ID: PMRREP32319| 243 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

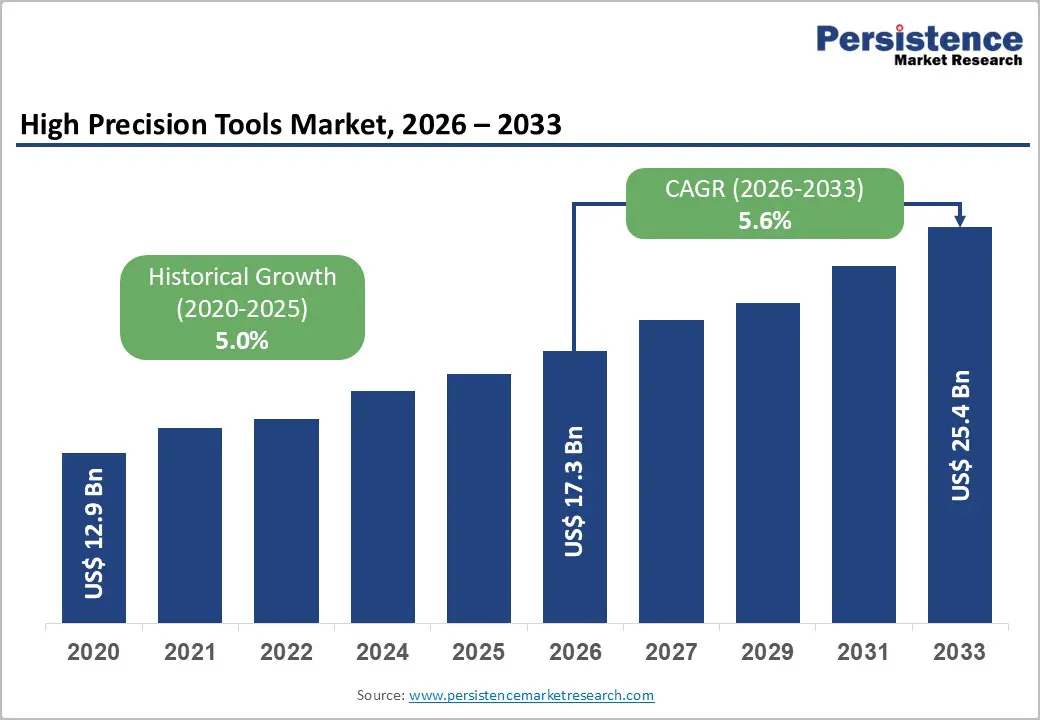

The global High Precision Tools Market size is likely to be projected at US$ 17.3 Billion in 2026 and is projected to reach US$ 25.4 Billion by 2033, growing at a CAGR of 5.6% between 2026 and 2033.

Market expansion is driven by systematic Industry 4.0 adoption with widespread IoT, AI, and cloud computing integration enabling smart manufacturing and predictive maintenance, surge in electric vehicle production requiring advanced lightweight component machining and precision engineering capabilities, and escalating complexity in aerospace and automotive manufacturing demanding ultra-high precision components with micron-level tolerances and flawless finishes.

| Key Insights | Details |

|---|---|

| High Precision Tools Market Size (2026E) | US$ 17.3 billion |

| Market Value Forecast (2033F) | US$ 25.4 billion |

| Projected Growth CAGR (2026-2033) | 5.6% |

| Historical Market Growth (2020-2025) | 5.0% |

Industry 4.0 Adoption and Smart Manufacturing Transformation

Industry 4.0 adoption and smart manufacturing transformation systematically drive high precision tools demand, with CNC machines dominating 72% market share due to advanced precision, automation, and integration capabilities combined with widespread IoT deployment enabling real-time monitoring, predictive maintenance, and data-driven optimization. AI-powered machine learning algorithms, automated inspection tools, image processing systems, and edge computing integration demonstrate emerging technology leadership supporting premium market positioning where smart precision tools command 15-20% price premiums through enhanced productivity, delivering 25-30% cycle time reduction and superior surface finish quality, particularly in aerospace and automotive sectors.

Aerospace and Automotive Sector Precision Component Growth

Aerospace and automotive sector growth systematically drives precision tools expansion, as the aerospace machine tools market grows at a 6.89% CAGR, reflecting sustained investment in aircraft engine components, structural parts, and landing gear requiring extreme dimensional accuracy. The automotive sector commands roughly 32% market share, driven by engine components, transmission systems, and gearboxes demanding micron-level tolerances. Modern vehicle manufacturing operates 24/7 precision production environments supporting just-in-time assembly lines, automation, and throughput optimization. This manufacturing intensity generates consistent, high-volume demand for advanced milling machines, grinding machines, and multi-tasking machining solutions, reinforcing long-term equipment replacement cycles, technology upgrades, and capacity expansion across global aerospace and automotive manufacturing ecosystems worldwide today continuously evolving.

High Capital Investment and Equipment Cost Barriers

Market expansion is constrained by substantial capital investment requirements, as advanced CNC precision tools cost USD 500,000–2,000,000 per unit, creating significant adoption barriers, particularly for small and medium enterprises in developing regions. Equipment financing limitations, extended payback periods, and strict ROI justification requirements restrict purchasing decisions, slow technology upgrades, and limit market penetration across price-sensitive segments, contract manufacturers, and emerging industrial ecosystems globally, driving cautious investment behavior worldwide over time.

Skilled Labor Shortage and Technical Expertise Requirements

Market expansion is constrained by a critical shortage of skilled operators, programmers, and maintenance technicians for advanced precision tool systems, combined with complex multi-axis machining programming that creates adoption friction, particularly across emerging manufacturing hubs. High training costs, lengthy skill development cycles, and limited technical expertise reduce productivity, delay commissioning timelines, and negatively impact equipment utilization rates, overall return on investment, and consistent quality performance across global industrial ecosystems worldwide.

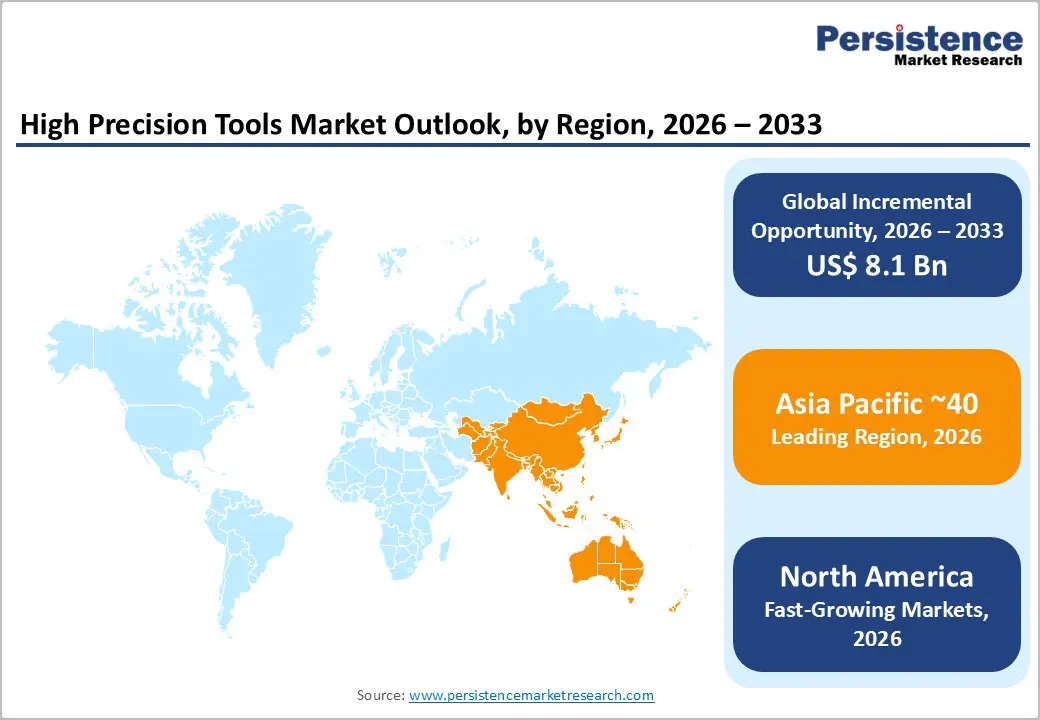

India and Asia-Pacific Precision Manufacturing Growth

Asia-Pacific and India represent substantial opportunity, with India’s precision tools market expanding at an 8.18% CAGR, driven by more than 8,000 precision machining facilities, strong policy incentives, and export-oriented manufacturing growth. The broader Indian machine tools sector is projected to grow at a 7.8% CAGR, supported by rapid industrialization, localization initiatives, and rising capital investment. Asia-Pacific collectively accounts for 40% of global demand, reinforcing its position as a high-volume manufacturing hub. Expanding automotive and aerospace supply chains, increasing OEM localization, and technology upgrades are accelerating adoption of high precision tools, positioning the region as a critical growth engine for manufacturers.

5-Axis and Multi-Axis Advanced Machining Solutions

Advanced multi-axis machining solutions represent a strong growth opportunity, with 5-axis and 7-axis CNC systems expanding at an estimated 8.5 to 9% CAGR, driven by complex component manufacturing and rising aerospace demand. These technologies support an emerging premium segment globally, enabling differentiation, higher margins, and precision leadership. Hybrid manufacturing approaches combining additive and subtractive processes, along with laser-assisted machining integration, are creating specialized capabilities. These innovations address intricate geometries, lightweight materials, and tighter tolerances, opening niche markets and accelerating adoption among advanced manufacturers worldwide across high-value industries, supporting long-term competitiveness and sustainable industrial transformation globally worldwide ecosystems.

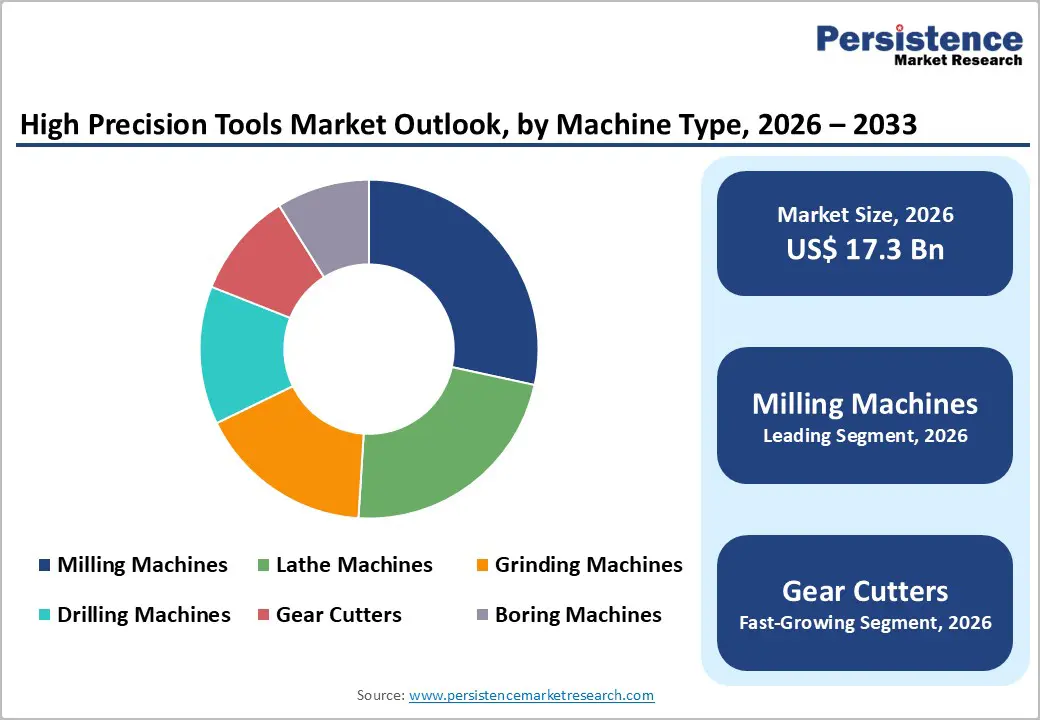

Milling machines command 28% of global market share, representing dominant product type with versatility for flat surfaces, contoured profiles, and complex 3D geometries across diverse industries including automotive, aerospace, and manufacturing. The milling machine market is expanding rapidly, with vertical mills capturing the majority share, supporting broad adoption, consistent volume demand, and sustained market dominance, particularly across precision component manufacturing applications.

Gear cutters expand at 6.5% CAGR driven by automotive transmission demand, wind turbine component manufacturing, and industrial machinery applications where precision gear cutting represents critical bottleneck requiring specialized equipment. Emerging demand from EV drivetrain development and industrial gearbox customization support emerging high-value specialized market segment.

CNC technology commands nearly 72% market share, driven by superior precision, advanced automation, multi-axis functionality, and strong Industry 4.0 compatibility. The segment continues to expand at over 6% CAGR, while the broader CNC machine tools market is advancing at approximately 7.5% CAGR, reflecting strong, long-term technology preference across automotive, aerospace, electronics, and general industrial manufacturing segments worldwide.

Conventional technology grows at 2.9% CAGR driven by cost-effective positioning, job shop applications, and low-volume custom manufacturing supporting emerging niche market segment for budget-conscious operators. Used equipment markets maintaining conventional machine relevance particularly in emerging markets with limited capital availability.

Offline sales channel commands 78% market share, driven by direct dealer relationships, comprehensive demonstrations, equipment trials, and aftermarket support enabling consistent sales momentum particularly among large manufacturing facilities requiring complex customization. Established dealer networks and technical support infrastructure sustaining channel dominance across global markets.

Online sales channel expands at 8.2% CAGR driven by digital procurement platforms, equipment comparison capabilities, and direct-to-customer models supporting emerging channel particularly among SME operators and emerging markets. E-commerce automation enabling efficient market penetration and supply chain optimization for emerging digital buyers.

Automotive applications command approximately 32% of total market share, driven by sustained demand for high precision production of engine components, transmission systems, and structural chassis parts. The automotive sector remains the largest revenue contributor, supported by continuous capital investment, high-volume manufacturing, and strict quality standards, providing a stable demand anchor particularly for precision grinding and milling applications across global vehicle production ecosystems.

Aerospace applications expand at 6.9% CAGR with aerospace machine tools market driven by aircraft engine components, structural parts, and titanium/nickel alloy machining. Emerging civil aviation growth and next-generation aircraft development supporting sustained demand momentum for high-precision machining solutions.

North America expands at 5.0% CAGR supported by established aerospace and automotive manufacturing base, stringent quality standards, and technology innovation leadership driving consistent capital equipment investment. Premium market positioning with advanced multi-axis systems and Industry 4.0 integration supporting technology differentiation across diverse applications particularly in aerospace supplier networks and automotive OEM facilities reflecting operational maturity. Established technical expertise and comprehensive aftermarket support enabling rapid technology adoption. Strong emphasis on automation and digital integration supporting smart factory development. Partnership ecosystems advancing autonomous systems and AI-driven machining innovation.

Europe maintains 26% market share with 4.7% CAGR growth driven by stringent quality standards (ISO), regulatory harmonization, and advanced technical expertise particularly in Germany, United Kingdom, and France. Strong sustainability emphasis and energy-efficiency focus supporting premium equipment adoption with advanced features across diverse applications from aerospace manufacturing to industrial machinery reflecting technical leadership. Advanced technical expertise in custom solutions and specialized precision applications. Strong emphasis on quality control and regulatory compliance driving adoption of certified systems. Established supply chain networks supporting efficient equipment deployment across integrated European manufacturing ecosystem.

Asia Pacific dominates with 40% market share and fastest growth trajectory driven by emerging manufacturing growth, rapid industrialization, and cost-competitive production particularly in China, Japan, and India. India machine tools market expanding at 7.8% CAGR and India precision tools market at 8.18% CAGR with emerging 8,000+ precision facilities supporting fastest regional growth momentum particularly in automotive and aerospace supply chains enabling significant emerging market opportunity. Emerging manufacturing capabilities supporting regional supply chain localization. Rapid infrastructure development supporting automation and precision manufacturing facility expansion. Rising government support through PLI schemes and industrial investment programs.

Strategic Developments

Business Strategies

Market leaders employ innovation-focused product development advancing multi-axis CNC systems and smart manufacturing integration, cost leadership through manufacturing optimization and Asia-Pacific expansion, sustainability positioning through energy-efficient designs, comprehensive aftermarket support excellence, and emerging business models emphasizing Industry 4.0 connectivity and predictive maintenance capabilities. Regional specialists emphasize local expertise.

The High Precision Tools Market is anticipated at US$ 17.3 Billion in 2026 and projected to reach US$ 25.4 Billion by 2033.

Growth is fueled by Industry 4.0-led CNC dominance ~72% share, rising aerospace and automotive precision machining demand, and the EV surge requiring advanced motor and battery housing tools.

The market expands at 5.6% CAGR between 2026 and 2033.

Major opportunities lie in India and Asia-Pacific’s fast-expanding precision manufacturing, 5-axis and multi-axis aerospace machining, and digital twin–enabled predictive maintenance in smart factories.

Key players include Yamazaki Mazak, DMG Mori, Haas Automation, Okuma, Makino, and Doosan, supported by rapid automation, robotics-CNC integration, and Asia-led manufacturing expansion.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Machine Type

By Technology Type

By Sales Channel

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author