ID: PMRREP2814| 178 Pages | 30 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

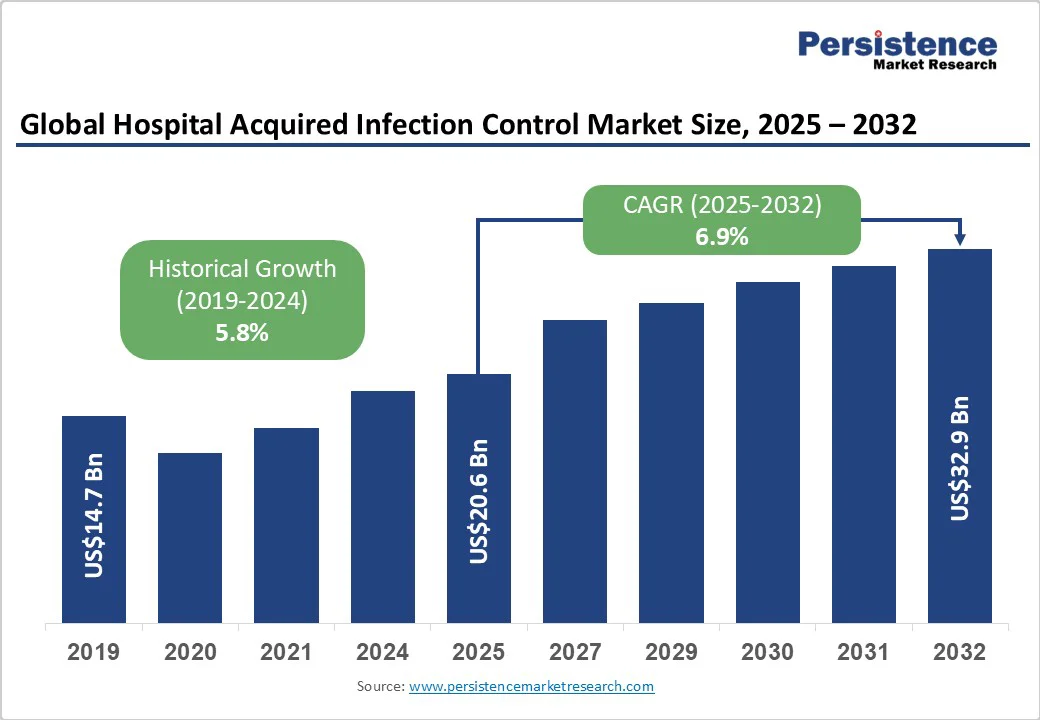

The global hospital acquired infection control market size is likely to value at US$20.6 Bn in 2025 and is estimated to reach US$32.9 Bn in 2032, growing at a CAGR of 6.9% during the forecast period 2025 - 2032, fueled by increasing prevalence of HAIs, rising adoption of novel sterilization technologies, and surging demand for automated disinfection solutions.

| Key Insights | Details |

|---|---|

| Hospital Acquired Infection Control Market Size (2025E) | US$20.6 Bn |

| Market Value Forecast (2032F) | US$32.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.8% |

The persistent and rising occurrence of infections acquired in hospitals and clinics is a key driver for the market. Patients with chronic illnesses, weakened immunity, or post-surgical conditions are highly susceptible to pathogens such as MRSA, Clostridioides difficile, and multidrug-resistant Gram-negative bacteria.

Recent studies in North America and Europe show that despite strict hygiene protocols, outbreaks in ICUs and general wards remain frequent, underlining the need for infection control solutions. The steady rise in such HAIs globally fuels demand for effective sterilization, disinfection, and monitoring systems.

The healthcare sector is witnessing increasing pressure to implement rigorous infection prevention standards. Regulatory bodies, accreditation agencies, and public health authorities are propelling hospitals and clinics to adopt systematic protocols to prevent outbreaks. Recent initiatives in Asia Pacific-based hospitals focus on staff training and antibiotic stewardship programs to curb infection spread.

High-profile cases of post-surgical infections or antibiotic-resistant outbreaks have prompted healthcare facilities to prioritize preventive strategies, including surface disinfection, sterilization, and real-time monitoring of hygiene practices. This rising awareness and regulatory push further contribute to the expansion of the global market.

Novel technologies are now shaping infection control practices in healthcare. Modern sterilization methods, such as low-temperature hydrogen peroxide vapor systems and automated autoclaves, ensure high pathogen elimination rates. Additionally, smart surveillance systems equipped with IoT and AI enable hospitals to track infection patterns in real-time, predict potential outbreaks, and enforce hygiene compliance.

In 2025, several hospitals across Europe reported a 30% drop in C. difficile infections after adopting automated disinfection systems combined with predictive monitoring tools. The adoption of these high-tech solutions not only improves patient safety but also streamlines infection control processes, driving market growth.

One key challenge restricting the adoption of hospital-acquired infection control solutions is the lack of adequate infrastructure in various healthcare facilities, mainly in low- and middle-income countries. Hospitals with outdated ventilation systems, insufficient sterilization equipment, or inadequate isolation wards struggle to implement comprehensive infection control protocols.

Even in developed regions, small clinics or rural hospitals often lack the space or funding for novel disinfection systems. For example, a 2023 report from Southeast Asia revealed that several hospitals were not able to maintain proper sterilization cycles due to outdated autoclaves and inadequate staff training. Such infrastructural limitations hinder the effectiveness of infection prevention strategies, slowing market growth despite increased awareness of HAIs.

Healthcare professionals often face high patient loads and tight schedules, which can limit adherence to strict infection control protocols. Intensive care units and surgical wards, where HAI risk is highest, may see staff rushing through cleaning or sterilization procedures, unintentionally compromising hygiene standards.

A 2024 study in hospitals across Europe revealed that, despite having advanced disinfection technologies, compliance with hand hygiene and equipment sterilization protocols dropped during peak workload periods. Time constraints also reduce the opportunity for regular training and monitoring, making consistent infection prevention challenging.

Increasing recognition of the serious health and economic consequences of hospital-acquired infections is creating new market opportunities. Patients and healthcare authorities are now more aware that infections such as MRSA, Clostridioides difficile, and ventilator-associated pneumonia can lead to long hospital stays, high treatment costs, and mortality.

For example, a 2024 U.S. hospital study revealed that proactive infection control protocols reduced post-surgical infections by 25%, emphasizing the value of preventive measures. This increased awareness is pushing hospitals to invest in novel sterilization, disinfection, and monitoring technologies.

Rising costs associated with treating HAIs are putting financial pressure on healthcare systems, creating opportunities for preventive infection control solutions. Hospitals are recognizing that investing in sterilization equipment, disinfection systems, and staff training is more cost-effective than managing outbreaks.

In Europe, initiatives in 2023 showed that hospitals implementing automated disinfection systems saw drastic reductions in hospital stay durations and treatment costs for surgical site infections. Such financial incentives encourage the adoption of comprehensive HAI control programs, driving growth for companies providing infection prevention products.

The rise of antimicrobial resistance (AMR) has boosted the urgency for effective infection control measures. Resistant pathogens such as multidrug-resistant Klebsiella pneumoniae or Candidozyma auris are reported in hospitals worldwide, making standard treatments less effective and infections difficult to manage.

For instance, Europe reported a surge in Candidozyma auris cases in 2023, with over 1,300 confirmed infections across multiple countries. This trend is prompting hospitals to adopt unique sterilization techniques, antimicrobial coatings, and smart surveillance systems to contain resistant pathogens.

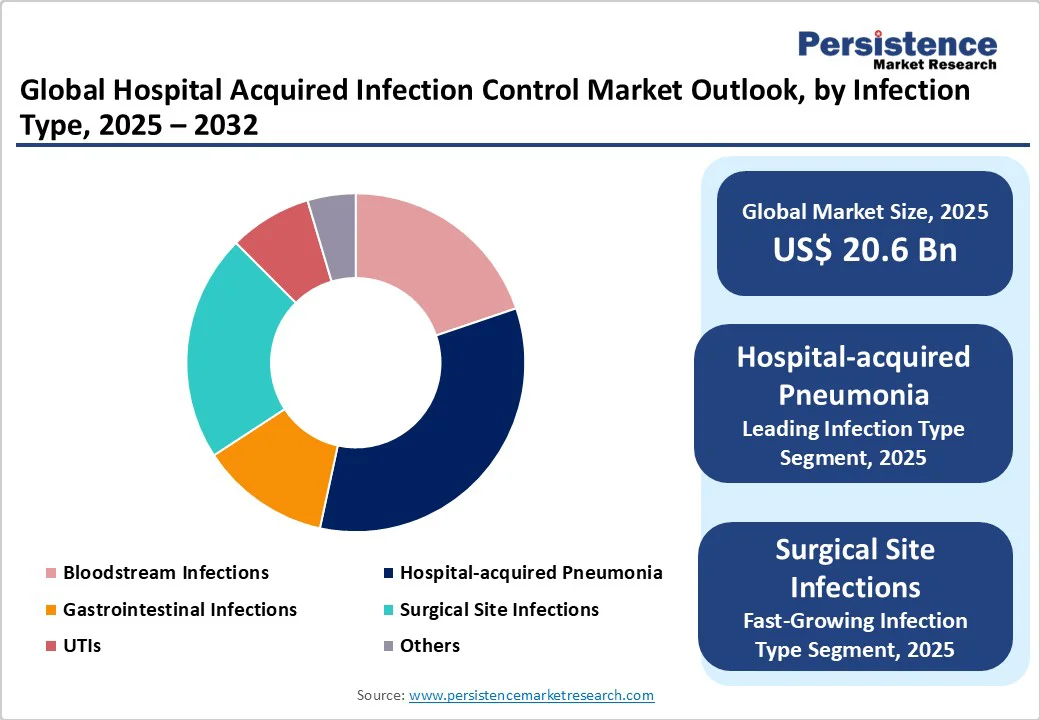

Hospital-acquired pneumonia is poised to hold around 33.6% of the market share in 2025, as patients in hospitals often have weakened immune systems, underlying chronic conditions, or are on mechanical ventilation, which increases susceptibility.

Ventilator-Associated Pneumonia (VAP) is common in ICUs, since bacteria can easily colonize respiratory equipment. A recent study in the U.S. highlighted that VAP accounted for nearly 30% of ICU-related infections in 2024, emphasizing the persistent challenge in preventing respiratory infections despite advanced hygiene protocols.

Surgical Site Infections (SSIs) are a key concern because they directly impact patient recovery, increase hospital stays, and raise post-surgical morbidity and mortality. SSIs occur due to contamination during surgery or inadequate sterilization of surgical tools. In Europe, recent ECDC reports noted that SSIs accounted for almost 20% of all HAIs in acute care hospitals in 2023, making them a priority for infection prevention programs.

Sterilization is estimated to account for nearly 40.3% of the market share in 2025, as it eliminates all forms of microbial life, including bacteria, viruses, and spores, from surgical instruments, medical devices, and reusable healthcare equipment. Without proper sterilization, pathogens such as Clostridioides difficile or multidrug-resistant Staphylococcus aureus can persist on instruments, leading to outbreaks.

Cleaning and disinfection products are emphasized as surface contamination is a major source of HAIs. High-touch areas such as bed rails, doorknobs, and ventilator surfaces can harbor pathogens that survive for days or weeks. The COVID-19 pandemic reinforced the importance of routine surface disinfection in hospitals, prompting hospitals in Europe and Asia Pacific to adopt novel disinfectants, including hydrogen peroxide vapor systems and antimicrobial coatings.

Hospitals and clinics are speculated to hold around 59.4% of the market share in 2025 as they handle large volumes of patients with diverse medical conditions, including those with weakened immune systems. High patient turnover, invasive procedures, and intensive care units create an environment where infections can spread quickly.

Surgical centers are important end users as they perform procedures that breach the body’s natural barriers, making patients highly susceptible to infections. The complexity of surgeries, use of implants, and frequent invasive procedures raise infection risks.

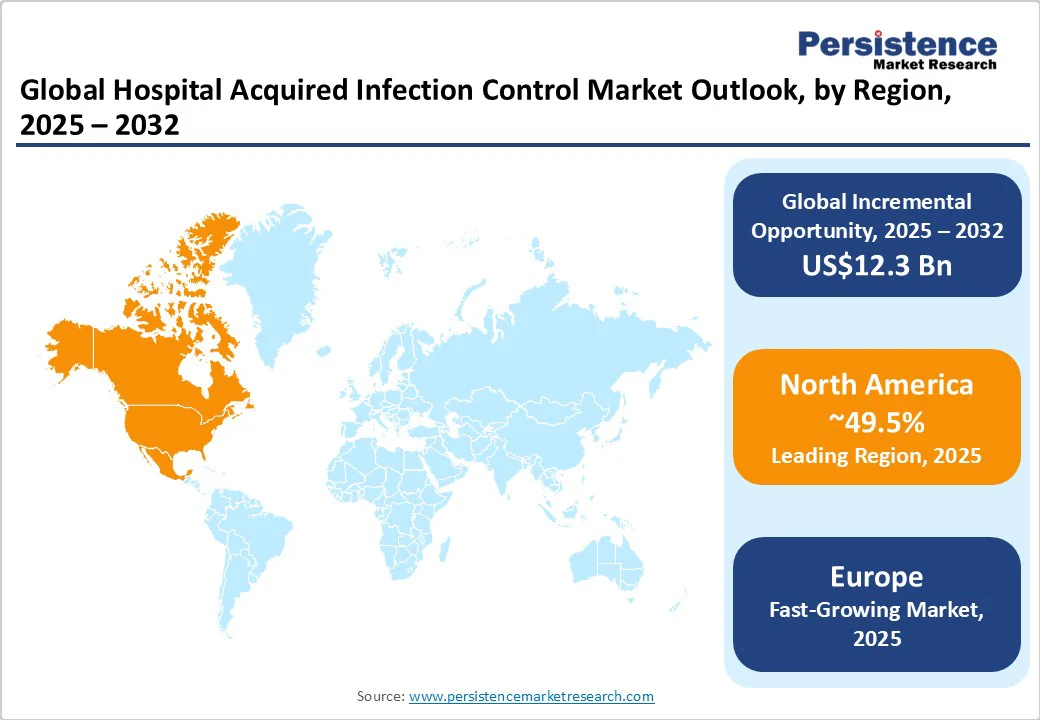

North America is projected to account for approximately 49.5% of the market share in 2025. HAIs remain a key concern in the region, especially among the elderly and immunocompromised patients.

Despite a temporary surge during the COVID-19 pandemic, infection rates have declined, with approximately 85% of hospitals reporting improvements in reducing infections such as Methicillin-resistant Staphylococcus aureus (MRSA), central line-associated bloodstream infections, and catheter-associated urinary tract infections.

The Centers for Disease Control and Prevention (CDC) funds 64 state, local, and territorial health departments to detect, prevent, and respond to HAIs and Antimicrobial Resistance (AR). These programs aim to accelerate detection, response, and containment of AR in healthcare settings, promote antibiotic stewardship, and improve healthcare safety and quality.

In Europe, HAIs continue to be a major concern. The European Center for Disease Prevention and Control (ECDC) estimates that over 3.5 million cases of HAIs occur annually in the European Union and European Economic Area (EU/EEA), leading to more than 90,000 deaths. These infections are associated with approximately 2.5 million disability-adjusted life years (DALYs), surpassing the combined burden of influenza and tuberculosis in the region.

The most frequently reported types of HAIs in Europe are respiratory tract infections, surgical site infections, urinary tract infections, bloodstream infections, and gastrointestinal infections. Clostridioides difficile infections represent nearly half of the gastrointestinal infections. The ECDC emphasizes that up to 50% of HAIs are preventable through the application of infection prevention and control measures in healthcare settings.

HAIs present a key challenge across Asia Pacific, especially in low- and middle-income countries. The prevalence of HAIs in these countries is notably higher than the global average, with up to 25% of hospitalized patients affected. In Southeast Asia, the incidence is even more alarming, reaching up to 37%. The World Health Organization (WHO) has highlighted the urgent requirement for superior infection prevention and control (IPC) programs across Asia Pacific.

These programs are essential for reducing the spread of infections and ensuring patient and healthcare worker safety. The WHO's Western Pacific Regional Office emphasizes the importance of robust IPC programs with well-trained staff to provide quality health services and prevent avoidable infections.

The WHO has hence developed several resources to support IPC efforts in the region. These include guidelines on core components of IPC programs, practical manuals for improving IPC at health facilities, and educational curricula for pre-service training of health workers.

The global hospital acquired infection control market consists of various established multinational corporations and specialized regional players. Key global companies dominate the market by providing comprehensive portfolios that include sterilization equipment, disinfection solutions, and infection prevention services.

Regional players focus on specific aspects of infection control, including sterilization and disinfection products. These companies often collaborate with large global firms to assemble consumable kits locally, improving affordability and compliance reporting.

Market leaders in hospital-acquired infection control employ strategies centered on innovation, cost leadership, and market expansion. Innovation is boosted by the development of novel sterilization technologies and infection prevention solutions. Cost leadership is achieved through economies of scale and efficient manufacturing processes. Market expansion involves entering emerging countries and forming strategic partnerships to improve global reach.

The hospital acquired infection control market is projected to reach US$20.6 Bn in 2025.

Increasing adoption of novel sterilization technologies and rising incidence of HAIs are the key market drivers.

The hospital acquired infection control market is poised to witness a CAGR of 6.9% from 2025 to 2032.

Expanding awareness of HAI consequences and financial incentives for preventive measures are the key market opportunities.

Belimed Inc., The 3M Company, and ASP (Advanced Sterilization Products Services, Inc.) are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Infection Type

By Products and Services

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author