- Executive Summary

- U.S. Costume Jewelry Market Snapshot, 2026 and 2033

- Market Opportunity Assessment, 2026 – 2033, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Product Lifecycle Analysis

- U.S. Parent Market Overview

- Costume Jewelry Market: Value Chain

- List of Raw Distribution Channel Supplier

- List of Manufacturers

- List of Distributors

- List of End Use Industries

- Profitability Analysis

- Forecast Factors – Relevance and Impact

- Covid-19 Impact Assessment

- PESTLE Analysis

- Porter Five Force’s Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Distribution Channel Landscape

- 3.1. Macro-Economic Factors

- U.S. Sectorial Outlook

- U.S. GDP Growth Outlook

- Other Macro-economic Factors

- Price Trend Analysis, 2020 – 2033

- Key Highlights

- Key Factors Impacting Product Prices

- Prices By Product Type/Distribution Channel/Application

- Regional Prices and Product Preferences

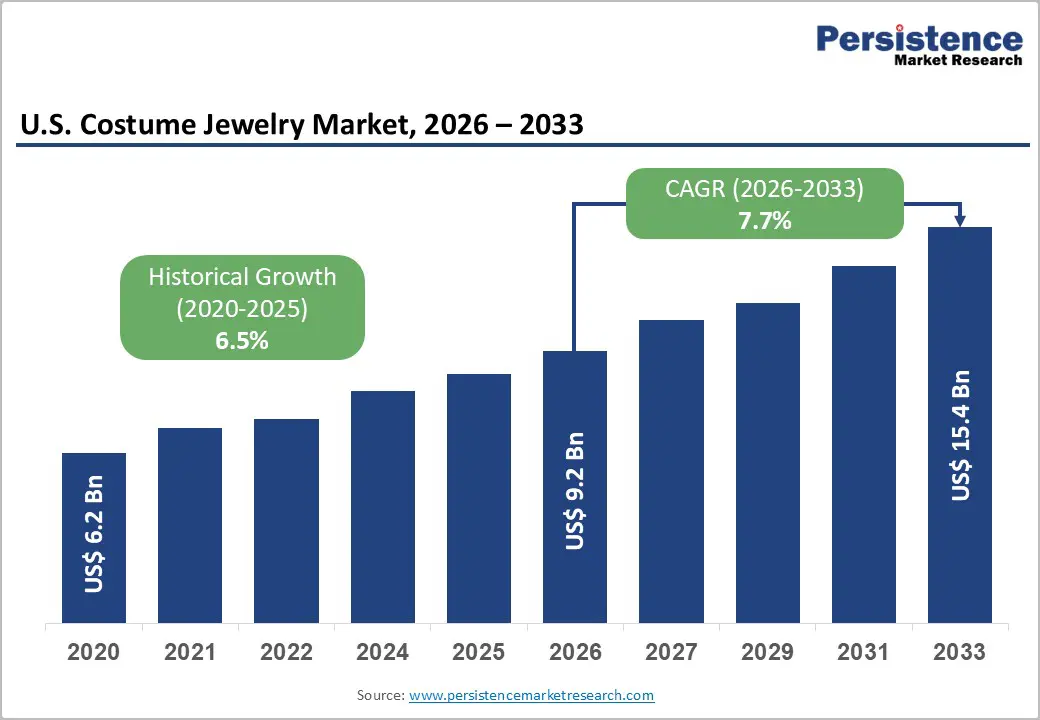

- U.S. Costume Jewelry Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Market Size and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size Analysis, 2020-2025

- Current Market Size Forecast, 2026–2033

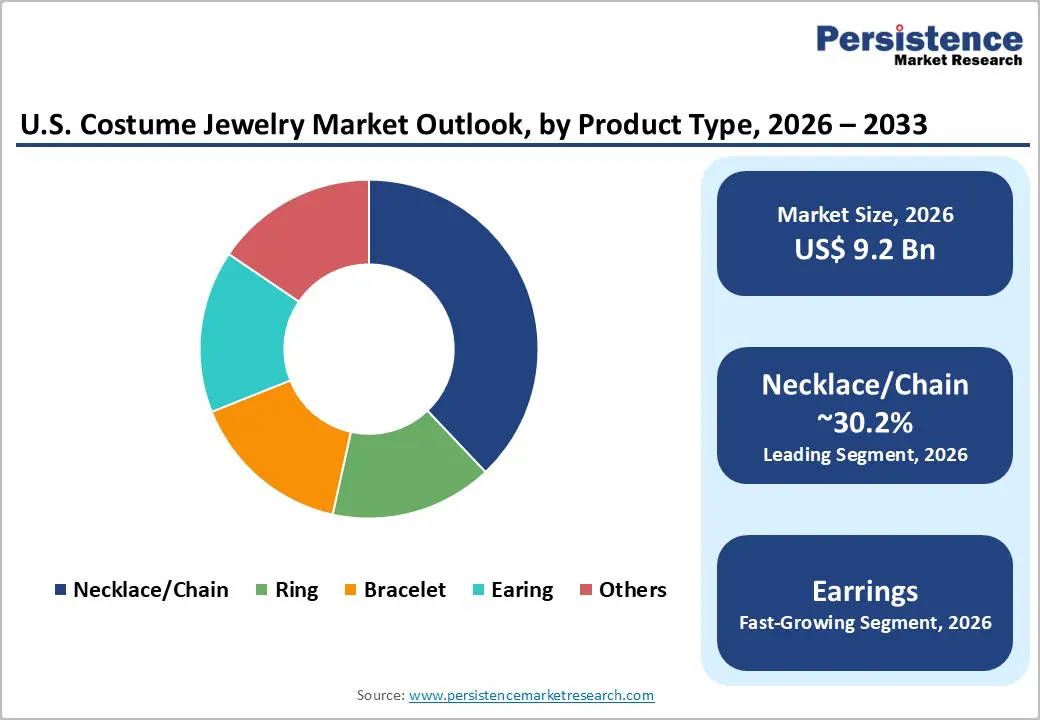

- U.S. Costume Jewelry Market Outlook: Product Type

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis By Product Type, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Necklace/Chain

- Earrings

- Ring

- Bracelet

- Others

- Market Attractiveness Analysis: Product Type

- U.S. Costume Jewelry Market Outlook: Distribution Channel

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis By Distribution Channel, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By Distribution Channel, 2026 – 2033

- Online Retail

- Specialty Jewelry Stores

- Department Stores

- Fashion & Lifestyle Stores

- Direct‑to‑Consumer (Brand)

- Misc.

- Market Attractiveness Analysis: Distribution Channel

- U.S. Costume Jewelry Market Outlook End User

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis By End User, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Men

- Women

- Market Attractiveness Analysis: End User

- Key Highlights

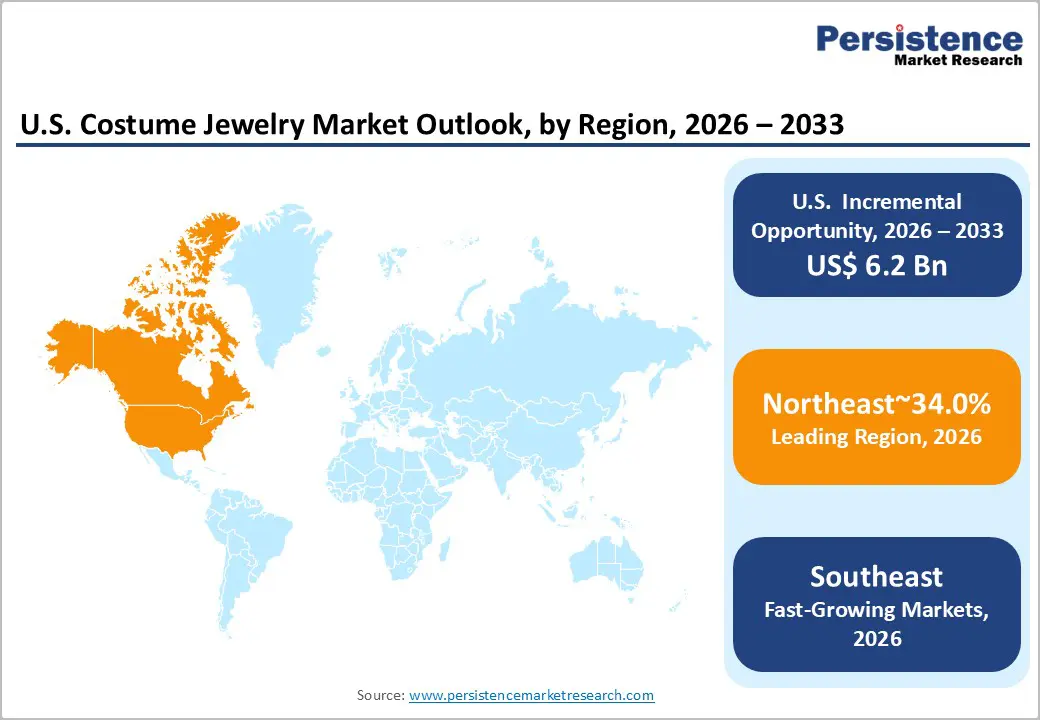

- U.S. Costume Jewelry Market Outlook Region

- Key Highlights

- Historical Market Size (US$ Mn) Analysis By Region, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By Region, 2026 – 2033

- Northeast

- Southeast

- Midwest

- Southwest

- West

- Market Attractiveness Analysis: Region

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Apparent Production Product Type

- Company Profiles (Details – Overview, Financials, Strategy, Recent Developments)

- Swarovski AG

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Chanel S.A.

- LVMH Moët Hennessy Louis Vuitton SE

- Guess Inc.

- Gianni Versace S.p.A.

- Pandora A/S

- Alex and Ani, LLC

- Hermès International S.A.

- Hennes & Mauritz AB (H&M)

- Industria de Diseño Textil, S.A. (ZARA)

- Gucci S.p.A. (Kering Group)

- Claire’s Stores, Inc

- Swarovski AG

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment