ID: PMRREP22759| 288 Pages | 9 Feb 2026 | Format: PDF, Excel, PPT* | Industrial Automation

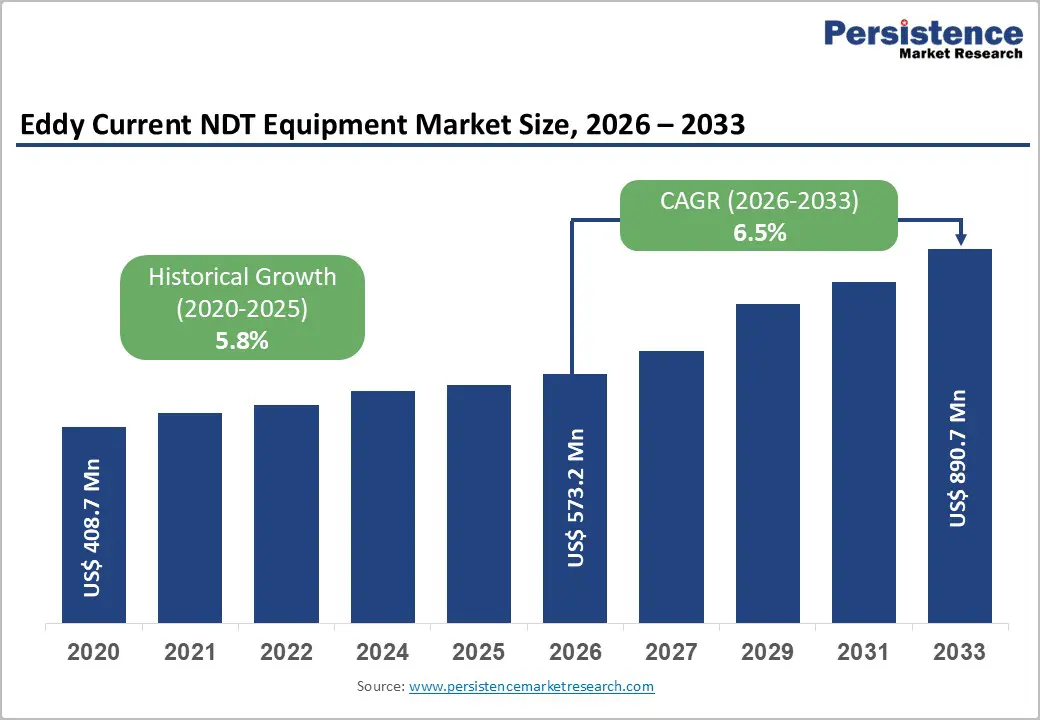

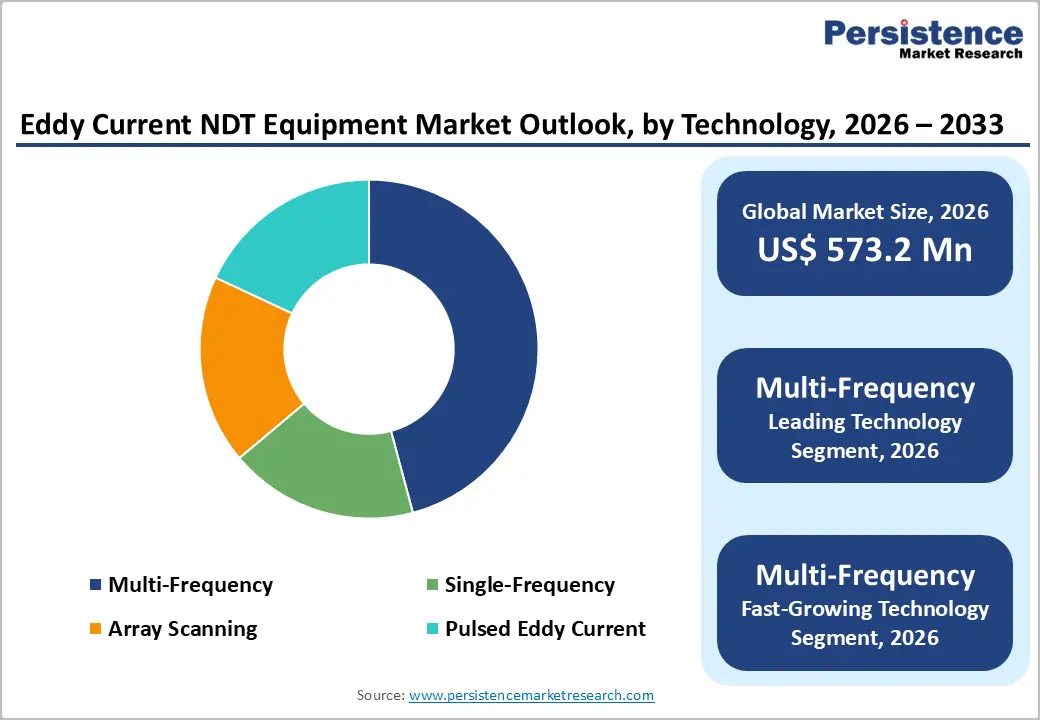

The global eddy current NDT equipment market size is expected to be valued at US$ 573.2 million in 2026 and projected to reach US$ 890.7 million by 2033, growing at a CAGR of 6.5% between 2026 and 2033.

This robust growth trajectory is primarily driven by escalating demand for advanced non-destructive testing solutions across critical infrastructure sectors and stringent regulatory mandates for structural integrity verification. The aerospace, oil and gas, and automotive industries are increasingly adopting sophisticated eddy-current technologies to detect subsurface defects, measure coating thickness, and ensure compliance with safety standards, thereby driving market expansion across developed and emerging economies.

| Key Insights | Details |

|---|---|

| Eddy Current NDT Equipment Market Size (2026E) | US$ 573.2 million |

| Market Value Forecast (2033F) | US$ 890.7 million |

| Projected Growth CAGR (2026 - 2033) | 6.5% |

| Historical Market Growth (2020 - 2025) | 5.8% |

The global aviation industry's adherence to rigorous safety protocols is fundamentally transforming the eddy current NDT equipment landscape. According to the Federal Aviation Administration (FAA), commercial aircraft undergo mandatory structural inspections at intervals determined by flight cycles and operational hours, with eddy-current testing as the primary method for detecting fatigue cracks in critical components. The European Union Aviation Safety Agency (EASA) mandates comprehensive NDT procedures under Part-145 certification requirements for aircraft maintenance organizations, creating sustained demand for advanced inspection equipment. The International Air Transport Association (IATA) projects the global commercial aircraft fleet will reach approximately 50,000 units by 2040, representing nearly 100% growth from current levels. This fleet expansion, coupled with aging aircraft that require more frequent inspections, necessitates substantial investments in eddy-current systems capable of detecting microcracks in landing gear, engine components, and fuselage structures. The Boeing Commercial Market Outlook estimates that the aviation maintenance, repair, and overhaul sector will require expenditures exceeding US$ 4.7 trillion over the next two decades, with NDT equipment representing a critical component of this infrastructure investment.

Global infrastructure deterioration and energy-sector pipeline integrity programs are generating unprecedented demand for eddy-current NDT solutions. The American Society of Civil Engineers (ASCE) estimates that the United States alone faces a US$ 2.6 trillion infrastructure funding gap, with aging bridges, pipelines, and industrial facilities requiring systematic inspection protocols. The Pipeline and Hazardous Materials Safety Administration (PHMSA), under the U.S. Department of Transportation, mandates comprehensive integrity management programs for natural gas transmission pipelines, with eddy-current testing serving as a primary inspection method for detecting corrosion and stress-corrosion cracking.

According to the American Petroleum Institute (API), there are approximately 2.7 million miles of pipelines transporting natural gas and hazardous liquids across North America, with regulatory frameworks requiring regular inspection intervals. The European Pipeline Research Group reports that pipeline infrastructure in Europe is on average more than 40 years old, necessitating advanced NDT techniques for condition assessment. Pulsed eddy current technology has emerged as particularly valuable for pipeline applications, enabling through-insulation inspection without requiring protective coating removal, thereby reducing inspection costs and operational downtime while enhancing detection capabilities for corrosion under insulation.

The substantial initial investment required for advanced eddy current NDT systems presents a significant barrier, particularly for small and medium-sized inspection service providers and manufacturing facilities. Sophisticated multi-frequency and array scanning systems can cost between US$50,000 and US$300,000, depending on configuration and capabilities, while specialized aerospace inspection equipment may exceed US$ 500,000 for fully automated systems. According to the American Society for Nondestructive Testing (ASNT), the total cost of ownership extends beyond equipment acquisition to include operator training, certification programs, calibration standards, and ongoing software updates.

The technical complexity of modern eddy current systems requires skilled technicians holding Level II or Level III certifications under ASNT SNT-TC-1A or ISO 9712 standards, creating additional workforce development challenges. Many organizations in emerging markets struggle to justify these investments, given uncertain inspection volumes and competitive pricing pressures from established service providers with depreciated equipment assets.

Fundamental physical limitations of eddy current technology restrict its applicability across certain industrial inspection scenarios, constraining market expansion opportunities. Eddy current testing is inherently limited to electrically conductive materials and typically provides effective penetration depths of 0.5-6 mm, depending on frequency selection and material properties, according to NASA's Nondestructive Evaluation Sciences Branch. This limitation preventsthe detection of deep subsurface defects in thick-walled components, necessitating complementary techniques such as ultrasonic or radiographic testing for comprehensive structural assessment.

The International Committee for Non-Destructive Testing (ICNDT) notes that eddy current inspection performance is significantly influenced by component geometry, surface roughness, and electromagnetic properties, requiring extensive calibration procedures and reference standards. Additionally, ferromagnetic materials introduce complexities related to magnetic permeability variations, which reduce inspection reliability and require specialized equipment configurations. These technical constraints limit market penetration in applications involving thick structural components or materials with unfavorable electromagnetic characteristics.

The convergence of eddy current NDT equipment with digital technologies and Industry 4.0 frameworks represents a transformative market opportunity. Leading manufacturers are developing smart inspection systems incorporating artificial intelligence (AI), machine learning algorithms, and cloud-based data analytics for automated defect recognition and predictive maintenance applications. General Electric has pioneered digital twin technology, integrating real-time inspection data with asset performance models, enabling condition-based maintenance strategies that optimize inspection intervals and reduce unplanned downtime.

The International Organization for Standardization (ISO) is developing standards for digital NDT data management under the ISO 19232 series, facilitating industry-wide adoption of digital inspection workflows. According to the World Economic Forum, industrial digitalization could unlock more than US$ 3.7 trillion in value across the manufacturing and supply chain sectors by 2030, with intelligent inspection systems playing a crucial role. The integration of Internet of Things (IoT) sensors with portable eddy current devices enables continuous structural health monitoring of critical assets, creating recurring revenue opportunities through data analytics services and subscription-based business models that transform traditional equipment sales dynamics.

The rapid expansion of additive manufacturing across aerospace, medical devices, and industrial sectors is creating substantial demand for specialized eddy current inspection capabilities. The ASTM International Committee F42 has established comprehensive standards for additive manufacturing quality control, with ASTM F3456 specifically addressing non-destructive testing requirements for metal additive-manufactured components. According to Wohlers Associates, the global additive manufacturing industry reached approximately US$18 billion in 2024, with projections indicating continued double-digit growth, driven by aerospace and medical device applications. Additive manufacturing processes introduce unique metallurgical characteristics including residual stresses, porosity, and microstructural variations that require advanced inspection methodologies.

NASA and the Air Force Research Laboratory are collaborating on eddy-current array technologies specifically optimized to detect defects in additively manufactured aerospace components, including titanium-alloy structures and nickel-based superalloy engine parts. The Food and Drug Administration (FDA) is developing regulatory frameworks for additively manufactured medical implants, with eddy-current testing emerging as a critical quality-assurance tool. This convergence of additive manufacturing adoption and regulatory scrutiny creates significant opportunities for equipment manufacturers developing specialized inspection solutions tailored to the unique challenges of layer-by-layer fabrication processes.

Multi-frequency eddy current technology leads the market with approximately 44% market share in 2025 and is projected to grow at a CAGR of 7.1% from 2026 to 2033, reflecting its strong adoption across critical inspection environments. This technology enables simultaneous or sequential use of multiple excitation frequencies, allowing inspectors to evaluate varying penetration depths and defect characteristics within a single scan. Its superior ability to distinguish between geometric features and actual flaws significantly reduces false positives and improves inspection accuracy. Multi-frequency systems are especially valuable for complex components with variable thicknesses, supporting faster inspection cycles while maintaining high sensitivity. Standardization under ASME Section V and declining cost premiums have further accelerated adoption across aerospace, power generation, and industrial maintenance applications.

Testing and inspection applications dominate the eddy current NDT equipment market, accounting for approximately 52% of the market in 2025, driven by stringent quality assurance and regulatory compliance requirements. This segment supports critical inspection activities such as weld evaluation, surface flaw detection, conductivity measurement, and tubing inspection across manufacturing and maintenance operations. Eddy current testing is widely used to detect surface and near-surface defects in non-ferromagnetic materials, particularly aluminum and titanium alloys. Mandatory inspection requirements in nuclear power generation and aerospace manufacturing sustain consistent demand, with utilities and OEMs conducting inspections at fixed operational intervals. The growing emphasis on predictive maintenance and asset integrity management continues to reinforce the importance of eddy current testing within this application segment.

Aerospace and defense represent the largest end-use industry for eddy current NDT equipment, holding approximately 38% market share in 2025, underpinned by uncompromising safety standards and rigorous inspection protocols. The extensive use of lightweight, high-strength materials such as aluminum alloys, titanium, and nickel-based superalloys makes eddy current testing particularly suitable for this sector. Mandatory structural integrity programs require routine inspections to detect fatigue cracks and material degradation before failure. Both military and commercial aviation maintenance schedules specify eddy-current testing for critical components, thereby ensuring sustained equipment reliability. With global aerospace production valued at approximately US$ 170 billion in 2024, ongoing aircraft manufacturing and maintenance activities continue to anchor long-term market stability.

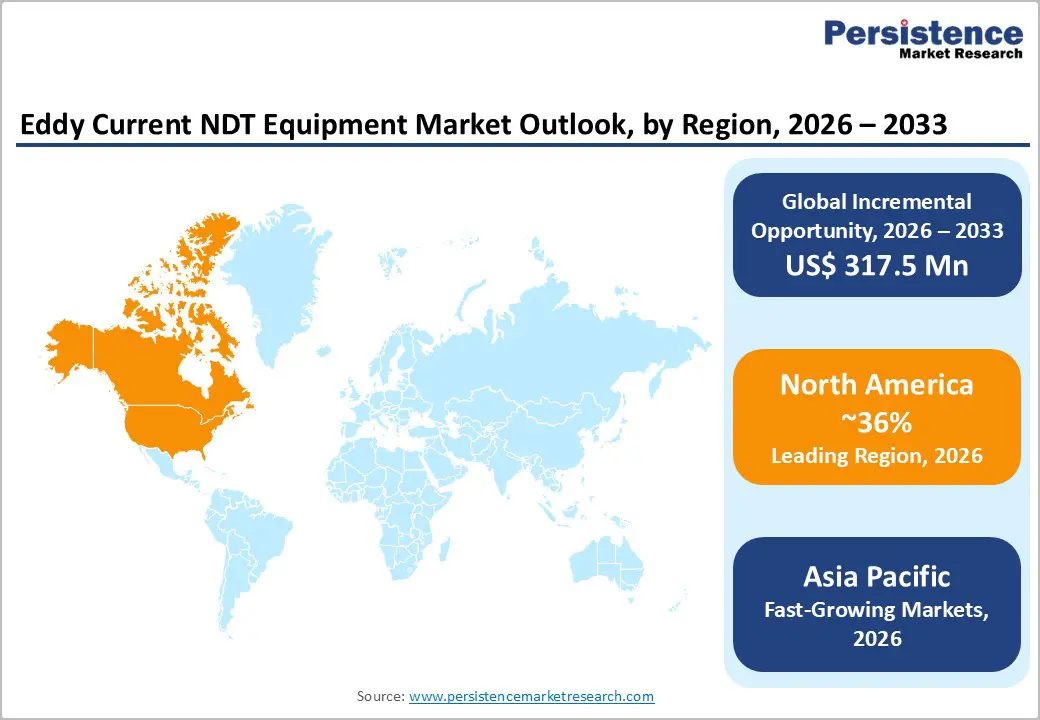

North America commands the largest market share at approximately 36% in 2025, anchored by the United States' extensive aerospace manufacturing base, aging infrastructure, and comprehensive regulatory frameworks. The region benefits from the presence of major aircraft manufacturers including Boeing, Lockheed Martin, and Northrop Grumman, whose production programs drive sustained demand for advanced NDT equipment. According to the U.S. Bureau of Labor Statistics, the aerospace product and parts manufacturing sector employed approximately 500,000 workers in 2024, supporting a robust ecosystem of quality assurance and inspection services.

The Federal Aviation Administration's stringent airworthiness certification requirements under 14 CFR Part 43 mandate comprehensive inspection procedures incorporating eddy current testing for critical aircraft components. The U.S. Department of Energy's nuclear facilities oversight program requires extensive NDT capabilities, with 17 operating commercial nuclear power plant sites utilizing eddy current systems for steam generator tube inspection during refueling outages. The American Petroleum Institute headquarters in Washington, D.C. continues developing industry standards that influence global pipeline inspection practices. Canada's aerospace industry, concentrated in Quebec and Ontario, contributes significantly to regional demand, with companies like Bombardier and CAE maintaining comprehensive NDT capabilities. The region's innovation ecosystem, supported by institutions including NASA, Sandia National Laboratories, and numerous universities, drives continuous technological advancement in eddy current inspection methodologies and equipment performance.

Europe maintains a substantial market presence characterized by stringent regulatory harmonization and advanced manufacturing capabilities, particularly in Germany, United Kingdom, France, and Spain. The European Union Aviation Safety Agency (EASA) establishes comprehensive airworthiness standards that govern maintenance organization approvals under Part-145 regulations, creating consistent demand for certified NDT equipment across member states. According to Airbus, the company delivered approximately 735 commercial aircraft in 2024, with each unit requiring extensive quality assurance procedures incorporating eddy current inspection at various manufacturing stages.

Germany's automotive industry, represented by manufacturers including BMW, Mercedes-Benz, Volkswagen, and Audi, increasingly utilizes eddy current testing for aluminum component quality verification as lightweighting initiatives accelerate. The United Kingdom's nuclear fleet decommissioning programs and offshore wind energy infrastructure development create specialized inspection requirements, with EDF Energy operating 15 nuclear reactors requiring comprehensive NDT capabilities. France's nuclear energy sector, managed by Électricité de France (EDF), operates 56 reactors representing approximately 70% of national electricity generation, necessitating systematic eddy current inspection programs for steam generator components. The European Commission's Pressure Equipment Directive (PED) 2014/68/EU establishes harmonized safety requirements for pressure vessels and piping systems, standardizing NDT inspection protocols across industrial facilities. Spain's renewable energy infrastructure, including extensive wind farm installations, requires ongoing structural integrity monitoring of turbine components, creating opportunities for portable eddy current inspection systems.

Asia-Pacific is the fastest-growing regional market, with an anticipated CAGR of 7.8% from 2026 to 2033, driven by rapid industrialization, infrastructure development, and expanding aerospace manufacturing capabilities across China, Japan, India, and ASEAN countries. China's ambitious Made in China 2025 initiative prioritizes aerospace, advanced rail transportation, and high-performance manufacturing, thereby creating substantial demand for quality-assurance equipment. According to the Civil Aviation Administration of China (CAAC), the country's commercial aircraft fleet is projected to reach approximately 9,600 units by 2040, representing nearly a tripling of current capacity.

Commercial Aircraft Corporation of China (COMAC) production expansion for the C919 narrow-body airliner and ARJ21 regional jet necessitates comprehensive NDT infrastructure development, with the company establishing partnerships with international equipment suppliers. Japan's nuclear power sector restart following Fukushima safety enhancements has renewed focus on rigorous inspection protocols, with Japan Nuclear Safety Institute establishing comprehensive NDT qualification programs. India's Make in India initiative encompasses the expansion of aerospace and defense manufacturing, with Hindustan Aeronautics Limited (HAL) increasing production rates for indigenous aircraft programs, including the Tejas fighter. The ASEAN region's expanding manufacturing base, particularly in Thailand, Vietnam, and Indonesia, benefits from foreign direct investment in the automotive and electronics sectors requiring quality assurance capabilities. Singapore has emerged as a regional aerospace maintenance hub, with Seletar Aerospace Park hosting major MRO facilities operated by Pratt & Whitney, Rolls-Royce, and ST Engineering that maintain sophisticated NDT equipment for engine overhaul operations.

The eddy current NDT equipment market displays a moderately consolidated structure, with a mix of large global suppliers and specialized regional manufacturers addressing both high-volume and niche inspection requirements. Competitive strategies increasingly emphasize technology-led differentiation, particularly in advanced probe designs, signal processing, and inspection software integration.

Market leaders are shifting toward solution-oriented offerings, combining hardware, software, and data management capabilities aligned with Industry 4.0 and digital inspection workflows. Service-driven models such as equipment leasing, calibration, training, and lifecycle support are gaining importance as suppliers seek recurring revenue and stronger customer lock-in. Strategic growth is supported by selective acquisitions targeting complementary technologies and regional expansion, while pricing competition intensifies in cost-sensitive segments due to improving capabilities among emerging-market suppliers.

The market is expected to reach US$ 573.2 million in 2026, driven by aerospace regulations and industrial inspection demand.

Demand is driven by aviation safety regulations, aging infrastructure inspections, pipeline integrity mandates, and expanding aerospace manufacturing.

North America leads with around 36% market share in 2025, supported by aerospace manufacturing and strict inspection regulations.

Industry 4.0 and digital inspection integration using AI, IoT, and data analytics is the key growth opportunity.

Leading companies include General Electric, Olympus Corporation, Zetec, Inc., Eddyfi Technologies, Magnetic Analysis Corporation, and Rohmann GmbH.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Technology

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author