- Executive Summary

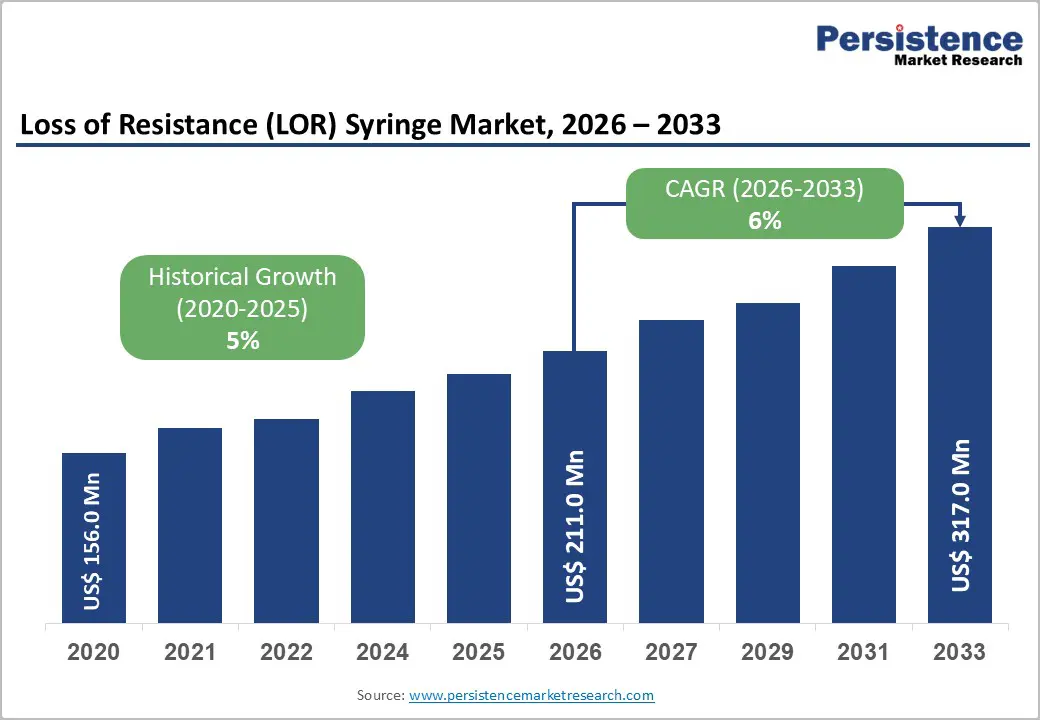

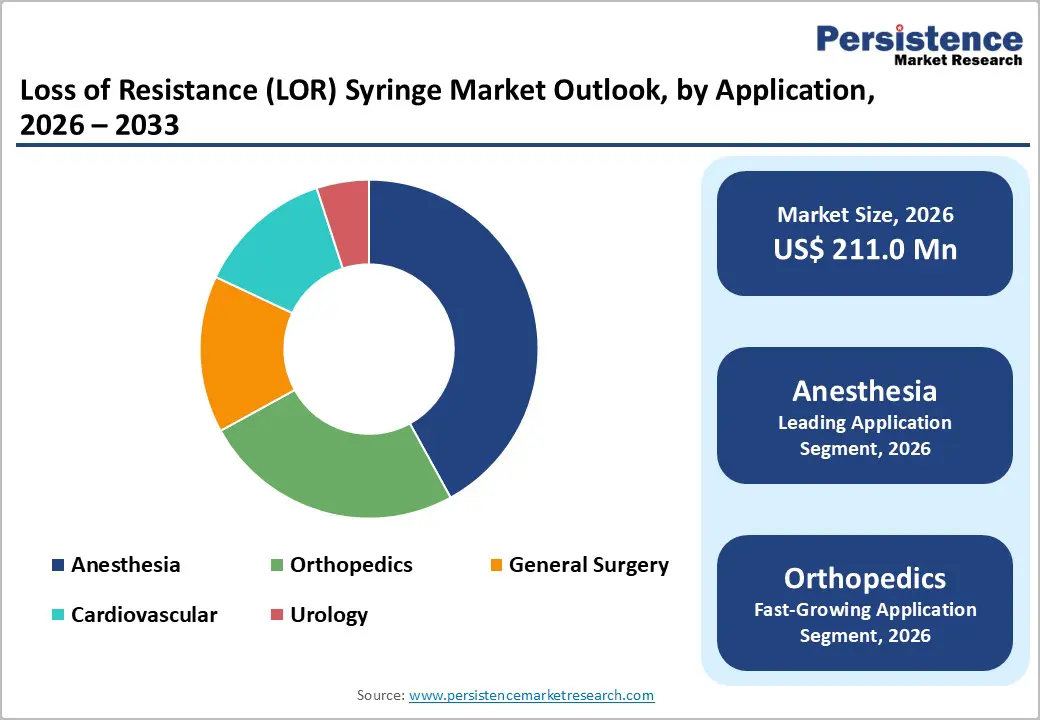

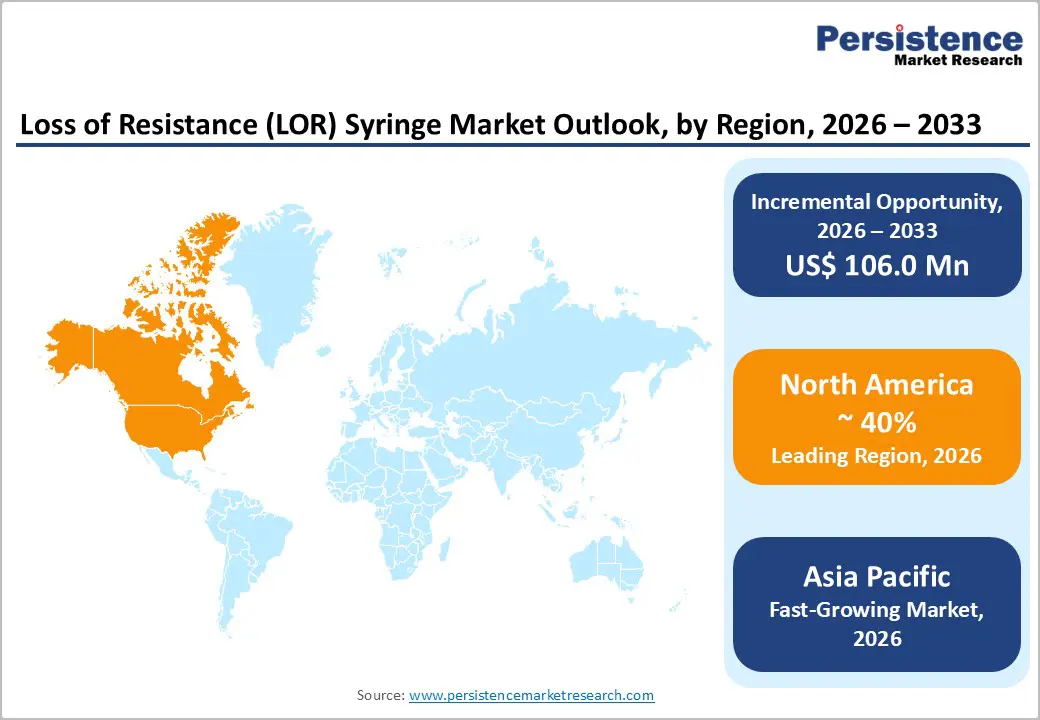

- Global Loss of Resistance (LOR) Syringe Market Snapshot, 2026 and 2033

- Market Opportunity Assessment, 2026 - 2033, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Key Trends

- Macro-economic Factors

- Global Sectoral Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Tool Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Analysis, 2025A

- Key Highlights

- Key Factors Impacting Deployment Costs

- Pricing Analysis, By End-User

- Global Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Market Volume (Units) Projections

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2020-2025

- Current Market Size (US$ Bn) Analysis and Forecast, 2026 - 2033

- Global Loss of Resistance (LOR) Syringe Market Outlook: Application

- Introduction / Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Application, 2020 - 2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Market Attractiveness Analysis: Application

- Global Loss of Resistance (LOR) Syringe Market Outlook: End-User

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By End-User, 2020 - 2025

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Market Attractiveness Analysis: End-User

- Global Loss of Resistance (LOR) Syringe Market Outlook: Modality Type

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Modality Type, 2020 - 2025

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026 - 2033

- Disposable

- Reusable

- Market Attractiveness Analysis: Modality Type

- Key Highlights

- Global Loss of Resistance (LOR) Syringe Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Region, 2020 - 2025

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Region, 2026 - 2033

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Application

- By End-User

- By Modality Type

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- U.S.

- Canada

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026-2033

- Disposable

- Reusable

- Market Attractiveness Analysis

- Europe Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Application

- By End-User

- Modality Type

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026-2033

- Disposable

- Reusable

- Market Attractiveness Analysis

- East Asia Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Application

- By End-User

- By Modality Type

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- China

- Japan

- South Korea

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026-2033

- Disposable

- Reusable

- Market Attractiveness Analysis

- South Asia & Oceania Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Application

- By End-User

- By Modality Type

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026-2033

- Disposable

- Reusable

- Market Attractiveness Analysis

- Latin America Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Application

- By End-User

- By Modality Type

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026-2033

- Disposable

- Reusable

- Market Attractiveness Analysis

- Middle East & Africa Loss of Resistance (LOR) Syringe Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2020 - 2025

- By Country

- By Application

- By End-User

- By Modality Type

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2026 - 2033

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Application, 2026 - 2033

- Anesthesia

- General Surgery

- Urology

- Cardiovascular

- Orthopedics

- Current Market Size (US$ Bn) Analysis and Forecast, By End-User, 2026 - 2033

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Current Market Size (US$ Bn) Analysis and Forecast, By Modality Type, 2026-2033

- Disposable

- Reusable

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Medline Industries, Inc.

- Overview

- Segments and Deployments

- Key Financials

- Market Developments

- Market Strategy

- Becton, Dickinson and Company

- Terumo Corporation

- B. Braun Melsungen AG

- Smith’s Medical

- Teleflex Incorporated

- Nipro Corporation

- Weigao Group Medical Ploymer Company Limited

- Gerresheimer AG

- Owen Mumford Ltd

- PAJUNK GmbH Medizintechnologie

- Vygon SA

- Well Lead Medical Co., Ltd.

- Zhejiang Fert Medical Device Co., Ltd.

- Vogt Medical Vertieb GmbH

- Medline Industries, Inc.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment