Loading page data

Please wait a moment

Second Floor, 150 Fleet Street,

London, EC4A 2DQ.

+44 203-837-5656

108 W 39th Street, Ste 1006,

PMB2219, New York, NY 10018

+1 646-878-6329

IT Unit No. 504, 5th Floor, Icon

Tower, Baner, Pune - 411045.

+91 906 779 3500

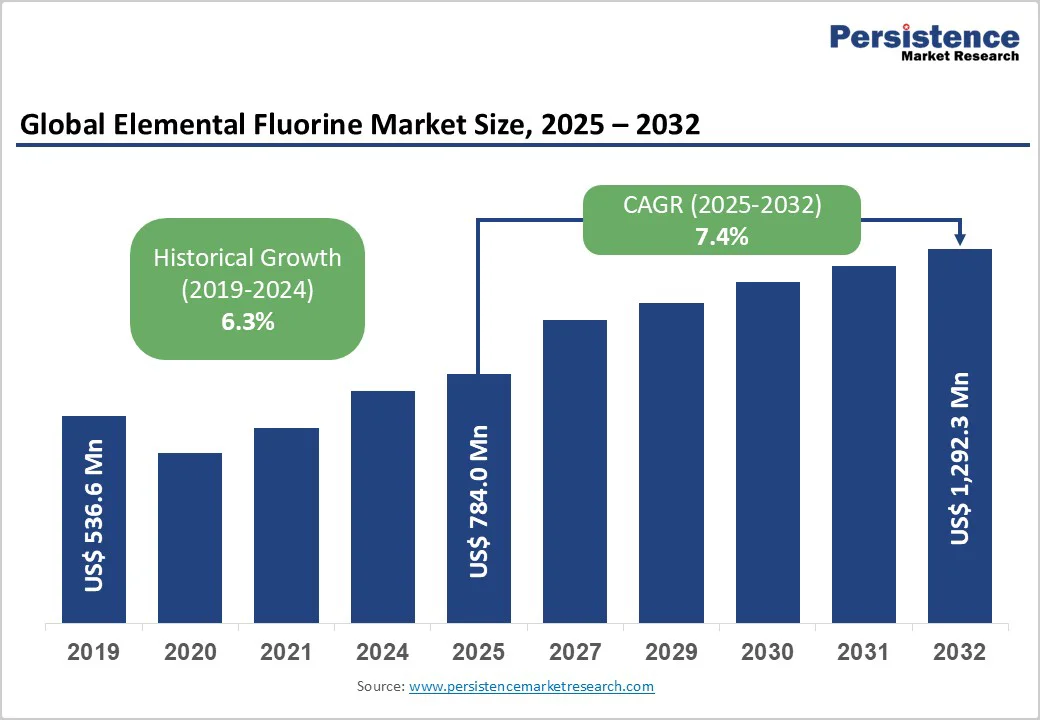

| Key Insights | Details |

|---|---|

| Elemental Fluorine Market Size (2025E) | US$784.0 Mn |

| Market Value Forecast (2032F) | US$1,292.3 Mn |

| Projected Growth (CAGR 2025 to 2032) | 7.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.3% |

Expansion of Semiconductor Manufacturing and Advanced Microfabrication Technologies

The rapid growth of the semiconductor sector is a dominant driver shaping the global elemental fluorine market. With worldwide semiconductor sales projected to reach over US$700 Billion in 2025, as per several industry forecasts, the role of elemental fluorine in plasma etching and wafer cleaning is increasingly vital. Highly reactive elemental fluorine is indispensable in the production of high-purity silicon wafers required for chips powering 5G devices, electric vehicles, and AI applications. The surge in silicon wafer production directly translates to heightened fluorine demand, as proper etching processes improve chip performance and yield.

Government initiatives in the U.S., South Korea, and China are injecting billions into semiconductor fabs and R&D, anticipating a compounded increase in fluorine consumption annually over the next decade. Industry partnerships between semiconductor giants and chemical providers focus on optimizing fluorine purity and delivery systems, underpinning this niche growth driver with both technological and commercial momentum.

Stringent Environmental Regulations on Fluorine Emissions

The elemental fluorine market growth is confronted with a complex challenge in the form of tightening environmental regulations targeting fluorine emissions and related waste management. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) enforce strict limits on fluorine-containing gases released during manufacturing, citing their high reactivity and potential for environmental harm.

Compliance efforts have led to increased capital expenditure on emission control technologies and process optimizations, raising operational costs significantly for fluorine producers. Regulatory complexity varies regionally, complicating global production and supply chain planning. Violations carry penalties that can reach millions in fines, exposing players to a lack of robust risk management.

Growing Demand for Fluorine-Containing Electrolytes in Lithium-Ion and Solid-State Batteries

The accelerating shift toward electrification in transportation and grid storage is creating lucrative opportunities for elemental fluorine providers through its use in advanced battery electrolytes. Fluorine-enriched compounds improve ionic conductivity and thermal stability in lithium-ion and emerging solid-state batteries, enhancing performance and safety. This translates to an elevated demand for high-purity elemental fluorine derivatives tailored for electrolyte synthesis.

Regulatory incentives in Europe, China, and North America for electric vehicle adoption boost investments in battery R&D, aligning upstream fluorine supply chains strategically with downstream electric mobility growth. Early partnerships between fluorine chemical producers and battery manufacturers are focused on scalable production of fluorinated solvents and additives, positioning this trend as a key avenue for widening revenue streams for market players over the next several years.

Form Insights

The liquid form segment is set to be the leader in 2025, commanding an estimated 60.7% of the elemental fluorine market revenue share. This leadership is attributable to liquid fluorine’s superior handling, storage safety, and application versatility, particularly in metallurgy and chemical synthesis processes. Liquid fluorine’s utility in aluminum production benefits from its high reactivity and ease of precise dosage control, enabling efficient fluxing and alloying. The chemical industry also prefers liquid fluorine for pharmaceutical-grade compound synthesis, where product purity and process stability are paramount.

Gaseous fluorine is slated to be the fastest-growing form across 2025-2032. This accelerated expansion is driven by innovations in semiconductor manufacturing technologies, which increasingly require ultra-high purity gaseous fluorine for plasma etching and wafer cleaning processes. The explosive growth of the semiconductor sector, underpinned by 5G deployment, electric vehicles (EVs), and IoT device production, is fueling the demand for precisely controlled gaseous delivery systems. Technological progress in gas purification and handling has also mitigated previous safety constraints, further enabling market penetration.

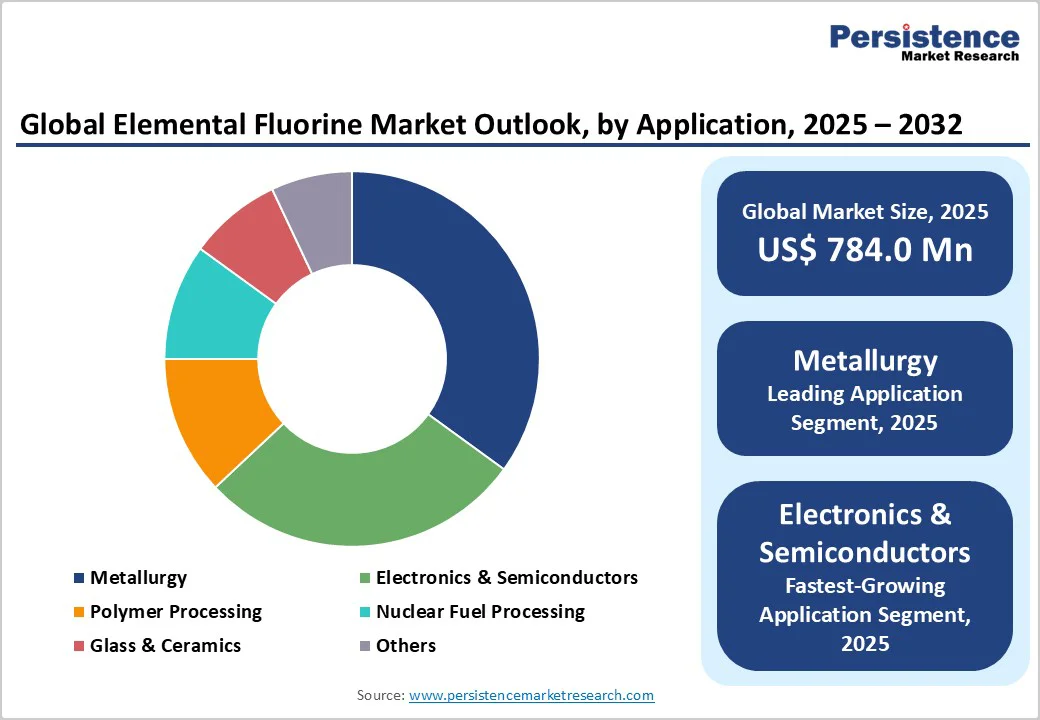

Application Insights

Metallurgy stands as the leading segment with an estimated 35% market share in 2025, boosted predominantly by the aluminum industry. Elemental fluorine occupies a central place in metal treatment and alloy formation, as it enhances aluminum’s corrosion resistance and mechanical properties through fluorine compound interactions during smelting. The wide consumption of aluminum across the automotive and aerospace sectors further propels the consistent demand for elemental fluorine within metallurgy.

Electronics and semiconductor applications represent the fastest-growing segment through 2032. This growth is driven by the rapid expansion of wafer fabrication capacity worldwide, particularly in Asia Pacific, supported by government incentives fostering domestic chip manufacturing. Elemental fluorine is indispensable in plasma etching to remove layers from silicon wafers without damaging minute chip features, ensuring device miniaturization and high performance. With the semiconductor industry forecast to maintain annual growth rates, its associated fluorine consumption demonstrates magnified dynamics due to high purity and processing stringency.

Product Type Insights

The α-fluorine segment currently leads the market with an estimated 58% share in 2025, benefiting from its extensive use in pharmaceutical and agrochemical synthesis, where unique reactivity patterns afford enhanced drug molecule efficacy and selectivity. Its established presence in manufacturing high-value fluorinated compounds continues to secure stable revenue and volume contributions. The pharmaceutical industry’s continued growth ensures a steady demand for α-fluorine for developing new active pharmaceutical ingredients (APIs), positioning it as a core product type.

β-fluorine is forecast to be the fastest-growing product type with an impressive CAGR through 2032. This acceleration is stimulated by its rising application in specialty polymers and advanced material sectors, including aerospace-grade composites and industrial coatings, where fluorine’s thermal stability and chemical resistance are critical. Increasing R&D efforts around novel β-fluorine derivatives emphasize material performance enhancements, opening lucrative new markets. Its rapid adoption underlies significant future market share gains, encouraging players to prioritize β-fluorine portfolio expansion.

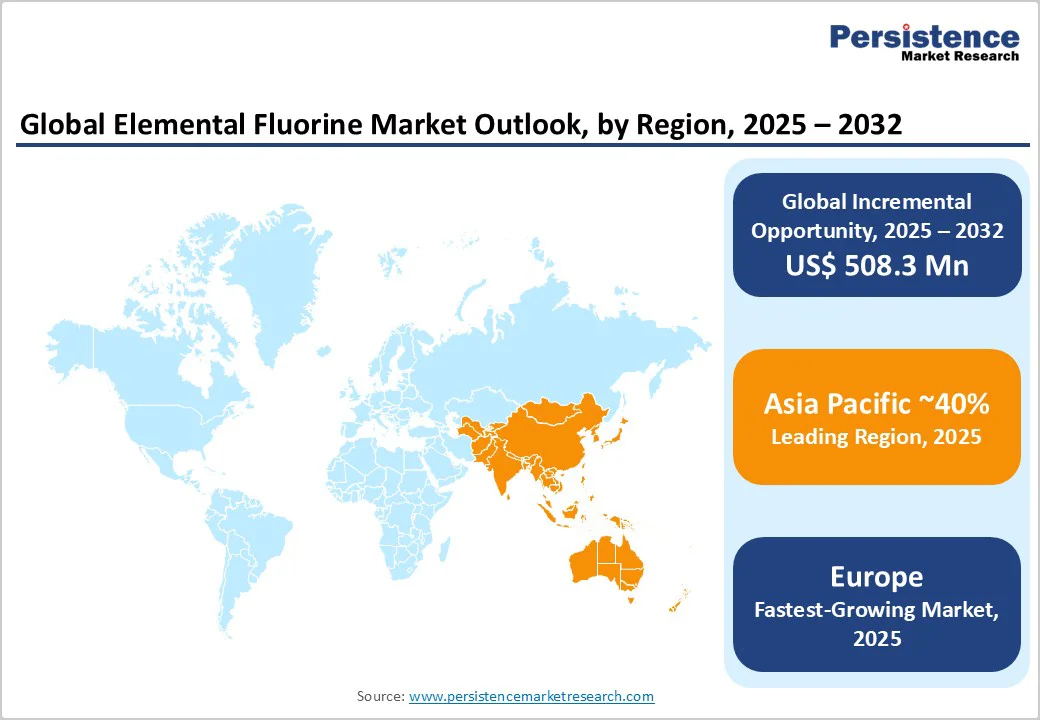

North America Elemental Fluorine Market Trends

North America is expected to hold approximately 25% of the global market in 2025, with the U.S. as the principal driver, leveraging a dominant semiconductor manufacturing industry infrastructure. The regional market is forecast to grow through 2032, reflecting continued investments in next-generation chip fabs and materials development. The U.S. government's strategic semiconductor initiatives, such as the CHIPS Act, allocate billions for domestic production, enhancing supply chain resilience, and directly increasing fluorine demand for wafer processing.

Regulatory frameworks in North America have evolved to balance industrial activity with environmental stewardship. As a result, the EPA enforces stringent emission controls for fluorine-related substances, compelling producers to adopt cutting-edge mitigation technologies, thus increasing operating costs but also promoting sustainable practices. The region’s advanced chemical manufacturing ecosystem benefits from substantial venture capital inflows and university-industry research collaboration, fostering innovation in fluorine purification and delivery technologies. Key players in the region have been known to invest in R&D to develop customized fluorine solutions for the semiconductor and pharmaceutical sectors, maintaining leadership while addressing evolving regulatory and market requirements.

Europe Elemental Fluorine Market Trends

Europe is poised to command about 20% of the elemental fluorine market share in 2025 and is distinguished as the fastest-growing regional market through 2032. Central to this expansion is France and Germany's advanced nuclear fuel processing capabilities, where elemental fluorine is pivotal in manufacturing uranium hexafluoride for nuclear enrichment. Europe’s commitment to nuclear energy transition as part of its climate goals supports long-term fluorine demand in this sector. Regulatory harmonization under the European Chemicals Agency (ECHA) and REACH regulations fosters a stringent yet innovation-friendly environment focusing on green chemistry and sustainable fluorine use.

The pharmaceutical sector notably contributes to the growth of the regional market. European pharma companies strengthen research pipelines by integrating fluorine chemistry for drug design, expanding α-fluorine product demand. Capital investment flows from both public and private sectors to upgrade manufacturing facilities and scale up specialty chemical production. The competitive landscape is characterized by collaborations between nuclear, chemical, and pharmaceutical entities, leveraging cross-sector expertise to maximize market potential.

Asia Pacific Elemental Fluorine Market Trends

Asia Pacific dominates the elemental fluorine market with an estimated 40% share in 2025, stimulated by rapid industrialization, favorable government policies, and expansive semiconductor, polymer, and nuclear industries across China, Japan, South Korea, India, and ASEAN countries. China’s manufacturing scale and semiconductor expansion alone represent a substantial fluorine consumption base, aligned with policy-driven industrial upgrades. The regulatory landscape of the region is progressively elevating chemical safety and environmental impact standards. Governments are adopting frameworks akin to Western regulations while balancing economic growth imperatives, driving fluorine producers to innovate in low-emission processes and enhanced supply chain transparency.

Investment volumes in fluorochemical capacity expansion are robust, supported by foreign direct investment and public initiatives aimed at high-tech materials. Competitive pressure is intense with domestic players competing against multinational corporations via pricing strategies, localized R&D, and joint ventures. Strategic alliances increasingly focus on developing high-purity fluorine products customized for regional semiconductor fabs and polymer applications.

The global elemental fluorine market structure is moderately consolidated. The top five players, Solvay S.A., Navin Fluorine International Ltd., Air Products & Chemicals, Linde plc, and BASF SE, collectively control approximately 60% of the global market share. This consolidation reflects strong barriers to entry stemming from complex fluorine production requirements, regulatory compliance, and technological expertise. Despite concentration, niche players operate in specialized applications such as pharmaceutical-grade fluorine derivatives, maintaining dynamic competitive tension and innovation within the market.

Leading firms are prioritizing R&D investments, focusing on enhancing fluorine purity, safer handling technologies, and process efficiency to align with environmental regulations and customer demands. Strategic acquisitions and partnerships have become commonplace as companies seek to broaden geographic reach and product portfolios.

Key Industry Developments

The global elemental fluorine market is projected to reach US$784.0 Million in 2025.

Broadening the applicability of fluorine across high-performance industries such as semiconductors, metallurgy, and pharmaceuticals is driving the market.

The elemental fluorine market is poised to witness a CAGR of 7.4% from 2025 to 2032.

Advancements in materials engineering, increasing demand for elemental fluorine as a critical raw material in semiconductor wafer etching, aluminum production, and fluorinated drug synthesis, and regulatory oversight prioritizing chemical safety and sustainable production are key market opportunities.

Solvay S.A., Navin Fluorine International Ltd., and Air Products & Chemicals, Inc. are a few of the key players in the market.