ID: PMRREP34635| 199 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

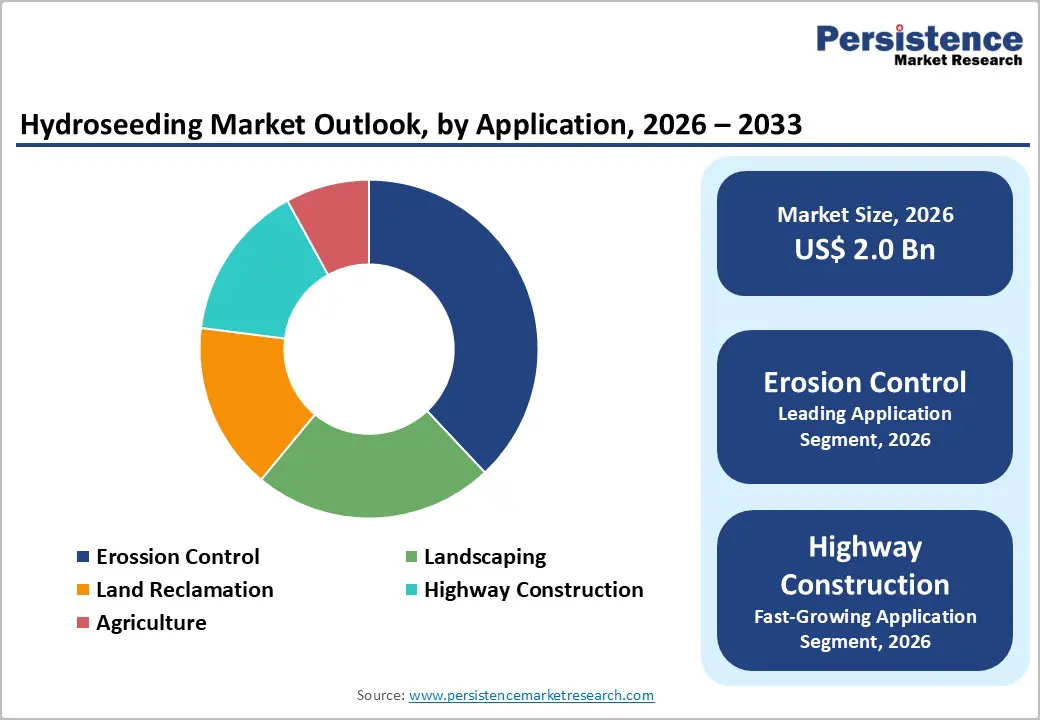

The global hydroseeding market size is likely to be valued at US$ 2.0 billion in 2026, and is projected to reach US$ 3.2 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2026–2033.

This market expansion is driven by rising investments in erosion control infrastructure, highway and rail construction, and post-mining land reclamation projects across developed and emerging economies. Increasing regulatory enforcement related to soil conservation and stormwater runoff management is accelerating hydroseeding adoption over conventional seeding techniques. Technological improvements in mulch composition and customized seed-fertilizer blends are further improving germination efficiency, supporting long-term market scalability.

| Key Insights | Details |

|---|---|

|

Hydroseeding Market Size (2026E) |

US$ 2.0 Bn |

|

Market Value Forecast (2033F) |

US$ 3.2 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

6.9% |

|

Historical Market Growth (CAGR 2020 to 2025) |

6.1% |

The global infrastructure expansion and stricter environmental compliance are driving hydroseeding adoption for soil stabilization. Large-scale highway, rail, and urban development projects disturb extensive soil areas that require rapid vegetation to prevent erosion and sediment runoff. The U.S. Federal Highway Administration reinforced the National Pollutant Discharge Elimination System (NPDES) mandates, requiring vegetative cover within defined timelines after construction. Hydroseeding enables fast, uniform seed application, reducing fines, rework, and project delays while stabilizing slopes efficiently. Its operational advantages align with contractor requirements for cost-effective, schedule-compliant execution. Public and private projects increasingly integrate hydroseeding into standard specifications. Major U.S. highway expansions now routinely use hydroseeding to meet regulatory and project delivery requirements.

Regulatory enforcement in other regions further strengthens demand. Canada’s Investing in Canada Plan ties infrastructure funding to environmental performance, mandating rapid post-construction revegetation. India’s National Infrastructure Pipeline enforces strict soil stabilization and erosion control for roads and industrial projects. Compliance frameworks now prioritize measurable vegetation outcomes, making hydroseeding the preferred solution. Contractors benefit from faster project turnover, improved germination success, and reduced operational risk. With global infrastructure pipelines expanding, hydroseeding adoption is increasingly driven by regulatory alignment and operational efficiency. This combination positions hydroseeding as a core solution across multiple high-growth regions.

Hydroseeding adoption is constrained by high upfront equipment costs and premium material requirements. Fully equipped hydroseeding systems range from US$ 15,000 to over US$ 80,000, making initial investment prohibitive for small contractors and limiting penetration in emerging economies. Premium mulch, seed, and additive prices remain volatile due to raw material supply fluctuations, raising operational expenses by 8–10%. Regulatory restrictions on synthetic tackifiers and biodegradable content in regions such as the EU further restrict formulation flexibility, forcing contractors to customize products for local compliance. In past years, several infrastructure contractors in Germany and France had to revise hydroseeding mixes to meet updated soil protection standards, increasing costs and delaying project approvals. These factors limit economies of scale and raise entry barriers for new market participants.

Weather and water availability amplify operational constraints, making hydroseeding highly climate-dependent. Effective application requires consistent moisture and moderate temperatures; excessive rainfall or drought can reduce germination success and force costly re-applications. The municipal highway projects in the U.S. Midwest and Southern Europe experienced multiple reapplications after spring storms compromised initial coverage, while water restrictions in parts of India and Australia delayed slope stabilization efforts. These climatic and resource dependencies constrain scheduling flexibility, reduce equipment utilization, and introduce additional operational expenses. With capital and regulatory pressures, weather and environmental limitations create a significant barrier to consistent hydroseeding adoption across regions and project types.

The hydroseeding market growth is being fuelled by expanding infrastructure projects, urban development, and smart city initiatives that require rapid soil stabilization and landscaping. Large-scale highways, industrial corridors, and urban green spaces often mandate erosion control and quick vegetation cover, creating predictable demand for hydroseeding services. Government-backed programs in India and China set specific revegetation targets for reclaimed land and transport corridors, offering measurable contract opportunities. The ability of hydroseeding to cover slopes and embankments quickly ensures compliance and reduces rework. Contractors benefit from faster project timelines and consistent quality. Infrastructure-driven demand encourages adoption of efficient, scalable hydroseeding methods.

Technological innovation and climate resilience further expand opportunities. Custom mix hydroseeding with region-specific seeds, bio-fertilizers, and organic tackifiers improves germination and long-term soil health while meeting environmental standards. Rising climate-related events, such as floods and landslides, increase the need for rapid slope stabilization, especially in government and municipal projects. Emergency restoration and disaster mitigation programs favor hydroseeding due to its fast deployment and reliable performance. For example, the State Highways Department of Tamil Nadu, India, has implemented soil-nailing and hydro-seeding on vulnerable ghat road slopes in Nilgiris, successfully stabilizing them against landslides at 50% lower cost than retaining walls while enhancing aesthetics and withstanding cyclone rains. Sustainable formulations also create premium pricing potential for service providers. These infrastructure expansion, innovative technology, and climate adaptation drive a resilient, high-growth market for hydroseeding solutions.

Wood fiber hydroseeding is expected to be the leading process type, holding approximately 42% of market revenue in 2026, due to its excellent moisture retention, erosion control, and adaptability to steep slopes. Its natural fibers adhere effectively to uneven terrain, enabling rapid vegetation growth and reducing post-construction maintenance. Contractors commonly use wood fiber for highways, embankments, and industrial projects where regulatory compliance mandates effective soil stabilization. This preference is illustrated by its use on interstate embankments by transportation authorities, which required quick slope stabilization to prevent erosion during road expansions. Companies have enhanced formulations with natural adhesives and water-retention polymers to improve germination success and durability. The combination of proven performance, regulatory acceptance, and adaptability explains its dominant market position. Wood fiber remains the standard for large-scale, compliance-driven projects.

Custom mix is anticipated to be the fastest-growing process type, with a CAGR of around 7.6% from 2026 to 2033, driven by a surging demand for tailored, region-specific seed blends and environmentally compliant additives. Contractors and municipal authorities prefer custom mixes to match local soil types, slope conditions, and climate, ensuring higher survival rates and long-term vegetation health. Urban landscaping projects, such as park redevelopments in dense city environments, increasingly rely on these mixes to establish vegetation across diverse terrains efficiently. Innovations like microbial soil enhancers and biodegradable polymers further improve nutrient absorption and environmental compliance. Rising sustainability awareness and local regulatory pressures reinforce adoption. The flexibility and performance benefits of custom mixes explain their strong growth trajectory. Custom formulations are now central to specialized landscaping and ecological restoration projects.

Erosion control is projected to lead the application segment with over 38% of the hydroseeding market revenue share in 2026, largely due to regulatory requirements in construction, mining, and environmental restoration. Sites such as riverbanks, embankments, and reclaimed mining areas need rapid vegetation to prevent soil loss and ensure compliance. Hydroseeding delivers uniform coverage on slopes and irregular terrain, reducing rework and improving germination outcomes. For example, during a major urban riverbank redevelopment, hydroseeding was used to stabilize slopes and prevent sediment runoff while meeting local environmental mandates. Government-backed infrastructure and reclamation projects continue to favor hydroseeding for its reliability and consistent performance. Its leadership is reinforced by its ability to meet both environmental and operational standards. Contractors benefit from predictable results and alignment with project timelines, solidifying its dominant application.

Highway construction is expected to be the fastest-growing application through 2033, driven by heavy investments in enhancing transportation infrastructure worldwide and compressed project timelines. Highway embankments, medians, and cut-and-fill zones require fast revegetation to minimize erosion risks. Hydroseeding enables quicker project completion and uniform vegetation coverage across challenging terrains. On Brazil’s BR-101 highway expansion, hydroseeding was used on steep embankments to establish vegetation efficiently while meeting regulatory requirements, demonstrating its practical value. Pre-mixed seed-slurry solutions further speed deployment and improve germination over large areas. Infrastructure investment growth and stricter environmental compliance continue to drive demand.

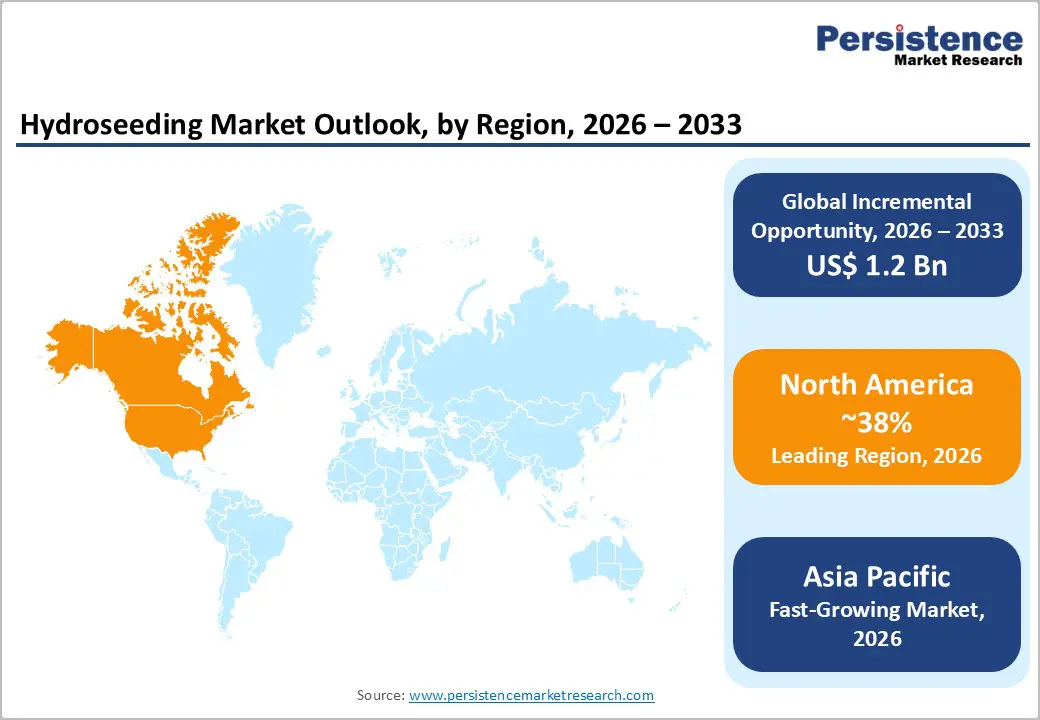

North America is expected to dominate, accounting for about 38% of the hydroseeding market share in 2026, largely because regulatory mandates and project complexity create consistent demand for professional soil stabilization. Environmental regulations related to stormwater management and erosion control require measurable vegetation cover on disturbed lands, compelling the use of hydroseeding on transportation, mining, and urban projects. The United States also benefits from a mature contracting ecosystem and established standards that formally integrate hydroseeding into project specifications. For example, expansion of hydroseeding equipment dealer networks and support services across the region has improved service availability and project responsiveness, increasing adoption by landscape and civil engineering contractors. The presence of advanced slurry application systems enhances operational reliability.

Operational performance and equipment innovation reinforce regional dominance. Automated hydroseeding rigs and precision application technologies allow contractors to complete large highway, municipal, and reclamation projects with improved germination success and reduced rework, crucial in meeting compliance benchmarks. Government-driven land management programs frequently specify rapid revegetation outcomes, making hydroseeding the de facto solution over manual methods. Infrastructure modernization funding and environmental compliance requirements create a predictable pipeline of hydroseeding work. Accessibility of service providers and equipment further enhances market depth. These attributes continue to position North America as the largest hydroseeding market globally.

Europe is a significant market for hydroseeding solutions owing to strong environmental policies and sustainability mandates requiring vegetation establishment in infrastructure and land management projects. EU directives emphasize soil protection and biodiversity conservation, making hydroseeding an effective compliance tool for erosion control, transport corridor projects, and urban greening efforts. Municipal and regional authorities increasingly incorporate sustainable landscaping specifications into public works, reinforcing hydroseeding demand. Contractors leverage advanced erosion-control materials, such as biodegradable mulch and customized seed blends, to satisfy these regulations. Enhanced formulations allow rapid vegetative cover on slopes and reclaimed sites without long maintenance cycles. These environmental and regulatory drivers support stable regional adoption.

Infrastructure modernization and ecological integration further strengthen Europe’s market demand. Public transportation and renewable energy projects include land rehabilitation requirements that favor hydroseeding solutions capable of uniform coverage on challenging terrain. Urban development plans in key countries particularly those integrating green infrastructure and climate resilience elevate the need for reliable vegetation establishment. Policy frameworks that prioritize environmental resilience and sustainable land use make hydroseeding integral to execution strategies. These region-specific drivers explain Europe’s strong, steady market presence across multiple application sectors.

Asia Pacific is projected to be the fastest-growing regional market for hydroseeding, expanding at a CAGR above 7.5% from 2026 to 2033, on the back of massive infrastructure investments, skyrocketing urban expansion, and ecological restoration initiatives that are driving high repeated demand for hydroseeding. Large transportation networks, industrial corridors, and urban development across China, India, and ASEAN nations inherently create significant soil disturbance requiring erosion mitigation and revegetation. National programs, such as major highway stabilization efforts and ecological conservation projects, increasingly integrate hydroseeding to meet environmental compliance and reduce landslide risk. For example, hydroseeding techniques have been adopted on critical mountainous corridors to stabilize slopes prone to erosion and landslides, demonstrating alignment with government execution strategies. These large, ongoing construction pipelines fuel scalable hydroseeding deployment and explain accelerated regional growth.

The combination of government mandates, cost advantages, and localized innovation underpins the rapid pace of market expansion. Lower labor costs and expanding domestic manufacturing provide contractors with cost efficiencies that make hydroseeding economically attractive for both public and private sector projects. Custom mixes tailored to varied climates and soil conditions improve performance outcomes and resilience in diverse geographies. Government infrastructure plans that specify rapid vegetation establishment as part of compliance frameworks further catalyze adoption. Urbanization, environmental policies, and large-scale project execution reinforce Asia Pacific’s position as the fastest-emerging hydroseeding market.

The global hydroseeding market structure is moderately consolidated, with top vendors such as Hydro-Seed Inc., Profile Products, Wood Mulch Supply, and Scotts Miracle-Gro collectively accounting for a significant share of market revenue. These established players leverage extensive contractor networks, regulatory expertise, and proprietary hydroseeding equipment and formulations. Heavy investment in R&D enables them to maintain technological leadership through custom seed blends, bio-based tackifiers, and high-efficiency slurry systems, improving germination rates and application speed.

Meanwhile, regional and niche players focus on localized solutions and specialized applications, such as municipal landscaping or slope stabilization in challenging terrains. Regulatory compliance, capital intensity, and equipment costs create barriers for new entrants, though rising demand for sustainable and custom-mix solutions is enabling smaller players to participate. Market consolidation is expected to increase gradually as leading companies acquire regional service providers, expand production capabilities, or enter emerging markets, while innovation partnerships between equipment manufacturers and bio-formulation firms continue to shape competitive dynamics.

The global hydroseeding market is projected to reach US$ 2.0 billion in 2026.

Rising infrastructure development, regulatory mandates for soil stabilization and erosion control, and increasing adoption of sustainable and custom hydroseeding solutions are driving market growth.

The market is poised to witness a CAGR of 6.9% from 2026 to 2033.

Technological innovations in bio-based and custom mix hydroseeding and growing demand for climate adaptation and disaster recovery applications present significant opportunities.

Finn Corporation, Deere & Company, Bark Blowers Inc., Turbo Turf LLC, Reinco Equipment Inc., Ewing Irrigation, Hydroseeding Solutions LLC, and Green Thumb Hydroseeding are a few market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Process Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author