ID: PMRREP3536| 201 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Packaging

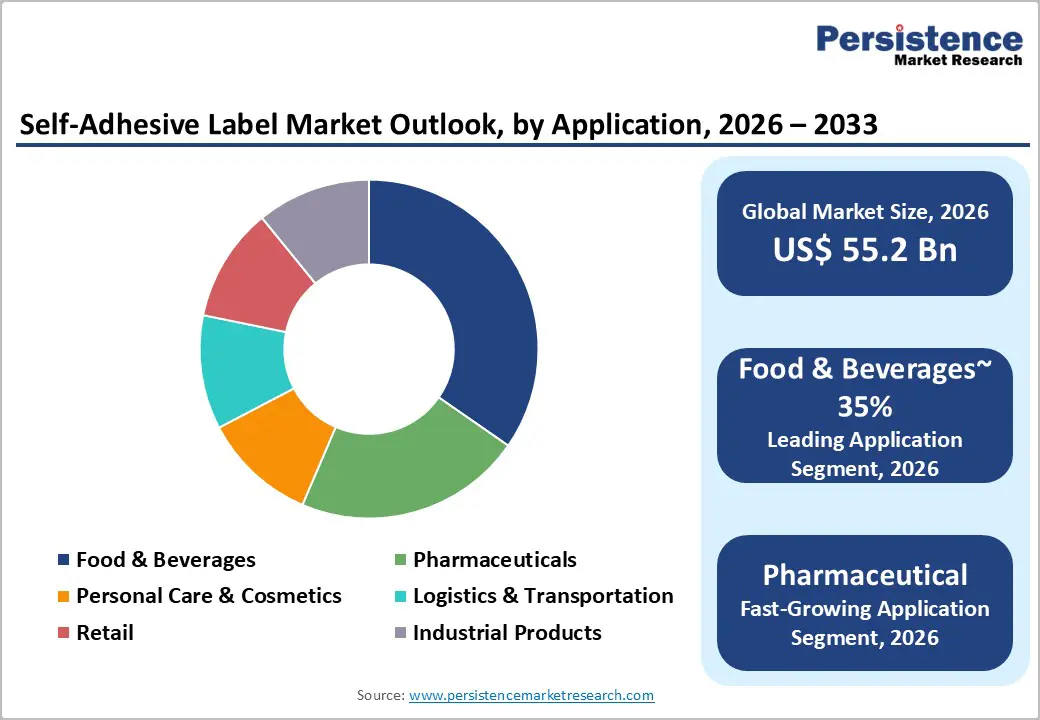

The global self-adhesive labels market size is projected to rise from US$55.2 Bn in 2026 to US$80.3 Bn by 2033. It is anticipated to witness a CAGR of 5.5% during the forecast period from 2026 to 2033, driven by surging demand across industries such as FMCG, pharmaceuticals, logistics, and retail packaging.

These labels, commonly referred to as pressure-sensitive labels, are highly favored due to their ease of use, cost-effectiveness, and ability to adhere to a wide range of surfaces. The market is driven by increasing demand for product traceability, anti-counterfeiting measures, and automation in packaging systems. The move toward sustainable packaging and the integration of smart labeling technologies, such as RFID and NFC, is transforming product design approaches. Rising e-commerce activity, changing labeling regulations, and ongoing innovations in label materials and adhesives further enhance the positive outlook for the self-adhesive product labeling market through 2033.

| Key Insights | Details |

|---|---|

| Self-Adhesive Labels Market Size (2026E) | US$55.2 Bn |

| Market Value Forecast (2033F) | US$80.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.1% |

The surge in demand for thermal self-adhesive logistics labels is a key growth driver, as automated supply chain hubs increasingly deploy machine-readable labels that are compatible with high-speed applicators, particularly in cold-chain and temperature-controlled environments. The growing adoption of variable data digital printing for self-adhesive labels is significantly transforming packaging strategies. This technology enables brands to offer personalized packaging, implement batch-specific tracking, and execute short-run label production without incurring plate setup costs. The trend is especially prevalent in private-label consumer goods, where flexibility and customization are key competitive advantages.

Strict regulations surrounding food safety and pharmaceutical serialization are driving the increased demand for tamper-evident self-adhesive labels in the pharmaceutical industry, which help meet anti-counterfeiting and traceability standards. In addition, the shift toward linerless recyclable biodegradable label facestocks is accelerating growth as brands adopt circular packaging strategies and environmentally compliant labeling formats. These material innovations reduce waste and align with both consumer preferences for eco-friendliness and regulatory mandates.

Despite growing demand, the release-liner Self-adhesive labels segment faces performance challenges on low-surface-energy materials such as recycled plastics and coated boards, where poor adhesive anchorage leads to label detachment or wrinkling. The rise of direct-to-package digital printing is disrupting demand in high-speed bottling and carton lines, especially in the beverage and personal care sectors. The increasing availability of alternative labeling technologies, such as shrink sleeves and in-mold labels, is gradually capturing market share from pressure-sensitive solutions, particularly in premium applications.

The linerless label segment is gaining popularity due to its sustainability benefits, but it still faces challenges with infrastructure compatibility. Most existing applicator machines are not optimized for handling linerless rolls, requiring retrofits or complete replacements. Moreover, adhesive instability at high-speed application, particularly in cold-chain, moist, or textured packaging environments, can lead to inconsistent label placement. These factors limit widespread adoption among small and mid-sized converters, where initial capital investment in linerless systems remains a significant deterrent.

Manufacturers can capitalize on the growth of RFID-enabled self-adhesive logistics labels as smart warehousing and real-time inventory tracking demand accelerate, especially with companies such as Amazon and DHL leading automation adoption. The rise of battery-free NFC smart labels and IoT-enabled stickers presents a unique opportunity to cater to industries such as cold-chain and pharmaceuticals, addressing their modernization needs by combining traceability with sustainability. Developing these connected label formats lowers manual scanning errors and supports eco-conscious packaging strategies.

The surge in demand for custom short-run digital labels in the craft food and beverage industries opens a promising niche where producers favor variable-data digital printing for personalized label batches, avoiding plate setup costs. The rising interest in linerless, biodegradable facestock labels aligns with circular economy mandates, enabling converters to reduce material waste and appeal to eco-conscious end users. These innovations position firms to serve premium and private-label brands seeking responsive and sustainable labeling solutions.

The permanent adhesive segment is expected to dominate, accounting for nearly 67.3% of the market. These adhesives provide strong, long-lasting bonds that are ideal for high-volume applications in food packaging, pharmaceuticals, and shipping labels. Their ability to withstand moisture, temperature fluctuations, and mechanical stress makes them the preferred choice for compliance-driven sectors where label durability is critical throughout the product lifecycle. For instance, Nestlé employs permanent adhesive labels on its food packaging to ensure branding and nutritional information remain intact throughout distribution and storage. Similarly, pharmaceutical companies such as Pfizer rely on permanent adhesives to maintain tamper-evident seals and regulatory compliance.

The repositionable adhesive segment is projected to be the fastest-growing through 2033, driven by increasing demand in retail promotions, inventory management, and variable product packaging, where temporary adhesion without residue is crucial. Brands are increasingly adopting these labels for limited-time offers and dynamic pricing tags, especially across omnichannel retail environments. Brands such as Zara and IKEA use repositionable labels for price tags and promotional stickers that can be easily removed or updated without damaging the product packaging. The flexibility offered by these adhesives is particularly valuable in omnichannel retail environments where dynamic pricing and limited-time offers are common.

The food and beverages segment is anticipated to be the largest application segment, contributing approximately 35% of market revenue. This dominance stems from the massive volume of labeling required for product branding, ingredient disclosures, nutritional labeling, and barcoding. The segment benefits from growing packaged food consumption, private label expansion, and strict traceability norms, particularly in North America and Asia Pacific. For example, PepsiCo and Unilever extensively use self-adhesive labels on snack packaging and beverages to comply with labeling laws and enhance consumer engagement.

The pharmaceutical segment is the fastest-growing, driven by rising global healthcare demands and increasingly strict labeling regulations. Labels in this sector require tamper-evident features, anti-counterfeit mechanisms, and compliance with serialization mandates. With expanding drug exports, clinical trial volumes, and OTC product launches, pharma labeling is scaling rapidly, especially in regulated markets such as the U.S., EU, and Japan.

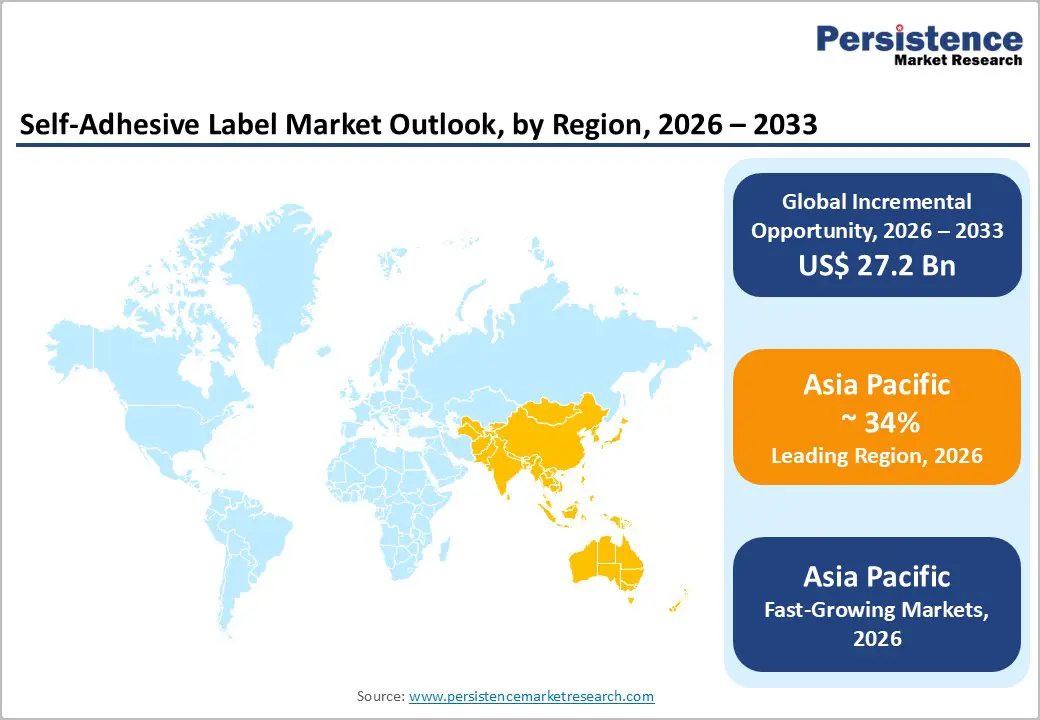

Asia Pacific holds the largest share of the market and is also the fastest-growing region, driven by massive demand across the FMCG, pharmaceuticals, and logistics sectors. The region accounted for nearly 34% of global revenue and is projected to grow at a high CAGR through 2033. China has firmly established itself as the largest national market for self-adhesive labels in the Asia Pacific region, driven by its expansive manufacturing capabilities and export-oriented economy.

The country's strong industrial base, particularly in consumer electronics, food, and beverages, has led to widespread adoption of advanced labeling technologies, including smart labeling, QR codes, RFID tags, and anti-counterfeit features, across various industries. For example, Alibaba’s Freshippo (Hema) retail stores use QR-coded labels to provide shoppers with complete product traceability, from origin to shelf. This supports consumer trust while ensuring compliance with evolving food safety regulations. Similarly, Huawei deploys RFID-based asset tracking labels across its electronics and logistics chains, significantly enhancing inventory accuracy and supply chain visibility.

India is emerging as the fastest-growing national market in the region due to rising pharmaceutical production, tightening regulations on drug labeling, and a massive retail transformation driven by modern trade and online grocery platforms. Leading Indian pharmaceutical companies such as Sun Pharma and Dr. Reddy’s Laboratories are implementing compliance-grade self-adhesive labels to meet international standards, including those set by the U.S. FDA and the EU Falsified Medicines Directive (FMD).

North America is anticipated to experience steady growth over the forecast period. The U.S. remains the key revenue generator, accounting for over 70% of the regional market, supported by advanced infrastructure and regulatory standards. Growth is sustained by rising demand for pressure-sensitive labels in pharmaceuticals, clean-label food packaging, and omnichannel retail logistics. Digital printing technologies and eco-conscious label materials, such as linerless and recyclable adhesives, are gaining popularity in line with consumer expectations and ESG mandates. The rising demand for product authentication and serialization in the pharmaceutical supply chain is driving the adoption of tamper-evident and smart labeling solutions.

In the U.S., demand is driven by high consumption of packaged goods and stringent FDA labeling mandates across the food and drug sectors. The U.S. is also a leader in the adoption of RFID-enabled self-adhesive labels for logistics automation and cold-chain traceability. In Canada, growth is supported by the clean-label movement, especially in organic and plant-based foods, where visually appealing and eco-friendly labels help brands differentiate. The country is also seeing increased demand for bilingual and regulatory-compliant labeling due to its unique linguistic and trade policies.

Europe represents one of the most mature and innovation-led markets for self-adhesive labels. The region is projected to grow at a moderate CAGR between 2026 and 2033. Growth in Europe is primarily driven by stringent EU packaging regulations, increasing adoption of sustainable labeling solutions, and widespread automation in packaging processes. The region has also been at the forefront of innovation in linerless, compostable, and recyclable label materials, aligning with its strong circular economy initiatives. Rising demand for premium FMCG packaging, pharmaceutical traceability, and retail personalization further boosts market momentum.

In Germany, the demand is fueled by high production volumes in the food & beverage, automotive, and chemical sectors. German converters are rapidly integrating UV-flexo and digital hybrid presses to support short-run, high-value label production. The country is also driving innovation in low-migration and solvent-free adhesive technologies used in pharma and beverage labeling.

The global self-adhesive labels market is moderately fragmented, with the presence of both global giants and regional converters competing across value, innovation, and sustainability. The top players focus on product differentiation, mergers & acquisitions, and eco-label development to gain market share, while regional firms leverage cost-effective production and customization to serve local markets efficiently.

The market has become increasingly technology-intensive, with players competing on capabilities in digital printing, hybrid press integration, and smart label features such as RFID, tamper-evidence, and real-time traceability. Innovation is no longer limited to label materials but extends to adhesive chemistry, face stock customization, and variable data printing.

Leading companies such as Avery Dennison and UPM Raflatac are investing heavily in linerless, recyclable, and bio-based label technologies. These companies are adapting their portfolios to meet the EU Green Deal targets and the growing demands of a circular economy. Their R&D pipelines include wash-off adhesives, compostable substrates, and recyclable PET films, aiming to meet both compliance and consumer demand for green packaging.

The self-adhesive labels market is expected to be valued at approximately US$55.2 billion in 2026.

By 2033, the self-adhesive labels market is anticipated to reach around US$80.3 billion.

Key trends include the rising adoption of linerless and eco-friendly labels, increased use of smart labeling technologies (RFID, QR codes), growing demand for personalized short-run labeling, and the shift toward digital hybrid printing systems.

The self-adhesive labels market is expected to grow at a CAGR of 5.5% from 2026 to 2033, driven by demand for sustainable packaging, e-commerce logistics, and smart label solutions.

Key players include Avery Dennison Corporation, UPM Raflatac, CCL Industries Inc., Multi-Color Corporation (MCC), and LINTEC Corporation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Label Type

By Material Type

By Adhesive Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author