ID: PMRREP33215| 210 Pages | 16 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

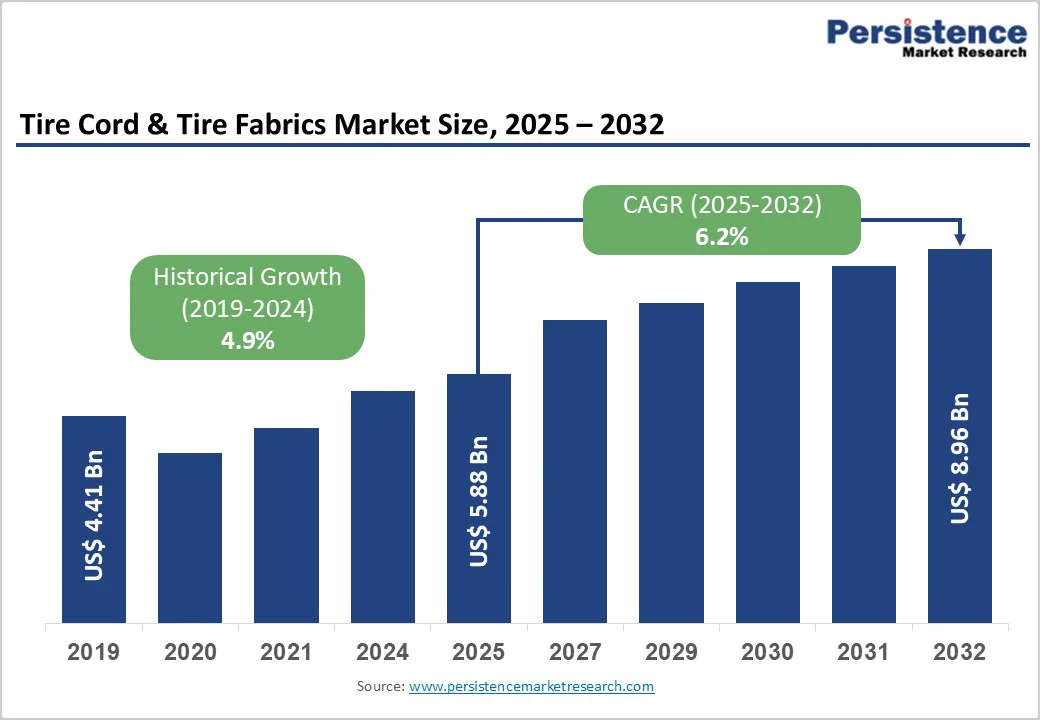

The global tire cord & tire fabrics market size is valued at US$5.9 billion in 2025 and is projected to reach US$9.0 billion by 2032, growing at a CAGR of 6.2% between 2025 and 2032. The market's expansion stems from surging global vehicle production and a shift toward advanced tire reinforcements that enhance durability and performance.

The automotive output reached over 90 million units in 2024 according to the International Organization of Motor Vehicle Manufacturers (OICA), driving demand for high-strength cords. Rising adoption of EVs, which require specialized low-rolling-resistance fabrics, contributes significantly, as evidenced by IEA reports showing 17 million EV sales in 2024. These factors collectively bolster the market's trajectory amid urbanization and infrastructure growth.

| Key Insights | Details |

|---|---|

|

Tire Cord & Tire Fabrics Market Size (2025E) |

US$5.9 Bn |

|

Market Value Forecast (2032F) |

US$9.0 Bn |

|

Projected Growth CAGR (2025-2032) |

6.2% |

|

Historical Market Growth (2019-2024) |

4.9% |

Global automotive production continues to fuel the Tire Cord & Tire Fabrics Market, with output exceeding 90 million vehicles in 2024 as per OICA data, necessitating robust tire reinforcements for safety and longevity. China maintains its position as the world's largest vehicle manufacturer, producing 30.2 million vehicles in 2023, while India ranks as the third-largest producer with 5.9 million units annually, reflecting the rapid industrialization of emerging markets. This surge, particularly in emerging economies, increases demand for durable cords that withstand higher loads and improve fuel efficiency.

The pneumatic tire market itself is projected to grow from US$195.7 billion in 2025 to US$271.7 billion by 2032, generating significant downstream demand for tire reinforcement materials. The positive impact is evident in supply chain expansions, where manufacturers invest in capacity to meet this volume, ensuring steady market growth through enhanced tire performance and cost savings for end-users.

Consumers and regulators increasingly prioritize tires with superior grip and eco-friendliness, propelling the market forward. The European Union has set a target to reduce CO2 emissions from new cars by 37.5% by 2030, pushing automotive manufacturers to focus on energy-efficient technologies, including low-resistance radial tires reinforced with advanced tire cord fabrics. This driver is reinforced by innovations in fabric treatments that boost adhesion and heat resistance, vital for high-speed applications.

In the Automotive Tire Market, such advancements have led to a 15% rise in premium tire sales since 2022. Overall, this trend not only expands market reach but also encourages R&D investments, fostering long-term growth by meeting stringent standards like those from the European Union on tire labeling.

The tire cord fabric industry faces persistent headwinds from fluctuating prices of key raw materials, including polyester chips, nylon polymers, and petrochemical feedstocks, which represent significant cost components in manufacturing. Crude oil price volatility, geopolitical tensions affecting chemical supply chains, and disruptions in synthetic rubber markets create unpredictable cost structures that compress manufacturer margins and reduce overall market profitability.

In regions like Asia, where 80% of cords rely on imported feedstocks, supply disruptions from geopolitical tensions exacerbate costs, hindering market stability. Supply chain uncertainties combined with energy price inflation have historically resulted in extended lead times and inventory accumulation costs throughout the tire manufacturing ecosystem.

Tire cord and tire fabrics manufacturers face increasingly stringent environmental regulations regarding dipping chemistry, manufacturing emissions, and end-of-life product recyclability that necessitate substantial investments in cleaner production technologies. The European Union's Euro 7 regulation, adopted in April 2024, represents a major regulatory shift by introducing particle emission thresholds for tire wear, mandating that tires exceeding established limits will no longer be permitted in the market. The Euro 7 framework extends beyond exhaust emissions to address brake particle emissions and microplastic production from tire wear, applying universally to all vehicles regardless of powertrain type, including electric vehicles.

Manufacturers must invest significantly in research and development activities to create innovative reinforcement materials complying with evolving environmental standards while maintaining performance characteristics demanded by original equipment manufacturers and replacement market customers. The impact manifests in slower market penetration for new products, particularly in replacement segments, constraining expansion amid global pushes for circular economies.

The rapid electrification of global automotive fleets presents transformative opportunities for tire cord and tire fabrics manufacturers to develop specialized reinforcement solutions addressing the unique requirements of electric vehicle platforms. The burgeoning electric vehicle sector offers substantial potential, with the International Energy Agency projecting 145 million EVs on roads by 2030, demanding lightweight, high-strength cords for extended range. Electric vehicles impose distinctive demands on tire construction due to battery-induced weight increases, instant torque delivery, and the critical importance of rolling resistance reduction for range optimization, necessitating advanced reinforcement materials with superior strength-to-weight ratios.

Kordsa Global has strategically positioned itself to capture this opportunity through its REV Technologies brand, launched at Tire Technology Expo 2024, offering specialized products focusing on increased durability, reduced weight, and lower rolling resistance specifically engineered for EV tire applications. Teijin Limited's medium-term management plan for 2024-2025 emphasizes aramid tire cords for luxury cars and EVs, recognizing market trends toward vehicles becoming heavier due to electrification and the need for lighter, high-performance tires and battery components.

Sustainability transformation across the tire industry is creating substantial opportunities for manufacturers developing recyclable fabric architectures, bio-based materials, and circular production processes that align with automotive OEM sustainability commitments. Indorama Ventures Public Company Limited achieved International Sustainability and Carbon Certification (ISCC+) across key fiber manufacturing sites in September 2024, positioning its high-performance fiber portfolio to serve mobility, tire cords, airbags, and industrial rubber goods sectors with certified sustainable materials.

Shifting toward bio-based and recycled materials presents key growth avenues, backed by Ellen MacArthur Foundation estimates of a $100 billion circular economy opportunity by 2030. The Steel Tire Cord Market integration with recycled metals further amplifies this, with policies like the U.S. Inflation Reduction Act incentivizing green production. These developments enable market players to tap premium pricing in eco-conscious regions, fostering demand through certifications and collaborations that promise long-term viability and expanded end-user bases.

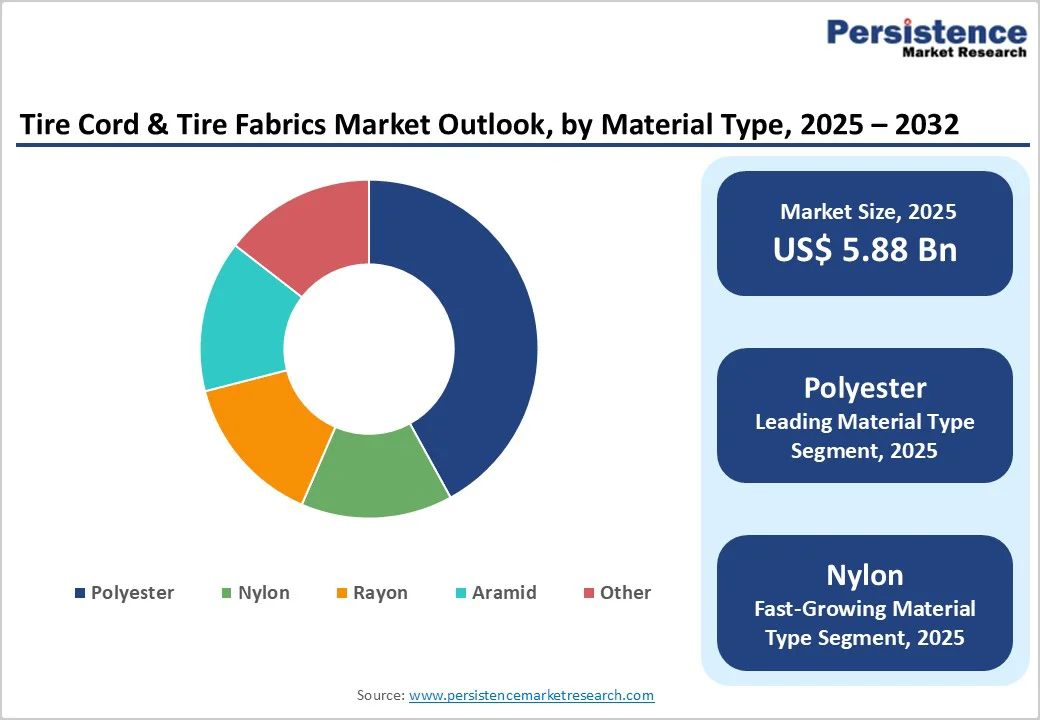

Polyester dominates the tire cord fabrics market with approximately 42% market share, driven by its favorable cost-to-performance balance across passenger and commercial tire applications. Polyester tire cords are mainly used in passenger car radial tires for their stability and handling benefits. Their high-modulus properties enable lighter tires with lower rolling resistance and better fuel efficiency, supporting emissions compliance. HMLS polyester fibers are increasingly used in premium tires and EVs for their superior performance. Proven reliability, strong supply chains, and ongoing innovations secure their market leadership.

SRF Limited, India's largest technical textiles manufacturer, expanded its presence in the N66 (Nylon 6,6) and Polyester tire cord fabric segments in FY25, successfully enhancing its customer base and diversifying its product portfolio despite intense competition and margin pressure. In the Pneumatic Tire Market, its lightweight properties contribute to fuel savings, reinforcing its position amid rising vehicle efficiencies. Overall, polyester's versatility supports sustained dominance, with ongoing R&D enhancing its sustainability profile.

Radial tires command about 75% of the market share in tire type, owing to their enhanced stability and longevity compared to bias constructions. Radial tires provide demonstrably superior performance characteristics, including extended tread life, improved fuel efficiency with lower rolling resistance properties, enhanced handling stability, and superior comfort attributes compared to legacy bias-ply designs.

JK Tires recently unveiled a new range of electric vehicle-specific radial tires equipped with in-house developed Treel TPMS sensors suitable for light commercial vehicles, passenger vehicles, SUVs, electric trucks, buses, and two-wheelers. This segment's lead is substantiated by manufacturing advantages, where radial plies allow independent sidewall movement, minimizing heat buildup during high-speed travel. In commercial applications, radials extend service life by 25%, per fleet operator studies.

The Replacement application holds roughly 65% market share, fueled by the vast aftermarket for tire renewals in aging vehicle fleets. International Rubber Study Group statistics show that replacement demand accounts for 80% of total tire volume globally, as consumers prioritize durable reinforcements for extended mileage.

Replacement volumes generate sustained demand for tire cord fabrics as aging vehicle fleets and frequent tire replacement cycles, particularly in commercial vehicle segments, drive continuous aftermarket requirements. However, the OEM segment is experiencing amplified importance as vehicle manufacturers focus on enhancing the performance, safety, and fuel efficiency of commercial fleets, prioritizing high-quality tires meeting stringent specifications and standards. Japan produced nearly 7.8 million motor vehicles in 2024, driving the OEM tire market while replacement demand remains stable due to an aging vehicle fleet, with domestic automobile tire demand projected at approximately 98.5 million units in 2025 according to the Japan Automobile Tire Manufacturers Association (JATMA).

Passenger Car end-users dominate with around 50% share, propelled by surging personal vehicle ownership and demand for comfort-oriented tires. OICA figures indicate over 60 million passenger cars produced annually, requiring cords that balance ride quality and safety. Justification lies in polyester-rayon blends used in these tires, offering vibration dampening that reduces noise by 15%, as per acoustic testing from the Society of Automotive Engineers.

The passenger vehicle segment benefits from rising consumer preferences for fuel-efficient tires, safety features, and comfort characteristics that necessitate advanced tire cord fabrics with optimized strength, flexibility, and rolling resistance properties. This segment's growth is tied to urbanization, with urban drivers favoring radials for daily commutes. In the Automotive Tire Market, passenger focus drives fabric innovations, solidifying its leading role amid lifestyle shifts.

North America leads in innovation for tire cords, with the U.S. holding the regional market dominance through advanced R&D ecosystems. The National Highway Traffic Safety Administration mandates low-rolling-resistance standards, spurring developments in aramid hybrids that improve EV efficiency by 12%. Recent investments by firms like Bridgestone in sustainable fabrics align with the Clean Air Act, fostering a robust regulatory framework that encourages high-performance materials.

Technological hubs in Michigan and Ohio drive collaborations, as seen in the 2024 SAE International conferences highlighting nylon enhancements for off-road tires. This ecosystem supports a 10% annual increase in premium cord adoption, bolstered by aftermarket growth from 35 million annual vehicle miles traveled per capita.

Europe's market emphasizes regulatory harmonization, with Germany excelling in precision engineering for high-safety cords. The EU Tyre Labelling Regulation requires performance disclosures, boosting demand for traceable fabrics that meet A-grade efficiency ratings, as per 2024 European Commission audits. Volkswagen Group integrations demonstrate this, enhancing tire durability by 20% in performance vehicles.

In the U.K. and France, post-Brexit standards and France's eco-incentives drive polyester recycling initiatives, with Spain focusing on commercial applications. British Rubber Manufacturers' Association reports an 8% rise in radial cord usage, supported by harmonized policies across the EU that promote cross-border supply chains and innovation in sustainable materials.

Asia Pacific represents the dominant global market, accounting for approximately 50% of worldwide tire cord fabrics demand, with China leading production capacities exceeding 300 million tires yearly, according to the China Rubber Industry Association. This scale enables cost-effective nylon and polyester outputs, supporting EV growth where cords reduce weight for a 30% better range, as in BYD models.

Japan and India contribute through tech advancements, like Toyota's aramid trials and India's Make in India policy, attracting $5 billion in tire investments by 2024. ASEAN nations like Thailand benefit from export hubs, with 15% CAGR in commercial cords driven by logistics booms. Overall, regional dynamics favor volume growth amid urbanization.

The global tire cord & tire fabrics market exhibits a consolidated structure, with top players controlling over 60% share through vertical integration and global supply chains. Companies pursue expansion via capacity upgrades, as Kordsa invested $100 million in 2024 for aramid lines, while R&D trends focus on bio-based materials to meet sustainability goals. Key differentiators include customized dipping technologies for adhesion, and emerging models emphasize circular economy partnerships. The competitive landscape reflects ongoing consolidation pressures, with smaller regional manufacturers increasingly acquired by global players seeking to expand geographic footprints and production capacity. Market leaders pursue differentiation strategies emphasizing hybrid material architectures, specialized EV tire cord platforms, sustainability certifications, and advanced adhesion technologies rather than competing primarily on commodity pricing.

Kordsa Global, Inc. (Turkey) leads with a strong portfolio in reinforcement technologies, generating over $1 billion in revenue from tire cords, emphasizing R&D for high-tenacity nylons that serve major OEMs globally.

Indorama Ventures Public Company Limited (Thailand) excels in polyester dominance, with expansions in recycled fabrics, bolstering its influence through sustainable supply chains for passenger tires.

Kolon Industries Inc. (South Korea) offers mature aramid solutions, leveraging $3 billion in chemical revenues for innovative cords, its portfolio strength evident in partnerships with Asian automakers for commercial applications.

The market is valued at US$5.9 Bn in 2025 and expected to reach US$9.0 Bn by 2032, growing at 6.2% CAGR driven by automotive expansions.

Rising vehicle production over 90 million units annually and EV adoption requiring advanced reinforcements are key, enhancing tire durability and efficiency.

Polyester leads with 42% share, valued for its strength and cost balance in radial tires, supporting widespread use in passenger applications.

Asia Pacific dominates the global market, controlling approximately 50% of worldwide tire cord fabrics demand, driven by massive automotive production capacity in China and India.

EV tire segment offers growth, with lightweight sustainable cords projected to capture 20% more share via OEM partnerships and eco-policies.

Top players include Kordsa Global, Inc., Indorama Ventures, and Kolon Industries, leading with integrated production and R&D for global tire supplies.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Material Type

By Tire Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author