- Executive Summary

- U.S. Animal Drug Compounding Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Macro-Economic Factors

- U.S. Sectorial Outlook

- U.S. GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Regulatory Landscape

- Key Deals and Mergers

- PESTLE Analysis

- Porter’s Five Force Analysis

- U.S. Animal Drug Compounding Market Outlook:

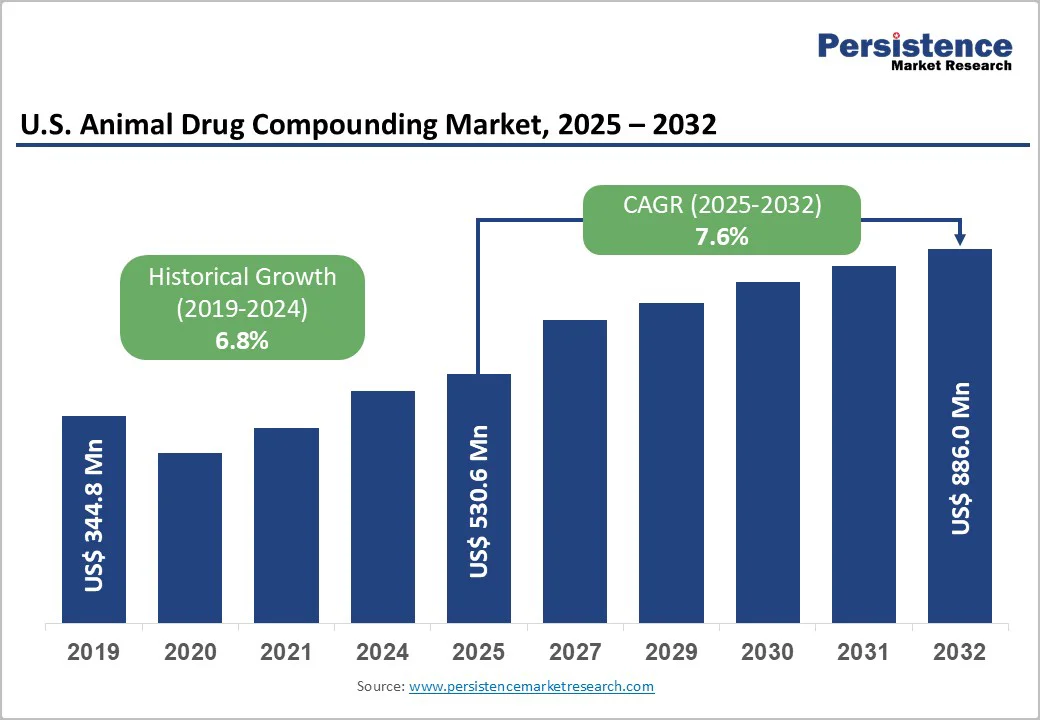

- Key Highlights

- Market Size (US$ Mn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size (US$ Mn) Analysis, 2019-2024

- Market Size (US$ Mn) Analysis and Forecast, 2025-2032

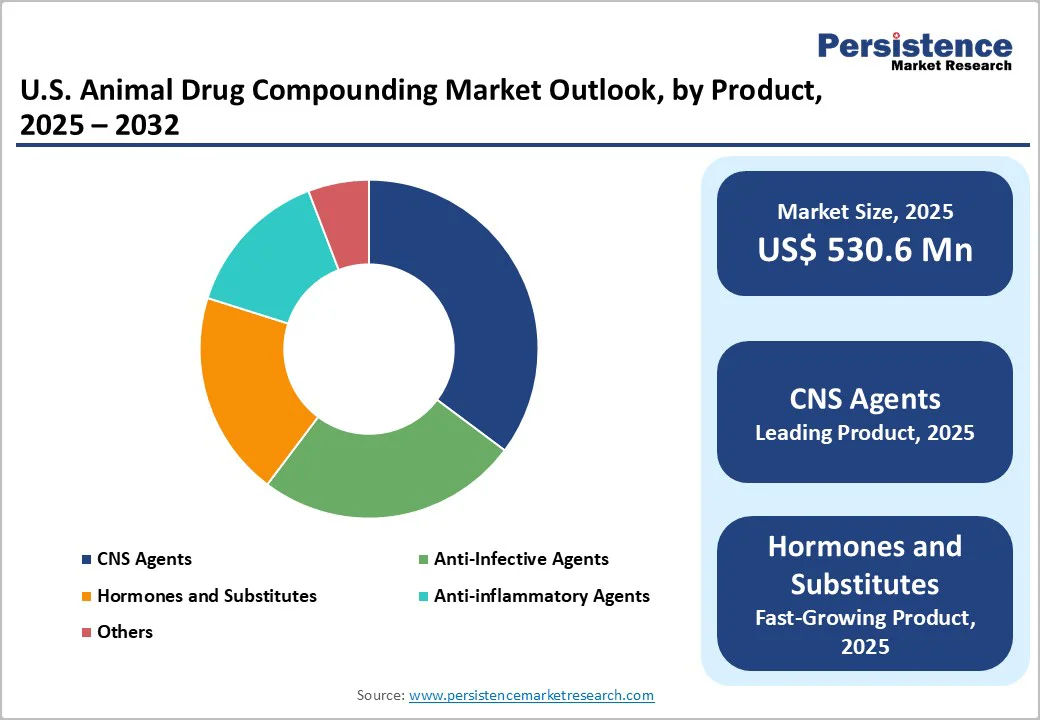

- U.S. Animal Drug Compounding Market Outlook: Product

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Product, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Product, 2025 - 2032

- CNS Agents

- Anti-Infective Agents

- Hormones and Substitutes

- Anti-inflammatory Agents

- Others

- Market Attractiveness Analysis: Product

- U.S. Animal Drug Compounding Market Outlook: Animal

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Animal, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Animal, 2025 - 2032

- Companion

- Cats

- Dogs

- Others

- Livestock

- Companion

- Market Attractiveness Analysis: Animal

- U.S. Animal Drug Compounding Market Outlook: Formulation

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis, By Formulation, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Formulation, 2025 - 2032

- Oral

- Injectable

- Others

- Market Attractiveness Analysis: Formulation

- Key Highlights

- U.S. Animal Drug Compounding Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) Analysis, By Region, 2019 - 2024

- Market Size (US$ Mn) Analysis and Forecast, By Region, 2025 - 2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- Competition Landscape

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Hoye's Pharmacy

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Vertisis Custom Pharmacy

- Dougherty's Pharmacy

- Triangle Compounding Pharmacy Inc.

- Medisca Inc.

- Wedgewood Pharmacy

- Millers Pharmacy

- Essential Pharmacy Compounding Veterinary

- Custom Med Compounding Pharmacy, Inc.

- Davis Islands Pharmacy, Inc.

- Wellness Pharmacy of Cary, Inc.

- Cencora, Inc.

- Sixth Avenue Medical Pharmacy

- Bova Compounding

- Others

- Hoye's Pharmacy

- Market Structure

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment