ID: PMRREP4801| 196 Pages | 8 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

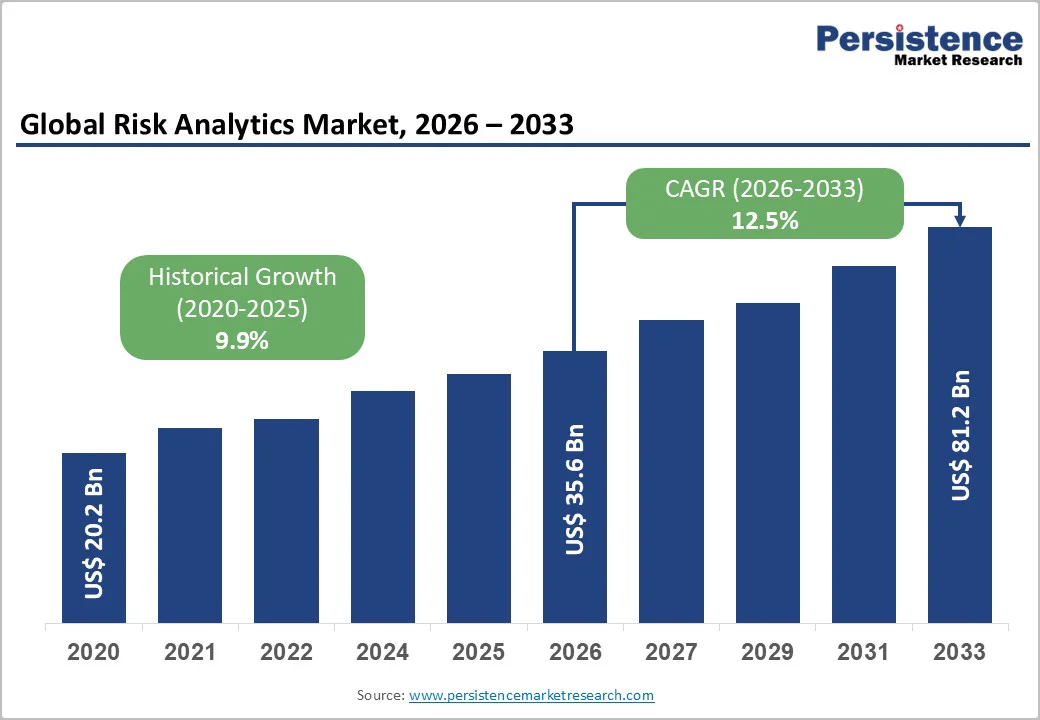

The global risk analytics market size is likely to be valued at US$ 35.6 billion in 2026, and is projected to reach US$ 81.2 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2026-2033. The market is driven by increasingly complex regulatory compliance requirements, expanding volumes of structured and unstructured data necessitating advanced analytics, and accelerating digitization across industries.

These factors push organizations to invest in sophisticated risk-analytics solutions and services to manage financial, operational, compliance, and emerging climate or environmental, social, & governance (ESG)-related risks. As digital transformation deepens and regulatory scrutiny intensifies, demand for cloud-native, real-time risk analytics platforms is rising steadily.

| Key Insights | Details |

|---|---|

|

Risk Analytics Market Size (2026E) |

US$ 35.6 Bn |

|

Market Value Forecast (2033F) |

US$ 81.2 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

12.5% |

|

Historical Market Growth (CAGR 2020 to 2024) |

9.9% |

Global regulatory expectations across finance, corporate governance, and ESG reporting are rapidly tightening, pushing organizations to adopt automated and auditable risk analytics systems. Requirements for capital adequacy, stress testing, anti-money laundering (AML) monitoring, and climate-risk disclosure are transforming risk analytics from optional to mandatory. As regulators demand deeper transparency and faster reporting cycles, enterprises are investing in integrated platforms that streamline data aggregation and ensure compliance accuracy. The urgency for reliable, regulation-aligned analytics continues to grow, and recent moves by major vendors to strengthen compliance capabilities further reflect this shift toward mandatory, system-driven risk management.

Enterprises now generate massive amounts of operational, transactional, and behavioral data, making traditional risk processes insufficient. Organizations increasingly rely on AI-driven platforms to detect anomalies, monitor threats in real time, and model multilayered risks such as cyber, ESG, operational, and supply-chain disruptions. Cybersecurity risk, in particular, has become a priority as threats grow more sophisticated. As emerging risks intensify, sectors beyond BFSI are adopting enterprise-wide, analytics-based risk management.

A large number of enterprises struggle with internal capability deficits that fundamentally impede the deployment and management of sophisticated risk analytics platforms. Implementing AI/ML models, climate-risk frameworks, and integrated enterprise risk systems demands advanced analytical, technical, and governance competencies that remain underdeveloped across most organizations. This expertise gap is particularly acute in mid-sized firms and regulated sectors, where specialized talent is scarce and budget allocation for new analytical capabilities competes with core operational priorities.

Beyond capability constraints, organizations confront a formidable cost-complexity matrix in the form of steep implementation expenses, intricate system integrations, data-sovereignty regulatory burdens, and perpetual maintenance obligations that delay adoption timelines and erode budget readiness. These systemic barriers disproportionately disadvantage resource-constrained organizations and regulated industries, where rising subscription costs and operational overhead diminish the financial case for expanding risk analytics investments, creating a vicious cycle in which underfunded firms fall further behind in risk management maturity.

The accelerating shift toward cloud infrastructure is creating strong momentum for SaaS and platform-based risk analytics solutions. Cloud deployment minimizes upfront investment, enables scalable real-time processing, and simplifies integration across enterprise systems. This transition is particularly beneficial for mid-sized organizations that previously faced financial and technical barriers with on-premises systems. As cloud becomes the preferred environment for risk scoring, fraud detection, and scenario modeling, vendors offering secure, compliant, and modular cloud-native platforms are positioned to capture a significantly larger addressable market.

The demand for risk analytics is rapidly growing in sectors other than BFSI, including healthcare, retail, manufacturing, and government, as these industries face higher exposure to cyber threats, ESG obligations, and operational disruptions. At the same time, organizations are broadening their risk management scope to include climate risk, strategic risk, and advanced cybersecurity modeling. This shift enables vendors to expand into new customer segments and offer multi-risk solutions tailored to sector-specific needs. As regulatory expectations tighten and digitization accelerates, providers capable of delivering integrated, cross-domain risk analytics stand to benefit from sustained, multi-industry adoption.

Solutions are expected to remain the dominant component, accounting for about 65% of the risk analytics market revenue share in 2026. Enterprises continue to rely on core software platforms for risk modeling, reporting, scenario analysis, and data integration. These tools form the backbone of digital risk management architectures, enabling automated workflows and regulatory-ready outputs. As risk complexity increases, organizations prioritize robust solution stacks to centralize and operationalize analytics capabilities.

Services, including consulting, integration, and managed services, are set to emerge as the fastest-growing component between 2026 and 2033. Their growth is fueled by the urgent need to integrate analytics engines with legacy systems, customize regulatory reporting processes, and ensure ongoing data governance. Several organizations lack in-house capabilities for complex implementations, making external service providers essential to optimize deployments and maintain continuous compliance across evolving risk categories.

On-premises deployment is likely to hold the largest market share at approximately 67.6% in 2026, driven by strict data sovereignty, privacy, and regulatory requirements, especially within banking, government, and sensitive infrastructure environments. Organizations with entrenched legacy systems favor on-premises models for enhanced control over data and workflows. Despite rising cloud adoption, many regulated enterprises still view on-premises infrastructure as critical for mission-critical risk functions.

Cloud deployment is expected to be the fastest-growing, posting an estimated CAGR of 12.7% during 2026-2033. Enterprises are increasingly adopting cloud-native analytics to achieve real-time risk scoring, advanced fraud detection, and cost-efficient scalability. The shift is reinforced by maturing cloud security frameworks and the appeal of reducing capital expenditure. Hybrid architectures that blend on-premises stability with cloud agility are gaining prominence, making cloud expansion a central growth vector.

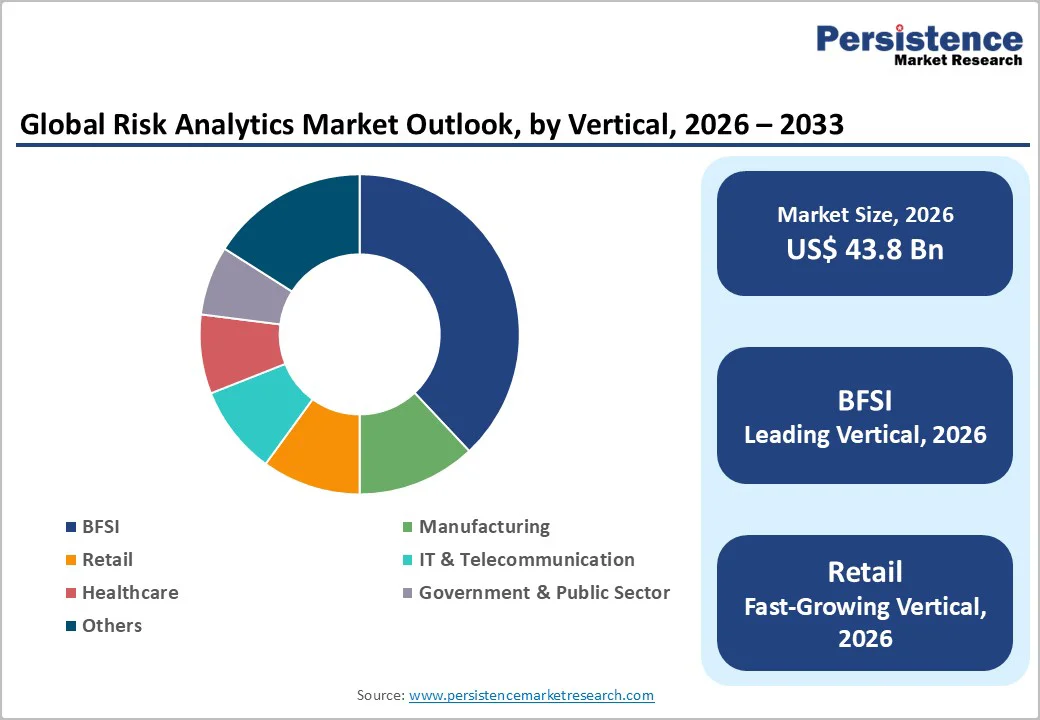

The BFSI sector is likely to remain the leading vertical with an estimated 37.5% revenue share in 2026, driven by stringent regulatory frameworks, exposure to credit and market risks, and increasing fraud detection requirements. Financial institutions continuously invest in advanced analytics to meet audit expectations, strengthen governance, and enhance risk-adjusted decision-making. The high frequency of regulatory updates sustains consistent technology spending in this segment.

The non-BFSI sectors are envisioned to expand rapidly through 2033, as they confront rising digital risks, data protection mandates, and operational complexities. Retailers are accelerating adoption for fraud and supply chain monitoring, healthcare organizations for patient data and operational safety, IT & telecom providers for cybersecurity and network resilience, and government agencies for regulatory oversight and threat detection. Their combined momentum reflects diversified growth beyond traditional financial sector demand.

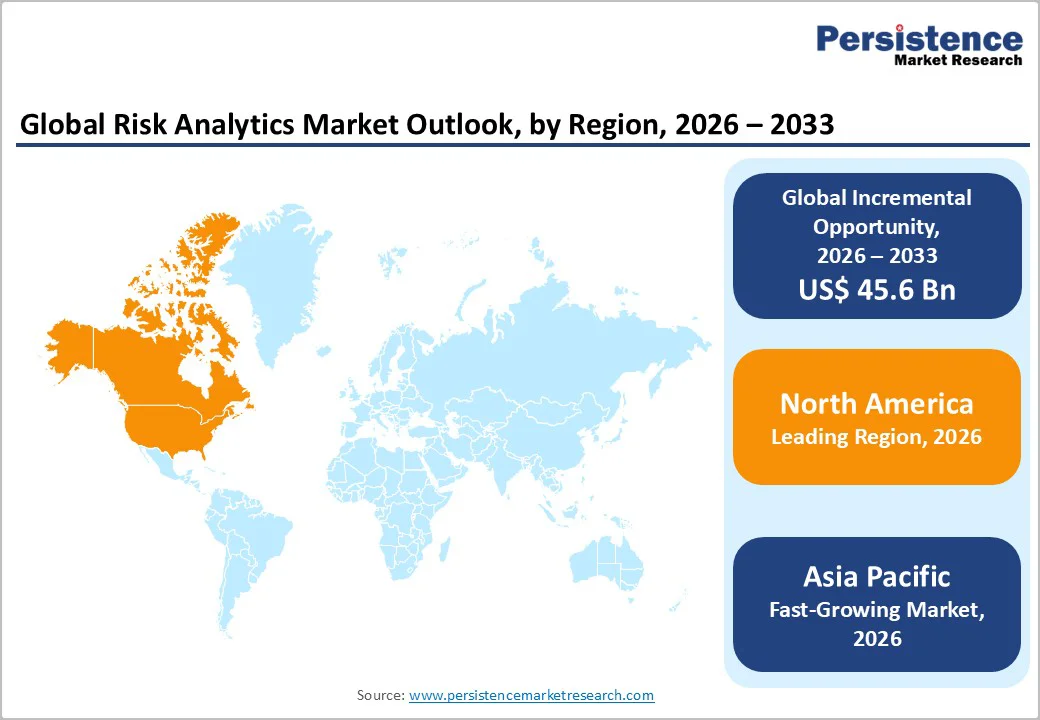

North America is expected to lead with around 38.6% of the risk analytics market share in 2026, supported by strong regulatory requirements and high adoption across banking, capital markets, and government sectors. The region’s advanced digital infrastructure and early use of AI-driven risk models reinforce demand for integrated platforms. Real-time fraud monitoring, climate-risk reporting, and enterprise-wide compliance tools remain central to investment priorities, keeping the region ahead in terms of capability maturity.

The competitive landscape features large enterprise vendors and innovative cloud-native providers, creating a balanced mix of incumbents and disruptors. Increased investment in cloud-based analytics, quantum-resilient security, and unified risk engines highlights a shift toward scalable, automation-driven solutions. Alignment with global reporting standards further boosts reliance on auditable, standardized platforms.

In 2026, Europe is expected to hold around 29% share, maintaining its position as the second-largest regional market after North America. Strong demand for risk analytics continues from the BFSI sector, as firms comply with data-protection, ESG, and digital-resilience regulations. Major economies such as Germany, the U.K., France, and Spain support the robust adoption of analytics platforms for compliance, stress testing, and ESG reporting. Cross-border enterprises prefer unified risk tools that support multiple regulatory frameworks.

Regional market growth is also supported by increasing investment in sovereign-cloud and hybrid-cloud infrastructures, and modular analytics platforms tailored to compliance, operational resilience, and sector-specific risk needs. Adoption continues to expand beyond BFSI into manufacturing, retail, energy, and healthcare, reflecting rising supply-chain, cybersecurity, and ESG concerns. A mix of established vendors and specialized regional providers ensures a competitive market, while regulatory consolidation and digital transformation fuel steady growth.

Asia Pacific is likely to be the fastest-growing regional market for risk analytics from 2026 to 2033, driven by rapid digitization, financial inclusion initiatives, and expanding regulatory frameworks across India, China, Japan, Singapore, and Australia. The regional market benefits from rising enterprise adoption of cloud-based risk platforms, strong investment in AI and analytics modernization, and increasing exposure to cyber, operational, and climate-related risks. In June 2025, a notable shift occurred when BlackRock introduced its Aladdin risk management platform in India through a joint venture with Jio Financial Services, a move that underscores APAC’s expanding strategic importance for global players.

Demand continues to accelerate across BFSI, telecom, retail, healthcare, and manufacturing, bolstered by a growing base of small and medium enterprises (SMEs) adopting SaaS-based risk solutions. Governments across the region are strengthening compliance requirements, data localization norms, and operational resilience guidelines, prompting organizations to invest in integrated, real-time analytics.

The global risk analytics market landscape is dominated by leading players such as SAS, Oracle, IBM, Moody’s Analytics, FIS, SAP, MSCI, and BlackRock. These companies maintain leadership through comprehensive risk platforms, AI/ML-powered modeling, and regulatory-compliant solutions. Strengths include broad industry coverage, robust R&D pipelines, strategic partnerships, and global client networks, enabling continuous innovation in financial, operational, and emerging risk management solutions across multiple sectors worldwide.

Competition is increasingly shaped by both established enterprises and emerging technology-focused vendors offering cloud-native platforms, SaaS models, and integrated analytics solutions. Investments in cybersecurity, ESG, scenario modeling, and real-time risk monitoring are key differentiators. Companies are expanding their global footprint through strategic alliances, mergers, and acquisitions, while developing modular, scalable, and multi-domain risk platforms to address evolving market needs and regulatory requirements across diverse industries.

The global risk analytics market is projected to reach US$ 35.63 billion in 2026.

Regulatory pressure (Basel III/IV, AML, ESG disclosures), rising data volumes, and the need for integrated, real-time risk monitoring across financial and non-financial sectors are driving the market.

The market is poised to witness a CAGR of 12.5% between 2026 and 2033.

The development of cloud-native and SaaS-based risk solutions, growing adoption across non-BFSI sectors, and expansion into strategic, ESG, and cyber analytics are key market opportunities.

Some of the key players in the market include SAS, IBM, Oracle, SAP SE, FICO, Moody’s Analytics, and NICE Actimize.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Component

By Deployment Mode

By Vertical

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author