- Executive Summary

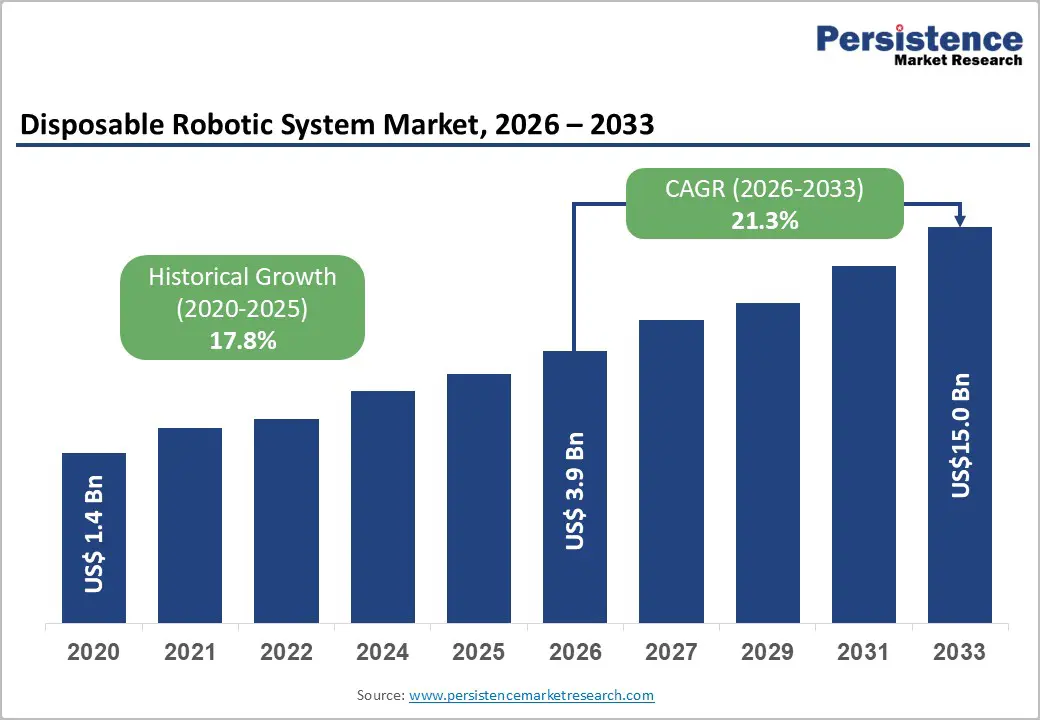

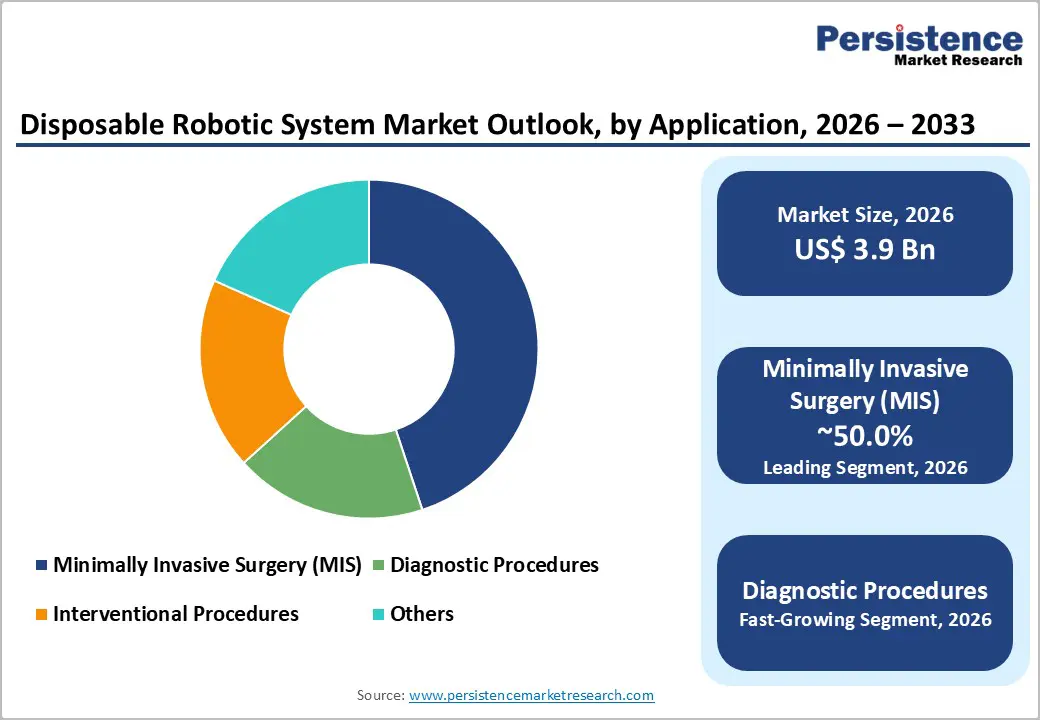

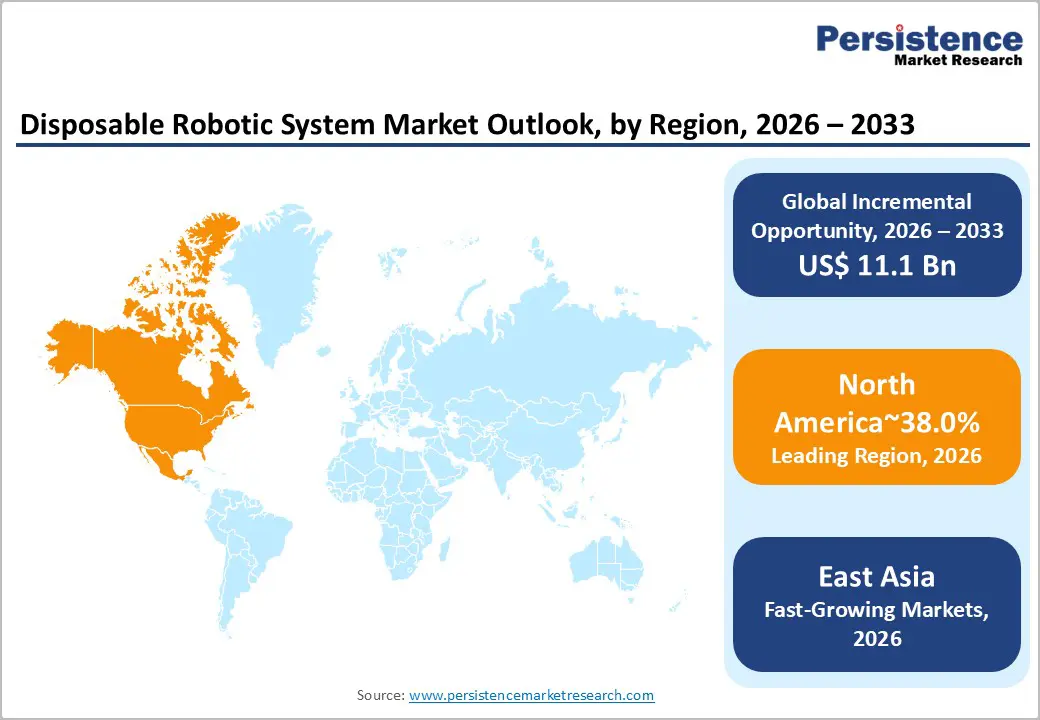

- Global Disposable Robotic System Market Snapshot, 2026 and 2033

- Market Opportunity Assessment, 2026 – 2033, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- Product Lifecycle Analysis

- Global Parent Market Overview

- Disposable Robotic System Market: Value Chain

- List of Raw Deployment Mode Supplier

- List of Manufacturers

- List of Distributors

- List of End User Industries

- Profitability Analysis

- Forecast Factors – Relevance and Impact

- Covid-19 Impact Assessment

- PESTLE Analysis

- Porter’s Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Deployment Mode Landscape

- 3.1. Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- Other Macro-economic Factors

- Price Trend Analysis, 2020 – 2033

- Key Highlights

- Key Factors Impacting Product Prices

- Prices By Product Type/Deployment Mode/End User

- Regional Prices and Product Preferences

- Global Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Market Size and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size Analysis, 2020-2025

- Current Market Size Forecast, 2020–2033

- Global Disposable Robotic System Market Outlook: Product Type

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis By Product Type, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Market Attractiveness Analysis: Product Type

- Global Disposable Robotic System Market Outlook: Application

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis By Application, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Market Attractiveness Analysis: Application

- Global Disposable Robotic System Market Outlook End User

- Introduction / Key Findings

- Historical Market Size (US$ Mn) Analysis By End User, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis: End User

- Key Highlights

- Global Disposable Robotic System Market Outlook Region

- Key Highlights

- Historical Market Size (US$ Mn) Analysis By Region, 2020 – 2025

- Current Market Size (US$ Mn) Forecast By Region, 2026 – 2033

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) Analysis By Market, 2020 – 2025

- By Country

- By Product Type

- By Application

- By End User

- Current Market Size (US$ Mn) Forecast By Country, 2026 – 2033

- U.S.

- Canada

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis

- Europe Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) Analysis By Market, 2020 – 2025

- By Country

- By Product Type

- By Application

- By End User

- By Current Market Size (US$ Mn) Forecast By Country, 2026 – 2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis

- East Asia Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) Analysis By Market, 2020 – 2025

- By Country

- By Product Type

- By Application

- By End User

- Current Market Size (US$ Mn) Forecast By Country, 2026 – 2033

- China

- Japan

- South Korea

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis

- South Asia & Oceania Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) Analysis By Market, 2020 – 2025

- By Country

- By Product Type

- By Application

- By End User

- Current Market Size (US$ Mn) Forecast By Country, 2026 – 2033

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis

- Latin America Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) Analysis By Market, 2020 – 2025

- By Country

- By Product Type

- By Application

- By End User

- Current Market Size (US$ Mn) Forecast By Country, 2026 – 2033

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis

- Middle East & Africa Disposable Robotic System Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) Analysis By Market, 2020 – 2025

- By Country

- By Product Type

- By Application

- By End User

- Current Market Size (US$ Mn) Forecast By Country, 2026 – 2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Current Market Size (US$ Mn) Forecast By Product Type, 2026 – 2033

- Disposable Surgical Robots

- Disposable Endoscopic Robotic Systems

- Disposable Catheter-based Robotic Systems

- Others

- Current Market Size (US$ Mn) Forecast By Application, 2026 – 2033

- Minimally Invasive Surgery (MIS)

- Laparoscopy

- Orthopedic Surgery

- Urology

- Gynecology

- Cardiothoracic Surgery

- Diagnostic Procedures

- Interventional Procedures

- Others

- Minimally Invasive Surgery (MIS)

- Current Market Size (US$ Mn) Forecast By End User, 2026 – 2033

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Apparent Production Capacity

- Company Profiles (Details – Overview, Financials, Strategy, Recent Developments)

- Intuitive Surgical

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Smith & Nephew

- Microdot Medical

- Medtronic

- EndoWays

- Stryker Corporation

- Zimmer Biomet Holdings

- TransEnterix Surgical

- Verb Surgical

- Medicaroid

- Intuitive Surgical

Note: List of companies is not exhaustive in Nature. It is subject to further augmentation during course of research

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations