![]() 250 Users Online

250 Users Online

Sports Nutrition Market Segmented By Aeronutrix Sports Products, Sports Food, Sports Drinks and Sports Supplements

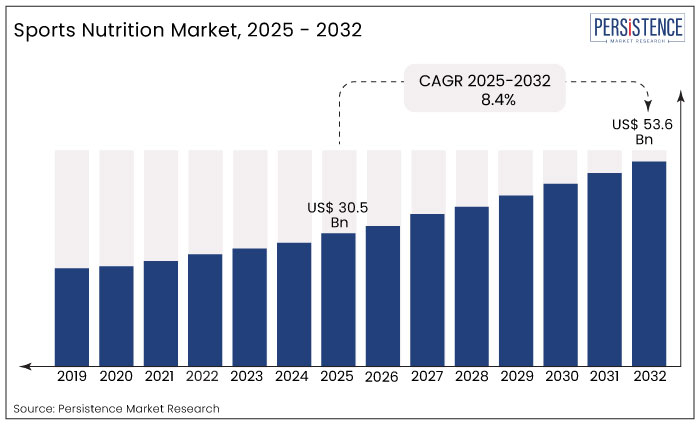

Expanding at a value CAGR of 9.6%, the global sports nutrition market is projected to increase from a valuation of US$ 21 Bn in 2022 to US$ 52.5 Bn by 2032-end.

| Attribute | Key Insights |

|---|---|

|

Sports Nutrition Market Size (2022E) |

US$ 21 Bn |

|

Projected Sales of Sports Nutrition (2032F) |

US$ 52.5 |

|

Value CAGR (2022-2032) |

9.6% |

|

Value Share of Top 5 Countries (2021A) |

55% |

As of 2021, by value, sports nutrition supplement consumption accounted for around 20% of the global nutraceuticals market share. North America is projected to hold more than 20% of the global market value share for sports nutrition through 2032.

Over the historical period of 2017-2021, the global sports nutrition market expanded at a value CAGR of 7.6%, fuelled by an increase in the demand and consumption of products made from natural extracts, especially in North America. Market expansion is aided by increase in disposable income as well as changes in lifestyles and healthy eating habits.

Major demanding regions for sports nutrition products are North America and East Asia. Rapid rise in consumer awareness regarding several health benefits of sports nutrition supplements is fuelling demand across the world.

The U.K., in the European region, holds the highest value share of more than 15%, followed by Germany and Russia. In North America, the U.S. holds the highest market share. The East Asia and South Asia markets are expected to reach US$ 2.27 Bn and US$ 2.53 Bn, respectively, by 2032.

Over, the global market for sports nutrition is expected to expand rapidly at a value CAGR of 9.6% through 2032.

“Increase in Health Clubs & Fitness Centers Driving Demand for Sports Nutrition Items”

The millennial demographic is targeted by health clubs and fitness centers when it comes to signing up for memberships. Most of these health clubs make money by selling protein supplements, nutrition bars, energy drinks, and other sports nutrition goods to their members.

On the advice of medical experts, middle-aged and elderly customers are joining these exercise centers and taking nutritional supplements. Obesity and joint pain are mostly to blame for the growth in these people's participation rates.

During COVID lockdowns, the popularity of online exercise courses surged in 2020. As a result, this has become an even more effective digital platform for brand promotion. Expansion of online fitness channels would boost the sports nutrition market, which will offer incremental development prospects, according to Persistence Market Research, allowing the market to reach US$ 52.5 Bn by 2032.

“Growing Health, Wellness, & Food Fortification Trends – Boon for Sports Nutrition Providers”

Consumers have become increasingly health-conscious, with a majority allocating a large percentage of their disposable cash to fitness and well-being. They've also realized that, in addition to exercise, a healthy diet is required to achieve physical fitness. Food fortification is the addition of vital proteins, vitamins, and minerals to daily foods.

Various variables, such as increased incidence of lifestyle-related diseases and weight management, contribute to consumers' poor eating habits and inadequate nutrition consumption. High-protein foods help consumers maintain their health. Consumers are becoming more interested in sports nutrition goods such as Ready-to-Drink (RTD) products, energy bars, and nutrition snacks.

As a result, food fortification is becoming more popular, which will help the sports nutrition industry grow. With the popularity of sports in the East expanding by the day, sports academies, sports clubs, and training facilities are springing up to accommodate and train newcomers. As a result, rising interest in sports, particularly in emerging countries, is expected to propel the worldwide sports nutrition market forward.

“e-Commerce Increasing Sports Nutrition Product Transparency & Penetration”

Electronic technologies are being used more and more in the sports nutrition supply chain. e-Commerce has grown in importance as a platform for both, producers and customers. Sports nutrition product makers can promote and sell their products on a global scale, as well as connect with a far larger consumer base, thanks to rising Internet penetration.

Furthermore, customers gain from the increased use of e-Commerce in the supply chain since they have better access to products. Consumers benefit from the openness of being able to compare products and pricing on the same platform, facilitating easier decision-making. As a result of the burgeoning e-commerce business, sports nutrition supplement consumption is surging.

“Increased Use of Digital Marketing & Strategic Sponsorships for Nutritional Supplements for Sports”

Not just premier sports nutrition firms and new start-ups, but also top players in the global food and beverage sector have been intrigued by the combination of giant size and quick expansion. Consumer tastes have become puzzled as a result of the abundance of options available, making it difficult for businesses to differentiate themselves in the global sports nutrition industry.

In the end, it all boils down to how you position your product in the market, particularly in the digital realm. Although collaborations with gyms and expert suggestions are beneficial, in today's world, promoting items through content videos, sponsored partnerships, event sponsorships, and publicity stunts attract a lot of attention.

Many foods and beverages with added sugars, such as sports drinks, have calories but lack critical nutrients and dietary fiber. Sugar-sweetened beverage use has been linked to lower milk consumption, as well as calcium, vitamin D, folate, and iron intake in children and adolescents. This may deplete the essential nutrients required by an individual for fitness and healthy diets.

Sports beverages can raise the chances of having bad oral health as tooth enamel is eroded by citric acid, which is commonly found in sports drinks. Even after the pH has been neutralized, enamel erosion continues. To neutralize acids, saliva acts as a natural buffering agent. When saliva production is reduced after exercise, athletes may exacerbate dental erosion by consuming sports beverages.

Why Does India Account for the Largest Share in the South Asia Sports Nutrition Market?

The India sports nutrition market is witnessing significant growth in South Asia at a value CAGR of 9.5%.

High demand for sports nutrition supplements in the country is due to changes in consumers' consumption habits, increasing dietary requirements, and high production of nutritional supplements.

Which Country Leads the East Asia Market for Sports Nutrition Product Sales?

China holds a major share in the East Asia sports nutrition supplements market. This is due to increase in domestic production of sports nutrition products and also rise in consumption by the population in the country.

Moreover, increasing demand for convenience foods will have a positive impact on the market. The market in China is expected to expand through 2032 at 6.9% CAGR.

Why are Powdered Sports Nutrition Supplements Most Demanded?

Based on form, powdered nutrition supplements are mostly demanded and consumed across the world. Market value of powder nutrition supplements in 2022 is slated to reach US$ 15.1 Bn.

Demand for sports nutrition products from nutraceutical product manufacturers is set to increase rapidly over the coming years.

How are Various Functionalities Offering Sales Opportunities for Sports Nutrition Supplement Manufacturers?

Sales of sports nutrition supplements are expected to register high growth due to their various functionalities. Based on function, the market is observing a dominance of energizing products, followed by pre-workout, hydration, recovery, and weight management products.

Energizing sports nutrition products are expected to be valued at US$ 20.9 Bn by the end of 2032.

With COVID-19, consumers have shifted their focus from splurging on non-essential goods and services to preserving and extending the life of critical items. Consumers are far more conscious of their consumption patterns than they were previously.

Meanwhile, to minimize COVID-19 transmission through food, the World Health Organization has recommended particular requirements for maintaining food hygiene and food safety regulations. Clean label legal sports nutrition products will only grow in popularity as a result of these trends.

Rebound of the global economy would eventually lead to a rise in per capita income and the adoption of healthier lifestyles, which will boost demand for sports nutrition items even further.

Prominent manufacturers of sports nutrition supplements are focused on promotional activities and product launches. They are also adopting new technologies to offer better products and improve efficiency.

| Attribute | Details |

|---|---|

|

Forecast period |

2022-2032 |

|

Historical data available for |

2017-2021 |

|

Market analysis |

US$ Million for Value |

|

Key regions covered |

|

|

Key countries covered |

|

|

Key market segments covered |

|

|

Key companies profiled |

|

|

Report coverage |

|

|

Customization & pricing |

Available upon request |

Sports Nutrition Market by Function:

Sports Nutrition Market by Product Form:

Sports Nutrition Market by Flavor:

Sports Nutrition Market by Sales Channel:

Sports Nutrition Market by Nature:

Sports Nutrition Market by Price Range:

Sports Nutrition Market by Region:

At present, the global sports nutrition market is valued at over US$ 21 Bn.

COVID-19, government measures to promote sport activities, increasing interest of consumers toward athletics, and work-centric lifestyles calling for preventive health measures are all driving market expansion.

From 2016 to 2020, demand for sports nutrition products increased at a CAGR of 7.6%.

Sales of sports nutrition supplements are projected to increase at 9.6% CAGR and close in on a valuation of US$ 52.5 Bn by 2032.

Increasing demand for healthy supplements, and rising consumers’ awareness regarding preventive healthcare and physical fitness are key market drivers.

Nestlé, Coca-Cola, Keurig Dr. Pepper, and Ajinomoto are the top 5 sports nutrition product suppliers accounting for over 50% market share.

The U.K. market for sports nutrition is predicted to surge at 9.9% CAGR over the decade.

The U.S., Chile, U.K., China, and India account for the highest consumption of sports nutrition supplements.

China, the U.S., India, and U.K. are key producers/exporters of sports nutrition supplements.

In 2022, Japan holds a market value of US$ 108.6 Mn, whereas South Korea has a market value of US$ 140.2 Mn.