ID: PMRREP32988| 191 Pages | 2 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

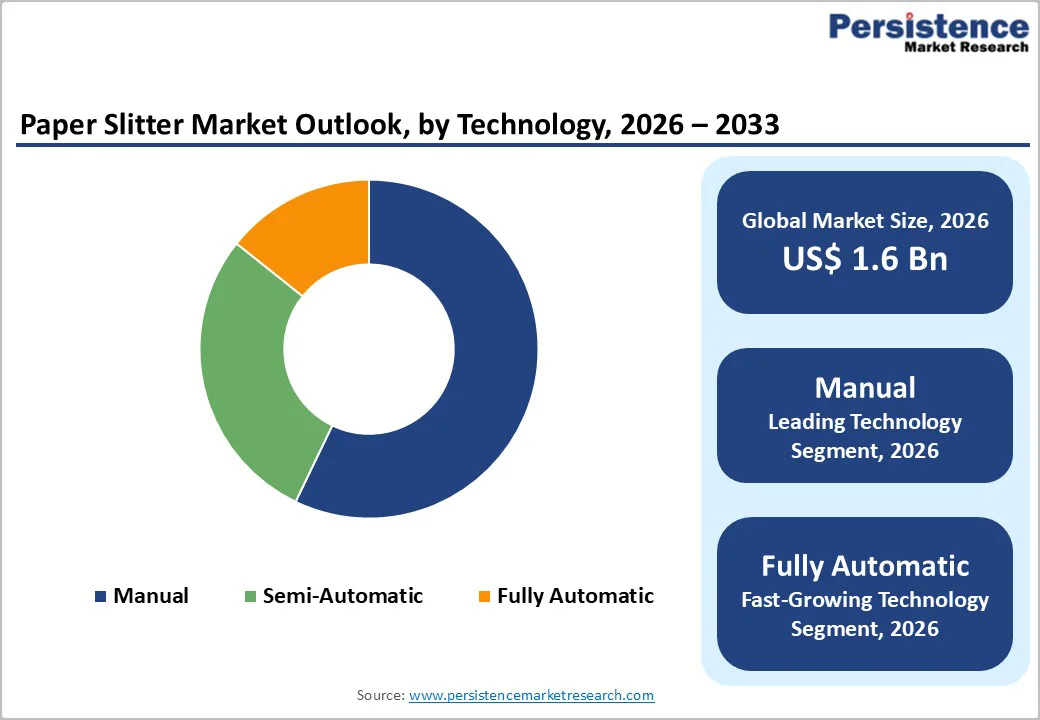

The global Paper Slitter Market size was valued at US$ 1.6 Bn in 2026 and is projected to reach US$ 2.2 Bn by 2033, growing at a CAGR of 4.7% between 2026 and 2033. Market expansion is driven by accelerating demand for sustainable packaging solutions aligned with environmental regulations and consumer preferences, with flexible paper packaging market. E-commerce industry explosive growth necessitating efficient, customized packaging solutions establishes critical growth driver supporting market expansion.

| Key Insights | Details |

|---|---|

| Global Paper Slitter Market Size (2026E) | US$ 1.6 Bn |

| Market Value Forecast (2033F) | US$ 2.2 Bn |

| Projected Growth CAGR(2026-2033) | 4.7% |

| Historical Market Growth (2020-2025) | 4.1% |

The accelerating global shift toward sustainability is significantly strengthening demand for paper slitter machines as manufacturers replace plastic packaging with paper-based alternatives. Governments and regulatory bodies worldwide are enforcing stricter environmental policies aimed at reducing plastic waste, carbon emissions, and landfill dependency, compelling packaging producers to invest in sustainable production infrastructure. The rapid expansion of the flexible paper packaging market, from US$ 79.81 billion in 2024 to a projected US$ 133.76 billion by 2034, illustrates the scale of this transition and directly supports demand for high-precision slitting equipment.

Paper slitters play a critical role in enabling waste reduction through precise cutting, improved material utilization, and consistent output quality, aligning closely with circular economy principles. In Europe, initiatives under the EU Green Deal are encouraging investments in recyclable and biodegradable packaging materials, driving upgrades in converting and slitting technologies. The pharmaceutical and food sectors further amplify demand, as they require sustainable packaging that meets stringent safety, traceability, and compliance standards. Advanced slitting machines support these requirements by ensuring dimensional accuracy, cleanliness, and repeatability. As sustainability becomes a long-term corporate priority rather than a short-term trend, paper slitting equipment is increasingly viewed as a strategic investment supporting regulatory compliance, brand reputation, and long-term operational efficiency.

The rapid expansion of global e-commerce continues to reshape packaging requirements, emerging as a powerful growth driver for the paper slitter market. Online retail platforms demand highly customized, lightweight, and protective packaging formats to accommodate diverse product sizes, shipping conditions, and branding requirements. This diversity necessitates flexible slitting systems capable of handling multiple paper grades, widths, and thicknesses with minimal downtime.

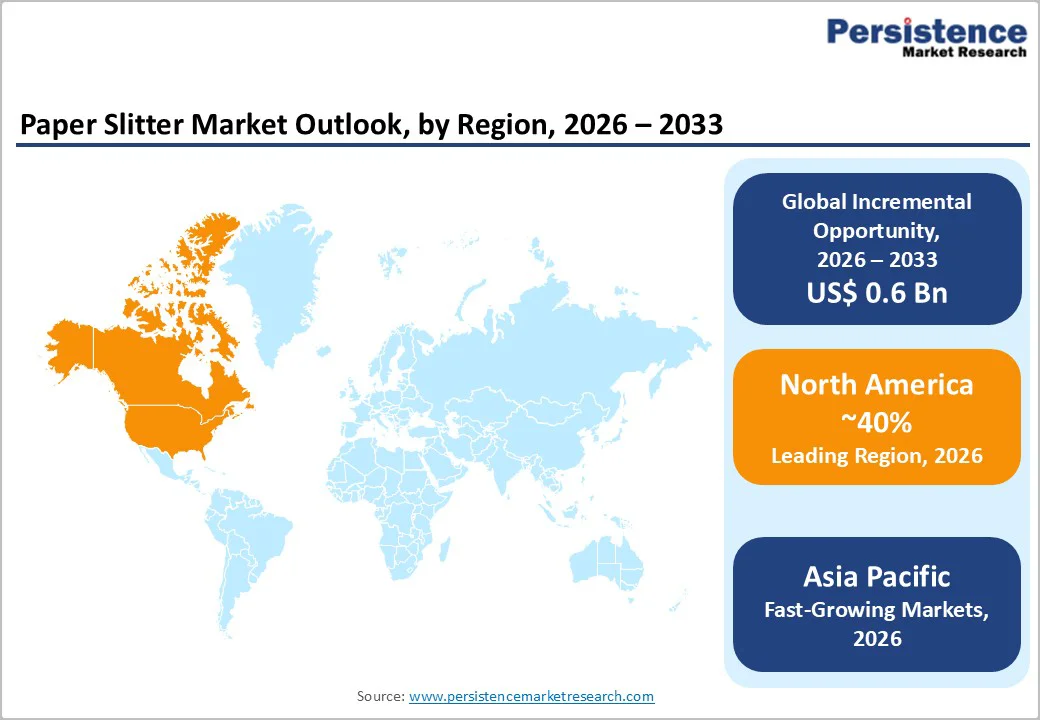

Packaging manufacturers serving e-commerce supply chains increasingly adopt advanced slitting solutions to support fast changeovers, shorter production runs, and just-in-time manufacturing models. These machines enable rapid response to fluctuating order volumes, seasonal demand spikes, and evolving consumer preferences. Asia Pacific stands out as a key growth region, where digital commerce penetration and logistics infrastructure expansion are driving significant packaging consumption. Countries such as China and India are witnessing strong investments in packaging capacity expansion, directly translating into higher demand for automated and high-speed slitting machines. As e-commerce continues to prioritize efficiency, customization, and sustainability, paper slitter equipment remains integral to meeting evolving packaging performance and delivery expectations.

Despite strong demand fundamentals, high upfront capital requirements remain a major restraint for the paper slitter market. Advanced slitting machines involve significant costs related to equipment acquisition, installation, precision calibration, and facility integration. For small and medium-sized enterprises, these investments can be financially prohibitive, delaying modernization or limiting adoption altogether.

Beyond capital expenditure, operational complexity adds to total cost of ownership. Skilled technicians are required for machine operation, preventive maintenance, blade management, and troubleshooting, increasing labor and training expenses. Regular maintenance and spare part replacement further elevate long-term operating costs. Volatility in raw material prices and broader economic uncertainty also influence investment decisions, prompting manufacturers to postpone capital upgrades during periods of margin pressure. These financial and technical barriers collectively slow market penetration, particularly in price-sensitive regions and among smaller packaging converters.

The growing need for customized slitting solutions presents another significant market restraint. Packaging producers often require machines tailored to specific paper grades, roll widths, speeds, and downstream processing requirements, increasing engineering complexity for equipment manufacturers. Customization extends development timelines, raises production costs, and limits economies of scale, impacting pricing competitiveness.

Integrating new slitting equipment with existing production lines can be technically challenging. Compatibility with legacy control systems, automation platforms, and quality inspection technologies often requires extensive modification and testing. These integration hurdles increase implementation time and risk, discouraging potential buyers from upgrading equipment. For new market entrants, meeting diverse customer specifications while maintaining cost efficiency and reliability poses substantial challenges. As a result, equipment complexity and customization demands act as structural barriers, slowing adoption rates and restricting market expansion across certain end-user segments.

Fully automatic slitter machines representing fastest-growing technology segment offer exceptional market opportunity through superior productivity, labor cost reduction, and automation capabilities. Fully automatic machines delivering approximately 3x output compared to semi-automatic alternatives while reducing labor requirements by up to 95% establish compelling economic justification for capital investment. Touch screen control systems enabling automatic knife positioning and production setup optimization dramatically reduce operator training requirements and setup time.

IoT integration enabling cloud-based monitoring, real-time defect detection, and predictive maintenance aligns with Industry 4.0 transformation objectives supporting sustained equipment demand growth. AI-powered predictive maintenance reducing unplanned downtime and extending equipment lifespan creates additional value proposition supporting premium pricing and margin profiles, establishing sustained growth opportunity through forecast period.

Pharmaceutical sector expansion with sterile medical paper packaging market growing significantly through 2034 driven by surgical procedure growth, hospital-acquired infection prevention, and biopharmaceutical manufacturing expansion creates exceptional market opportunity. ISO 11607 compliance requirements and FDA regulatory mandates necessitate precision slitting equipment meeting stringent sterility and safety standards. Single-dose and unit-dose packaging proliferation in pharmaceutical and biological segments requires specialized slitting capabilities supporting individual package customization.

Tamper-evident packaging demand and traceability requirements create incremental slitting equipment demand for advanced features and capabilities. Rapid expansion of vaccine manufacturing and biologics production post-pandemic establishes sustained structural demand for advanced slitting solutions supporting multi-year market expansion through forecast period.

Shear blades command market dominance representing approximately 65% market share driven by superior cutting accuracy, reduced material damage, and professional-quality results. Shear cutting on upper and lower round knives executing precise shear action eliminates burrs and edge defects characteristic of alternative cutting methods. Shear blade technology capability of achieving minimal material loss and consistent cut quality across diverse paper types and material compositions establishes universal applicability supporting broad market adoption.

Equipment manufacturers' preference for shear blade integration across semi-automatic and fully automatic machines reflects proven reliability and customer satisfaction. Continued shear blade dominance supported by established manufacturing expertise and wide supplier ecosystem ensures sustained leadership position throughout forecast period.

Fully automatic slitting machines represent fastest-growing technology segment commanding increasing market share momentum driven by superior productivity, labor cost reduction, and advanced automation capabilities. Fully automatic machines achieving output of approximately 40,000+ rolls per day compared to semi-automatic alternatives producing 13,440 rolls per day demonstrate exceptional productivity advantage justifying premium capital investment. Automatic knife positioning systems eliminating manual adjustment requirements combined with touch screen control enabling rapid setup changes reduce production downtime and operational complexity.

Integrated unwinding and rewinding systems with automatic tension control and sophisticated edge correction mechanisms ensure consistent product quality across production runs. IoT-enabled monitoring, real-time defect detection, and predictive maintenance integration position fully automatic machines at forefront of Industry 4.0 transformation, establishing sustained competitive advantage and market growth momentum through forecast period.

Packaging represents largest application segment commanding 40-50% market share driven by e-commerce industry expansion, sustainable packaging transition, and customization demand acceleration. Cardboard, corrugated paper, and flexible packaging requiring precise slitting for box manufacturing, wrapping, and protective applications establish substantial equipment demand baseline.

E-commerce industry growth at double-digit rates across Asia Pacific creates incremental packaging production requirements supporting slitter machine orders. Pharmaceutical and healthcare segment experiencing fastest application growth with sterile packaging requirements driving specialized equipment demand. Tissue, napkins, and hygiene product manufacturing representing established consumer demand base provides structural market foundation supporting sustained market expansion throughout forecast period.

North America maintains developed market maturity with United States commanding regional leadership through strong packaging industry presence, advanced manufacturing base, and regulatory framework promoting automation and sustainability. High-speed, precision-cutting solutions and cost-effective equipment demand reflect competitive manufacturing environment and efficiency maximization focus. Labor cost pressures driving investment in fully automatic machines for labor cost reduction establish capital investment cycle supporting advanced machine adoption.

Europe represents significant developed market with Germany and United Kingdom commanding regional leadership through environmental regulations, circular economy initiatives, and advanced manufacturing expertise. European Union Green Deal targets and stringent waste minimization directives establish institutional support for sustainable packaging equipment investment. Industry 4.0 adoption across European manufacturing drives demand for digitally integrated, smart slitting systems with real-time monitoring and predictive maintenance capabilities. Premium product preference reflecting quality-conscious consumer base supports advanced technology adoption and higher-margin equipment sales.

Asia Pacific commands fastest regional growth position driven by rapid industrialization, expanding paper manufacturing base, and e-commerce explosion. China establishing position as global manufacturing hub for paper slitter production through vertically integrated supply chains and cost competitive advantages. India emerging as fastest-growing market globally with rising disposable incomes, growing packaging industry, and pharmaceutical sector expansion creating exceptional market opportunity. Southeast Asia and Japan participating in regional market expansion with diverse application requirements and specialized market niches.

The paper slitter market exhibits a moderately consolidated competitive structure dominated by global industrial leaders including Atlas Converting Equipment, Kampf, Parkinson Technologies, and ASHE Converting Equipment commanding substantial combined market share. Tier 1 manufacturers leveraging established technology platforms, manufacturing scale, and global distribution networks maintain competitive advantage in premium and large-volume segments. Regional competitors including Euromac, Goebel, and Jota Machinery establish competitive positions through specialized product offerings, material customization capabilities, and localized customer service. Strategic merger activity exemplified by Atlas Converting Equipment and Kampf merger effective April 1, 2025 demonstrates consolidation trends strengthening combined technology and market position. R&D investment emphasis on fully automatic solutions, IoT integration, and sustainable technologies creates competitive differentiation supporting market growth.

The global Paper Slitter Market is projected to reach US$ 2.2 billion by 2032, expanding from US$ 1.6 billion in 2025 at a CAGR of 4.7%, driven by sustainable packaging demand, e-commerce growth, pharmaceutical sector expansion, automation adoption, and Asia Pacific industrialization.

Market demand growth is driven by multiple converging factors including sustainable packaging solutions adoption with flexible paper packaging, e-commerce industry explosive growth requiring customized packaging, pharmaceutical sector expansion with sterile packaging requirements, automation and Industry 4.0 adoption, fully automatic machines offering 3x productivity and 95% labor reduction, and Asia Pacific region rapid industrialization.

Shear blades command market dominance with approximately 65% market share, driven by superior cutting accuracy, reduced material damage, professional-quality results, elimination of burrs and edge defects, and universal applicability across diverse paper types and material compositions.

North America maintains market leadership anchored by United States packaging industry dominance, advanced manufacturing base, strong automation adoption, regulatory support for sustainability, and labor cost pressures driving capital investment in advanced slitting equipment.

Major market opportunities include fully automatic technology expansion with 3x productivity advantage and 95% labor cost reduction; pharmaceutical and sterile packaging market growth driven by ISO 11607 compliance requirements; Industry 4.0 adoption enabling IoT integration and predictive maintenance; Asia Pacific region fastest-growing market; and sustainable packaging transition supporting equipment modernization.

Leading market players include Atlas Converting Equipment maintaining global leadership through comprehensive product portfolio; Kampf commanding European market presence as technology leader; Parkinson Technologies maintaining North American leadership through established customer relationships; ASHE Converting Equipment establishing competitive positions through specialized offerings; and Jota Machinery expanding presence in thermal paper slitting applications.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights | Market Forecast and Trends, Competitive Intelligence & Share Analysis, Growth Factors and Challenges, Strategic Growth Initiatives, Pricing Analysis & Technology Roadmap, Future Opportunities and Revenue Pockets, Market Analysis Tools |

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author