ID: PMRREP22555| 225 Pages | 18 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

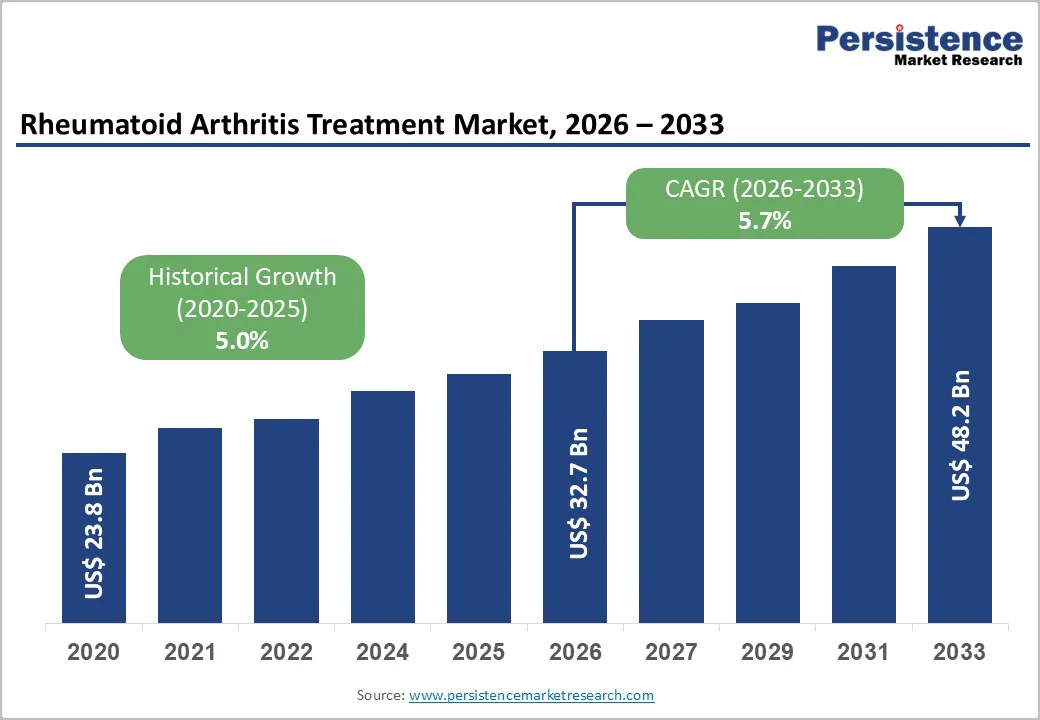

The global rheumatoid arthritis treatment market is likely to be valued at US$ 32.7 billion in 2026 and reach US$ 48.2 billion by 2033, growing at a CAGR of 5.7% during the forecast period from 2026 to 2033.

The global rheumatoid arthritis (RA) therapeutics Industry is growing steadily, driven by rising prevalence of chronic diseases, biologics patent expirations, and demand for cost-effective treatments.

North America dominates due to supportive regulations, while Asia Pacific leads in growth, fueled by expanding healthcare access, higher biosimilar adoption, and increasing domestic manufacturing capabilities, boosting regional market potential.

| Key Insights | Details |

|---|---|

| Rheumatoid Arthritis Treatment Market Size (2026E) | US$ 32.7 Bn |

| Market Value Forecast (2033F) | US$ 48.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.0% |

Rheumatoid arthritis (RA) is increasingly prevalent worldwide, affecting approximately 17.6 million people in 2020, with an age-standardized prevalence of 208.8 per 100,000, marking a 14.1% rise since 1990. The Global Burden of Disease study reports that RA prevalence grew from around 7.96 million in 1990 to approximately 17.92 million in 2021, driven largely by population growth (52%) and changes in age structure (31%).

In the U.S., about 4.1% of adults are diagnosed with RA, highlighting the disease’s significant public health impact. This rising prevalence of a chronic autoimmune condition is a primary driver for the RA therapeutics market, as it creates increasing demand for effective and long-term treatment options.

The growing patient population, coupled with awareness of disease management and early intervention strategies, continues to expand the market for pharmaceuticals, biologics, and biosimilars targeting RA, positioning it as a high-growth segment in the global healthcare landscape.

Safety and side-effect concerns remain a key restraint on the rheumatoid arthritis therapeutics market. Biologics, particularly TNF-α inhibitors, are associated with an elevated risk of serious infections, with studies reporting rates of 27-35 per 100 patient years for patients receiving anti-TNF therapy.

Meta-analyses indicate that standard-dose biologics increase the risk of serious infections by approximately 31% compared with conventional DMARDs, translating to roughly 55 additional infections per 1,000 treated annually when combination therapies are used.

Data from U.S. veterans show hospitalized bacterial infection rates of about 4.4 per 100 person-years among patients on rituximab and 3.0 per 100 person-years among those on other biologics, with higher rates among patients who also used high-dose corticosteroids.

Additionally, TNF-blockers carry risks of opportunistic infections, including Legionella and Listeria, due to immunosuppression. These safety concerns, along with patient apprehension about long-term immune compromise, limit the adoption of biologic therapies, especially among vulnerable populations, and act as a significant restraint on the growth of the RA therapeutics market.

Expansion of biosimilars in autoimmune and oncology therapies presents a strong opportunity in the RA therapeutics market. Regulatory bodies like the EMA have approved more than 55 biosimilars, and the FDA has approved over 26, though fewer than half are commercialized in the U.S. Biosimilars for key RA biologics, such as adalimumab, infliximab, and etanercept, have demonstrated equivalent efficacy and safety in over 10,000 patients across 25 clinical trials.

Real-world uptake in Europe underlines the promise: for example, infliximab biosimilars captured 79% of the UK market within a year of launch. Additionally, biosimilar use has reduced healthcare costs by expanding access: cheaper alternatives and established interchangeability make biologic therapies more affordable for autoimmune and oncologic patients, driving market growth.

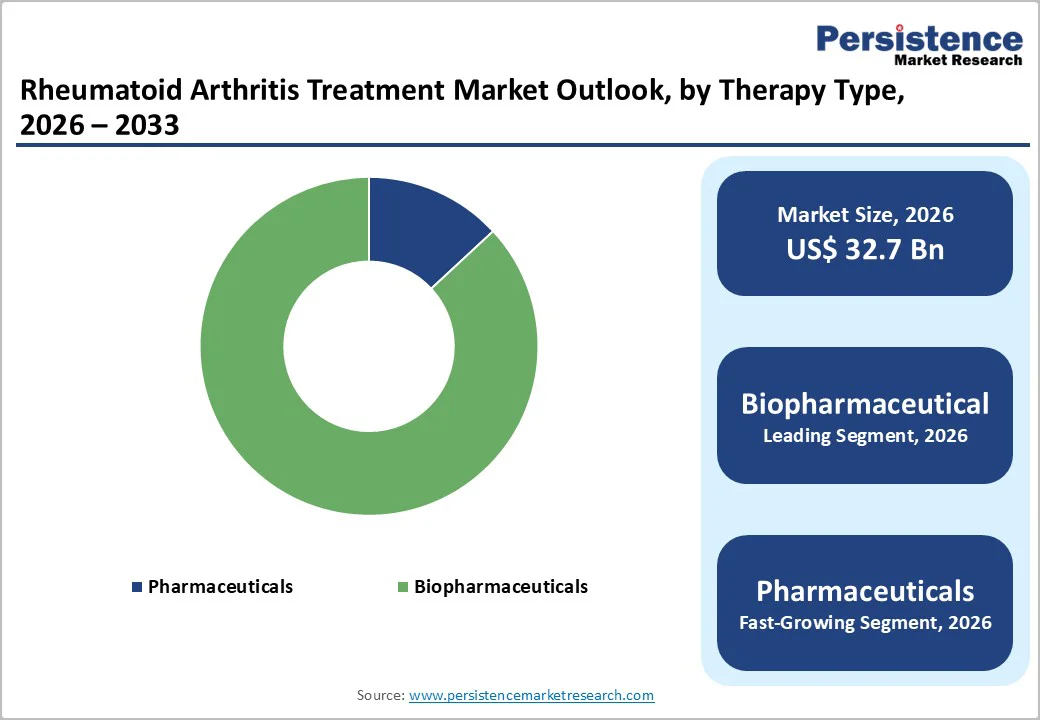

Biopharmaceuticals are likely to account for 86.9% of the market in 2026, driven by their pivotal role in modern RA management and rising prescription rates. In the United States, about 26% of Medicare beneficiaries with RA received a biologic, reflecting widespread clinical adoption. In Europe, many newly diagnosed RA patients start treatment with anti-TNF biologics, which show consistent long-term effectiveness.

Biosimilars of key biologics, such as adalimumab, infliximab, and etanercept, have been studied in over 10,600 patients across 25 randomized trials, demonstrating equivalent efficacy and safety. The introduction of these cost-effective alternatives has expanded patient access while reducing treatment costs.

High clinical efficacy, durable outcomes, and increasing physician confidence have solidified biopharmaceuticals as the largest and fastest-growing drug class in the global RA therapeutics market.

Instruments dominate the microsurgery robot market because they are the primary components responsible for precision, dexterity, and safety during delicate procedures. Their demand is rising as microsurgeries grow globally over 4.2 million cataract microsurgeries and 1.8 million neurosurgeries are performed annually worldwide.

Robotic instruments with advanced wristed tips, micro-forceps, and micro-scissors enable sub-millimeter accuracy, reducing tremor and improving surgical outcomes. Hospitals are investing heavily in these tools; surgical instrument upgrades account for 40-45% of total robotic system spending.

Reusable instruments with up to 15-20 use cycles also lower long-term costs, increasing adoption. As microsurgery volume expands in ophthalmology, ENT, and neurology, instrument demand continues to outpace robots and accessories, making this segment the market leader.

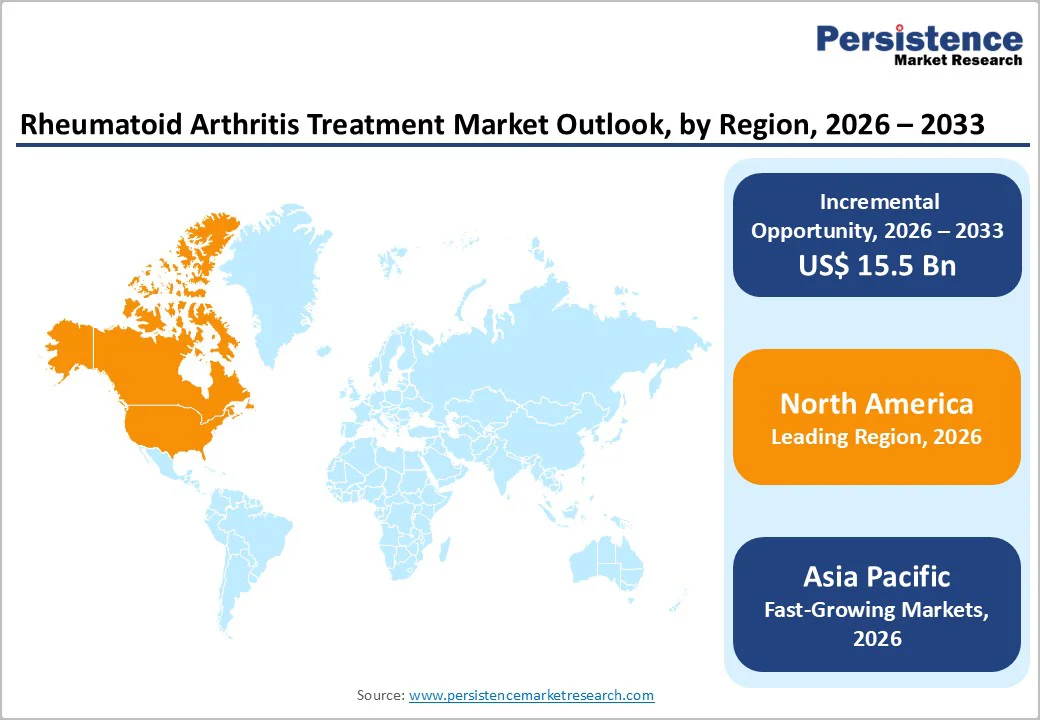

North America dominates the rheumatoid arthritis treatment market with a 51.0% share in 2026, due to its high disease burden, strong biologic adoption, and advanced healthcare access. In the U.S., arthritis affects over 21% of adults, and RA represents a significant share of these cases, creating sustained treatment demand.

The region also has one of the highest biologic utilization rates, with around 25-26% of RA patients receiving biologic or targeted therapies, far higher than most global regions. Healthcare spending further supports dominance; annual medical costs for RA patients exceed $20,000 per person, driving continuous investment in advanced drugs.

Combined with strong reimbursement, specialist availability, and rapid uptake of new therapies, these factors solidify North America’s leading position in the RA treatment market.

Europe is an important region in the rheumatoid arthritis treatment market due to its large patient base, strong reimbursement systems, and high adoption of advanced therapies. The region has over 2.3 million RA patients, creating strong and consistent therapeutic demand. RA also imposes a major economic burden, with annual healthcare costs ranging from €1,800 to €11,700 per patient and indirect costs such as work disability reaching €38,000 per patient.

European hospitals report high utilization of RA services, with countries like Spain recording over 315,000 RA-related hospitalizations across 15 years. Strong regulatory frameworks, widespread biosimilar uptake, and robust clinical research infrastructure further strengthen Europe’s position as a key and influential RA therapeutics market.

Asia Pacific is the fastest-growing region in the RA therapeutics market due to rising disease burden, expanding healthcare infrastructure, and increasing access to biologic therapies. For instance, China saw a standardized RA prevalence of 334 per 100,000 people in 2017, with incidence rates climbing at over 21% annually.

Meanwhile, Asia contributed nearly 10.3 million RA cases in 2021, a significant share of the global burden. The region’s growth is also fueled by improving affordability and manufacturing capacity, which enables wider use of advanced and increasingly biosimilar therapies. As economies invest in chronic disease management and health coverage expands, demand for RA treatments in the Asia-Pacific is expected to surge.

Leading companies in the rheumatoid arthritis treatment market focus on advanced biologic and targeted therapy development, high-precision manufacturing, and strict quality control. They invest heavily in monoclonal antibodies, JAK inhibitors, and biosimilars while expanding partnerships with hospitals and payers. R&D prioritizes safety, efficacy, and affordability, supporting wider patient access and strong adoption across global healthcare systems.

The global rheumatoid arthritis treatment market is projected to be valued at US$ 32.7 Bn in 2026.

Rising RA prevalence, strong biologics and biosimilar adoption, aging populations, improved diagnostics, and expanding access to advanced targeted therapies drive the market.

The global rheumatoid arthritis treatment market is poised to witness a CAGR of 5.7% between 2026 and 2033.

Expanding biosimilars, rising demand for targeted therapies, growth in Asia Pacific, digital therapeutics integration, and personalized medicine offer major market opportunities.

AbbVie, Inc., Boehringer Ingelheim International GmbH, Novartis AG, Regeneron Pharmaceuticals Inc., Pfizer, Inc., Bristol-Myers Squibb Company.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Drug Class

By Route of Administration

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author