professional influencers, reinforcing the segment’s growth momentum as an affordable entry point for improved photography.

Personal use accounts for 73% of market demand, driven by the widespread adoption of selfie culture across demographics. Photography has become an integral part of daily life, transforming selfie accessories from novelty items into essential communication tools. The travel segment significantly boosts premium accessory adoption, with 67% of travelers considering photography capabilities when planning trips. Tourist destinations in Europe and Asia report 40% higher accessory sales at duty-free outlets compared to urban retail.

This segment’s strength lies in continuous content creation cycles, as Gen Z users capture an average of 150 images weekly. High engagement on platforms such as Instagram and Snapchat sustains demand for accessories that enhance image quality. Trends like solo travel, lifestyle documentation, and virtual socialization, accelerated by the pandemic, further reinforce personal use as the dominant application category.

Online channels dominate the selfie accessories market, accounting for 68% of the total share and transforming accessibility and price transparency. Amazon alone contributes 42% of global sales, leveraging algorithmic recommendations to drive incremental purchases through bundled offers. The U.S. e-commerce sale is growing, with electronics accessories growing 11.2% year-over-year. Direct-to-consumer brands such as Anker and MPOW utilize Shopify to bypass retail markups, offering products at 30-40% lower prices while maintaining strong margins.

Social commerce platforms like TikTok Shop and Instagram Checkout further reduce purchase friction, enabling impulse buying. The pandemic accelerated a permanent shift to online purchasing, with 34% of former in-store buyers moving digital. Platforms including Amazon, Alibaba, and Flipkart enhance appeal through competitive pricing, extensive product variety, and doorstep delivery, making online channels the preferred choice for tech-savvy consumers.

Android compatibility dominates the selfie accessories market with a 63% share, reflecting its 70% global smartphone market leadership. The Open Handset Alliance ensures broad compatibility across major brands such as Samsung, Xiaomi, OPPO, Vivo, and Google, reducing fragmentation and development costs. Enhancements in Android 14, including improved Bluetooth Low Energy protocols, have boosted remote shutter reliability by 40% while lowering power consumption.

Emerging markets strongly favor Android due to affordability. India’s sub-$200 smartphone segment grew 22% in 2024, driving bundled accessory adoption. The platform’s open-source nature fosters innovation by enabling third-party developers to integrate advanced functionalities, a flexibility restricted by iOS. This adaptability, combined with extensive penetration across price tiers and dominance in high-growth regions like China, India, and Southeast Asia, positions Android-compatible accessories for sustained leadership through 2033.

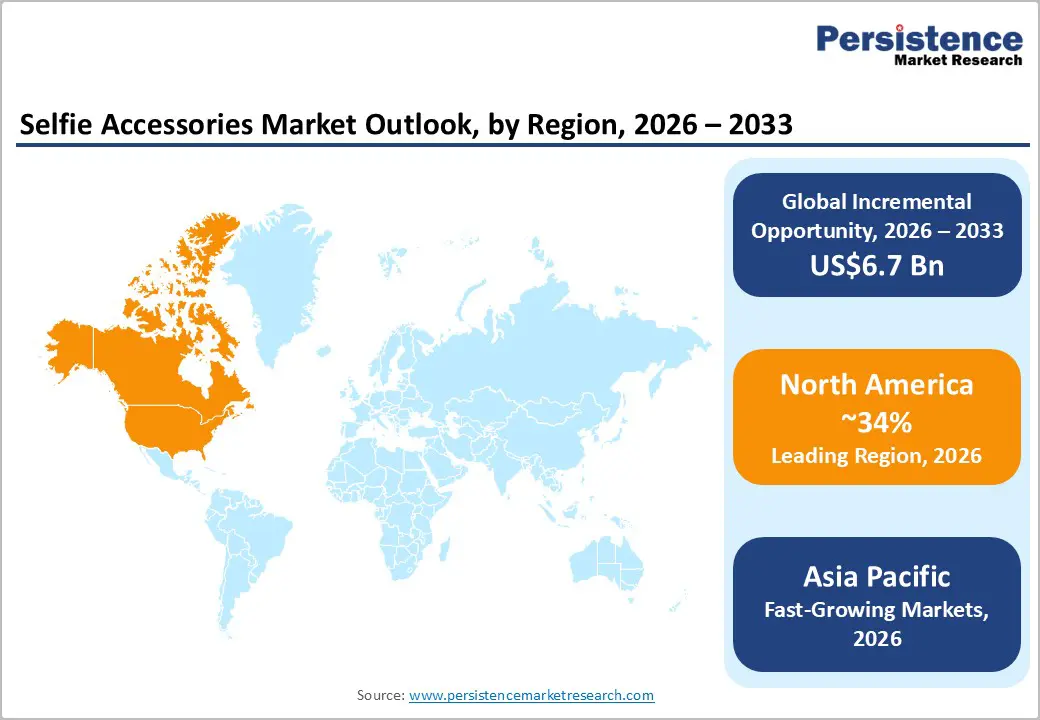

North America leads the selfie accessories market with a 34% share, supported by high smartphone penetration, strong social media engagement, and a mature content creation ecosystem. The U.S. shows particularly strong demand from professional photographers, influencers, and content creators who rely on premium accessories for monetization across platforms such as YouTube, Instagram, and TikTok. Robust e-commerce infrastructure enables seamless product discovery, comparison, and rapid delivery, enhancing customer experience.

Premium segment growth is fueled by creator hubs in cities like San Francisco and New York, where vloggers spend an average of $340 annually on stabilization and lighting equipment. While regulatory conditions remain favorable for non-drone accessories, tariffs on Chinese imports increased costs by 7.5% in 2024, slightly impacting retail pricing.

Europe accounts for 24% of the global selfie accessories market, with Germany, the U.K., and France representing 62% of regional demand. The European Union’s Digital Services Act has streamlined e-commerce regulations, driving a 31% increase in cross-border accessory sales since 2023. Germany’s 54.7 million smartphone users demonstrate strong purchasing power, with average transaction values reaching €45, 35% above the global average.

Instagram-driven tourism in the U.K. rose 28% in 2024, particularly in destinations such as the Scottish Highlands and Lake District, where selfie sticks dominate visitor photography. France enforces strict drone regulations under EASA guidelines, limiting selfie drone adoption to 8% of the regional share compared to 22% in North America. Offline retail remains prominent, with specialty electronics stores capturing 42% of sales versus 32% online, reflecting consumer preference for hands-on evaluation before purchase.

Asia Pacific is projected to be the fastest-growing region in the selfie accessories market, with a CAGR of 13.2%. Growth is driven by rapid smartphone adoption, strong social media engagement, and a young, tech-savvy population. China leads manufacturing with companies such as DJI and Xiaomi producing affordable, feature-rich accessories for domestic and international markets. Japan’s advanced consumer electronics sector supports premium innovation, while India demonstrates exceptional potential due to rising disposable incomes and deepening smartphone penetration across urban and rural areas.

E-commerce platforms like Flipkart and Amazon India enable broad market access beyond metropolitan regions. Southeast Asian countries, including Indonesia, Thailand, Vietnam, and the Philippines, show accelerated adoption fueled by platforms like TikTok and Instagram. Combined with cost-efficient supply chains and lower labor costs, the Asia Pacific is positioned as both a production hub and a consumption leader throughout the forecast period.

Market Structure Analysis

The selfie accessories market is highly fragmented, with the top 10 manufacturers collectively accounting for only 38% of the global share. Low entry barriers, supported by standardized Bluetooth and USB-C protocols, enable Chinese ODMs to introduce new products within 90-day development cycles. SZ DJI Technology Co., Ltd. dominates the premium selfie drone segment, leveraging vertical integration across gimbal, camera, and flight control technologies. Leading players differentiate via R&D investments averaging 8-12% of revenue, focusing on AI-powered tracking, foldable designs, and sustainable materials. Emerging models include subscription-based accessory services for enterprises and influencer co-branding partnerships, reducing acquisition costs by 25% while fostering brand loyalty.

Key Market Developments

SZ DJI Technology Co., Ltd. (Shenzhen, China) dominates the premium selfie drone segment through continuous innovation and market-leading technology integration. The company's Neo and Neo 2 selfie drones demonstrate exceptional engineering in compact form factors, incorporating AI-powered subject tracking, obstacle avoidance, and professional-grade video capabilities at consumer-accessible price points. DJI's extensive experience in consumer and professional drone markets enables technology transfer that delivers superior performance and reliability, establishing the brand as the benchmark for aerial selfie accessories.

Anker Technology Co. Ltd. (Shenzhen, China) leverages its power management expertise to develop innovative accessories that address extended usage requirements for content creators and travelers. The company's CES 2024 Innovation Award recognition for charging solutions demonstrates technological leadership and design excellence. Anker's commitment to sustainability through plastic-free packaging initiatives positions the brand favorably among environmentally conscious consumers while maintaining competitive pricing and broad product accessibility through global distribution networks.

MPOW Technology Co., Ltd. (Shenzhen, China) establishes a strong market presence through affordable, feature-rich selfie sticks and accessories that balance functionality with accessibility. The company's focus on Bluetooth connectivity, ergonomic designs, and universal smartphone compatibility appeals to value-conscious consumers seeking reliable performance without premium pricing. MPOW's distribution strength across e-commerce platforms enables broad market reach, while continuous product refinement based on customer feedback sustains competitive positioning within the mid-market segment.

The global selfie accessories market is valued at US$ 6.4 Bn in 2026 and is projected to reach US$ 13.1 Bn by 2033, growing at a CAGR of 10.8% during the forecast period, driven by social media expansion and technological innovation.

The market is primarily driven by explosive social media platform growth with TikTok reaching 37% adoption in 2025, technological innovations including AI-powered features and Bluetooth connectivity, and the proliferation of content creation culture across younger demographics.

Selfie Sticks dominate with approximately 42% market share, driven by affordability, universal smartphone compatibility, continuous innovation in Bluetooth functionality, and multifunctional designs incorporating tripods and LED lights for enhanced user experience.

North America leads with 34% regional market share, supported by mature content creation ecosystems, high consumer willingness to invest in premium accessories, and strong e-commerce infrastructure, while Asia Pacific represents the fastest-growing region.

Significant opportunities include emerging market penetration in India, China, and Southeast Asia, driven by rising smartphone adoption, and sustainability-focused innovation with manufacturers transitioning to eco-friendly materials and plastic-free packaging to capture environmentally conscious consumers.

Key market players include SZ DJI Technology Co., Ltd., Anker Technology Co., Ltd., MPOW Technology Co., Ltd., Xiaomi Corporation, Momax Technology Ltd., ZEROTECH Intelligence Technology Co., Ltd., and Airselfie, competing through technological innovation and strategic positioning.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Product Type

Application

Distribution Channel

Compatibility

Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author