ID: PMRREP33070| 199 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

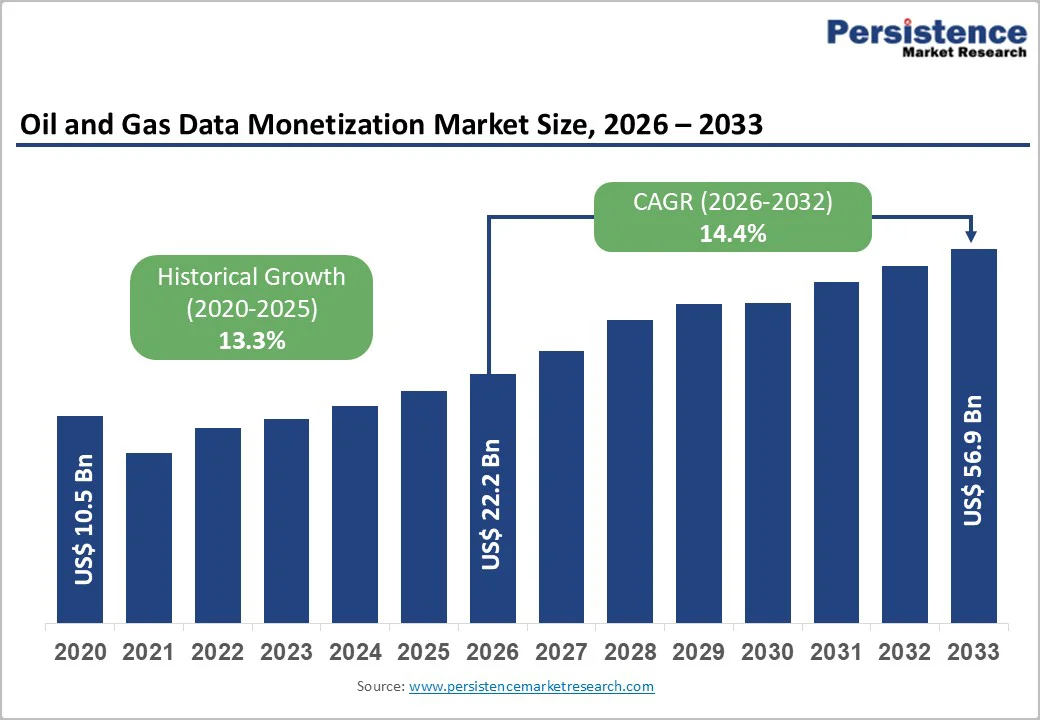

The global oil and gas data monetization market size is likely to be valued at US$ 22.2 billion in 2026 and is projected to reach US$ 56.9 billion by 2033, growing at a CAGR of 14.4% between 2026 and 2033.

The market expansion is primarily driven by the exponential increase in data generation from drilling operations, coupled with the industry's recognition of data as a revenue-generating asset. Rising adoption of advanced analytics and AI-driven platforms is enabling oil and gas companies to unlock deeper operational insights and create new revenue streams from previously underutilized datasets.

| Key Insights | Details |

|---|---|

| Global Oil and Gas Data Monetization Market Size (2026E) | US$ 22.2 Bn |

| Market Value Forecast (2033F) | US$ 56.9 Bn |

| Projected Growth CAGR(2026 - 2033) | 14.4% |

| Historical Market Growth (2020 - 2025) | 13.3% |

The deployment of Internet of Things sensors across drilling facilities, pipelines, and production platforms has emerged as a fundamental growth catalyst for the oil and gas data monetization market. North America alone hosts more than 2.5 million deployed sensors generating continuous streams of operational data, including pressure, temperature, flow rates, and vibration measurements. This real-time data capture capability enables companies to develop sophisticated analytics workflows that optimize production efficiency, reduce unplanned downtime, and generate predictive insights for equipment maintenance.

The integration of 5G private networks and edge computing infrastructure has accelerated data processing speeds, allowing operators to convert raw sensor information into actionable business intelligence within milliseconds. Companies such as ADNOC have committed USD 920 million to digitalize over 2,000 wells by 2027, underlining the industry-wide investment momentum in IoT infrastructure that simultaneously generates commercially valuable datasets suitable for licensing to third parties and external stakeholders.

Artificial intelligence and machine learning algorithms are fundamentally transforming how oil and gas organizations monetize production and subsurface data. In 2024 alone, more than 240 million labeled well-log and seismic datasets were utilized to train deep learning models that significantly enhanced drilling precision, reservoir characterization, and production forecasting accuracy. ExxonMobil achieved a 25% reduction in demand forecasting errors through AI-powered predictive models, while Chevron improved inventory management efficiency by 20% using machine learning-based demand predictions.

These technologies enable operators to extract value not only through internal operational optimization but also by packaging refined datasets and AI-trained models as licensable intellectual property. The monetization opportunity extends to predictive maintenance services, where companies can generate recurring revenue by offering external clients risk assessment and equipment failure prediction services powered by proprietary machine learning models trained on decades of operational data.

The substantial value concentration within data monetization initiatives has simultaneously elevated cybersecurity risks and created complex challenges for data governance frameworks. Oil and gas operations generate and store exabytes of sensitive subsurface information, operational parameters, and production metrics that represent critical competitive advantages and intellectual property assets. The industry faces mounting pressure from sophisticated cyberattacks, ransomware threats, and data breach attempts targeting these high-value datasets.

Companies investing billions in data infrastructure must simultaneously implement multi-layered security architectures, ensure regulatory compliance with jurisdiction-specific data protection requirements, and maintain operational continuity during potential security incidents. The capital-intensive nature of enterprise-grade cybersecurity solutions, combined with the specialized technical expertise required to protect distributed data systems across global operations and cloud environments, represents a significant barrier to market expansion, particularly for smaller independent operators with constrained technology budgets.

The accelerating global transition toward renewable energy, carbon neutrality, and alternative fuel sources has created unprecedented demand for historical geological and subsurface data from oil and gas companies. Hydrogen storage projects, carbon capture and sequestration initiatives, and geothermal energy development require a comprehensive understanding of deep subsurface geology, fault structures, and pressure regimes, information that energy companies have accumulated over decades of exploration and production activities. One pipeline operator generated USD 50 million in additional annual revenue by licensing seismic datasets for hydrogen and carbon storage projects, exemplifying the magnitude of commercial opportunities emerging from energy transition applications.

National governments across multiple continents have established data repositories in over 50 countries that are progressively transforming into commercial hubs for dataset transactions. This convergence of environmental imperatives, capital availability for alternative energy projects, and existing geological data assets positions oil and gas companies to monetize legacy datasets and expertise in emerging energy markets, creating sustainable revenue streams from infrastructure investments previously utilized exclusively for hydrocarbon extraction.

Asia-Pacific represents the fastest-growing market for oil and gas data monetization, driven by transformative digital initiatives and substantial capital deployment in emerging economies. China, India, and other regional energy-dependent nations are prioritizing digital transformation of legacy upstream operations through the deployment of AI-driven analytics platforms, predictive modeling systems, and real-time monitoring infrastructure. India has implemented comprehensive policy reforms, including the Hydrocarbon Exploration and Licensing Policy, designed to attract foreign direct investment and technological innovation in domestic production operations, while simultaneously targeting a 10% reduction in oil imports by 2030.

These governments are investing heavily in seismic data reprocessing, well log digitization, and production database modernization, creating substantial market demand for data management software, cloud infrastructure, analytics platforms, and professional consulting services. The emerging digital oilfield paradigm integrates sensors, machine learning algorithms, and automation systems to optimize drilling decisions, enhance recovery rates, and reduce operational costs, requirements that generate continuous demand for advanced data analytics solutions and attract investment from global technology companies seeking to expand presence in high-growth energy markets.

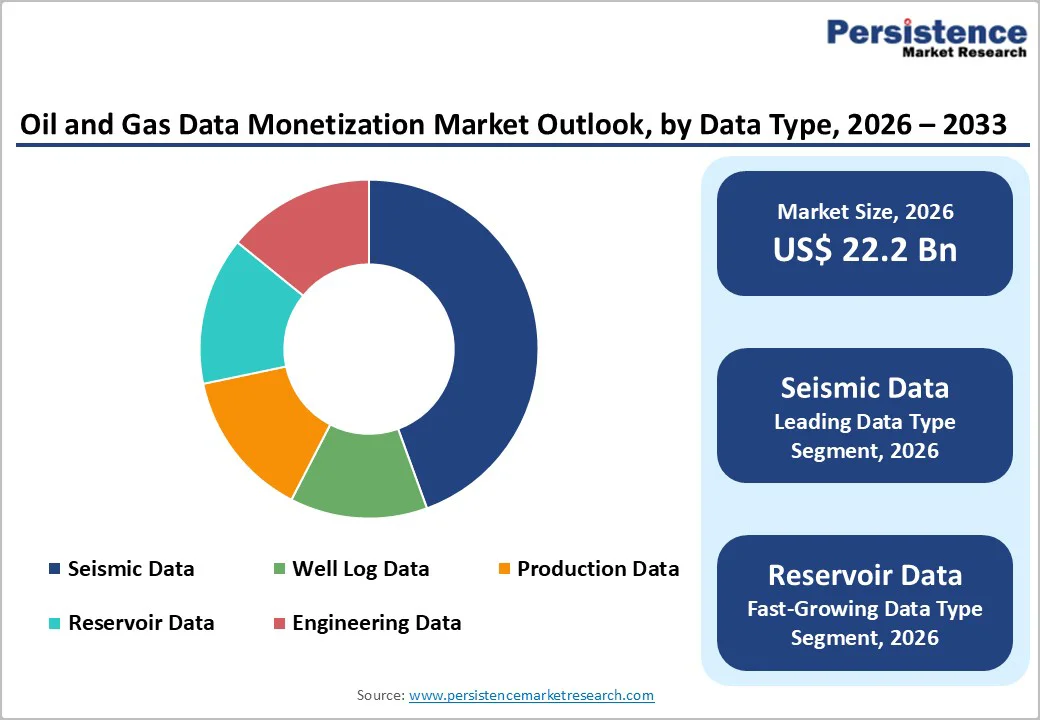

Seismic data dominates the oil and gas data monetization market, commanding approximately 54.7% of the market share, reflecting the critical strategic importance of subsurface imaging in exploration and production decision-making. Seismic datasets represent high-value assets that consolidate three-dimensional and four-dimensional subsurface information spanning geological formations across vast geographic areas and multiple decades of acquisition campaigns. The monetization of seismic data is driven by reprocessing capabilities that extract advanced attributes, mathematical interpretation layers aligned with basin models, and sophisticated AI-assisted interpretation workflows that significantly reduce turnaround time for analytical results.

Direct monetization represents the leading market segment, accounting for more than 60% of global licensing transactions, reflecting the industry's evolving perspective on data as an independent revenue-generating asset class. Direct data monetization involves companies selling or licensing datasets directly to external parties through contractual arrangements that specify usage rights, pricing mechanisms, intellectual property allocation, and confidentiality provisions.

In 2024, more than 60% of national oil companies and major international energy firms established structured frameworks for licensing geological data, seismic surveys, and production information through national data repositories and commercial marketplace platforms. The prevalence of direct licensing is further supported by the deployment of blockchain-based licensing systems and digital rights management technologies that ensure transparency, enforce contractual terms, and provide immutable transaction records across geographically distributed stakeholder networks.

Software and Platform solutions represent the fastest-expanding component within the oil and gas data monetization market, driven by escalating enterprise adoption of cloud-native technologies and integrated data management systems. Companies are investing substantially in software infrastructure that enables unified data repositories, sophisticated analytics workflows, secure access protocols, and real-time collaboration environments across geographically dispersed operational sites.

Data-as-a-Service offerings are expanding rapidly as companies recognize opportunities to monetize data through subscription-based models, where external parties gain programmatic access to curated datasets through standardized application programming interfaces rather than acquiring permanent licenses.

Upstream operations represent the dominant application segment within the oil and gas data monetization market, commanding approximately 45% of the total market value based on cumulative data monetization investments across exploration, drilling, reservoir characterization, and production optimization activities.

Upstream data monetization encompasses seismic surveys, well drilling data, petrophysical measurements, core analysis results, pressure and temperature logs, and fluid production information that collectively enable sophisticated reservoir simulation and production forecasting. The upstream segment's market dominance reflects the data intensity of exploration and appraisal activities, where companies evaluate hundreds of prospects annually utilizing diverse datasets and analytical frameworks.

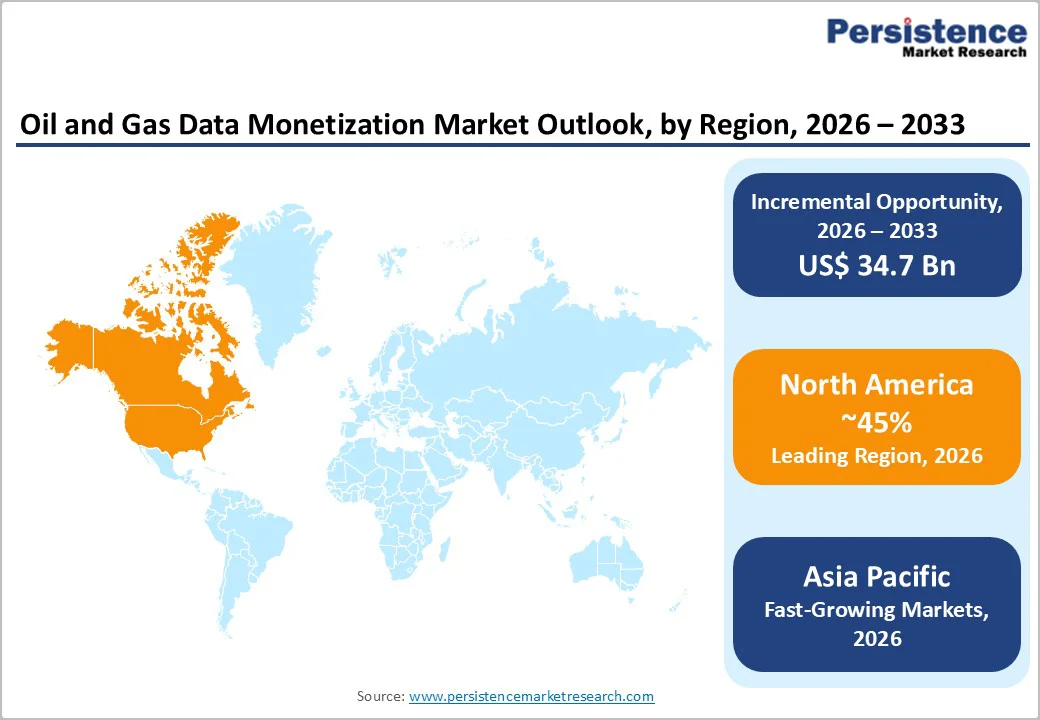

North America maintains commanding market leadership, capturing approximately 45% of global spending in oil and gas data monetization, reflecting the region's advanced digital infrastructure, mature technology adoption ecosystem, and concentration of energy infrastructure investments. The United States alone accounts for 82.8% of North American market value, driven by substantial federal methane emission control regulations, expansive shale hydrocarbon development across the Permian Basin and other unconventional plays, and integration of continuous emissions monitoring with production optimization workflows.

Canadian companies have established themselves as hub operators for seismic and geological data repositories, offering datasets to both domestic producers and international participants pursuing hydrogen and carbon capture storage projects. The region hosts major oilfield service companies including Halliburton, Schlumberger Limited, and Baker Hughes, alongside significant technology providers, which collectively foster deep collaboration between energy operators and digital solution vendors, accelerating commercialization and market penetration of innovative data monetization technologies.

Europe is emerging as a rapidly growing market for oil and gas data monetization, supported by comprehensive regulatory frameworks including the EU Data Act (effective from 2025), harmonized data protection requirements under the General Data Protection Regulation (GDPR), and continent-wide energy transition commitments requiring substantial subsurface characterization for hydrogen storage and carbon sequestration projects.

Germany, France, United Kingdom, and Spain collectively represent the largest European markets, where national governments and energy companies are collaborating to establish interconnected data repositories and standardized access protocols facilitating cross-border data sharing. European regulators are mandating data transparency, algorithmic accountability, and fair access pricing mechanisms that create structured environments for sustainable data monetization.

Asia-Pacific represents the fastest-growing regional market for oil and gas data monetization, driven by accelerating energy demand, government policies prioritizing domestic hydrocarbon production, and large-scale investments in digital oilfield technologies. China leads regional upstream investment programs, leveraging national data repositories and deploying AI-powered analytics platforms to optimize shale gas and tight oil production across complex subsurface environments.

India is intensifying upstream data acquisition and digitization initiatives through partnerships with international energy companies and technology providers, supported by policy frameworks like the Hydrocarbon Exploration and Licensing Policy designed to reduce import dependency and attract multinational investment.

The global oil and gas data monetization market demonstrates moderate consolidation characteristics, with dominance concentrated among large integrated energy companies possessing extensive legacy datasets and substantial capital availability for digital transformation initiatives. The ecosystem encompasses specialized technology vendors, emerging software companies, and professional services firms competing through differentiated capabilities in data management, analytics, and domain expertise.

Market leaders leverage proprietary datasets, established relationships with energy operators, and technological platforms enabling rapid monetization of accumulated information assets. Competitive differentiation strategies emphasize cloud-native architectures, artificial intelligence integration, open data standards adoption (particularly OSDU Data Platform compliance), and professional services capabilities supporting complex implementation requirements.

The global oil and gas data monetization market was valued at US$ 22.2 billion in 2026 and is projected to reach US$ 56.9 billion by 2033, representing a compound annual growth rate of 14.4% during the forecast period.

Primary demand drivers include exponential expansion of IoT sensor deployment, advancement of artificial intelligence and machine learning algorithms achieving unprecedented accuracy in production forecasting and risk management, regulatory compliance mandates.

Seismic Data represents the dominant segment commanding approximately 54.7% of the global market share, reflecting critical strategic importance in hydrocarbon exploration.

North America leads the global market commanding approximately 45% of market share, driven by advanced digital infrastructure maturity, substantial investments in sensor technology deployment.

Energy transition data monetization represents a compelling emerging opportunity, where historical geological and subsurface characterization datasets are licensed to hydrogen storage projects, carbon capture and sequestration initiatives, and geothermal energy development programs.

Leading market participants include Schlumberger Limited, Halliburton, Microsoft Corporation, Informatica Corporation, SAP SE, and Oracle Corporation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Data Type

By Method

By Component

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author